Macro and

Equity Market

Outlook

Equity Market

Outlook

Global Macro & Markets

Owing to concerns around the US taper and ripple

effect of the Evergrande crisis in China, global equities

took a pause on its winning streak and declined 4.3% in

September, sharpest monthly decline since March-2020.

NIKKEI (+4.9%) outperformed S&P500 (-4.8%) and

Euro-50 (-3.5%). Fall in Emerging Markets (-4.2%) was

led by Hang Seng (-5%) and BOVESPA Brazil (-6.6%),

while NIFTY India (+2.8%) and MOEX Russia (+4.1%)

outperformed the index. Crude oil prices rallied

7.6%m/m owing to a decline in US crude inventory,

lower supply concerns and higher global demand

outlook by the IEA (International Energy Agency) and

OPEC (Organization of the Petroleum Exporting

Countries). LME Metals index ended the month 3.1%

lower in contrast to crude oil prices.

Domestic Macro & Markets

India was among the best performing markets globally, taking its

year-to-date relative outperformance to 30 ppt compared to MSCI EM

Index. BSE MidCap index (+5.9%) and BSE SmallCap index (+4.3%) resumed

outperformance against SENSEX (+2.7%) after the first monthly

underperformance of the year in August. Among sector indices, Energy

(+12%), Discretionary (+6%) and Communication Services (+6%) gained the

most while Materials (-2%), HealthCare (-1%) and Financials (0%) lost the

most. Market breadth rose in September as 89% of BSE 100 stocks

remained above their respective 200-day moving averages. FPIs bought

US$1227 Mn of Indian equities while DIIs bought US$789 Mn.

India's high frequency data update:

With current account in surplus, GST collections improving, manufacturing

activity expanding and inflation moderating, macro data has been quite

encouraging in recent period.

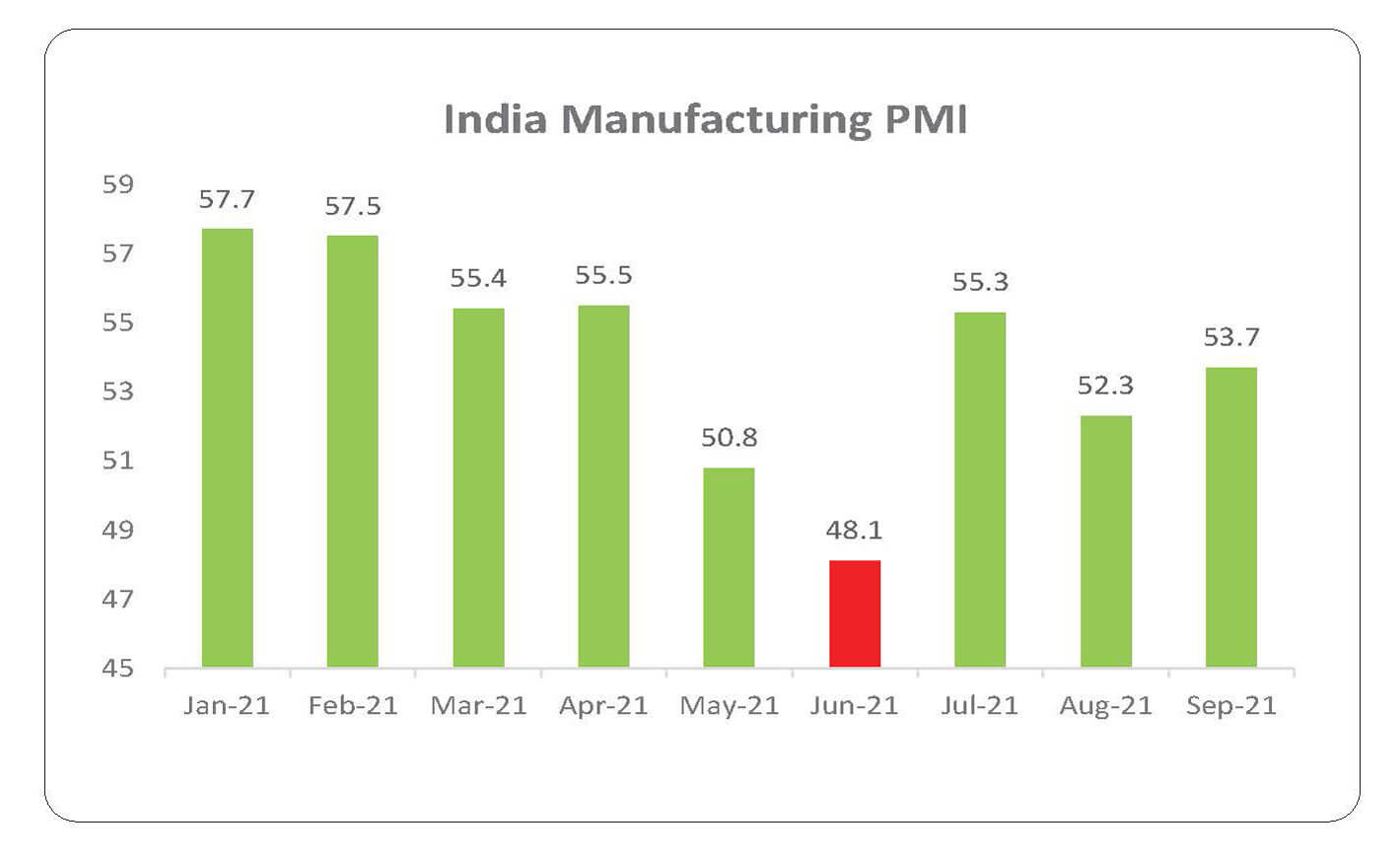

Manufacturing PMI:

Manufacturing PMI rose to 53.7 in September compared to 52.3 in August.

The factory activity rose on account of production growth boosted by

stronger new order inflows, companies scaling up input buying and

acceleration in input cost inflation.

GST Collection:

Collections in September picked up to INR 1.17 Tn (+23% YoY) as

compared to INR 1.12 Tn in August, crossing the crucial INR 1 Tn mark for

third month in a row, indicating a fast recovery.

Power consumption:

Power consumption in the month of September was 0.8% higher than

September-20 and 5.5% higher than the consumption in August 2019.

Core sector production:

Core sector production rose 9.3% in August as against a YoY rise of

16.4%

in July and fall of 6.9% in August last year.

Industrial Production:

Manufacturing IIP rose by 10.5% YoY in July vs a fall of 11.4% in July

of last

year.

Credit growth:

Credit growth remained sluggish at 6.7% YoY as of 10-Septmber against

YoY growth of 5.3% as observed on 11-September 2020. Aggregate

deposit growth fell to 9.3% YoY.

Inflation:

CPI inflation in August moderated to 5.3% from 5.6% as observed in July

led by lower-than-expected food inflation. WPI inflation came at 11.4% in

July increasing from 11.2% in June led by fuel and power inflation at 26.1%

and inflation for basic metals at 27.5%.

Trade Deficit:

August trade deficit further widened to US$13.9 bn as compared to US$11

bn in July. Non-oil exports increased 36.6% to US$28.6 bn over August

2020 while non-oil imports increased 43.9% YoY to US$35.4 bn.

Current Account Balance:

The current account registered a surplus in 1QFY22, rising to $6.5 bn

(0.9%

of GDP) against a deficit of US$8.2 bn in 4QFY21 (-1% of GDP). The surplus

was led by moderation in trade deficit to US$30.7 bn and an increase in net

services receipts to US$25.8 bn.

Normal Monsoon

Though delayed and erratic, 32% excess rain in September helped offset

the 24% and 6.8% deficiency in August and July rainfall respectively. With

rainfall amounting to 99% of the long period average, it has been a good

monsoon, making it third consecutive normal monsoon in India.

The DISCOM reform scheme

All Indian states have come on-board for the INR 3 Trillion DISCOMs

reforms

scheme. The new 'Reforms-based and Results-linked, Revamped Distribution

Sector Scheme' seeks to improve the operational efficiencies and financial

sustainability of all discoms/power departments (excluding private sector

discoms) by providing conditional financial assistance to discoms for

strengthening of supply infrastructure.

Market View

Indian equity market sentiment has remained resilient despite the

record

high valuations supported by higher liquidity, strong earnings possibility,

relatively lower rates. In our view profit to GDP ratio in India may continue

to rise in a foreseeable future as lot of segments which hitherto had not

contributed meaningfully are witnessing a turnaround. The improving

domestic macro data suggests that a reasonable economic recovery is

underway. Capex revival, business normalization, improving global trade

and domestic consumption are key contributors to this anticipated

recovery.

Higher inflation may pose a potential challenge for prevailing easy

liquidity

& lower rates and any faster than expected normalization in the same may

impact market sentiment. Geo-political developments and oil prices are

other key areas to be tracked.

We believe all three market cap segments (Large, Mid and Small) offer

similar risk reward, making a case for diversified strategies with investments

across market caps. Conservative investors seeking equity exposure with

lower volatility may consider asset allocation strategies like Multi

Asset/Balanced Advantage etc.

Note: The sectors mentioned are not a recommendation to buy/sell in the

said sectors.

The schemes may or may not have future position in the said

sectors. For complete details on Holdings & Sectors of NIMF schemes, please visit

website mf.nipponindiaim.com;

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

Chart of the month :

In contrast to some near-term growth challenges in the rest of the

World,

Indian manufacturing has been resilient on the back of improvement in

domestic demand.

Common Source:

IHS Markit, Nippon India Mutual Fund Research,

Bloomberg

Disclaimer: The information herein above is meant only for general

reading purposes and the views being expressed only constitute

opinions and therefore cannot be considered as guidelines, recommendations or as a

professional guide for the readers. The document

has been prepared on the basis of publicly available information, internally developed

data and other sources believed to be reliable. The

sponsor, the Investment Manager, the Trustee or any of their directors, employees,

associates or representatives (“entities & their

associates”) do not assume any responsibility for, or warrant the accuracy,

completeness, adequacy and reliability of such information.

Recipients of this information are advised to rely on their own analysis,

interpretations & investigations. Readers are also advised to seek

independent professional advice in order to arrive at an informed investment decision.

Entities & their associates including persons

involved in the preparation or issuance of this material shall not be liable in any way

for any direct, indirect, special, incidental,

consequential, punitive or exemplary damages, including on account of lost profits

arising from the information contained in this

material. Recipient alone shall be fully responsible for any decision taken on the basis

of this document.