Macro and

Equity Market

Outlook

Equity Market

Outlook

Global Macro & Markets

Russian-Ukraine conflict led to a massive spike in

commodity prices on supply side disruption

worries. Though nominal yields have been

sprinting upwards, inflation-led lower real yields

led investors to favor equities as an asset class.

Despite war worries, MSCI Word index rose 4.2%

m-o-m on the back of S&P500 (+5.2%), Euro-50

(+3.6%) and NIKKEI (+3.6%). MSCI EM index (-2.9%)

was dragged lower by Hang Seng index (-3.4%),

whereas other EMs gained quite handsomely.

MOEX Russia, BOVESPA Brazil and NIFTY India were

up 9.4%, 6.1% and 4% respectively. MSCI India

outperformed MSCI EM by 6% in March. LME Metals

index gained 4.2% while Brent crude was up 2.8%

m-o-m. Dollar index appreciated 0.9% in March.

India 10Y Gsec yeild rose 8bps whereas US 10Y and

Germany 10Y yields rose whopping 51bps and

41bps, respectively.

Domestic Macro & Markets

SENSEX gained 4% while BSE Midcap index and BSE Smallcap index

were up 3.2% and 5.8% MoM respectively. Energy (+9.8%), Utilities

(+8.8%) and Communication Services (+8.2%) outperformed the

index while Discretionary (-1.9%), Staples (-1.2%) and Financials

(+1.2%) lagged the most. Market breadth improved in February with

42% of BSE 200 stocks trading above their respective 200-day

moving averages. FPIs sold US$4.7 bn of Indian equities in the

secondary market while DIIs bought US$5.2 bn.

India's high frequency data update:

Positive momentum in GST collections, some pick up in

manufacturing activity and steady exports bode well for decent

economic recovery after the mild disruption caused by spread of

the Omicron variant.

GST Collection:

At INR 1.42 Tn, collections in March have marked all-time high levels

and topped INR 1.3 Tn for the sixth consecutive month.

Power consumption:

Power consumption in the month of March was 5.6% higher than

March-21 and 29.7% higher than the consumption in March-2020.

Core sector production:

Core sector production rose 5.8% YoY in February as against a YoY

rise of 4% in January and a decline of 3.3% in February last year.

Industrial Production:

Manufacturing IIP increased 1.1% in January vs decline of 0.9% in Jan

last year.

Credit growth:

Credit growth accelerated to 8.5% YoY as of 11-March against YoY

growth of 6.5% as observed on 12-March 2021. Aggregate deposit

growth remained flat at 8.8% YoY.

Inflation:

CPI inflation in February rose to 6.07% from 6.01% in January on the

back of sequentially higher food (+5.9%) and rural inflation (+6.4%).

WPI inflation increased 15bps to 13.11% in February.

Jobspeak index:

Naukri jobspeak index for February was up 31%yoy led by increased

hiring in sectors like retail and IT.

Trade Deficit:

February trade deficit widened to US$21.2 bn as compared to

US$17.4 bn in January. Exports increased 22.4% YoY to US$33.8 bn

while imports increased by 35% YoY to $55 bn.

Balance of Payments:

The current account registered a deficit of US$23 bn (2.7% of GDP)

in 3QFY22, widening from a deficit of US$9.9 bn in 2QFY22 (1.3% of

GDP) and a deficit of US$2.2 bn in 3QFY21 (0.3% of GDP). This was

mainly due to a widening of the trade deficit to US$60.4 bn (2QFY22:

US$44.5 bn).

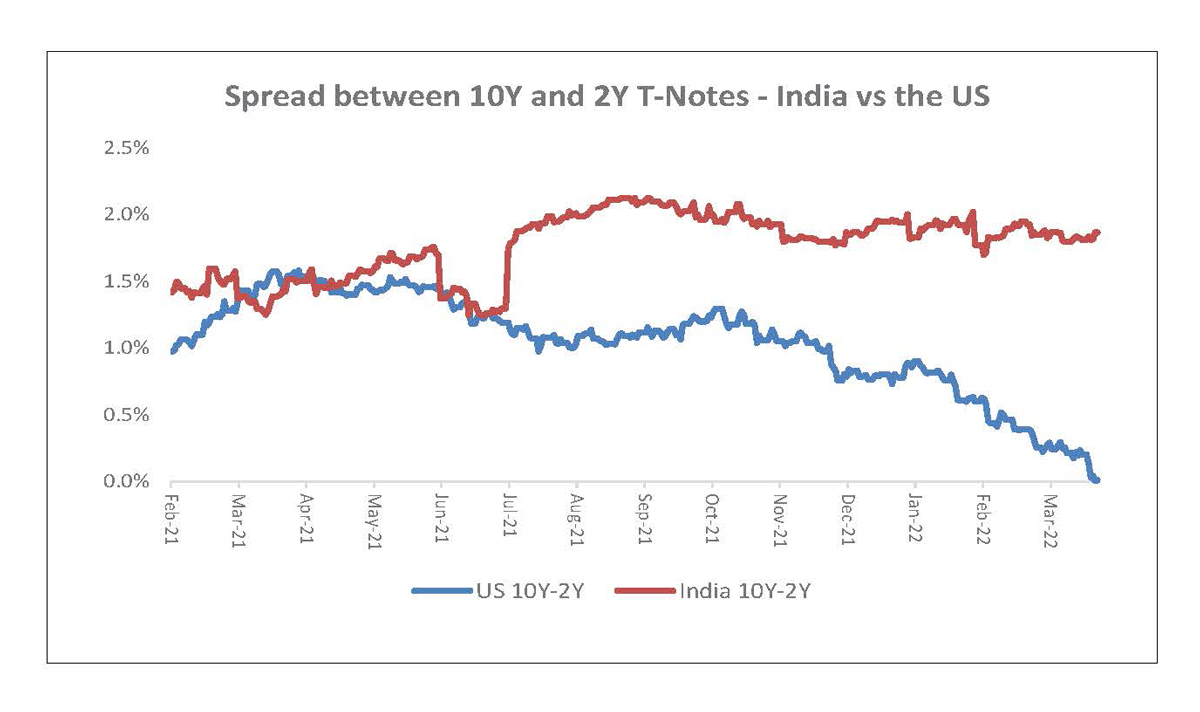

Decoupling of Govt security yield curve in the US and India:

There has been very sharp rise in yields across the curve in the US

market. Not only rates have risen but the short-term yields have

risen faster than long term yields leading to sharp flattening of

yield curve at a time when rates are hardening. Experts are getting

nervous on potential yield curve inversion in the US. A flattening

curve typically means fear of that investors are losing faith on

medium term economic growth outlook. In contrast, G-Sec yield

curve in India remains reasonably steep. This is partly due to RBI's

pro-growth and accommodative stance when domestic liquidity

conditions remain benign as of now.

Market View

Near term market sentiment is likely to be influenced by the

increased geopolitical risks in the backdrop of ongoing

Russia-Ukraine conflict, higher inflation/ commodity prices, rate

hikes by Global Central Banks and most importantly how these

factors impact the Global/domestic growth possibilities.

Accordingly, we anticipate higher than usual volatility or market

swings in the short term.

From a domestic perspective while direct impact of

Russian-Ukraine conflict, through trade channel may be limited, the

indirect impact on Crude prices, Inflation, rising input or raw

material prices needs to be monitored. Notwithstanding the

short-term global risks and assuming that the geo-political

tensions are diffused soon, we remain optimistic on a reasonable

domestic recovery. Key drivers include - relaxation of most COVID

led restrictions across states which may potentially spur demand,

anticipated revival in investment cycle & domestic manufacturing,

etc.

Accordingly, we are attempting to maintain balanced portfolios

through a combination of domestic recovery themes along with

secular businesses. Given the external risks and its potential impact

we believe investing in a staggered manner or systematic route

may help iron out market extremes. Based on the prevailing

valuations diversified funds with allocations across market cap

range may be considered from a medium-term view. Conservative

investors seeking equity exposure with lower volatility may consider

asset allocation strategies like - Balanced Advantage/Asset

Allocator which manage equity allocations dynamically.

Note: The sectors mentioned are not a recommendation to buy/sell in the

said sectors. The schemes may or may not have future

position in the said sectors. For complete details on Holdings & Sectors of NIMF

schemes, please visit website mf.nipponindiaim.com;

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

Chart of the month :

Rare decoupling visible in the Govt security yield curves of India

and the US. Medium-term growth concerns might likely explain

near inversion of the US yield curve.

Common Source:

Bloomberg, Nippon India Mutual Fund Research

Disclaimer:The information herein above is meant only for general

reading purposes and the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or

as a professional guide for

the readers. The document has been prepared on the basis of publicly available

information, internally developed data

and other sources believed to be reliable. The sponsors, the Investment Manager, the

Trustee or any of their directors,

employees, Associates or representatives (‘entities & their Associate”) do not assume

any responsibility for, or warrant the

accuracy, completeness, adequacy and reliability of such information. Recipients of this

information are advised to rely on

their own analysis, interpretations & investigations. Readers are also advised to seek

independent professional advice in

order to arrive at an informed investment decision. Entities & their associates

including persons involved in the preparation

or issuance of this material, shall not be liable in any way for any direct, indirect,

special, incidental, consequential, punitive

or exemplary damages, including on account of lost profits arising from the information

contained in this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this

document.