Macro and

Equity Market

Outlook

Equity Market

Outlook

GLOBAL MACRO &

MARKETS

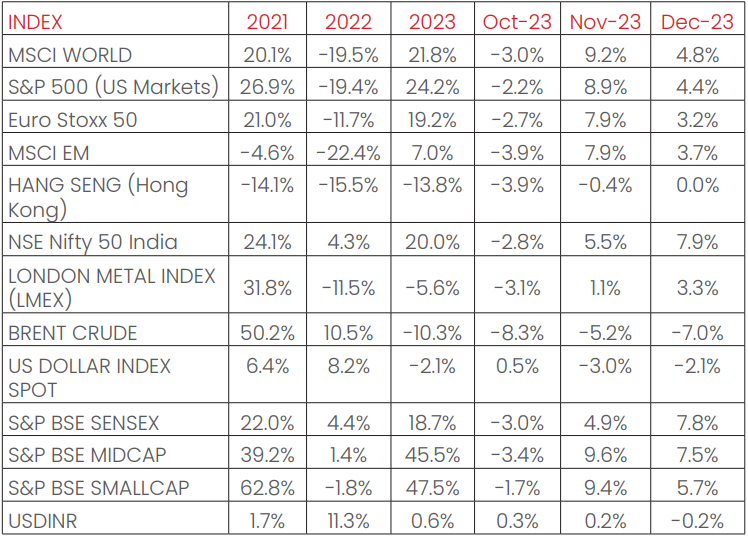

India’s NSE NIFTY 50 index ended the month with gains of 7.9%

MoM in December’2023. The S&P 500 (+4.4%), the Euro Stoxx 50

(+3.2%), and the Morgan Stanley Capital International World

(MSCI) (+4.8%), were all positive MoM, as Japan’s Nikkei 225

(-0.1%) remained flat. Among emerging markets indices, the

Morgan Stanley Capital International (MSCI) Emerging Markets,

and BOVESPA (BVSP) Brazil indices were up in December’2023, by

3.7%, and 5.4% respectively. The Moscow Exchange (MOEX) Russia

Index was down by 2.1%, and the HANG SENG (Hong Kong) was flat

(+0.0%) over the month. Overall, global equity markets ended

with strong gains in 2023.

London Metal Exchange (LME) Metals rose sequentially by 3.3%

in December’2023., as expectations of China’s recovery

remained in line, led by growth-supportive policies. West

Texas Intermediate (WTI) and Brent Crude slipped over the

month by 5.7% and 7.0% respectively as global oil markets

remained volatile based on production caps by The Organization

of the Petroleum Exporting Countries (OPEC+) countries and the

situation in the Red Sea.

The US Dollar index weakened by 2.1% through December’2023,

with the Dollar appreciating by 0.5% vis-à-vis Emerging Market

currencies and depreciating by 0.2% against the Indian Rupee

on the spot market. India 10Y G-Sec yields fell by 10.6 bps,

while US 10Y G-Sec yield slid by 44.7 bps, and the German Bund

yield fell by 42.3 bps, with rates settling at 7.17%, 3.88%

and 2.02% respectively. US yields falling were a function of

the Fed’s comments on potential rate cuts in the year 2024,

with inflation now expected to moderated sharper than expected

previously.

Domestic Macro &

Markets

The S&P BSE SENSEX (+7.8%) rose in December’2023, in tandem

with other Indian benchmark indices. S&P BSE Mid-cap and S&P

BSE Small-cap indices underperformed the S&P BSE large cap

index, posting performances of +7.5% and 5.7% respectively.

Sector-wise - Power, Oil & Gas, Metals, and Capital Good

indices were the top 4 performers over the month, clocking

+18.2%, +12.0%, +11.3%, and +11.3%, respectively. All 13 of

BSE’s sectoral indices ended the month in green.

Net Foreign Institutional Investors (FII) flows into equities

were positive for December’2023(+$5.85Bn, following +1.1Bn in

November). Domestic Institutional Investors (DIIs) remained

net buyers of Indian equities (+$1.5Bn, from +$1.7 Bn from

last month). In CY2023, Net Foreign Institutional Investors

(FII) Flows stood at +$21.17Bn, while net Domestic

Institutional Investors (DII) investments in the cash markets

stood at +$22.33Bn, outpacing Foreign Institutional Investors

(FII) investments.

India's high frequency data update:

Elevated levels of Goods and Services tax (GST) collections,

festive season demand uptick, stable retail inflation,

deflated input inflation, rising core sector outputs, and

elevated credit growth promiseds well for the Indian economy

at the end of 2023

Manufacturing Purchasing Managers’ Index (PMI):

Manufacturing PMI in December’2023 came in at 54.9, down from

56 in November’2023 and remained in expansion zone for the

30th straight month helped by reduced price pressures. New

orders growth has likely moderated further in December’2023.

Goods and Services Tax (GST) Collection:

Collections of INR 1.65 Tn (10% YoY) in December’2023

concluded the 22nd consecutive month of collections over the

INR 1.4 Tn mark, following record collections of INR 1.87 Tn

in April’2023. Collections for 7 out of 9 months in this

fiscal year crossed INR 1.6 Tn. Rising compliance, increased

formalization of the economy, recent festive demand, and

improved administrative efficiency have aided higher levels of

GST collections despite weakening price pressures.

Core sector production:

The index of eight core sector industries grew by 7.84% in

November’ 2023, against 12.03% jump in October’2023, as

unfavourable base effect came into play for India’s eight core

sectors. Six of the eight constituent sectors recorded

positive YoY growths, with crude oil and cement recording YoY

degrowths in November’2023.

Auto sales:

Overall Auto Sale delivered mixed performance in the domestic

market, despite year ending discounts. 2 wheelers and

passenger vehicles continued positive momentum, while

commercial vehicles and tractors recorded double digit

decline. Exports also remained subdued with various

geopolitical issues and currency related uncertainties.

Credit growth:

Banks’ non-food credit in November ’2023 sustained 16.3% yoy

growth (20.8% incl. HDFC’s merger). Further, Bank Credit

growth reached 20.15% YoY (incl HDFC merger) as of 15th

December,2023 against a YoY growth of 17.43% YoY as observed

on 16th December,2022.

Inflation:

November’s 2023 Consumer Price Index (CPI) inflation rate rose

to a three-month high, and reached 5.55%, accelerating from

4.87% in October’2023. Food inflation remained elevated and

accelerated, coming in at 8.7%. Wholesale Price Index (WPI)

inflation turned positive, with the November’2023 print at a

+0.26%, 78 bps up from October’2023s at -0.52%, as fuel and

manufactured products rose substantially.

Trade Deficit:

Indian Merchandise Exports recorded a fall of 2.9% YoY to

$33.9 Bn in November’2023, while Imports fell by -4.4% YoY to

$54.5 Bn. Merchandise trade deficit narrowed to a $20.6 Bn as

the global economic situation remained uncertain.

Events to watch out for in January 2024:

Oil Prices:

Organization of the Petroleum Exporting Countries (OPEC+) is

currently cutting output by 6 Mn BPD (Barrels Per Day), about

6% of global supply. Global oil markets remain volatile,

especially as conflict remains between Israel and Hamas, and

Russia and Ukraine. US Oil production remains on the rise, but

supply side risks remain and key to watch out for.

Quarterly Earnings:

Q3FY24 earnings season begins with a backdrop of a resilient

Indian economy and soft global economy. Global earnings growth

will also be keenly watched as market has runup in the last

couple of months of 2023.

FII Flows:

Net Foreign Institutional Investors (FII) Flows into India

stood at +$21.17Bn in CY23, one of the highest among emerging

markets. December’2023 saw +$5.8 bn of flows into the Indian

market. Given Fed easing expectations along with slowing

global economy, it would be interesting to observe trend in

Foreign Institutional Investors (FII) flows.

Festive season demand:

India’s private consumption, especially for consumer

discretionary goods, as festive and wedding season demand

momentum is expected to spillover from December’2023. However,

data on autos and select consumer discretionary goods sales in

December’2023 remain mixed and therefore requires keen

observation in coming weeks.

US FOMC Meet:

The US Federal Open Market Committee (FOMC) met in 2023

(12-13th December), keeping its policy Federal Funds Rates

(FFR) steady at 5.25-5.50% for the third consecutive time,

making room for the scope of up to three rate cuts in 2024.

Hopes of a “soft landing”, where the dual objectives of low

unemployment and low inflation are maintained without a

recession, will be dependent on incoming US economy data,

where inflation and employment conditions look to be

improving. The late January meeting (January 31st ,2024) will

be a key monitorable for global equity markets.

Monthly Performance for Key Indices:

Note: Market scenarios are not the reliable

indicators for current or future performance. The same should

not be construed as investment advice or as any research

report/research recommendation.

Past performance may or may not be sustained in future.

Source: Bloomberg

Past performance may or may not be sustained in future.

Source: Bloomberg

Market View

Equity market sentiment improved supported by some positive

news flows emerging both globally and locally. Deceleration in

US inflationary expectations relative to past and declining

Oil prices despite the production cuts & geopolitical tensions

have been important positives.

On the domestic front, the activity indicators remained robust

driven capex and discretionary consumption. The corporate

profits also remained strong primarily driven by benefits of

lower input costs.

Going forward the sentiment appears to buoyant supported by

India’s relatively better macros, possibility of higher

foreign flows and the narrative around policy continuity in

the upcoming general elections.

However, the valuations remain elevated compared to long term

averages with lower head room to absorb any disappointments.

The geo-political challenges continue and may impact the

growth trajectory while domestically the rural demand

continues to be tepid.

Hence, we believe Large Cap and Large Cap oriented strategies

across Large Cap and Flexi/Multi Cap categories appear to be

better placed on a risk- reward basis while Asset allocation

products can help to manage the downside risks.

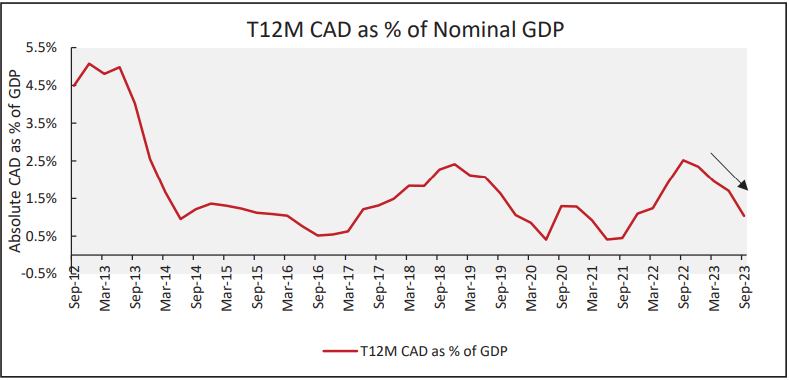

Chart of the month :

Current Account Deficit (CAD) narrows sharply reducing India’s external sector vulnerabilities.

India’s 2QFY24 Current Account Deficit (CAD) moderated to

US$8.3 bn (0.96% of GDP, (1QFY24: US$9.2 bn (1.1%). A Widening

trade deficit was widely offset by an increase in net

invisibles, augmented by technical and software exports.

Trailing 12M CAD as % of Nominal GDP also fell to 1% of GDP.

Source:

NIMF Research, CEIC

Disclaimer: The information herein above is meant only for general reading purposes and the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for

the readers. The document has been prepared on the basis of publicly available information, internally developed data

and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of their directors,

employees, Associates or representatives (‘entities & their Associate”) do not assume any responsibility for, or warrant the

accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on

their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in

order to arrive at an informed investment decision. Entities & their associates including persons involved in the preparation

or issuance of this material, shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive

or exemplary damages, including on account of lost profits arising from the information contained in this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this document.