Macro and

Equity Market

Outlook

Equity Market

Outlook

Global Macro & Markets

Global Markets rebounded in October with US S&P500

hitting its all-time high as more than 80% of the

companies reporting results surprised the street

positively on the quarterly earnings. MSCI World gained

5.6% MoM on the back of S&P500 (+6.9%) and Euro50

(+5%). MSCI EM lagged the rally at 0.9% gains as Brazil

was down 6.7% while NIFTY50 India and MOEX Russia

remained muted at 0.3% and 1.1% gains respectively.

Brent Crude crossed the $80/bbl mark to gain 7.5% over

the month. LME Metals index also gained 5.6% MoM

despite some weakness in the latter half of the month.

Domestic Macro & Markets

SENSEX hit new all-time highs in middle of the month but ended almost

flat amid concerns over steep valuations, rising commodity prices and

mixed earnings. BSE MidCap index (+0.1%) and BSE SmallCap index (-0.4%)

ended almost in-line with SENSEX (0.3%). Among sector indices,

Discretionary (+6%), Financials (+3%) and Energy (0%) outperformed the

index while Staples (-5.8%), HealthCare (-4.1%) and IT (-2.5%) lost the most.

Market breadth declined in September with 81% of BSE 100 stocks

remained above their respective 200-day moving averages. FPIs sold

US$2.2bn of Indian equities while DIIs bought US$0.6bn.

India's high frequency data update:

With current account in surplus, GST collections at all time highs,

manufacturing activity expanding rapidly and inflation moderating, macro

data has been quite encouraging over the month.

Manufacturing PMI:

Manufacturing PMI rose to an 8-month high of 55.9 in October compared

to 53.7 in September. New orders continued to expand in October amidst

low inventory levels.

GST Collection:

Collections in October 2021 clocked second highest collections of over

INR

1.3 Tn (+24% YoY) as compared to INR 1.17 Tn in September.

Power consumption:

Power consumption in the month of October was 6.6% higher than

October-20 and 19.5% higher than the consumption in October-2019.

Core sector production:

Core sector production rose 4.4% in September as against a YoY rise of

11.5% in August and rise of 0.6% in September last year.

Industrial Production:

Manufacturing IIP rose 9.7% YoY in August vs a fall of 7.6% in August

of last

year.

Credit growth:

Credit growth remained sluggish at 6.5% YoY as of 8-October against YoY

growth of 5.7% as observed on 9-October 2020. Aggregate deposit

growth picked up to 10.5% YoY.

Inflation:

CPI inflation in September fell sharply to 4.35% yoy amid favourable

base

and softening food prices. WPI inflation came at 10.7% yoy in September

moderating from 11.4% in August.

Trade Deficit:

September trade deficit increased sharply to US$22.9 bn as compared to

US$13.9 bn in August. Non-oil exports increased 18.7% to US$28.5 bn over

September 2020 while non-oil imports increased 57.8% YoY to US$39 bn.

Current Account Balance:

The current account registered a surplus in 1QFY22, rising to $6.5 bn

(0.9%

of GDP) against a deficit of US$8.2 bn in 4QFY21 (-1% of GDP) and surplus

of US$19.1 bn (3.7% of GDP) in 1QFY21. The surplus was led by moderation

in trade deficit to US$30.7 bn (4QFY21: US$41.7 bn) and an increase in net

services receipts to US$25.8 bn (US$23.5 bn in 4QFY21).

GatiShakti initiative

The Union cabinet approved the INR 100 Cr PM GatiShakti National Master

Plan for multi-modal connectivity to develop infrastructure and reduce the

logistics cost to boost the economy.

Reappointment of the RBI Governor

The Government has reappointed Mr Shaktikanta Das as Reserve Bank of

India’s Governor for 3 more years. As the RBI starts to unwind its loose

monetary policy, stability in its top leadership has been critical and

reappointment of Das is being considered as a welcome development.

Market View

Indian equity market sentiment has remained resilient despite the

record

high valuations supported by higher liquidity, strong earnings possibility,

relatively lower rates. The improving domestic macro data suggests that a

reasonable economic recovery is underway. Capex revival, business

normalization, improving global trade and domestic consumption are key

contributors to this anticipated recovery.

Higher inflation may pose a potential challenge for prevailing easy

liquidity

& lower rates and any faster than expected normalization in the same may

impact market sentiment. Geo-political developments and oil prices are

other key areas to be tracked.

We believe all three market cap segments (Large, Mid and Small) offer

similar risk reward, making a case for diversified strategies with investments

across market caps. Conservative investors seeking equity exposure with

lower volatility may consider asset allocation strategies like Multi

Asset/Balanced Advantage etc.

Note: The sectors mentioned are not a recommendation to buy/sell in the

said sectors.

The schemes may or may not have future position in the said

sectors. For complete details on Holdings & Sectors of NIMF schemes, please visit

website mf.nipponindiaim.com;

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

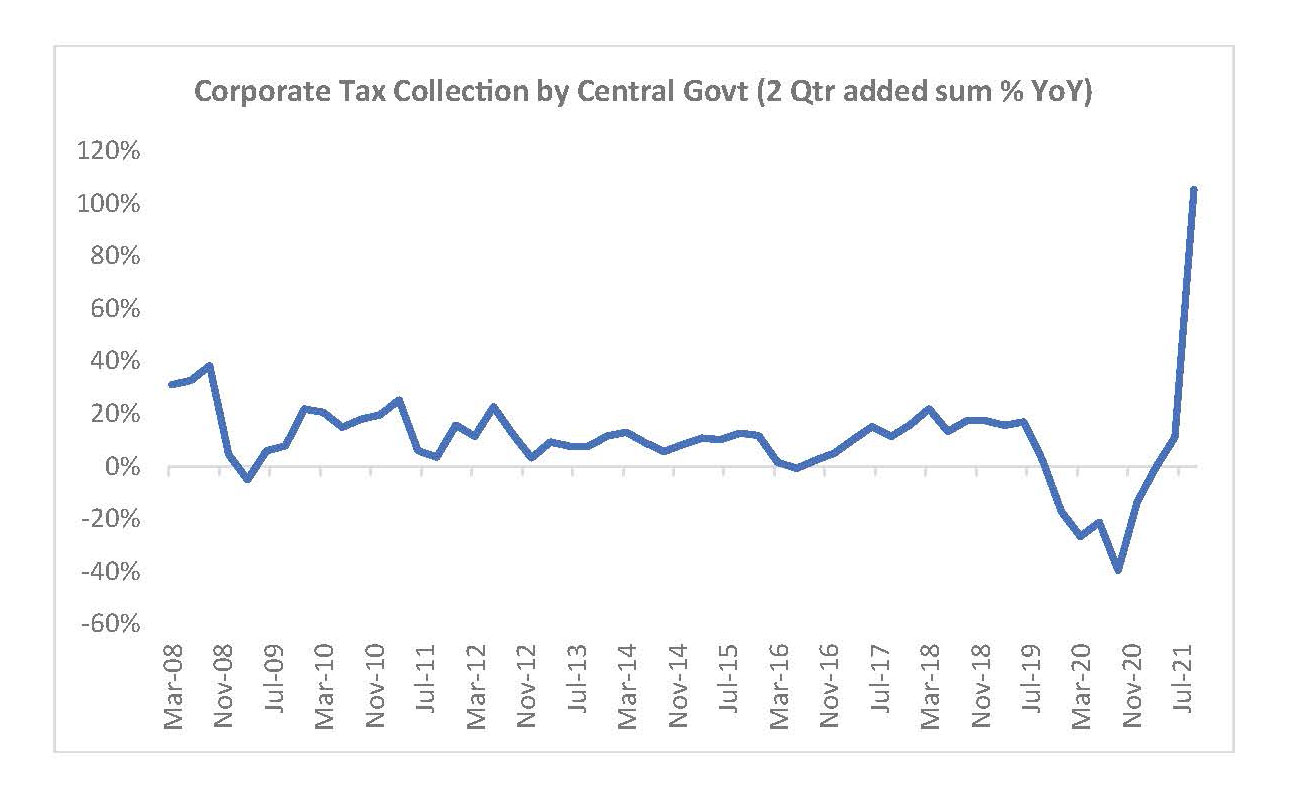

Chart of the month :

Central Govt tax collections have been very strong in 1HFY22. Within

that,

partly aided by favourable base, corporate tax collections grew massive

105% YoY in the 1H. This amounts to 56% of the budgeted target.

Common Source:

CMIE, Nippon India Mutual Fund Research, Bloomberg

Disclaimer: The information herein above is meant only for general

reading purposes and the views being expressed only constitute

opinions and therefore cannot be considered as guidelines, recommendations or as a

professional guide for the readers. The document

has been prepared on the basis of publicly available information, internally developed

data and other sources believed to be reliable. The

sponsor, the Investment Manager, the Trustee or any of their directors, employees,

associates or representatives (“entities & their

associates”) do not assume any responsibility for, or warrant the accuracy,

completeness, adequacy and reliability of such information.

Recipients of this information are advised to rely on their own analysis,

interpretations & investigations. Readers are also advised to seek

independent professional advice in order to arrive at an informed investment decision.

Entities & their associates including persons

involved in the preparation or issuance of this material shall not be liable in any way

for any direct, indirect, special, incidental,

consequential, punitive or exemplary damages, including on account of lost profits

arising from the information contained in this

material. Recipient alone shall be fully responsible for any decision taken on the basis

of this document.