Macro and

Equity Market

Outlook

Equity Market

Outlook

Global Macro & Markets – Nov 2022

Indian markets rose for a second straight month in November to

new record high, but at a slower pace than global peers. Major

indices broadly rose over the month, except for BOVESPA Brazil

(-3.1%). The S&P500 (5.4%), the Euro 50 (9.6%), the MSCI World (6.8%)

and the Nikkei (1.4%) witnessed consecutive monthly rise in

November. Additionally, the MSCI EM, Hang Seng, NIFTY 50 India and

MOEX Russia all rose 14.6%, 26.6%, 4.1%, and 0.4% MoM respectively.

LME Metals Index witnessed a rise of 12.5% MoM owing to a weaker

dollar. Dollar index fell by 5% over the month, notching its biggest

monthly loss since 2010. WTI and Brent crude fell by -6.9% and -9.9%

MoM as well. US, India, and Germany 10Y G-Sec rates fell by 43, 20

and 21 bps MoM and settled at 3.61%, 7.25% and 1.93%, respectively.

Domestic Macro & Markets - Nov 2022

SENSEX rose by 3.9% in November. Mid-cap and small-cap indices

underperformed large-cap and were up 2% and 3% respectively. Of

the sectoral indices, Metals (6.5%), Oil and Gas (5.8%), and IT (5.5%)

indices were the top gainers, with the Auto (-1.1%), Consumer

Durables (-2.7%), and Power indices (-3.5%) falling MoM. Market

breadth improved over the month with 88% of NIFTY stocks trading

above their respective 200-day moving averages on December 1st,

2022. FPIs bought US$3.6 bn worth of Indian equities, while DIIs sold

US$300 mn in November.

India's high frequency data update:

Indian macro dataflow remained strong on balance.

Manufacturing PMI:

Manufacturing PMI rose MoM in November’22, reaching 55.7, and

remained in expansion zone (>50 points) for the 17th straight

month, with a marked rise in business optimism, new orders,

including exports orders.

GST Collection:

Collections of INR 1.46 Tn (+11% YoY) in November’22 concluded the

ninth consecutive month of collections over 1.4Tn mark. Improving

tax compliance, commodity price pressure and robust consumer

demand sustainably driving the GST collections.

collections.

Core sector production:

Core sector production growth slowed to a 12-month low of +0.1%

YoY in October’22, owing to a contraction in cement, refinery

products and natural gas production, which shrank for a fourth

successive month.

Industrial Production:

Manufacturing IIP rose by 3.1% YoY in September’22 vs a -0.7%

contraction in August’22.

Credit growth:

Credit growth accelerated to 17% YoY as of 4th November 2022

against YoY growth of 6.1% as observed on 5th November 2021.

Inflation:

October’22 CPI inflation fell to 6.8% from 7.4% in September’22, led

by still elevated food prices. WPI inflation continued to fall sharply

with the October’22 print at 8.4%YoY, 230 bps down from

September 2022’s at 10.7%YoY reading.

Trade Deficit:

Indian goods exports declined by 16.7% MoM to $29.78 Bn in

October’22, while imports declined by 6% to $56.69 Bn. India’s trade

deficit widened to $26.9 Bn from $25.71 Bn in September’22.

India's Q2 FY23 GDP Grows At 6.3%:

Indian 2QFY23 (July-September) GDP growth moderated to a

normal rate of 6.3% vs a 13.5% growth in the previous quarter

(April-June). GDP had expanded by 8.4% in 2QFY22. Construction

grew 6.6%yoy while public administration, defence & other services

rose 6.5%yoy. Electricity, gas, water supply & other utility services

climbed 5.6% and agriculture, forestry & fishing segment witnessed

a 4.6% rise in Gross Value Added (GVA). The GVA in the

manufacturing sector contracted 4.3% during the quarter, with

mining also declining by 2.8% YoY. Nominal GDP growth remained

strong as GDP deflator grew by over 9%yoy. Notably, India

remained the fastest-growing major economy in July to

September period.

Market View

Global macros continue to remain uncertain as counter inflationary

steps like higher interest rates, lower liquidity are likely to result in

weaker growth and impact demand across the globe. However, on

positive note the growth concerns have led to cool off in the

commodity prices including crude, which bodes well for India.

Both from cyclical and structural perspective India is better placed

vs the rest of the World. Domestic high frequency indicators

remained resilient despite the global headwinds. Policy reforms,

huge under investments in Capex, stronger corporate Balance

Sheets alongside a transition to a multipolar world may aid

manufacturing, exports and capex - creating a virtuous cycle of

growth. However, near term global uncertainties are unlikely to

wither away soon. The anticipated global slowdown, rising energy &

interest costs may lead to higher than usual volatility especially in

the short run.

We are attempting to maintain balanced portfolios through a

combination of domestic recovery themes along with secular

businesses. The attempt is to identify relatively better valued

opportunities across these themes.

From an investor’s perspective given the external risks and its

potential impact investing in a staggered manner or systematic

route may help iron out market extremes. Given our view that

broader markets can do well with the present fundamentals,

long-term investors can consider diversified strategies like

multi-cap or flexi-cap offerings for equity investments.

Conservative investors seeking equity exposure with lower volatility

may consider asset allocation strategies like - Balanced

Advantage/Asset Allocator which manage equity allocations

dynamically.

Note:The sectors mentioned are not a recommendation to buy/sell in the said sectors.

The schemes may or may not have future

position in the said sectors. For complete details on Holdings & Sectors of NIMF schemes, please visit

website mf.nipponindiaim.com.

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

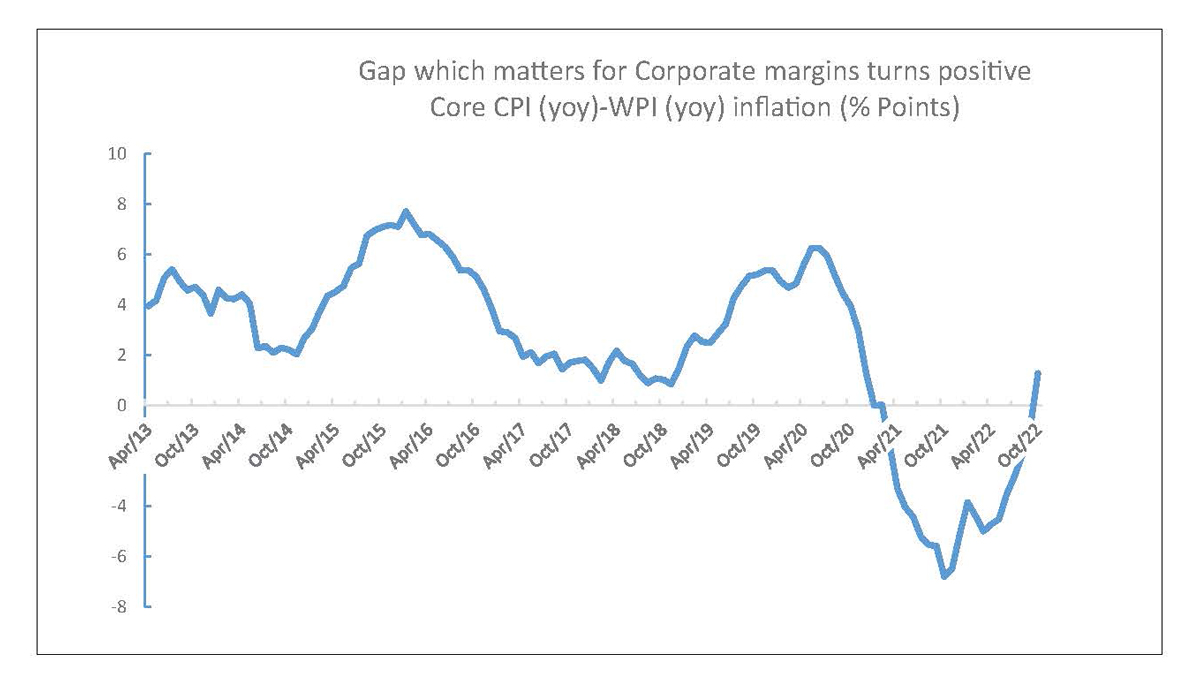

Chart of the month :

Rising cost pressures cool as the gap between Core CPI Inflation

and Core WPI inflation turns positive in October’22 (1.3%).

Common Source:

CMIE, Nippon India Mutual Fund Research, Bloomberg

Disclaimer:The information herein above is meant only for general reading purposes and

the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or as a

professional guide for

the readers. The document has been prepared on the basis of publicly available information, internally

developed data

and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of

their directors,

employees, Associates or representatives (‘entities & their Associate”) do not assume any responsibility

for, or warrant the

accuracy, completeness, adequacy and reliability of such information. Recipients of this information are

advised to rely on

their own analysis, interpretations & investigations. Readers are also advised to seek independent

professional advice in

order to arrive at an informed investment decision. Entities & their associates including persons

involved in the preparation

or issuance of this material, shall not be liable in any way for any direct, indirect, special,

incidental, consequential, punitive

or exemplary damages, including on account of lost profits arising from the information contained in

this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this document.