Macro and

Equity Market

Outlook

Equity Market

Outlook

GLOBAL MACRO & MARKETS

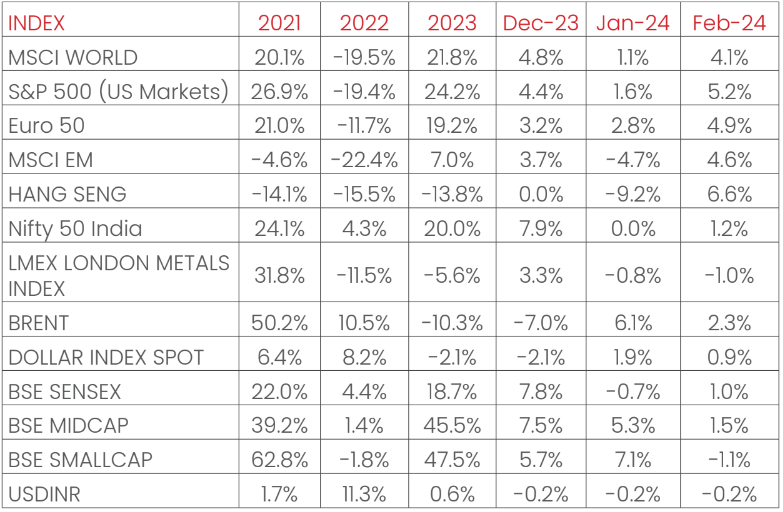

India’s NSE NIFTY index ended the month higher, +1.2% MoM, in

February 2024. The S&P500 (+5.2%), the Euro 50 (+4.9%), the

Morgan Stanley Capital International (MSCI) World (+4.1%), and

the Japanese NIKKEI (+7.9%) rounded a second consecutive

positive month for major global indices. Among Emerging Market

(EM) indices, the Morgan Stanley Capital International (MSCI)

Emerging Markets, the HANG SENG (Hong Kong), The Moscow

Exchange (MOEX) Russia and the BOVESPA (BVSP) Brazil ended

February 2024 in green, with returns of +4.6%, +6.6%, 1.3%,

and +1.0% respectively.

The London Metal Exchange (LME) Metals Index was down (-1.0%)

in February 2024, as top consumer China’s demand outlook

remained moderate, with manufacturing London Metal Exchange

Purchasing Managers' Index (PMI)remaining in contraction in

February 2024. West Texas Intermediate (WTI) and Brent Crude

rose over the month, by +3.2% and +2.3% respectively as global

oil markets remained volatile based on the sustenance of The

Organization of the Petroleum Exporting Countries (OPEC+)

production caps, anticipation of US inventory data and the

situation in the Red Sea. The West Texas Intermediate (WTI)

reached the highest prices seen since November 2023.

The Dollar index strengthened by +0.9% through February 2024,

with the Dollar depreciating by -1.2% vis-à-vis Emerging

Market currencies and depreciating by -0.2% against the Indian

Rupee on the spot market. India 10Y G-Sec yields fell by -6.6

bps, while US 10Y G-Sec yield rose by +33.8 bps, and the

German Bund yield rose by +24.5 bps, with rates settling at

7.08%, 4.25% and 2.41% respectively.

Domestic Macro & Markets

The S&P BSE SENSEX (+1.2%) rose in February 2024, in line with

the NSE NIFTY Index. BSE Mid-cap index outperformed the S&P

BSE SENSEX Index, rising by +1.6%, while the BSE Small-cap

index ended the month -1% down. Sector-wise, Oil & Gas, Auto,

and Realty were the top 3 performers over the month, clocking

+6.7%, +6.4%, and +6.3%, respectively. 12 of S&P BSE’s 13

sectoral indices ended the month in green.

Net Foreign Institutional Investors (FIIs) flows into equities

were positive for February 2024 (+$0.4 Bn, following -$3.35 Bn

in January 2024). Domestic Institutional Investors (DIIs)

remained net buyers of Indian equities (+$3.06 Bn, from

+$3.3Bn last month). In CY2024, Net Foreign Institutional

Investors (FIIs) Flows stood at -$2.7 Bn, while net Domestic

Institutional Investors (DIIs) investments in the cash markets

stood at +$6.3 Bn, outpacing Foreign Institutional Investors

(FIIs) investments.

India's high frequency data update:

Elevated levels of Goods and Services Tax (GST) collections,

festive season demand uptick, stable retail inflation,

deflated input inflation, rising core sector outputs, and

elevated credit growth augurs well for the Indian economy.

Manufacturing PMI:

Manufacturing Purchasing Managers' Index (PMI) in February

2024 recovered to 56.9, at a five-month high and remained in

expansion zone for the 32nd straight month driven by

accelerating sales and new export orders.

GST Collection:

Gross collections of INR 1.68 Tn (+12.5% YoY, fourth highest

ever recorded) in February 2024 concluded the twenty fourth

consecutive month of collections over the INR 1.4 Tn mark,

following record collections of INR 1.87 Tn in April 2023.

Collections for 9 out of 10 months in this fiscal year crossed

INR 1.6 Tn. Rising compliance, increased formalization of the

economy, festive demand, and improved administrative

efficiency have driven high tax collection buoyancy.

Core sector production:

The index of eight core sector industries grew by 3.6% in

January 2024, against a 3.8% jump in December 2023, as an

unfavourable base effect came into play. Six of the eight

constituent sectors recorded positive YoY growths, with

refinery products and fertilisers recording a YoY degrowth.

Industrial Production:

Factory output growth as measured by the Index of Industrial

Production (IIP) index accelerated MoM in December 2023, with

a rise of 3.8%, vs a growth of 2.4% YoY in November 2023,

driven by muted, but positive YoY growths in all 3 constituent

sectors- Mining, Manufacturing and Electricity.

Credit growth:

Scheduled Commercial Bank Credit growth reached 20.34% YoY as

of 9th February 2024 against a YoY growth of 16.06% as

observed on 10th February 2023.

Inflation:

January’s 2024 Consumer Price Index (CPI) inflation rate

reached a 3-month low of 5.1%, decelerating from 5.69% in

December 2023. Food inflation remained elevated but falling,

coming in at 8.3%. WPI inflation reached a three month low,

with the January 2024 print at +0.27%, 46 bps down from

December’s 2023 at +0.73%, as WPI inflation printed positive

for the third month in a row.

Trade Deficit:

Indian Merchandise Exports rose by +3.13% YoY to $36.92 Bn in

January 2024, while Imports rose by +2.99% YoY to $54.41 Bn.

Merchandise trade deficit narrowed by +2.7% to $17.49 Bn as

the global economic situation remained uncertain.

Other key updates:

Earnings Season 3Q FY24:

The earnings season gone by was strong, driven by margin

tailwinds in domestic cyclicals (Autos and Financials) and

global cyclicals (Metals and Energy). A higher number of

companies in Energy, Auto, Healthcare, Industrials and

Utilities had earnings revised upwards, while IT earnings

delivery remained tepid. Interest rate and an uncertain global

economic outlook continues to drive earnings expectations,

which remained stable.

Oil Prices:

The coalition of Oil Producing and Exporting Countries (OPEC+)

rolled over its production cut policy to the second quarter of

2024, in March 2024. Current production cuts remain at 2.2 Mn

BPD (Barrels per day), with Saudi Arabia maintaining a 1 Mn

BPD voluntary cut in production till the end of June 2024.

Russia also agreed to cut its production by .47 Mn BPD until

the end of June 2024. The situation in the Red Sea and the

Israel-Hamas conflict remains an overhang for global oil

markets.

Monthly Performance for Key Indices:

Source: Bloomberg

.*Calendar year returns.

Note: Market scenarios are not reliable indicators for current or future performance. The same should not be construed as investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Note: Market scenarios are not reliable indicators for current or future performance. The same should not be construed as investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Market View

India displays resilience with notable gains across major

broad based indices, reflecting positive investor sentiment

and confidence supported by demographic advantage,

deregulation & policy reforms, digitization, and demand

(aspirational spending).

The earnings season gone by was strong, driven by margin

tailwinds in domestic cyclicals (Autos and Financials) and

global cyclicals (Metals and Energy) and the overall outlook

towards domestic capital markets remains optimistic as the

earnings cycle for 3QFY24 was in line with the expectations.

Going forward the sentiment appears to be buoyant supported by

India’s relatively better macros, earnings outlook for India

remains strong relative to emerging markets, driven by healthy

credit demand and robust high-end consumption demand,

possibility of higher foreign flows and the narrative around

policy continuity in the upcoming general elections.

We believe Large Cap oriented strategies across Large Cap and

Flexi/Multi Cap categories appear to be better placed on a

risk- reward basis while Asset allocation products can help to

manage the downside risks.

Asset allocation in line with investment goals and risk

appetite is important for better risk – return optimization.

Herein asset allocation funds can help in lowering volatility

and provide better balance to the overall portfolio mix.

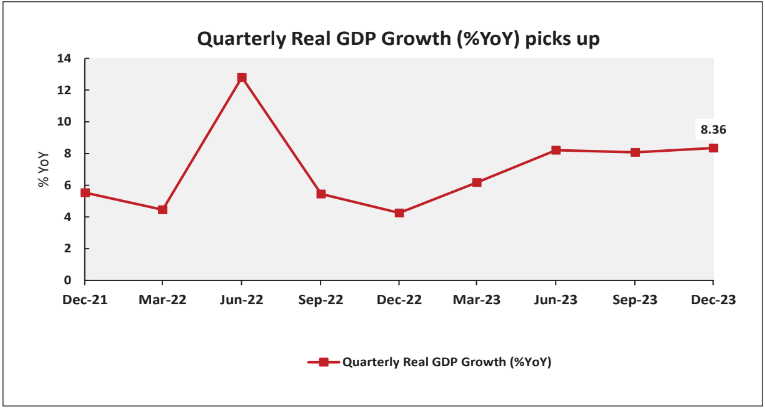

Chart of the month :

Quarterly Real GDP Growth (%YoY) picks up

India's economy rose 8.4% in the October 2023-December 2023

period, the fastest pace seen in last six quarters and partly

helped by a surge in manufacturing activity, according to data

released by the government on 29th February’2024.

Source:

MOSPI, NIMF Research, CEIC

Disclaimer: The information herein above is

meant only for general reading purposes and the views being

expressed only constitute opinions and therefore cannot be

considered as guidelines, recommendations or as a professional

guide for the readers. The document has been prepared on the

basis of publicly available information, internally developed

data and other sources believed to be reliable. The sponsors,

the Investment Manager, the Trustee or any of their directors,

employees, Associates or representatives (‘entities & their

Associate”) do not assume any responsibility for, or warrant

the accuracy, completeness, adequacy and reliability of such

information. Recipients of this information are advised to

rely on their own analysis, interpretations & investigations.

Readers are also advised to seek independent professional

advice in order to arrive at an informed investment decision.

Entities & their associates including persons involved in the

preparation or issuance of this material, shall not be liable

in any way for any direct, indirect, special, incidental,

consequential, punitive or exemplary damages, including on

account of lost profits arising from the information contained

in this material. Recipient alone shall be fully responsible

for any decision taken on the basis of this document.

The sectors mentioned are not a recommendation to buy/sell

in the said sectors. Details mentioned above are for

information purpose only.