Macro and

Equity Market

Outlook

Equity Market

Outlook

Global Macro & Markets

Even amid concerns over surging cases of a more

virulent Omicron variant, rising inflation and the

hawkish tone by global central banks, MSCI World

and MSCI EM delivered 4.2% and 1.6% respectively

over the month in December 2021. Euro-50 (+5.8%)

led the DM rally followed by S&P 500 (+4.4%) and

NIKKEI (+3.5%). While almost all markets globally

ended higher than previous month, MOEX Russia

(-2.7%) and Hang Seng (-0.3%) dragged the EM

index. Commodities had a good month as fear

over the impact of Omicron on the global

economy receded, with early data suggesting it

causes a milder illness versus previous variants

like Delta. LME Metals index jumped 4% while Brent

Crude oil gained over 10% MoM.

Domestic Macro & Markets

SENSEX and NIFTY both settled with over 2% gain each. While BSE

MidCap index (+1.1%) lagged, BSE SmallCap index (+5.4%) continued

its outperformance over the narrow index. Among sector indices, IT

(+10%), Industrials (+5%) and Discretionary (+3%) outperformed the

index while Energy (-1%), Financials (-1%) and Staples (0%) lagged

the most. Market breadth declined in November with only 50% of

BSE 200 stocks trading above their respective 200-day moving

averages. FPIs sold US$3.5 bn of Indian equities in the secondary

market while DIIs bought US$4 bn.

India's high frequency data update:

With real GDP now above pre-COVID levels, GST collections at all

time highs, manufacturing activity expanding and inflation settling

at moderate levels, macro data has been quite encouraging over

the month.

Manufacturing PMI:

Manufacturing PMI continued to remain expansionary at 55.5 in

December’21, albeit slowly though when compared to 57.6 in

November’21. International demand for Indian goods continued to

improve in December as new export orders rose for the sixth month

in succession.

GST Collection:

Collections at INR 1.3 Tn (+13% YoY) in December’21 were in line with

the collections of INR 1.32 Tn in November’21 and INR 1.3 Tn in

October’21.

Power consumption:

Power consumption in the month of December’21 was 2.8% higher

than December’20 and 8% higher than the consumption in

December’19.

Core sector production:

Core sector production rose 3.1% YoY in November’21 as against a

YoY rise of 7.5% in October’21 and decline of 1.1% in November last

year.

Industrial Production:

Manufacturing IIP rose 2% YoY in October’21 vs a rise of 4.5% in

October last year.

Credit growth:

Credit growth inched up to 7.3% YoY as of 3-Dec’21 against YoY

growth of 5.7% as observed on 4-Dec’20. Aggregate deposit growth

declined to 9.4% YoY.

Inflation:

CPI inflation in November’21 increased to 4.9% from 4.5% on the

back of higher food prices and core inflation rising from 6% to 6.3%

sequentially. WPI inflation came at a decadal high of 14.2% as fuel

and power inflation rose sharply to 39.8%.

Trade Deficit:

November’21 trade deficit rose to US$22.9 bn as compared to

US$19.9 bn in October’21. Exports increased 27.2% YoY to US$30 bn

while imports increased by 56.6% YoY to $52.9 bn.

Balance of Payments (BOP):

The current account registered a deficit of US$9.6 bn (1.3% of GDP)

in 2QFY22 against a surplus of US$6.5 bn in 1QFY22 (0.9% of GDP)

and surplus of US$15.3 bn (2.4% of GDP) in 2QFY21. The deficit was led

by a widening of the trade deficit to US$44.4 bn (1QFY22: US$30.7

bn) and an increase in net investment income outflow of US$10 bn

(US$7 bn in 1QFY22).

Year in Review

Indian Market was one of the best performing Emerging Markets in

2021. The Nifty Index was up 22.4% in US$ terms and 24.1% in INR

terms, touching an all-time high level in October and

outperformed the MSCI EM Index by over 29%. Mid-cap and

Small-cap indices returned over 46% and 59% respectively over the

year. INR remained range bound and depreciated 1.7% to close at

Rs.74.3/US$. India 10Y bond yield jumped to 6.45% in Dec’21 from

5.87% a year back . FPIs sold US$7 bn in CY2021 while DIIs bought

US$12 bn in CY2021.

Market View

Concerns on emergence of a new variant has led to higher volatility

across the globe. Also, some indicators suggest that global growth

may be slower. However, we believe that if the impact of new virus

strain is controlled, Indian recovery is likely to be in line with

expectations supported by strong earnings growth, capex revival

etc.

We believe all three market cap segments (Large, Mid and Small)

offer similar risk reward, making a case for diversified strategies with

investments across market caps. Conservative investors seeking

equity exposure with lower volatility may consider asset allocation

strategies like Multi Asset/Balanced Advantage etc which diversify

risk across different asset classes and/or manage equity

allocations dynamically.

Note: The sectors mentioned are not a recommendation to buy/sell in the

said sectors. The schemes may or may not have future

position in the said sectors. For complete details on Holdings & Sectors of NIMF

schemes, please visit website mf.nipponindiaim.com;

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

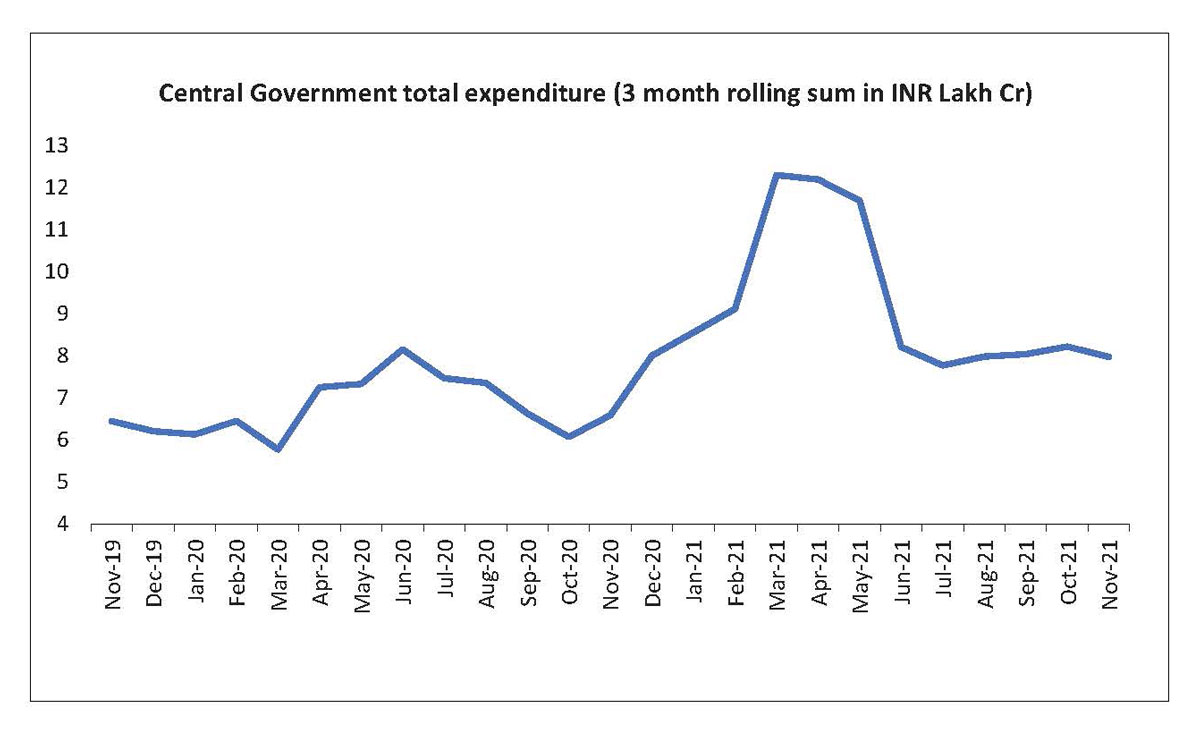

Chart of the month :

Government has been conservative in its spending so far in FY22.

Given buoyant tax revenue collections, Government may increase

spending

Common Source:

CMIE, Nippon India Mutual Fund Research, Bloomberg

Disclaimer: The information herein above is meant only for general

reading purposes and the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or

as a professional guide for

the readers. The document has been prepared on the basis of publicly available

information, internally developed data

and other sources believed to be reliable. The sponsor, the Investment Manager, the

Trustee or any of their directors,

employees, associates or representatives (“entities & their associates”) do not assume

any responsibility for, or warrant

the accuracy, completeness, adequacy and reliability of such information. Recipients of

this information are advised to

rely on their own analysis, interpretations & investigations. Readers are also advised

to seek independent professional

advice in order to arrive at an informed investment decision. Entities & their

associates including persons involved in the

preparation or issuance of this material shall not be liable in any way for any direct,

indirect, special, incidental,

consequential, punitive or exemplary damages, including on account of lost profits

arising from the information contained

in this material. Recipient alone shall be fully responsible for any decision taken on

the basis of this document.