Macro and

Equity Market

Outlook

Equity Market

Outlook

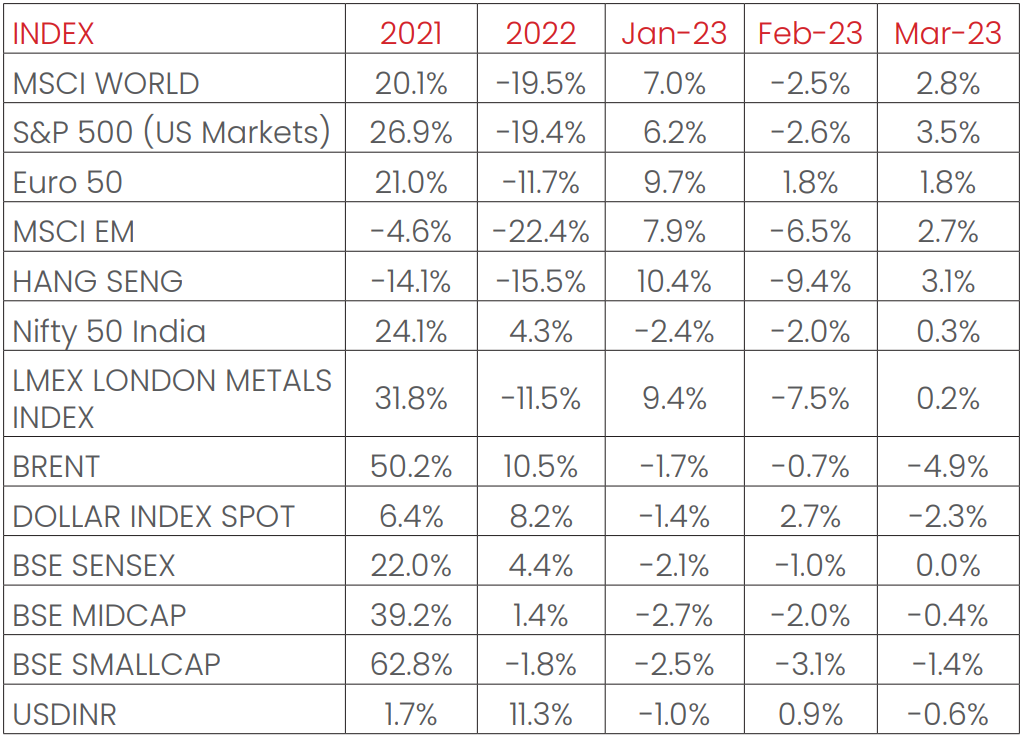

GLOBAL MACRO & MARKETS – Mar 2023

India’s NIFTY index remained flat MoM in March, ending the month

with a MoM growth of just 0.3%, lagging major global indices. MSCI

World index rose 2.8% in March and MOEX Russia led the ascent with

an 8.8% rise. The S&P500 (+3.5%), Euro 50 (+1.8%) and the Nikkei

(+2.2%) rebounded in March despite adverse news flow. Among

emerging markets indices, HANG SENG rose 3.1%, respectively.

BOVESPA (Brazil), fell 2.9% MoM in March. LME Metals Index remained

stable MoM, with mere 0.2% growth, owing to a firmer dollar and a

weaker than anticipated reopening led Chinese growth. WTI and

Brent Crude fell by -1.8% and -4.9% in March just before surprise

production cut by OPEC (Organization of the Petroleum Exporting

Countries). The Dollar index fell by 2.3% on rising expectations of

imminent end to the Fed’s rate hike cycle. Additionally, the US$

depreciated by 1% over the month vis-à-vis the INR. India’s 10Y

G-Sec rate fell by 12 bps, while the USA and Germany’s 10Y G-Sec

yields fell by 45 and 36 bps, settling at 7.31%, 3.47% and 2.29%

respectively.

Domestic Macro & Markets - Mar 2023

SENSEX remained flat in March. BSE Mid-cap (-0.4%) and small-cap

(-1.4%) indices underperformed in March. On the sectoral front,

power (+9%), oil & gas (+3%), and FMCG (+2%) gained the most,

while auto (-3%), IT (-3%), and real estate (-2%) indices closed in

the red. FIIs (Foreign Institutional Investors) turned net buyers of

Indian equities in March (+$1.5bn, following -$0.6bn in February).

DIIs (Domestic Institutional Investors) continued their buying trend

from the previous month, recording positive flows (+$3.7bn).

India's high frequency data update:

Sustained high levels of GST collections, resilient manufacturing,

infrastructure & agricultural sector outputs, moderating inflation and

healthy credit growth augur well for the Indian economy.

Manufacturing PMI:

Manufacturing PMI in March’23 jumped to a 3-month high, reaching

56.4, and remained in expansion zone (>50 points) for the 21st straight

month, as demand resilience, new order expansion remained healthy.

Supply chains easing up resulted in low input costs, as well as a rapid

build-up of input inventories.

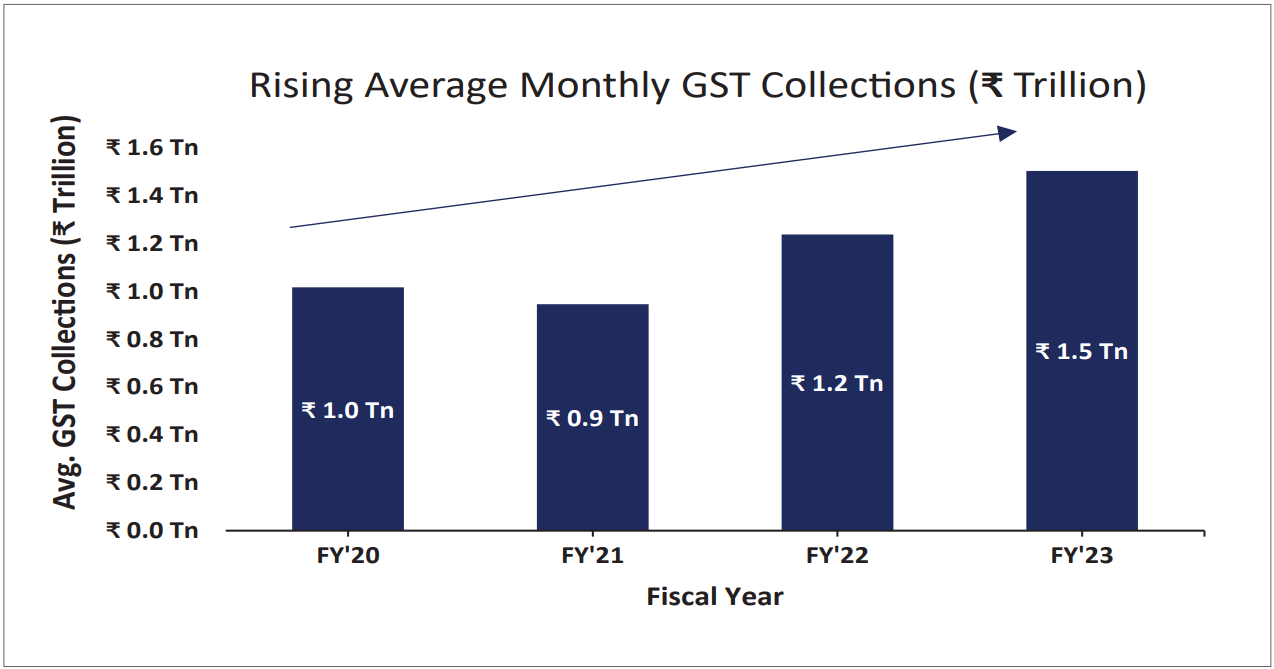

GST Collection:

Collections of INR 1.6 Tn (+13% YoY) in March’23 concluded the

thirteenth consecutive month of collections over the 1.4 Tn mark.

Rises in import and domestic transaction revenues have been

amongst the key reasons for sustained collection levels. For FY23,

the revenues mopped up under GST amounted to INR 18.1 Tn (+22%

YoY), with an average of INR 1.51 Tn being collected monthly.

Core sector production:

Core sector production grew by strong 6% YoY in February’23,

against a four-month high of 7.8% YoY, owing to a healthy

expansion in seven of the eight component sectors. Coal, fertilizers,

and electricity rose 8.5%, 22.2% and 7.6% respectively. Crude Oil was

the only component to decline, with a -4.9% fall.

Industrial Production:

Factory output as measured by the IIP index growth accelerated

MoM to 5.2% YoY in January’23 vs a growth of 4.7% YoY in

December’22. Electricity production recorded the biggest rise

(12.7%), followed by mining (8.8%) and manufacturing (3.7%).

Credit growth:

Credit growth reached 15.68% YoY as of 10th March 2023 against

YoY growth of 8.49% as observed on 11th March 2022.

Inflation:

February’23 CPI inflation eased to 6.44% from 6.52% in January’23,

led by rising food prices- namely cereals, milk, and spices.

Vegetables showed the sharpest decline. Fuel and light inflation

continued to slow. WPI inflation continued to drop, with the

February’23 print at a 24-month low of 3.85%, 88 bps down from

January’s at 4.73%.

Trade Deficit:

Indian Merchandise Exports recorded a decline of -8.8% YoY to

$33.9 Bn in February’23, on account of weaker global demand,

while Imports decreased slower, by -8.31% YoY to $51.31 Bn. India’s

trade deficit narrowed 7% YoY to $17.43 Bn from $16.56 Bn in January

of the 2023. Exports declined for a third time in five months. Imports

were led by a 277% MoM jump in gold imports in February’23.

Monthly Performance for Key Indices:

Note:Market scenarios are not the reliable indicators for current or future

performance. The same should not be construed as

investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Source: Bloomberg

Past performance may or may not be sustained in future.

Source: Bloomberg

Market View

Inflation seems to have peaked out globally but remains elevated

which has led to the expectation that “interest rates may be higher

for longer”. As the higher rates weigh on the growth, recent events in

the U.S. and European banking sectors may have further intensified

slowdown concerns. However, with consumer sentiment remaining

strong, energy prices falling back, and the reopening of China, it is

widely expected that the slowdown may not be as severe as

anticipated a few months back.

Both from cyclical and structural perspective, India seems to be

better placed vs rest of the World. Domestic high frequency

indicators like GST collections, credit growth, PMI, etc point to

elevated activity levels. India is expected to be one of the fastest

growing economies in 2023. Policy reforms in the recent past,

Government led Capex focus, stronger corporate Balance Sheets

have potentially created a robust platform for a virtuous multi

quarter cycle of growth.

Market will look for cues on the direction of interest rates. More

clarity on the same is likely to emerge in the second half of the year.

Till such time, volatility may remain elevated.

Indian market has underperformed MSCI EM in the last few months.

With recent underperformance, India’s relative valuations have

turned more favourable and very much in line with historical

average.

As a house we are overweight on domestic demand related sectors

as growth and earnings certainties may be higher in related

segments.

We suggest investors should have a long-term orientation for

equity investments and should consider products based on their

investment goals and risk appetite. Investors can look to invest in a

staggered manner. Conservative investors may consider asset

allocation strategies.

Note:The sectors mentioned are not a recommendation to buy/sell in the said sectors.

The schemes may or may not have future

position in the said sectors. For complete details on Holdings & Sectors of NIMF schemes, please visit

website mf.nipponindiaim.com.

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

Chart of the month :

FY’23 saw a strong 23% YoY growth in GST collections, reaching Rs.

18.1 Trillion. Average GST collections also rose to Rs. 1.5 Trillion, on

account of stronger compliance and inflation. March GST

collections topped Rs. 1.6 Trillion and grew 13% YoY.

Common Source:

NIMF Research, CMIE, Bloomberg

Disclaimer:The information herein above is meant only for general reading purposes and

the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or as a

professional guide for

the readers. The document has been prepared on the basis of publicly available information, internally

developed data

and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of

their directors,

employees, Associates or representatives (‘entities & their Associate”) do not assume any responsibility

for, or warrant the

accuracy, completeness, adequacy and reliability of such information. Recipients of this information are

advised to rely on

their own analysis, interpretations & investigations. Readers are also advised to seek independent

professional advice in

order to arrive at an informed investment decision. Entities & their associates including persons

involved in the preparation

or issuance of this material, shall not be liable in any way for any direct, indirect, special,

incidental, consequential, punitive

or exemplary damages, including on account of lost profits arising from the information contained in

this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this document.