Page

/ 5Our Investment Process

Investment is the backbone of Asset Management Companies (AMC). It is absolutely critical for AMCs to have robust investment processes to help to generate sustainable performance and mitigate risks. Mutual funds are highly regulated and have stipulated limits on various parameters to ensure prudent management of schemes. While stringent guidelines help deliver diversified portfolios to mutual fund investors, at Nippon India Mutual Fund, we have taken additional measures to strengthen investment processes further.

We are happy to bring to you a series of editorials where we would present these measures, one at a time. Welcome to Part 1 of the Investment Process – the Nippon Way, where we present:

Part 1: Investment Process

FUND CASING:

Importance of having limits on Sector Deviation

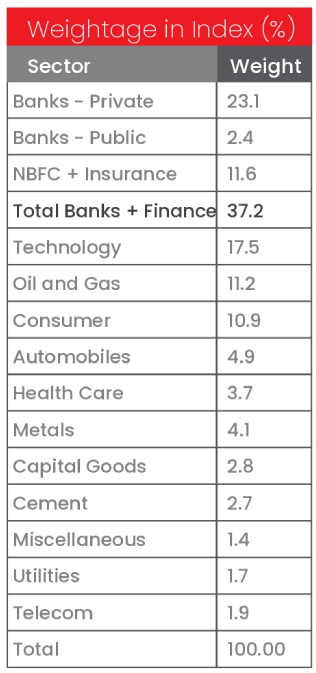

Before we dwell into the subject, please have a look at the below Table. The details mentioned are the Sector exposure details of the market, in this case the Nifty Index as of July 2021.

The top sector is Banks + Finance, accounts for nearly 37%.

Note: The sectors mentioned are not a recommendation to buy/sell in the said sectors.

The current regulations do not stipulate any sector limit / constraint for equity funds. Technically, a Fund Manager could take extreme calls on any sector. i.e., a Fund Manager (FM) may choose to have extreme Overweight (O/w) or Underweight (U/w) positions in any and / or multiple sectors. There may not be anything wrong with taking such extreme calls; after all, that’s why investors have entrusted their investments with Fund Managers – to take investment decisions on their behalf and to generate better returns. The above approach, if it works, may generate substantial returns (or alpha as we call it – the extra returns generated by the fund over the market / index). On the flip side, if the strategy were not to work out, the fund may substantially underperform, disappointing the investors.

THE NIPPON WAY

At Nippon India Mutual Fund, we understand that mutual funds cater to a variety of investors, including retail and high net worth individuals. While the endeavor is to generate alpha, we should also strive for consistent and sustained fund performance. Hence, as part of our investment processes, to mitigate excessive risks, we have placed limits on sector deviations, especially for the largest sector in certain funds. The Fund Manager cannot take excessive deviations away from the market, which is akin to taking big macro calls. Instead, the FM is encouraged to function within the defined framework, designed to prune away excessive risks – freedom within framework.

For example, a fund may have a Sector Deviation limit of, say, not more than 6% for the biggest sector – Banks and Finance. This would mean that if the market / index weight for Banks + Finance is 37%, the Fund may not go below 31% on the lower side or 43% on the higher side. Essentially, the Fund Manager cannot take a big macro call on the sector and be, let us say, tremendously underweight the sector, like having only 10% weight vs 37% of the index. A severe underweight position in a domestic cyclical theme like Banks and Finance, in line with the Fund Manager’s assessment may result in significant underperformance, if the opposite were to play out.

Fund Casing – The Nippon Way – with limits defined for sector deviation defines the framework for Fund Managers to operate within, eliminating excessive risks at the design stage and possibly generate returns on a relatively consistent and sustained manner.

Thank you for reading.

We sincerely hope that you found this material informative and useful.

We will meet you once again with Part 2 of the Investment Process shortly.

Disclaimer: Past Performance may or may not be sustained in the future. The information herein above is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsor, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (“entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision. Entities & their associates including persons involved in the preparation or issuance of this material shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.