Macro and

Equity Market

Outlook

Equity Market

Outlook

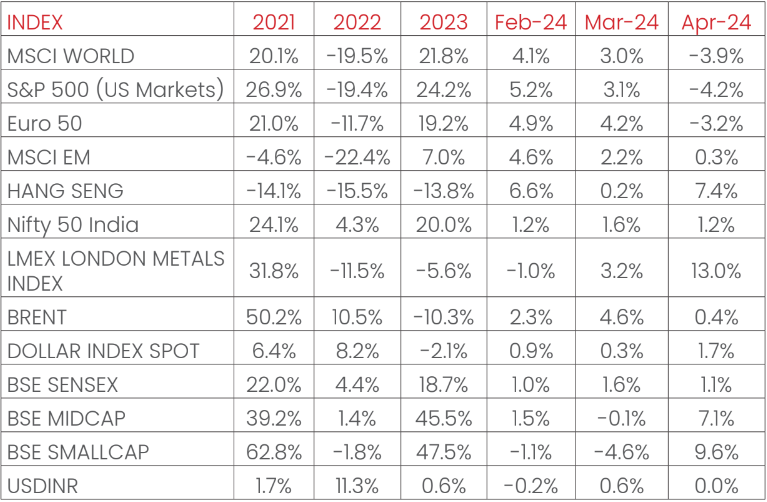

GLOBAL MACRO & MARKETS

India’s NSE NIFTY index ended the month in green, up +1.2%

MoM, in April 2024. The S&P500 (-4.2%), the Euro 50 (-3.2%),

the Morgan Stanley Capital International (MSCI) World (-3.9%),

and the Japanese NIKKEI (-4.9%) all ended the month in red.

Among Emerging Market (EM) indices, the Morgan Stanley Capital

International (MSCI) Emerging Markets, the HANG SENG (Hong

Kong), The Moscow Exchange (MOEX) Russia ended April 2024 in

green, with returns of +0.3%, +7.4%, +4.1%, respectively. The

BOVESPA (BVSP) Brazil ended in negative in April 2024, with a

return of -1.7% MoM.

The London Metals Exchange (LME) Index rose (+13.0%) in April

2024, as base metals gained, it drove global demand amidst

tighter supplies. The West Texas Intermediate (WTI) fell, and

Brent Crude rose MoM, by -1.5% and +0.4% respectively as high

inventory levels drew prices lower. The Dollar index

strengthened by +1.7% through April 2024, with the Dollar

depreciating by -0.8% vis-à-vis Emerging Market (EM)

currencies and remaining flat against the Indian Rupee on the

spot market. India 10Y G-Sec yields rose by 13 bps, while US

10Y G-Sec yield rose by 48 bps, and the German Bund yield rose

by 29 bps, with rates settling at 7.19%, 4.67% and 2.58%

respectively.

Domestic Macro & Markets

The S&P BSE SENSEX (+1.1%) rose in April 2024, in line with

the NSE NIFTY index. BSE Mid-cap and Small-cap indices

outperformed the S&P BSE Sensex, with performances of +7.1%

and +9.6% respectively. Sector-wise, Metals, PSU and Power

were the top 3 performers over the month, clocking +10.8%,

+10.0%, and +7.7%, respectively. 11 of BSE’s 13 sectoral

indices ended the month in green.

Net Foreign Institutional Investors (FII) flows into equities

were negative for April 2024 (-$1.3 Bn, following +4 Bn in

March 2024). The Domestic Institutional Investors (DIIs)

remained net buyers of Indian equities (+$5.3 Bn, from +$6.78

Bn last month). In CYTD2024, Net Foreign Institutional

Investors (FII) Flows stood at +$0.04 Bn, while net Domestic

Institutional Investors (DII) investments in the cash markets

stood at +$18.36 Bn, outpacing Foreign Institutional Investors

(FII) investments.

India's high frequency data update:

Record levels of Goods and Services Tax (GST) collections,

stable retail inflation, deflated input inflation, rising core

sector outputs, and elevated credit growth may augur well for

the Indian economy.

Manufacturing PMI:

India Manufacturing Purchasing Managers' Index (PMI) in April

2024 remained strong at 58.8 (vs 59.1 in March 2024),

remaining in expansion zone for the 33rd straight month driven

by accelerating output and new orders, underpinning strong

demand conditions.

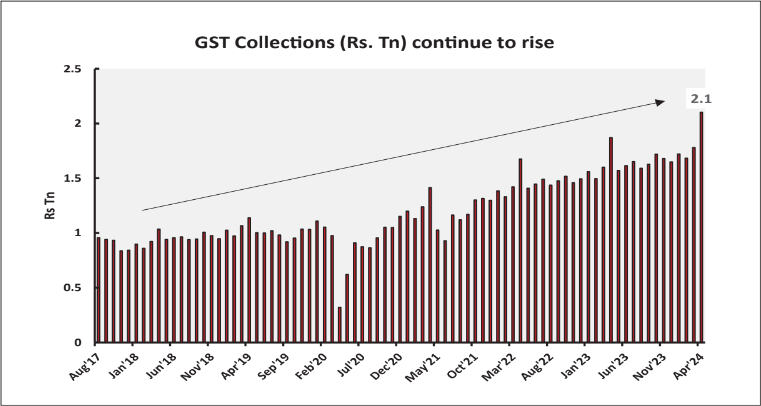

GST Collection:

Gross collections of INR 2.10 Tn (+12.4% YoY, highest ever

recorded) in April 2024 concluded the twenty sixth consecutive

month of collections over the INR 1.4 Tn mark, following

previous record collections of INR 1.87 Tn in April 2023.

Rising compliance, increased formalization of the economy,

domestic transaction volume uptick, and growth in imports have

driven elevated tax collections.

Core sector production:

The index of eight core sector industries decelerated YoY to

-5.2% in March 2024, against a +7.2% jump in February 2024

(Revised upwards from +6.7%). Six of the eight constituent

sectors recorded positive YoY growths, with Fertilizers and

refinery outputs recording a YoY degrowth.

Industrial Production:

Factory output growth as measured by the Index of Industrial

Production (IIP) index rose to a 4-month high in February

2024, with a rise of +5.7%, vs a growth of +3.8% YoY in

January 2024, driven by positive YoY growths in 3 major

sectors- Mining, Manufacturing and Electricity.

Credit growth:

Scheduled Commercial Bank Credit growth reached 19.01% YoY as

of 19th April 2024 against a YoY growth of 15.92% as observed

on 21st April 2023.

Inflation:

March’s 2024 Consumer Price Index (CPI) inflation rate reached

a 10-month low of 4.85%, decelerating from 5.09% in February

2024. Food inflation decelerated, coming in at 8.52%.

Wholesale Price Index (WPI) inflation accelerated from

February 2024, with the March 2024 print at +0.53%, 33 bps up

from February 2024, as WPI inflation printed positive for the

fifth month in a row.

Trade Deficit:

Indian Merchandise Exports rose by +0.67% YoY to $41.67 Bn in

March 2024, while Imports fell by -5.98% YoY to $57.27 Bn.

Merchandise trade deficit widened by +17.74% YoY to $15.59 Bn

as oil exports decelerated.

Events to watch out for in May 2024

Q4FY24 Earnings Season:

The Q4FY24 earnings season continues in May 2024, against the

backdrop of a better-than-expected earnings season in the

previous quarter. Earnings in general has been better than

expected led by domestic cyclical segments. Information

Technology (IT) services and Fast-moving consumer goods (FMCG)

posted weaker than expected earnings so far. Management

commentary around the outlook for FY25 profitability is one of

the most important variables to watch out for.

General Election Developments:

Voting for Indian General Elections which started on April

19th, 2024, which will run over six weeks in seven phases.

Bulk of the polling will happen in May 2024. The third phase

for elections will start from May 7th, 2024, with a total of

92 seats across 11 Union Territories (UTs) and states going to

the polls. Policy continuation towards developmental agenda

makes the elections a key monitorable for markets.

Oil Prices:

Oil markets remain data driven, with United States (US)

economic data leading to fresh concerns over near term demand,

with aggravated crude inventories and potential easing of

geopolitical risk leading to a drop in oil prices. When The

Organization of the Petroleum Exporting Countries (OPEC+)

cartel meets in June 2024, supply cuts are expected to be

carried over into the second half of the next year. Oil prices

in the context of supply cuts and weakening demand will be a

monitorable for markets.

Heat/ Monsoon:

The Indian Meteorological Department (IMD) forecasts an above

normal monsoon (> 106% of long period average (LPA) rainfall).

Climate model forecasts indicate neutral condition by the

beginning of monsoon season and La Niña conditions during

second half of monsoon season. The model forecasts also

indicate positive Indian Ocean Dipole (IOD) conditions likely

to develop during the monsoon season. With regards to the

spatial distribution, forecasts indicate above normal rainfall

is likely over most part of the country except some areas of

north-west, East, and north-east India, where below normal

rainfall is likely.

Monthly Performance for Key Indices:

Source: Bloomberg

.*Calendar year returns.

Note: Market scenarios are not reliable indicators for current or future performance. The same should not be construed as investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Note: Market scenarios are not reliable indicators for current or future performance. The same should not be construed as investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Market View

India's growth story may continue to unfold positively,

supported by a confluence of factors. FY24 was a good year for

all categories in the market, with mid and small cap doing

very well.

Despite global headwinds like geopolitical tensions and

commodity price volatility, the domestic economy has displayed

resilience. Several tailwind indicators such as power demand,

recovering rural demand, buoyant capital markets, improving

corporate capex and external demand, rising industrial output

led to a healthy investment climate and may provide a fillip

to the economy leading to growth momentum.

A notable trend in India's growth story is the improvement in

capacity utilization, largely driven by cyclical and

capital-intensive sectors which in turn suggests that

corporates are investing to keep pace with rising demand in

the economy.

While the larger construct looks positive in India, valuations

continue to remain elevated at a broad level with some

exceptions like Large Banks, select utilities, commodities

etc. With elevated valuations and rising bond yields, the

equity risk premium tends to reduce.

Given the election cycle across different countries, we can

anticipate some policy shifts which in turn may lead to higher

volatility/uncertainty in 2nd half of the year making a case

of asset allocation strategies which can aid better risk

management.

Asset allocation in line with investment goals and risk

appetite is important for better risk – return optimization.

Herein asset allocation funds investing across two or more

asset classes can help in lowering volatility and may provide

better balance to the overall portfolio mix.

From a pure equity perspective Large Cap oriented strategies

like Large/Flexi/Multi Cap appear better placed in the current

context while on the thematic space Banking & Financial

services space appears interesting on relative valuations.

Chart of the month :

Solid end to FY24 as Goods and Services Tax (GST) collections rose to record high level. GST collections in April 2024 (pertaining to business activity in March 2024) grew +13% YoY, broadly the same growth as in the last few months (growth had averaged 13% between the October 2023 – March 2024 period). Collections rose to record levels at INR 2.1 Tn in April 2024, highest since the tax regime started in 2017. Growth in GST collections is being driven largely by domestic activity led collections and not due to Indian Export Import (EXIM) Bank trade.

Source:

MOSPI, NIMF Research, CEIC

Disclaimer: The information herein above is

meant only for general reading purposes and the views being

expressed only constitute opinions and therefore cannot be

considered as guidelines, recommendations or as a professional

guide for the readers. The document has been prepared on the

basis of publicly available information, internally developed

data and other sources believed to be reliable. The sponsors,

the Investment Manager, the Trustee or any of their directors,

employees, Associates or representatives (‘entities & their

Associate”) do not assume any responsibility for, or warrant

the accuracy, completeness, adequacy and reliability of such

information. Recipients of this information are advised to

rely on their own analysis, interpretations & investigations.

Readers are also advised to seek independent professional

advice in order to arrive at an informed investment decision.

Entities & their associates including persons involved in the

preparation or issuance of this material, shall not be liable

in any way for any direct, indirect, special, incidental,

consequential, punitive, or exemplary damages, including on

account of lost profits arising from the information contained

in this material. Recipient alone shall be fully responsible

for any decision taken on the basis of this document.

*The sectors mentioned are not a recommendation to buy/sell

in the said sectors. Details mentioned above are for

information purpose only.