-

Balanced budget with a focus on growth while sticking to the path

of fiscal consolidation

Balanced budget with a focus on growth while sticking to the path

of fiscal consolidation

-

Higher capital expenditure to support

growth

Higher capital expenditure to support

growth

-

Measures to support the rural economy

to boost rural spending

Measures to support the rural economy

to boost rural spending

-

Accelerate GDP growth to improve

economic efficiency

Accelerate GDP growth to improve

economic efficiency

-

Pro-people programmes to be formulated

and implemented to more

opportunities for employment and entrepreneurship

Pro-people programmes to be formulated

and implemented to more

opportunities for employment and entrepreneurship

Growth

Power and Nari Shakti

- Creation of a robust gateway for global capital and financial services for the economy.Proactive Inflation Management within the policy band.

- Digital Public Infrastructure (Social, Physical and Digital), a new ‘factor of production’ in formalization of the economy.

- Average real income of the people has increased by fifty per cent. Inflation is moderate. People are getting empowered, equipped and enabled to pursue their aspirations.

- Target each and every household and individual, through ‘housing for all’, ‘har ghar jal’, electricity for all, cooking gas for all, bank accounts and financial services for all.

- Sabka Sath, Sabka Vikas, Sabka Vishwas - Trinity of demography, democracy and diversity

- New programme to promote research in Pharmaceuticals

- With the pursuit of ‘Sabka ka Saath’ in last few years, the Government has assisted 25 crore people to get freedom from multi-dimensional poverty.

- With the introduction of PM-Jan Dhan accounts, ‘Direct Benefit Transfer’ of ` 34 lakh crore from the Government has led to savings of ` 2.7 lakh crore for the Government which in turn has provided more funds for ‘Garib Kalyan’.

- PM-SVANidhi has provided credit assistance to 78 lakh street vendors. From that total, 2.3 lakh have received credit for the third time.

- PM-JANMAN Yojana reaches out to the particularly vulnerable tribal groups and PM-Vishwakarma Yojana provides end-to-end support to artisans and craftspeople engaged in 18 trades.

- Capital expenditure increased by 11.1% to Rs 11 lakh crore (3.4% of GDP)

- Continuation of 50-year interest free loan to State Governments to incentivize infrastructure development - a provision of Rs 75 thousand crore.

- Three corridors planned a) energy, mineral, cement b) Port connectivity corridor c) high traffic corridor. The projects are planned under PM Gati Shakti and together with the Dedicated Freight Corridor Corporation, it will reduce logistics costs

- India-Middle East-Europe corridor a game changer planned for next 100 years.

- Housing for middle class- will be announcing a new scheme to buy or built their own houses.

- PM Awas Yojana Grameen – Government near to achieve a target of 3 crs of houses with plans for additional 2 crs of houses will be built over next 5 years.

- Number of airports have doubled to 149. Roll out of air connectivity to tier-two and tier- three cities under UDAN scheme has been widespread.

- Under PM-KISAN SAMMAN Yojana, direct financial assistance is provided to 11.8 crore farmers, including marginal and small farmers. Farmers are our ‘Annadata.’

- Crop insurance is given to 4 crore farmers under PM Fasal Bima Yojana.

- Electronic National Agriculture Market has integrated 1361 mandis and is providing services to 1.8 crore farmers with trading volume of ` 3 lakh crore.

- Defence capital budget for FY25 at Rs1.72 lakh crore vs FY24 revised estimate of Rs1.57lakh crore - an increase of 9.4%

- PLI (Production Linked Incentive) scheme allocation increased to Rs62bn

- Semiconductor and Display Manufacturing – Rs69bn

- Solar power Grid Rs85bn

- States to be incentivized for the holistic development of tourist destinations.

- Business tourism, cultural and domestic tourism under focus

- The finance minister has shown commitment towards net zero target by 2070 by emphasizing on expanding scope for alternative energy and mobility

- Coal gasification and liquefaction capacity of 100 MT will be set up by 2030. This will also help in reducing imports of natural gas, methanol, and ammonia.

- Green Credit Programme to incentivize environmentally sustainable actions

- For promoting green growth, a new scheme of bio-manufacturing and bio-foundry will be launched. - help in transforming today’s consumptive manufacturing paradigm to the one based on regenerative principles.

- Expand and strengthen the e-vehicle ecosystem by supporting manufacturing and charging infrastructure.

- PM ScHools for Rising India (PM SHRI) are delivering quality teaching, and nurturing holistic and well-rounded individuals.

- The Skill India Mission has trained 1.4 crore youth, upskilled and reskilled 54 lakh youth, and established 3000 new ITIs. A large number of new institutions of higher learning, namely 7 IITs, 16 IIITs, 7 IIMs, 15 AIIMS and 390 universities have been set up

- PM Mudra Yojana has sanctioned 43 crore loans aggregating to ` 22.5 lakh crore for entrepreneurial aspirations of our youth. Besides that, Fund of Funds, Start Up India, and Start Up Credit Guarantee schemes are assisting our youth. They are also becoming ‘rozgardata’.

- Thirty crore Mudra Yojana loans have been given to women entrepreneurs.

- Female enrolment in higher education has gone up by 28% in last few years.

- In STEM (science, technology, engineering and mathematics) courses, girls and women constitute forty-three per cent of enrolment - one of the highest in the world. All these measures are getting reflected in the increasing participation of women in workforce.

- Reservation of 1/3rd seats for women in the Lok Sabha and State legislative assemblies and giving over 70% houses under PM Awas Yojana in rural areas to women as sole or joint owners have enhanced their dignity.

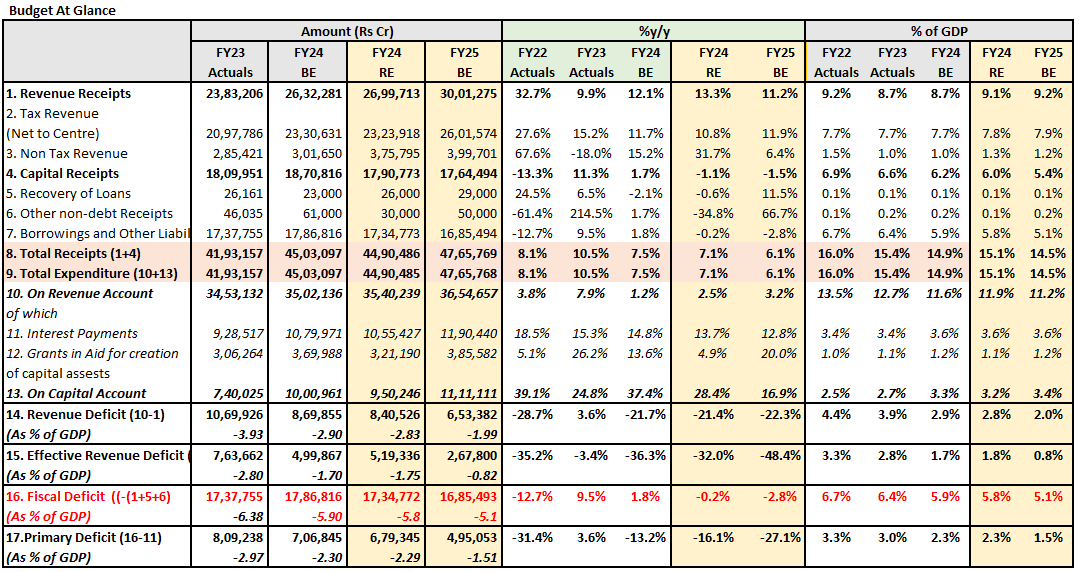

BE: Budget Estimates, RE: Revised Estimates

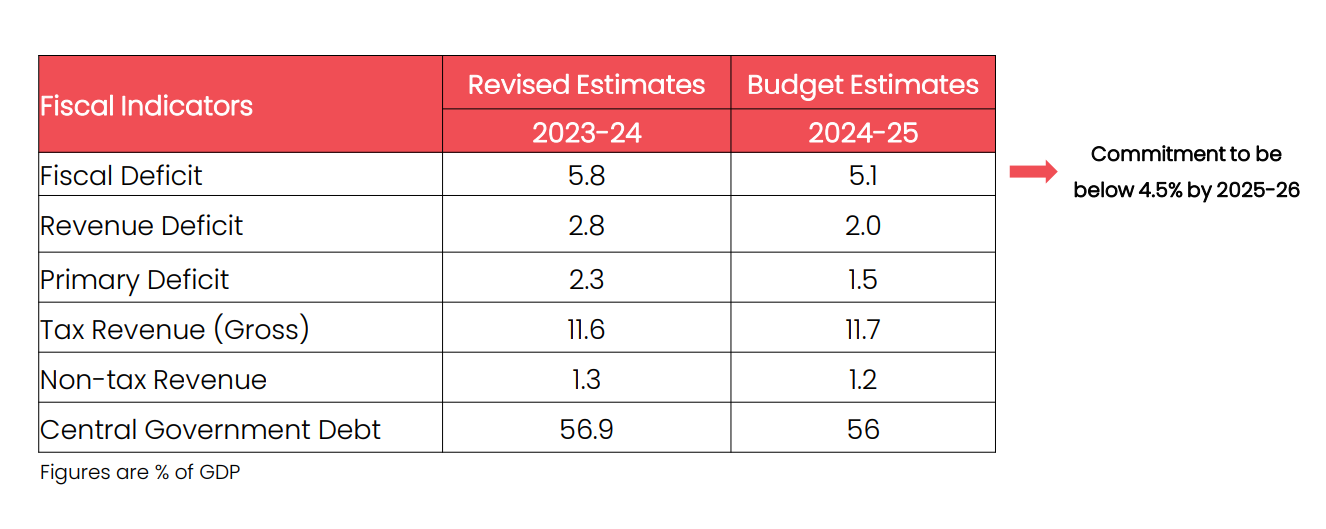

- A well-balanced budget with commitment to fiscal consolidation, policy continuity and macro stability

- Fiscal situation appears to be well managed with Current Account Deficit at ~1% of GDP and fiscal deficit at 5.8% of GDP with next year target at 5.1% of GDP.

- Budget for capital expenditure outlay for FY25 has been hiked by 11 per cent to Rs 11.11 lakh crore, or 3.4 per cent of GDP.

- Effective capex allocation has been increased by nearly 17%yoy.

- Adequate allocation has been made towards schemes like PM Awas and Mahatma Gandhi National Rural Employment Guarantee Act(MNREGA).

- India continues to be one of the fastest growing major economy supported by demographic advantage, deregulation & policy reforms, digitization and demand (aspirational spending).

- Overall outlook towards domestic capital markets remains optimistic, supported by resilient domestic demand and the signs of bottoming of global & domestic monetary tightening cycle.

- Prudent interim budget with a focus on fiscal consolidation, policy continuity can help reduce external risks and aid in attracting global investors.

- From an equity market perspective, some of the positives appear to be considered in valuations and therefore return expectations from near term perspective should be moderate.

- Asset allocation in line with investment goals and risk appetite is important for better risk – return optimization. Herein asset allocation funds can help in lowering volatility and provide better balance to the overall portfolio mix.

-

Fiscal consolidation on fast track :

- Lower Fiscal deficit FY24 RE estimate Fiscal Deficit (as % of GDP) lower at 5.8% (better than market expectations & budgeted 5.9%). This despite slower growth in nominal GDP.

- Improvement achieved through buoyant revenue growth (tax & non-tax) and slower than budgeted expenditure growth.

- FY25 Fiscal Deficit budgeted at 5.1% of GDP (Consensus: 5.3-5.4%) driven mainly through rapid consolidation of revenue expenditure.

-

With continued Focus on Capex :

- Improved Quality of Expenditure: Major incremental increase in FY24 RE & FY25 budget is driven by capex. (Revex/capex ratio projected at 3.3% of GDP (Pre-pandemic avg : ~7%).

- Push for capex via States continues for fourth consecutive year.

- Realistic estimates: 10.5%y/y nominal GDP growth and assuming tax buoyancy of ~1.1 for gross tax revenue, overall receipts numbers look robust yet realistic.

- Market Borrowings: FY25 net borrowing (Gsec + Tbills) print at 12.25 trn (FY24 RE : 11.82 trn) . Along with maturities of ~2.8 trn, gross Gsec borrowings are ~14.1 trn (Much better than market expectations)

-

Market Reaction: With fiscal consolidation better than

expectations and positive surprise in terms of lower supply (i.e

gross borrowing at 14.1 trn vis-à-vis 15.4 trn in FY24).

- 10-year G-Sec eased to 7.06%* (Previous day close : 7.14%). 3 year G-Sec eased to ~7.00%* (Previous close : 7.03%)

- Markets likely to take comfort from the realistic numbers, better than expected fiscal deficit & gross borrowing figure and improvement in quality of spending

- A good budget coupled with improving macros (reflected in inflation + Growth+ Current Account Deficit trinity) to provide comfort to RBI to move to neutral stance sooner (mostly in next RBI policy), thereby improving the sentiment further.

- Lower gross borrowing (decline of Rs. 1.3 trn) to provide comfort to the market, hence markets may trade in a range though with positive bias.

- Twin tailwinds from downward shift and steepening expected over the next 6-12 mnths. Long duration funds may generate returns via capital gains, whereas, intermediate duration funds may deliver good returns as the steepening benefit catches up with outright duration play.

The views expressed herein are based on publicly available information and other sources believed to be reliable. It is issued for information purposes only and is not an offer to sell or a solicitation to buy/sell any mutual fund units/securities. It should be noted that the analysis, opinions, views expressed in the document are based on the Budget proposals presented by the Honorable Finance Minister in the Parliament on Feb 1, 2023 and the said Budget proposals may change or may be different at the time the Budget is passed by the Parliament and notified by the Government. The information contained in this document is for general purposes only and not a complete disclosure of every material fact of Indian Budget. For a detailed study, please refer to the budget documents available on https://www.indiabudget.gov.in

The information herein above is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (‘entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision or contact their mutual fund distributor. Entities & their associates including persons involved in the preparation or issuance of this material, shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully