Macro and

Equity Market

Outlook

Equity Market

Outlook

Global Macro & Markets

Markets continued battling three key concerns:

China, geopolitics and the Fed. Though both MSCI

World and MSCI EM ended flat for the month,

global markets ended mixed. Singapore, Australia,

and Malaysia declined 3.7%, 3% and 1.9% while

Shanghai, Brazil and Germany gained 4.6%, 3.5%

and 2.1%. US 10Y rates declined 9 bps whereas India

and Germany 10Y treasury rates were up 28 and 18

bps respectively. LME Metal Index declined 6%

MoM. Brent crude oil prices rallied another 12.3%

over the month despite Dollar index strengthening

1.6%.

Domestic Macro & Markets

Amid volatile sessions, the BSE-30 and Nifty-50 indices settled with

a loss of 2.6% and 3% in the month of May. Mid-cap and small-cap

indices underperformed large-cap and were down 5% and 8%. On

the sectoral front, only Auto and FMCG indices ended in green.

Metals, power and consumer durables indices declined 16%, 12%

and 11% respectively. Market breadth declined further in May’22 with

25% of BSE 200 stocks trading above their respective 200-day

moving averages. FPIs sold US$5.7 bn worth of Indian equities in the

secondary market while DIIs bought US$6.3 bn.

India's high frequency data update:

Healthy GST collections, strength within core, manufacturing &

agricultural sectors and rising exports bode well for the economy in

near term.

Manufacturing PMI:

Manufacturing PMI continued to remain expansionary at 54.6 in

May’22, thereby pointing to a sustained recovery.

GST Collection:

INR 1.41 Tn (+44% YoY) in May’22 recorded third consecutive month

of collections over 1.4Tn mark, implying healthy overall economic

activity and improvement in tax compliance.

Core sector production:

Core sector production rose 8.4% YoY in April’22 as against a YoY

rise of 4.9% in March’22 and a rise of 62.6% same time last year. On

a sequential basis, infra output decreased 9.5%.

Industrial Production:

Manufacturing IIP increased 0.9% YoY in March’22 vs 28.4% rise in

March last year.

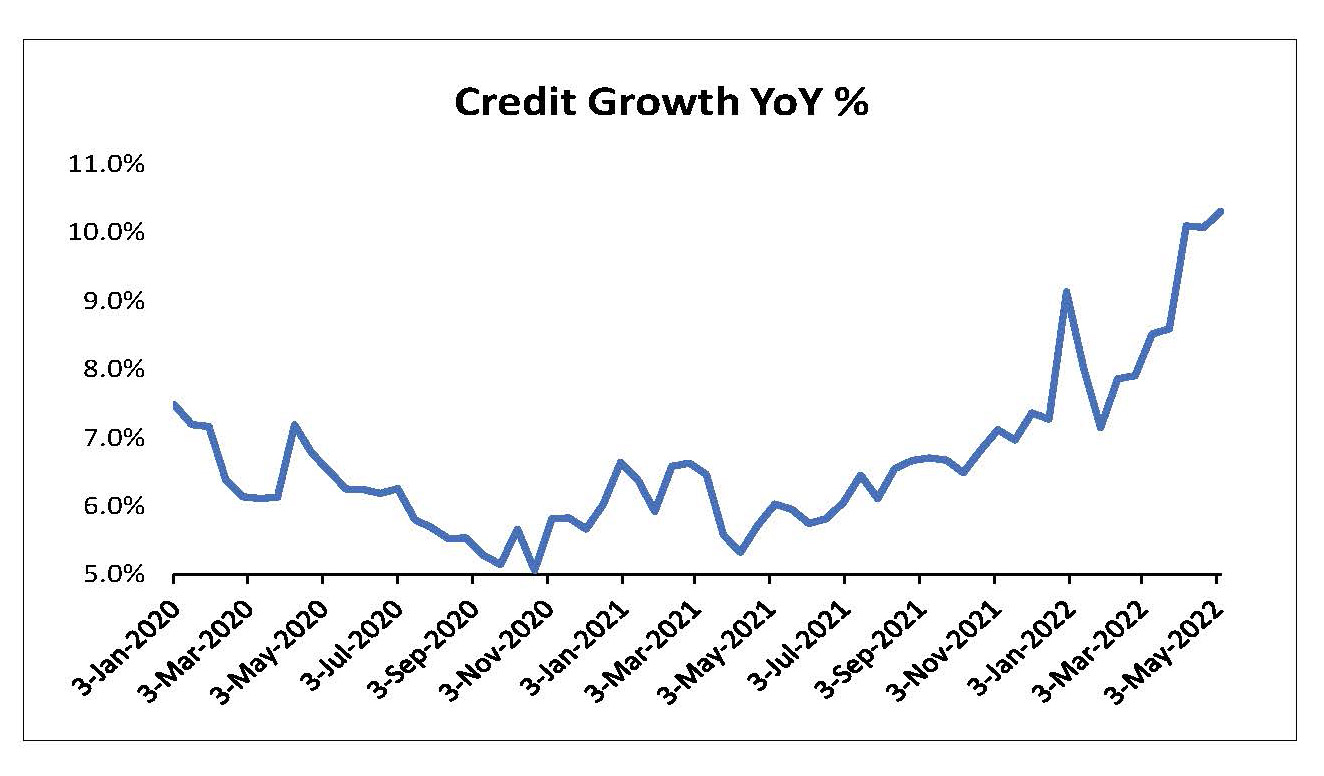

Credit growth:

Credit growth accelerated to 10.8% YoY as of 6-May 2022 against

YoY growth of 6% as observed on 7-May 2021. Aggregate deposit

growth also grew 9.7% YoY.

Inflation:

CPI inflation in April’22 shot up to 7.79% YoY from 6.95% in March’22

led by increases in food and core inflation. WPI inflation rose 60bps

to 15.1%.

Trade Deficit:

April’22 trade deficit widened to US$20.1 bn as compared to US$18.7

bn in March’22. Exports increased 24% YoY to US$38.2 bn while

imports increased by 26% YoY to $58.2 bn.

GDP Growth:

The 4QFY22 real GDP growth slowed to 4.1% (3QFY22: 5.4%), with

private consumption being the laggard at 1.8% (3QFY22: 7.4%).

Investment growth improved to 5.1% (3QFY22: 2.1%) and

government consumption growth at 4.8%. Omicron wave led

disruption led to sequential short-lived moderation in 4QFY22

growth.

Fiscal Measures to curb inflation:

With a view to curb inflationary pressures, the Central Government

announced: (1) excise duty cuts of Rs8/litre for petrol and Rs6/litre

for diesel (annualized revenue loss of around Rs1 tn with around 30

bps of lower inflation), (2) LPG subsidy of Rs200/cylinder

(annualized loss of around Rs61 bn), (3) approval of additional

expenditure of Rs1.1 tn for fertilizer subsidy, and (4) customs duty

cuts for coking coal, naptha, ferro-nickel, propylene oxide, etc. and

export duty hikes for select steel products. These measures follow

the earlier decision of wheat exports ban.

RBI:

The RBI Monetary Policy Committee (MPC), in an off-cycle meeting,

unanimously voted to hike repo rate by 40 bps to 4.4% and

continued with its focus on withdrawal of accommodation.

Consequently, Standing Deposit Facility (SDF) rate and Marginal

Standing Facility (MSF) rate increased to 4.15% and 4.65%. The RBI

also hiked CRR by 50 bps to 4.5% which would withdraw liquidity of

around Rs870 bn. The MPC highlighted that the domestic food

inflation was being pushed up by global commodity prices with

high and volatile crude oil prices also posing upside risks to

inflation. Core inflation is also likely to remain elevated in the near

term due to fuel prices and essential medicines. On the growth

front, the MPC expects recovery in farm output and capex.

Market View

Near term market sentiment is likely to be influenced by the

increased geopolitical risks in the backdrop of ongoing

Russia-Ukraine conflict, higher inflation/ commodity prices, rate

hikes by Global Central Banks and most importantly how these

factors impact the Global/domestic growth possibilities.

Accordingly, we anticipate higher than usual volatility or market

swings in the short term. From a domestic perspective while direct

impact of Russian-Ukraine conflict, through trade channel may be

limited, the indirect impact on Crude prices, Inflation, rising input or

raw material prices needs to be monitored. Notwithstanding the

short-term global risks and assuming that the geo-political

tensions are diffused soon, we remain optimistic on a reasonable

domestic recovery. Key drivers include - relaxation of most COVID

led restrictions across states which may potentially spur demand,

anticipated revival in investment cycle & domestic manufacturing,

etc.

Accordingly, we are attempting to maintain balanced portfolios

through a combination of domestic recovery themes along with

secular businesses. Given the external risks and its potential impact

we believe investing in a staggered manner or systematic route

may help iron out market extremes. Based on the prevailing

valuations diversified funds with allocations across market cap

range may be considered from a medium-term view. Conservative

investors seeking equity exposure with lower volatility may consider

asset allocation strategies like - Balanced Advantage/Asset

Allocator which manage equity allocations dynamically.

Note:Note:The sectors mentioned are not a recommendation to buy/sell in the said

sectors. The schemes may or may not have future

position in the said sectors. For complete details on Holdings & Sectors of NIMF schemes, please visit

website mf.nipponindiaim.com.;

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

Chart of the month :

Credit growth rose by 10.8% YoY led by sharp acceleration in retail

loans followed by credit in MSMEs and infrastructure related loans.

Common Source:

RBI, Bloomberg, Nippon India Mutual Fund Research

Disclaimer:The information herein above is meant only for general reading purposes and

the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or as a

professional guide for

the readers. The document has been prepared on the basis of publicly available information, internally

developed data

and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of

their directors,

employees, Associates or representatives (‘entities & their Associate”) do not assume any responsibility

for, or warrant the

accuracy, completeness, adequacy and reliability of such information. Recipients of this information are

advised to rely on

their own analysis, interpretations & investigations. Readers are also advised to seek independent

professional advice in

order to arrive at an informed investment decision. Entities & their associates including persons

involved in the preparation

or issuance of this material, shall not be liable in any way for any direct, indirect, special,

incidental, consequential, punitive

or exemplary damages, including on account of lost profits arising from the information contained in

this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this document.