Macro and

Equity Market

Outlook

Equity Market

Outlook

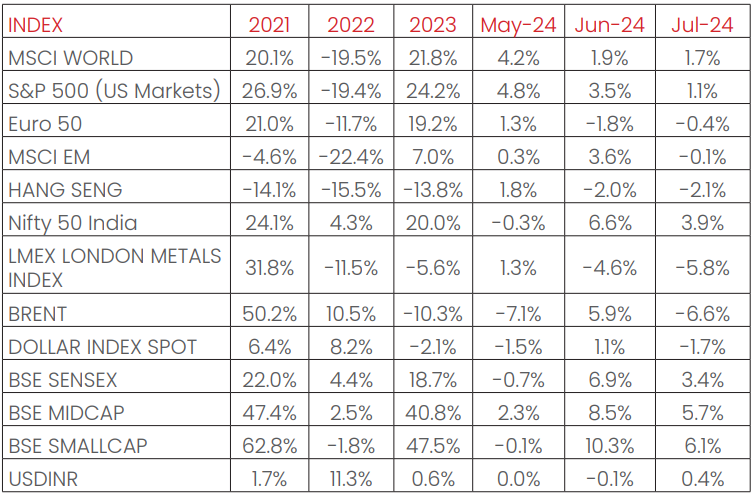

GLOBAL MACRO & MARKETS

India’s NSE NIFTY index rose to higher levels in July 2024, (+3.92%)

MoM, amidst volatility owing to the Union Budget 2024. Major global

indices, the S&P500 (+1.1%), the Euro 50 (-0.4%), the Morgan Stanley

Capital International (MSCI) World (+1.7%), and the Japanese NIKKEI

(-1.2%) ended the month, July 2024 with mixed results on a

sequential basis. Performance was also mixed among Emerging

Market (EM) indices, with the Morgan Stanley Capital International

Emerging Markets (MSCI EM) and the Hang Seng (Hong Kong)

ending the month July 2024 lower, with returns of (-0.1%) and

(-2.1%), respectively. The BOVESPA Brazil (BVSP) ended the month

July 2024 with a growth of (+3%) MoM, while the MOEX Russia

remained flat (+0.0%) in July 2024.

The London Metals Exchange (LME) Metals Index fell (-5.8%) in July

2024, as industrial growth data from China, the largest consumer

of metals remained soft. The West Texas Intermediate (WTI) and

Brent Crude fell MoM, by (-4.5%) and (-6.6%) respectively as United

States (US) economic data remained weak, despite tensions in the

Middle East looming ending July 2024.

The Dollar index depreciated by (-1.7%) through July 2024, with the

US Dollar (USD) depreciating by (-0.1%) vis-à-vis Emerging Market

(EM) currencies and remaining flat against the Indian Rupee (INR)

on the spot market (+0.4%). India 10Y G-Sec yields fell by (-8 bps),

while US 10Y G-Sec yield fell by (-37 bps), and the German Bund

yield fell by (-19.6 bps), with rates settling at 6.92%, 4.02% and 2.30%

respectively.

Domestic Macro & Markets

The BSE SENSEX (+3.4%) rose in July 2024, in line with the NSE NIFTY

index. BSE Mid-cap and Small-cap indices outperformed the BSE

Sensex, with growths of (+5.4%) and (+6.1%) respectively.

Sector-wise, Infotech, Teck and Oil & Gas were the top 3 performers

over the month, July 2024 clocking (+12.9%), (+11.2%), and (+10.5%),

respectively. 10 of BSE’s 13 sectoral indices ended the month, July

2024 in green.

Net Foreign Institutional Investors (FIIs) flows into equities were

positive for July 2024 (+$ 3.27 Bn, following -$ 3.11 Bn in June 2024).

The Domestic Institutional Investors (DIIs) remained net buyers of

Indian equities (+$2.80 Bn, from +$3.43 Bn last month, June 2024). In

CY2024, Net Foreign Institutional Investors (FIIs) Flows stood at

(+$3.60) Bn, while net Domestic Institutional Investors (DIIs)

investments in the cash markets stood at (+$31.29) Bn, outpacing

Foreign Institutional Investors (FII investments).

India's high frequency data update:

Record levels of Goods and Services Tax (GST) collections, stable retail

inflation, deflated input inflation, rising core sector outputs, and

elevated credit growth augurs well for the Indian economy.

Purchasing Managers’ Index Manufacturing PMI:

India’s Manufacturing Purchasing Managers' Index (PMI) in July 2024

fell to 58.1 (vs 58.3 in June 2024), remaining in expansion zone (>50) for

the 36th straight month driven by positive sentiment, strong

production volumes and new order intakes.

Goods and Services Tax (GST) Collection:

The index of eight core sector industries decelerated YoY to (-4%)

in June 2024, against a (+6.3%) jump in May 2024. This was the

lowest growth witnessed in twenty months (20 months). 7 out of

eight constituent segments grew YoY, driven by coal production

(14.8% YoY) and with electricity generation falling to a seven-month

low (7.7% YoY).

Industrial Production:

Factory output growth as measured by the Index of Industrial

Production (IIP) accelerated to (+5.9%) in May 2024, vs a growth of

(+5%) YoY in April 2024, driven by positive, and stable YoY growths

in 3 major sectors- Mining, Manufacturing and Electricity.

Credit growth:

Scheduled Commercial Bank Credit growth reached (+14.01%) YoY

as of 12th July 2024 against a YoY growth of (+20.07%) as observed

on 14th July 2023, as a strong base effect came to play post the

merger of HDFC and HDFC Bank.

Inflation:

June’s 2024 Consumer Price Index (CPI) inflation rate accelerated

MoM to (+5.08%), up from (+4.80%) in May 2024. Food inflation

came in at a faster pace, at 9.36%. Wholesale Price Index (WPI)

inflation accelerated to a sixteen-month high in June 2024, with the

print at (+3.36%), 75 bps up from May 2024.

Trade Deficit:

Indian Merchandise Exports rose by (+2.56%) YoY to $35.2 Bn in June

2024, while Imports rose by (+4.99%) YoY to $56.18 Bn. Merchandise

trade deficit narrowed by (-9.33%) YoY to $20.98 Bn.

Events to watch out for in August 2024:

Earnings Season:

Indian companies may continue to report earnings for Q1FY25/

Q2CY24 from the beginning of July 2024 till the middle of August

2024. Early days but earnings have remained remains buoyant and

in line with consensus expectations amidst robust economic

growth.

Monsoon:

Till 2nd August 2024, cumulative rainfall was 4.4% above long-term

average (LTA) while weekly rainfall was 18% above long-term

average (LTA). On a cumulative basis, rainfall was excess in central

India and southern India, normal in northern India, and deficient in

east and north-east India. Out of the 36 sub-divisions, till date, nine

have received deficient rainfall, 14 have received normal rainfall,

and 13 have received excess rainfall.

The Reserve Bank of India (RBI) Meeting:

The Reserve Bank of India’s (RBI’s) monetary policy committee will

meet to discuss the policy rate from 6-8th August 2024, with the

announcement likely to be made on 8th August 2024. Inflation is

within the RBI’s tolerance band of 2-6%, with the latest print at 5.08%

in June 2024. The RBI will closely track US policy trajectory, with the

Federal Open Market Committee (FOMC) keeping rates

unchanged at the end of July 2024, before tweaking the policy repo

rate, which stands at 6.5% since February 2023.

Monthly Performance for Key Indices:

Source: Bloomberg

.*Calendar year returns.

Note:Market scenarios are not reliable indicators for current or future performance. The same should not be construed as investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Note:Market scenarios are not reliable indicators for current or future performance. The same should not be construed as investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Market View

Indian growth outlook remains as most lead indicators remain in

the green. Longer term construct from a domestic growth point of

view remains positive but well captured in near term equity

valuations. From a market perspective the recent quarterly

earnings growth was largely in line with expectations, however

given the elevated valuations the room for disappointments are

incrementally lower.

The Union Budget 2024 remained focused on the fiscal

consolidation path as laid out in the Interim Budget 2024,

addressing skill development, agriculture, Ministry of Micro, Small

and Medium Enterprises (MSMEs), climate change and digital

penetration.

The Union Budget 2024 also reflected the policy continuity with a

continued thrust on Capex while attempting to create more

employment opportunities and drive consumption.

Investment cycle is expected to continue with greater

participation from private sector, assuming no major shifts in the

global dynamics and risk appetite.

We believe mid-teen earnings improvement is possible at a broad

level. Recovery in International demand conditions and local rural

recovery can provide some upside and going forward its

estimated that market performance may be largely dependent

on earnings growth.

In our view Large Cap oriented strategies like Large/Flexi/Multi Cap

appear better placed while on the thematic space Banking &

Financial services space appears interesting on relative

valuations.

In line with the medium-term perspective Mid and Small Cap

allocations in staggered manner through the systematic route

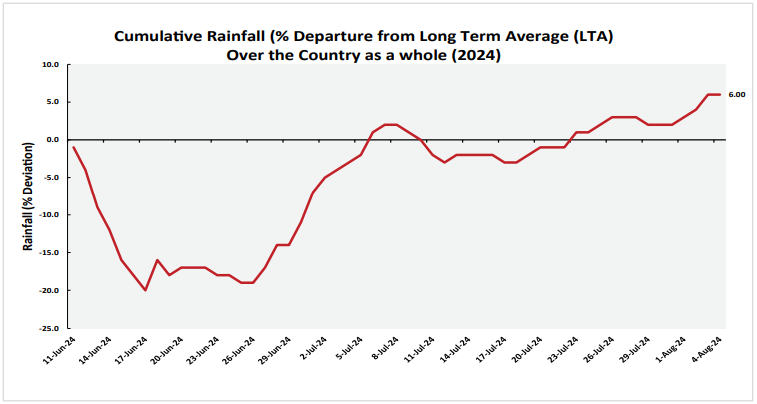

Chart of the Month: No complaints from the monsoon:

Till 4th August 2024, cumulative rainfall was 6.4% above long-term

average (LTA) while weekly rainfall was 18% above long-term

average (LTA). Healthy monsoons augur well for Indian food

inflation, as vegetable prices are seen to be moderating,

decelerating to 3.9% YoY in the week ending 1st August 2024, from

8.9% YoY last year. Surplus reservoir levels, improving rainfall

spreads, and higher than normal sowing of pulses all portend well

towards the dousing of agflation which may enable the RBI to

consider policy easing.

Source:

NIMF Research, CEIC, IMD

Disclaimer:The views expressed herein are based on publicly available information and

other sources believed to be

reliable. It is issued for information purposes only and is not an offer to sell or a solicitation to

buy/sell any mutual fund

units/securities. It should be noted that the analysis, opinions, views expressed in the document are

based on the Budget

proposals presented by the Honorable Finance Minister in the Parliament on July 22, 2024 and the said

Budget proposals

may change or may be different at the time the Budget is passed by the Parliament and notified by the

Government. The

information contained in this document is for general purposes only and not a complete disclosure of

every material fact

of Indian Budget. For a detailed study, please refer to the budget documents available on

http://www.indiabudget.gov.in

The information herein above is meant only for general reading purposes and the views being expressed

only constitute

opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide

for the readers.

The document has been prepared on the basis of publicly available information, internally developed

data and other

sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of their

directors, employees,

Associates or representatives (‘entities & their Associate”) do not assume any responsibility for, or

warrant the accuracy,

completeness, adequacy and reliability of such information. Recipients of this information are advised

to rely on their own

analysis, interpretations & investigations. Readers are also advised to seek independent professional

advice in order to

arrive at an informed investment decision. Entities & their associates including persons involved in

the preparation or

issuance of this material, shall not be liable in any way for any direct, indirect, special,

incidental, consequential, punitive,

or exemplary damages, including on account of lost profits arising from the information contained in

this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this document.

The sectors mentioned are not a recommendation to buy/sell in the said sectors. Details mentioned

above are for

information purpose only.