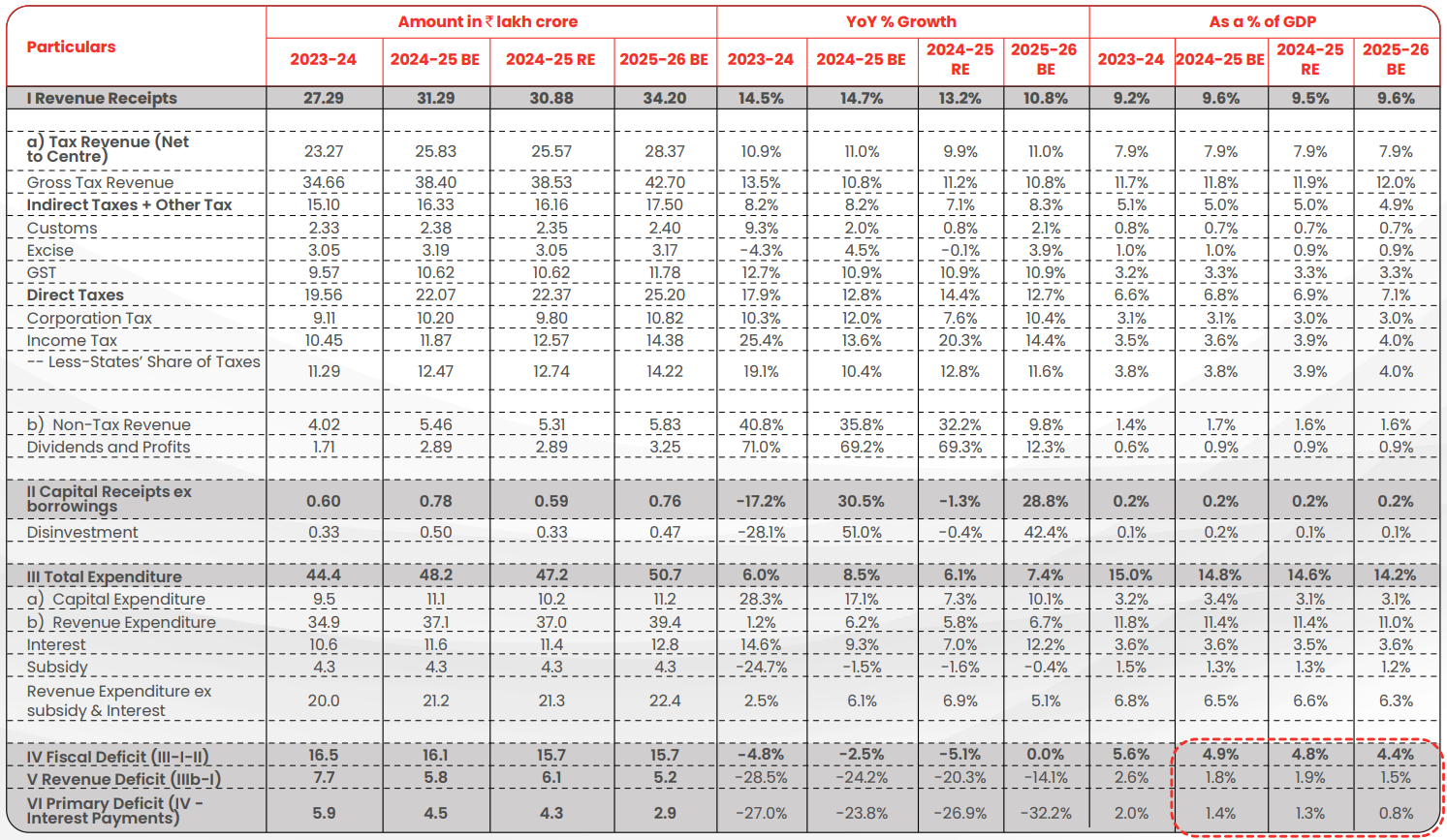

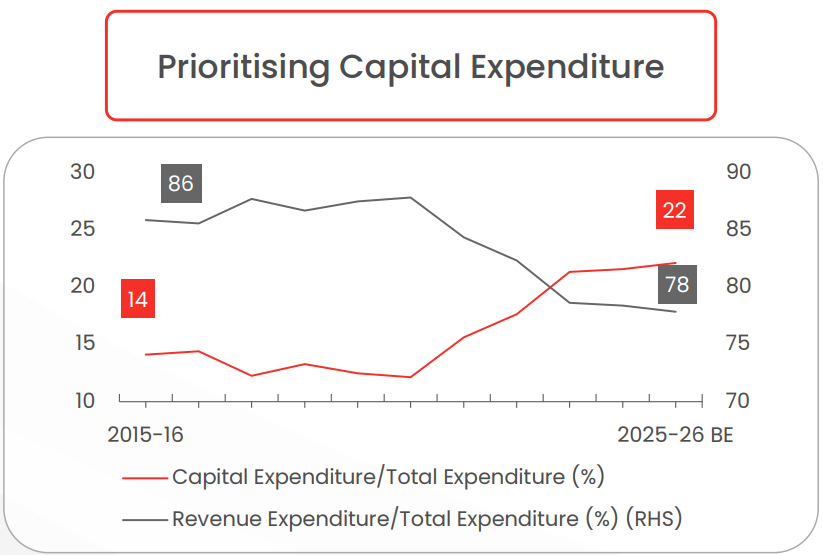

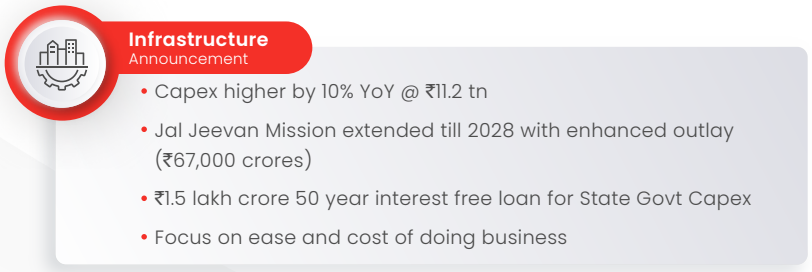

Capital outlay for FY26 at ₹11.2 lakh crore at 3.1% of GDP

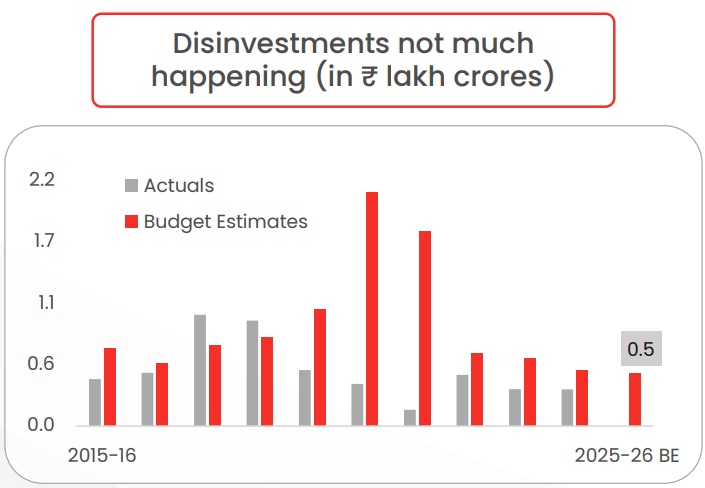

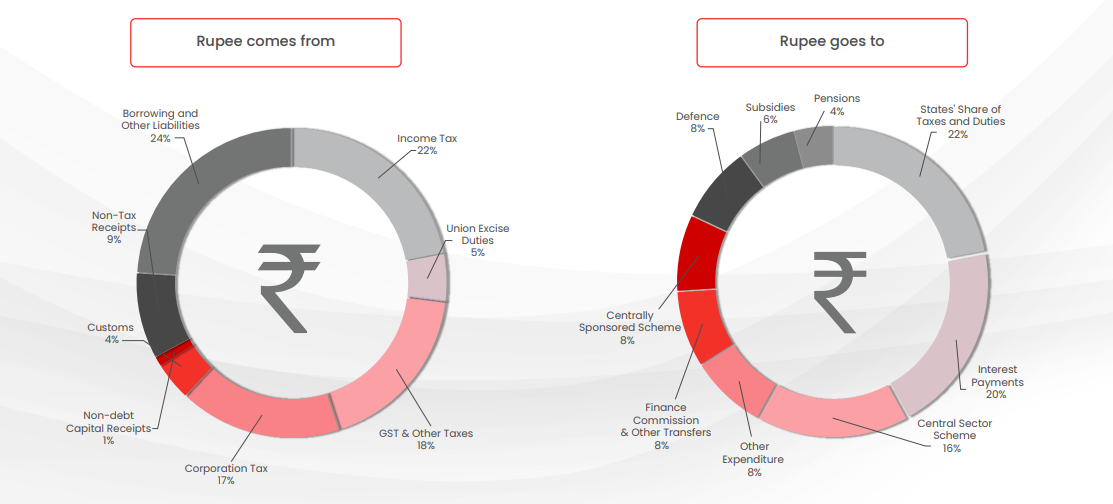

Disinvestment estimated at ₹47,000 crore for FY26

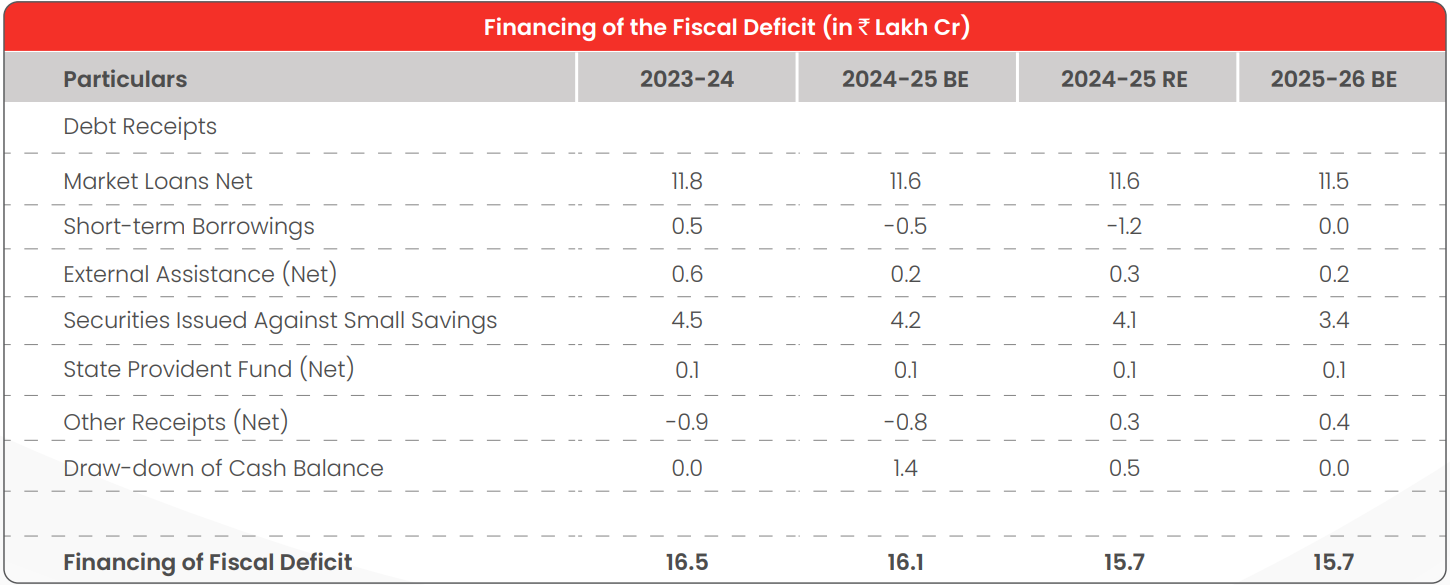

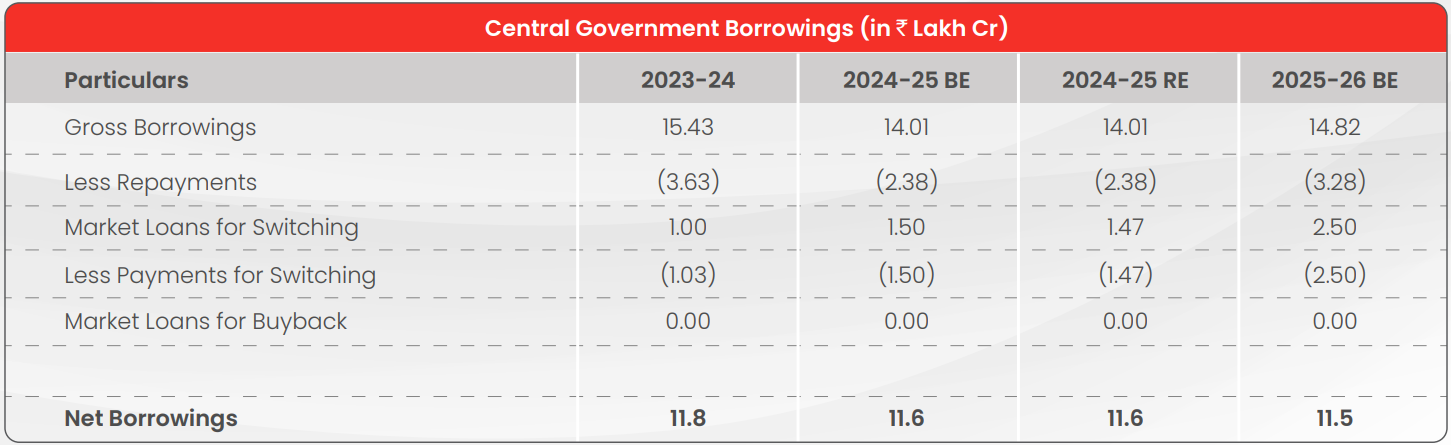

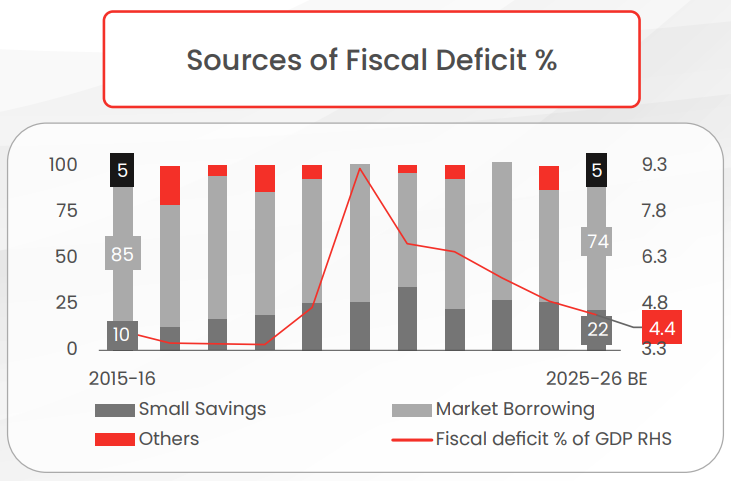

Net Market Borrowing at ₹11.5 lakh crore

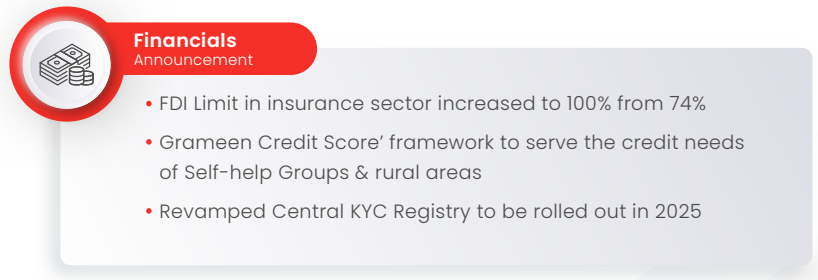

FDI in Insurance raised from 74% to 100%

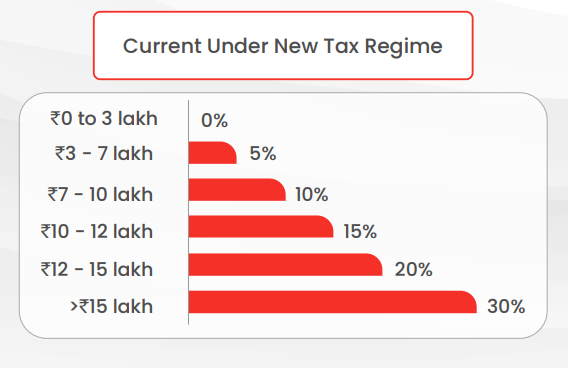

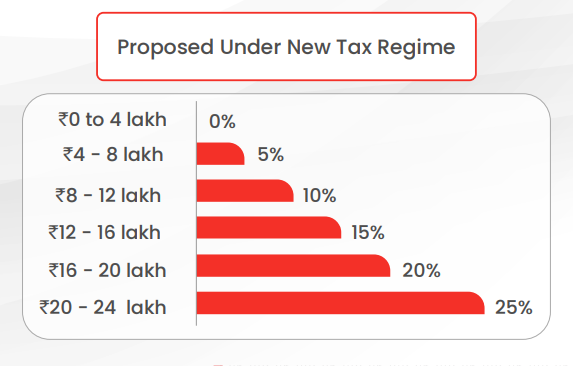

Consumption boost in the form of Income Tax slab rates cuts under new tax regime

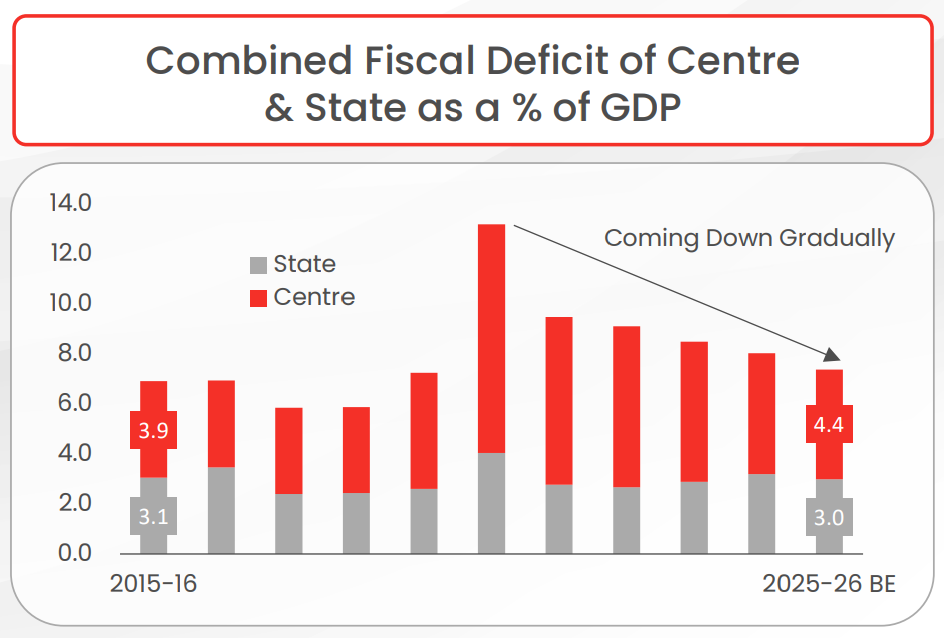

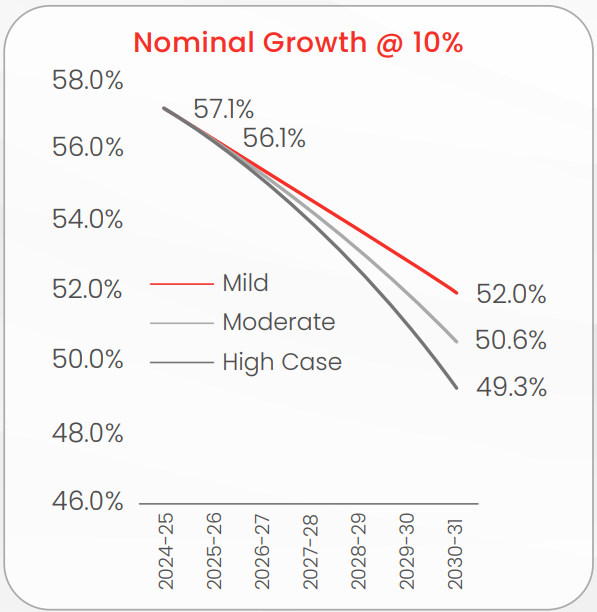

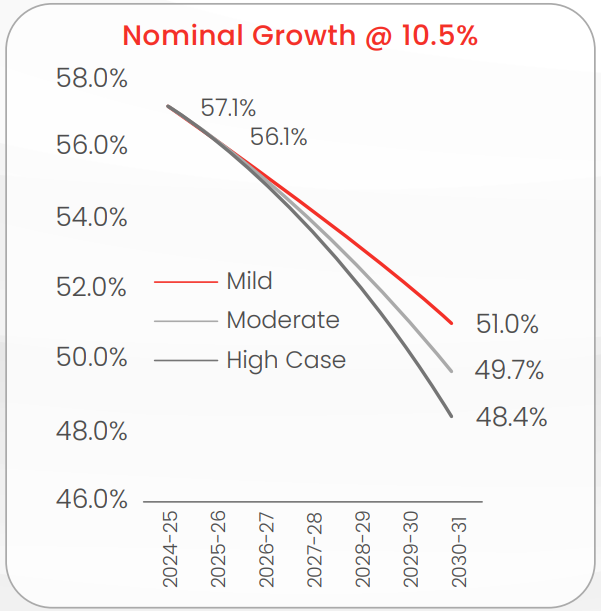

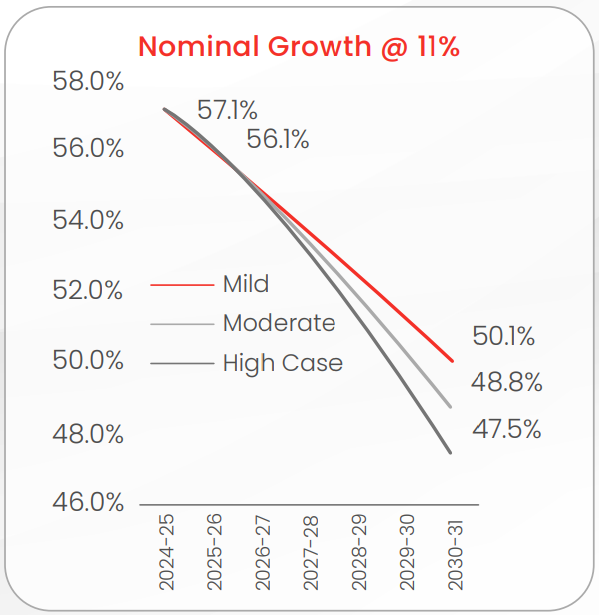

Fiscal deficit for FY26 at 4.4% of GDP. Endeavour to bring Debt to GDP ratio to 50+1% by FY31 from 57.1% in FY25

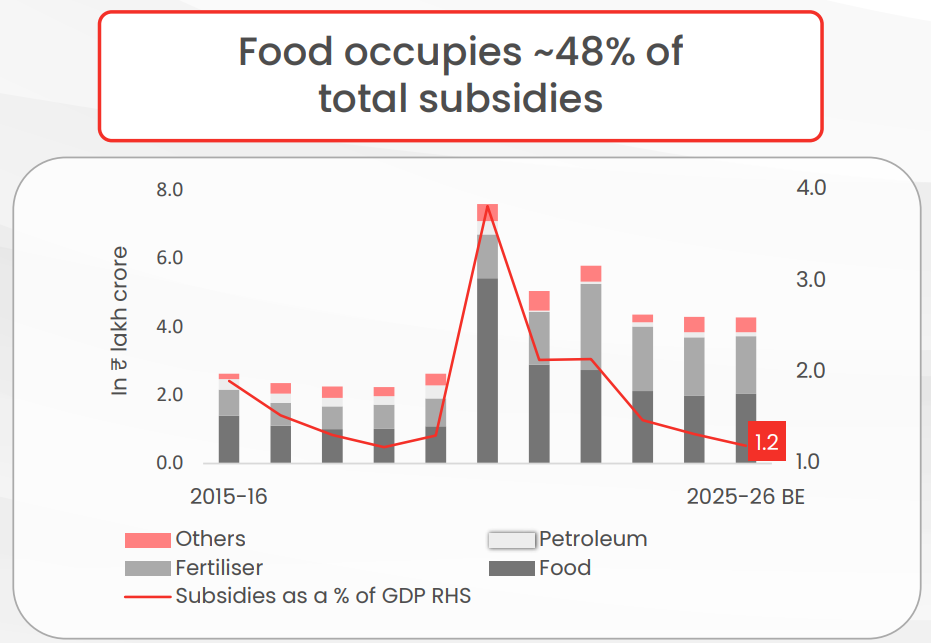

Subsidies at 1.2% of GDP

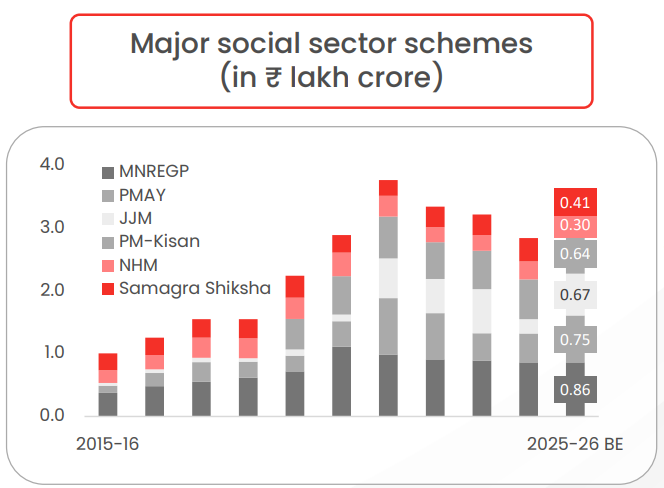

Outlay towards Mahatma Gandhi National Rural Employment Guarantee Programme remains unchanged at ₹86,000 crore

TDS threshold rationalised

- Balanced budget with proposals aimed at boosting consumption while maintaining fiscal prudence.

- A narrower fiscal deficit at 4.4% of GDP for FY26 vs 4.8% for FY25 revised estimates, underscores the government's commitment to long-term fiscal consolidation.

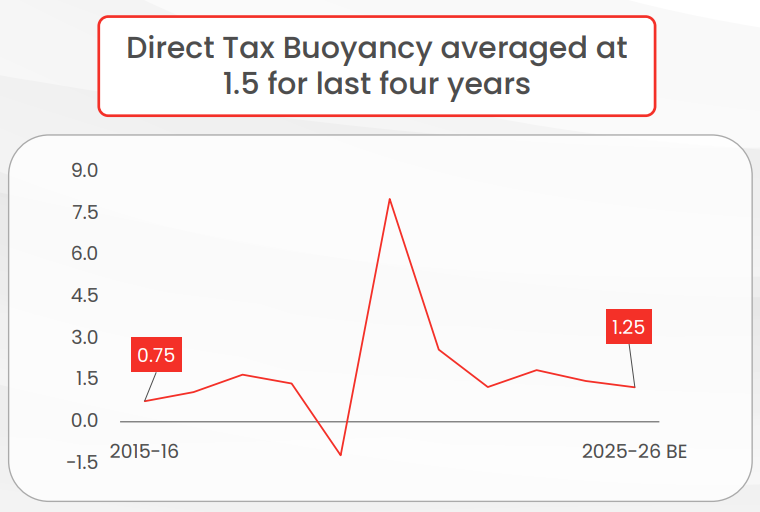

- The underlying nominal GDP growth assumption at 10.1% in FY26 is reasonable vs 9.7% in FY25 revised estimates, a function of moderation in real GDP as well as deflators.

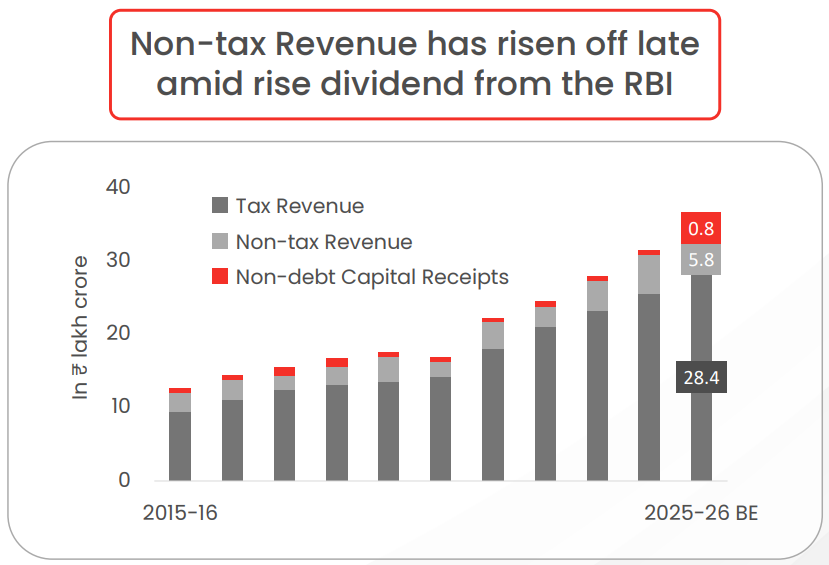

- Non-tax Revenue set to rise 12.3% YoY amid higher revenue from the RBI.

- An overhaul of the income tax structure may add more money into the hands of middle-class taxpayers, boosting consumption. The revenue foregone to the government on account of this stands at ₹1 lakh crore.

- Direct taxes are projected to grow at 12.7% YoY in FY26 vs 14.4% for FY25. If one adjusts the tax cuts, the growth in direct taxes look modestly optimistic as the implicit growth assumed in direct taxes is 17%, which is somewhat on the higher side.

Dependence on market borrowings increased in recent years

- MNREGP - Mahatma Gandhi National Rural Employment Guarantee Programme

- PMAY - Pradhan Mantri Awas Yojna

- JJM - Jal Jeevan Mission

- NHM - National Health Mission

State Fiscal Deficit for FY26 is assumed at 3% of GDP in line with FRBM Act

Likely Impact: Govt Capex shows reasonable 10% growth in FY26 over revised FY25. Focus is more on defense and power, while roads and railways take a backseat. While broader earnings outlook for the sector doesn't change, on relative basis Capex stocks may find lesser investor interest versus consumption stocks.

Likely Impact: No major impact on lenders. Consumer lending may increase so those stocks may benefit. Lenders into mortgages and MSMEs may benefit. All in all its positive for lenders

For AMCs and wealth managers this is positive as more money can now be channelised into these products.

Likely Impact: Budget is fairly neutral on Healthcare sector. Better purchasing power will help people to spend more on healthcare.

Likely Impact: We believe this higher disposable income in the hands of urban middle income consumers should support small ticket discretionary spend and non-discretionary spend.

- Fiscally prudent balanced budget where consumption push is preferred while Capex support is continued.

- Within consumption, focus has been more on urban and middle class linked consumption.

- Within Govt Capex, power and defence have been given preference.

- More disposable income is likely to lead to higher spending, better consumer - business confidence and eventually private capEx recovery backed by credit growth revival.

- Large financials, consumer discretionary segment along with structural themes like urbanisation, premiumisation and localisation of manufacturing appear well placed in the current context.

- Within infrastructure, power and defense remain long-term opportunities.

- We expect the budget will be viewed positively by markets and domestic flows will be supportive.

- Valuation have moderated after the recent corrections across segments with Large Caps being close to historical averages while Mid/Small premiums have reduced.

- Large Cap & it's oriented strategies along with hybrid funds appear better placed on risk-reward basis, while Mid/Small Cap allocation may be considered in a staggered manner through systematic investments.

- FY26 Fiscal Deficit of 4.4% is likely to be viewed positive by the markets, since it indicates the government's commitment to remain on fiscal consolidation path.

- Government's medium-term glide path (FY26-31) to reduce debt-to-GDP to 50% is a big positive for market and rating agencies.

- Risks to duration are fairly balanced. On one hand, fiscal consolidation & medium-term commitment to bring down debt to GDP is good for market; while FY26 gross borrowing number at ₹14.8 tn (vs market expectations of ₹14-14.5 tn) & higher budgeted switches for FY26 at ₹2.5 tn (market expectations ~ ₹2 tn) are downside risks.

- Market continues to remain positive on duration due to recent robust Open Market Operations (OMO) auctions (₹50,000 cr). Especially RBI's buying of 10 year paper is positive for benchmark.

- Going forward, the market focus will shift to the RBI policy on coming friday. With Economic survey focusing on growth impetus, budget sticking to fiscal consolidation path, we expect RBI to cut rate by 25 BPS in coming meeting.

- We recommend 70-75% in intermediate duration funds (which invests in 3-5 year corporate bonds and 5-10 year G-secs), and the remaining 25-30% in longer maturity/longer duration funds.

- Although the revenue numbers look little optimistic, given govt commitment to stick to fiscal consolidation, fiscal deficit target likely to be achieved through expenditure cut. Further, conservative funding from small saving provides addition support.

Note: Mild/Moderate/High case refer to degrees of fiscal consolidation

The views expressed herein are based on publicly available information and other sources believed to be reliable. It is issued for information purposes only and is not an offer to sell or a solicitation to buy/sell any mutual fund units/securities. It should be noted that the analysis, opinions, views expressed in the document are based on the Budget proposals presented by the Honorable Finance Minister in the Parliament on Feb 1, 2025 and the said Budget proposals may change or may be different at the time the Budget is passed by the Parliament and notified by the Government. The information contained in this document is for general purposes only and not a complete disclosure of every material fact of Indian Budget. For a detailed study, please refer to the budget documents available on http://www.indiabudget.gov.in

The information herein above is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. The sponsors, the Investment Manager, the Trustee or any of their directors, employees, associates or representatives (”entities & their associates”) do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision or contact their mutual fund distributor. Entities & their associates including persons involved in the preparation or issuance of this material, shall not be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material. Recipient alone shall be fully responsible for any decision taken on the basis of this document.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

Common Source: Budget Documents, NIMF Research