Macro and

Equity Market

Outlook

Equity Market

Outlook

GLOBAL MACRO &

MARKETS – September 2023

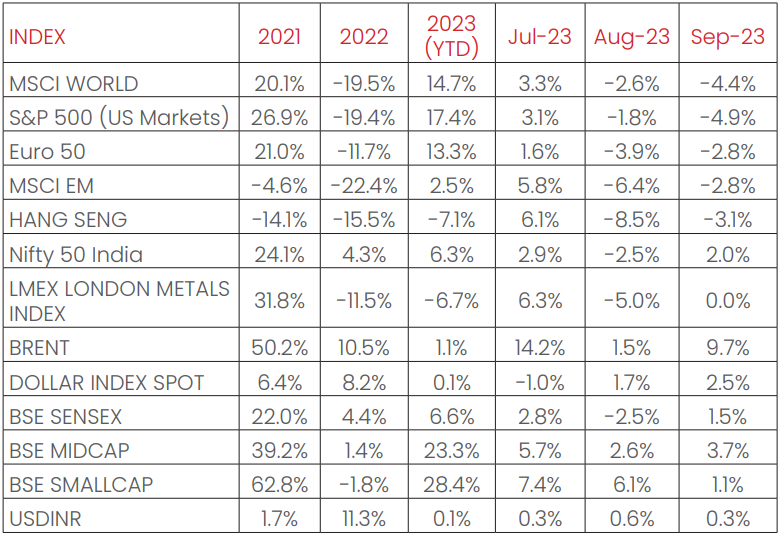

India’s S&P Nifty 50 index ended the month with 2.0% gains in

September. The S&P500 (-4.9%), the Euro 50 (-2.8%), the MSCI World

(-4.4%), Japan’s Nikkei (-2.3%) all ended the month negative, as

global markets faced a tumultuous month. Among emerging

markets indices, the MSCI EM, the HANG SENG, and the MOEX Russia

corrected marginally in September, by -2.8%, -3.1%, and -2.9%

respectively. BOVESPA Brazil bucked the negative trend, with +0.7%

MoM (month on month).

LME (London Metal Exchange) Metals Index remained flat in

September, as China’s Manufacturing PMI (Purchasing Manager's

Index) deteriorated slightly for September but remained in

expansion (>50). WTI and Brent Crude continued to rise in

September, by +8.6% and +9.7% respectively, as supplies remained

tightened on account of Saudi Arabia and Russia’s output cuts that

are expected to run through to the end of the year, and demand

growth remains stable. Saudi Arabia also hiked its official selling

price for the commodity, providing a fillip to the commodity’s price

levels, even as an uncertainty in Macro outlook remained. The

Dollar index strengthened by +2.5% over the month, with the Dollar

depreciating by -2.0% vis-à-vis EM currencies and appreciating by

+0.3% against the Indian Rupee. India 10Y G-Sec yields rose slightly,

rising by +5 bps, while US 10Y G-Sec yields rose by +46 bps, and the

German Bund rose by 37 bps, with rates settling at 7.21%, 4.57% and

2.83% respectively. US Yields rose to highest levels in 20 years.

Domestic Macro &

Markets - September 2023

The BSE SENSEX (+1.5%) rose in September, in tandem with other

benchmark Indian indices. BSE Mid-cap outperformed the SENSEX

and was up +2.6%. The BSE Small Cap index was up by +1.1 m/m.

Sector-wise, BSE PSU, Power, Metals and Capital Good indices were

the top 4 gainers over the month, with gains of +10.6%, +7.1%, +6.4%,

+5.6% over the month. All major sector indices ended the month in

green, rounding off a stellar month for Indian equities.

Net FII flows, were negative for September (-$1.8Bn, following +$1.2

Bn in August). DIIs turned into net buyers of Indian equities (+$2.6

Bn, up -$0.3 Bn from last month).

India's high frequency data update:

Elevated levels of GST collections, tolerable retail inflation, deflated

input cost inflation, rising core sector outputs, and elevated credit

growth augurs well for the Indian economy.

Manufacturing PMI (Purchasing Manager's Index):

Manufacturing PMI in September came in at 57.5, down from 58.6 in

August, and remained in expansion zone (>50) for the 27th straight

month, as output expanded at the slowest level in 5 months given a

tepid rise in new orders. Output gained for the 27th straight month,

and export sales growth cooled off a 9 month high the previous

month. Buying levels remained elevated, with confidence rising to

highest levels in CY2023.

GST Collection:

Collections of INR 1.62 Tn (+10% YoY) in September concluded the

nineteenth consecutive month of collections over the INR 1.4 Tn

mark, the fourth highest recorded since the inception of the

regime, following record collections of INR 1.87 Tn in April. The

average monthly gross collection this fiscal is INR 1.65 Tn (+11% YoY

from the same fiscal period last year). Rising compliance, rising

formalization of the economy, festive demand, and improved

administrative efficiency have driven sustainedly high levels of GST

collections.

Core sector production:

Core sector production growth shot up to 12.1% in August, against

an 8.0% (Revised later to 8.4%) jump in July 2023, as a favourable

base effect came into play for India’s eight core sectors. All the

eight constituent sectors recorded positive YoY growths, with

cement and coal production rising by 18.9% and 17.9% respectively.

Industrial Production:

Factory output as measured by the IIP index accelerated to 5.7%

YoY in July vs a growth of 3.8% YoY (upwardly revised by 10 bps) in

June 2023, buoyed by growths in all 3 constituent sectors- Mining

output growth accelerated +10.7% while manufacturing output

grew by 4.6% YoY, and Electricity output hastened to 8% in July.

Credit growth:

Scheduled Commercial Bank Credit growth reached 19.96% YoY as

of 22nd September 2023 against YoY growth of 16.44% as observed

on 23rd September 2022.

Inflation:

August’s CPI inflation rate remained above the RBI’s comfort zone

of 6% and reached 6.83%, easing from 7.44% in July, which came in

at a 15-month high. Acceleration in the CPI rate was attributed to

food basket inflation, which came in at 9.94% in August, compared

to the 11.51% rise in July. WPI (Wholesale Price Index) inflation

remained in negative territory, with the August print at a

five-month high of -0.52%, 83 bps up from July’s at -1.36%, as food,

fuel and manufactured products remained in the deflation zone.

This was the fifth straight month of deflation witnessed.

Trade Deficit:

Indian Merchandise Exports recorded a decline of -6.9% YoY to

$34.48 Bn in August, while Imports growth declined by -5.2% YoY to

$58.64 Bn. India’s trade deficit widened to a 10-month high of $24.2

Bn as the rupee weakened and oil prices surged.

Key Market Developments that may be tracked

in October 2023:

Oil Prices:

Oil markets continued surging in September as supply curbs from

key OPEC+ members pressurised physical markets. A poor print for

US gasoline consumption and rising inventories have dampened

the demand outlook, even as rising oil prices cut back into the

pockets of households globally. WTI Crude’s implied volatility

gauge is at local maxima for the year.

Global Bond Yields:

The USA’s benchmark bond yield, the Treasury yield rose to 4.6% in

September. As Central banks transition to the apogee of their

interest rate hiking cycles, with high levels of decoupling, bond

market volatility is rising. US Treasury inflation protected securities

(TIPS), used as a proxy for real interest (inflation adjusted) rates in

the economies are touching 2007 levels as markets are pricing in

various near-term triggers that elevate yields along with the

“higher for longer” policy advocated by central banks. Expanding

US budget deficits, unwinding demand for Treasury securities from

foreign investors including China and expectations and Japanese

monetary tightening in the coming quarters remain key

monitorable for markets.

Festive Season demand:

As India gears up for the festive season, demand in cyclical

industries will be a key monitorable for market participant. Boosted

demand will also play into rising indirect tax levels as the demand

outlook based on various gauges remains healthy.

RBI MPC Meet:

The RBI delivered a hawkish tone on 6th October, as it maintained

the benchmark repo rate unchanged at 6.5%, while reasserting a

stance of “withdrawal of liquidity”. The RBI governor pronounced

that inflation remains uncomfortably high, much above the

“target” of 4%. The RBI governor also highlighted crude and food

inflation as key risks for the inflation trajectory in India, as the prices

of crude remain elevated and weak rainfall plays into food prices.

Events to watch out for:

Q2FY24 earnings season in India and global earnings for 3QCY23

are important to track in coming month. Globally, China related

news flow is important to track from emerging markets

perspective.

Monthly Performance for Key Indices:

Note: Market scenarios are not the reliable indicators for current or future

performance. The same should not be construed as

investment advice or as any research report/research recommendation.

Past performance may or may not be sustained in future.

Source: Bloomberg

Past performance may or may not be sustained in future.

Source: Bloomberg

Market View

Global economic trends remain mixed and challenging.

Geopolitical challenges in addition to pressures on account of

higher interest rates and its impact on growth and returns continue

to remain. Domestic market rally has been driven by strong macro

fundamentals, robust foreign and domestic flows and healthy

earnings growth. While all the major indices are trading near

all-time highs, the run up in mid/ smaller capitalization companies

has been very sharp. What has worked for mid and small caps is the

broad basing of the market earnings and healthy balance sheets.

Local events like forthcoming state & general elections, global

developments like rising crude oil prices, mixed signals on global

growth etc appears to be ignored in the current euphoria. Large

Caps appear to be better positioned on a relative basis and along

with Asset Allocation products like Multi Asset Funds, Balanced

Advantage etc may assist to manage the near term risks. Investors

apprehensive of the equity market swings can consider

participating in a staggered manner in line with their risk appetite

and investment goals.

Note: The sectors mentioned are not a recommendation to buy/sell in the said sectors.

The schemes may or may not have future

position in the said sectors. For complete details on Holdings & Sectors of NIMF schemes, please visit

website mf.nipponindiaim.com.

Past performance may or may not be sustained in future

Past performance may or may not be sustained in future

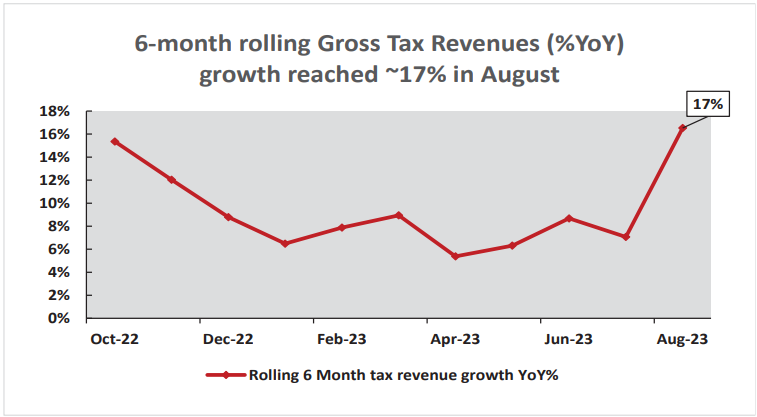

Chart of the month :

The Centre’s gross tax revenue rose by ~17% YoY in 5MFY24 as

corporate taxes rebounded allowing for continued front-loading of

capital expenditure.

Common Source:

NIMF Research, CMIE, Bloomberg

Disclaimer: The information herein above is meant only for general reading purposes

and

the views being expressed only

constitute opinions and therefore cannot be considered as guidelines, recommendations or as a

professional guide for

the readers. The document has been prepared on the basis of publicly available information, internally

developed data

and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of

their directors,

employees, Associates or representatives (‘entities & their Associate”) do not assume any

responsibility

for, or warrant the

accuracy, completeness, adequacy and reliability of such information. Recipients of this information

are

advised to rely on

their own analysis, interpretations & investigations. Readers are also advised to seek independent

professional advice in

order to arrive at an informed investment decision. Entities & their associates including persons

involved in the preparation

or issuance of this material, shall not be liable in any way for any direct, indirect, special,

incidental, consequential, punitive

or exemplary damages, including on account of lost profits arising from the information contained in

this material.

Recipient alone shall be fully responsible for any decision taken on the basis of this document.