Nippon India Flexi Cap Fund

(An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

Presenting a new fund that dynamically invests across time-appropriate market caps, with an aim to maximise your returns.

Stability through Large Caps & seeking growth opportunities through mid & small caps

Aims to leverage emerging trends before they become apparent

NFO Open Date: 26th July, 2021

NFO Close Date: 9th August, 2021

Investment Strategy

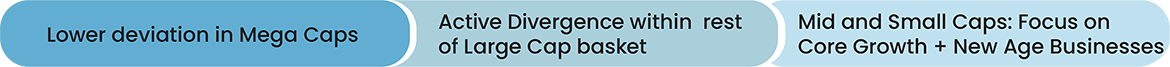

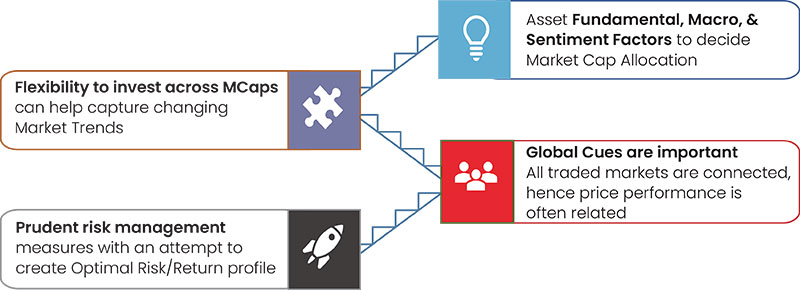

- Market Cap allocation: The fund would invest across large, mid, and small caps based on market view and relative attractiveness.

- Growth with Stability: While the fund will attempt to create Alpha or excess returns through bottom up stock selection and appropriate allocation to potentially high growth themes, it will maintain reasonable allocations to established leaders.

- Accordingly, for Large Caps exposure, the deviation will be capped at 50% from the benchmark weight.

- Well diversified portfolio across stock and sectors.

- Investment approach:

Our Strategy to navigate and benefit from Equity Shifts

Investment Framework

- Market Cap: Large Cap deviation will be max 50% of Large Cap weight in the Benchmark (Nifty 500 TRI)

- Active share: Active share is the percentage of fund holdings that is different from the benchmark holdings. A fund that has no holdings in common with the benchmark will have an Active Share of 100%, and a fund that has exactly the same holdings as the benchmark considered will have an Active Share of 0%. The fund would have an active share of 50 - 70%

- Stock deviation: Top 5 stocks by weight in the Benchmark - for each stock max deviation of 40%

- Stock Concentration: “ Based on Internal assessment of Business Risk, stocks have been classified under four rating buckets: A,B,C,D with A being the best and D being the worst. While it may appear all the investments should be concentrated in the A or B bucket, the stocks may not be reasonably priced. At the same time, stocks rated C or D may offer opportunities at reasonable valuations. Cummulative exposure: Max 45% in C, max 5% in D”

- Sector deviation: Max deviation of financials - 8 %

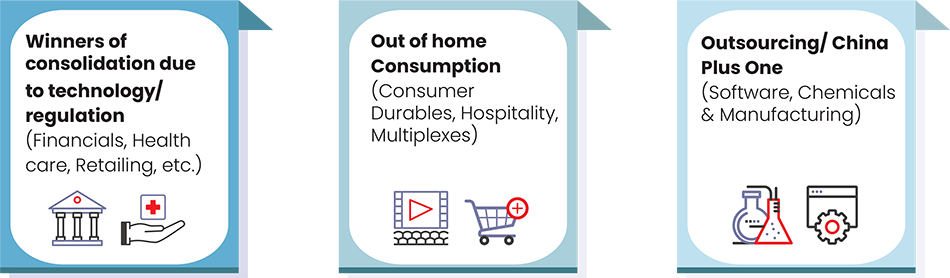

Current Focus Themes

Note: The sectors mentioned are not a recommendation to buy/sell in the said sectors. The scheme may or may not have future position in the said sectors.

Why invest in Nippon India Flexi Cap Fund?

Thus, Nippon India Flexi Cap Fund aims to deliver better returns by investing in best opportunities across market caps. “The go anywhere” approach would help to generate alpha across market cycles.

Other Scheme Details:

- Fund Manager:

Manish Gunwani; Dhrumil Shah

Varun Goenka & Nikhil Rungta (Co-Fund Manager)

Kinjal Desai (Dedicated Fund Manager for Overseas Investments) - Benchmark: NIFTY 500 TRI

- Minimum Application Amount: Rs. 500 in multiples of Rs. 1 thereafter

- Exit Load: 10% of the units allocated shall be redeem without any exit load, on or before completion of 12 months from the date of allotment of units. Any redemption in excess of such limit in the first 12 months from

the date of allotment shall be subject to the following exit load.

Redemption of units would be done on First in First Out Basis (FIFO):

- 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units.

- Nil, thereafter

- Plans and Options: Growth Plan (Growth Option), Income Distribution cum Capital Withdrawal Plan (Payout Option and Reinvestment Option)

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.