|

|

|||

|

Dear < Investor >, Greetings from Nippon India Mutual Fund! Are you interested in seeking potential benefits from the ups and downs of the markets? Presenting Nippon India SIP+ where your SIP instalments change dynamically based on our in-house Quantitative Model. The + point of SIP+ is that it attempts to make investments work in a smart manner, by analysing the market fluctuations and investing smartly and conservatively. SIP+ endeavours to increase the SIP instalment during favourable market conditions and vice versa, thus aiming to maximise potential returns. |

|||

|

|||

|

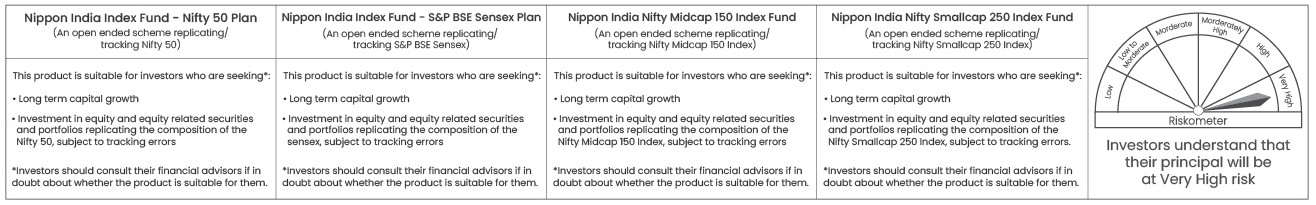

Currently, the SIP+ facility is available for the following schemes: • Nippon India Index Fund- Nifty 50 Plan • Nippon India Index Fund- S&P BSE Sensex Plan • Nippon India Nifty Midcap 150 Index Fund • Nippon India Smallcap 250 Index Fund Warm Regards, |

|||

|

|||

|

*For more explanation on Nippon India SIP+ feature, refer to the Notice cum Addendum No. 11 dated May 15, 2023 on our website : mf.nipponindiaim.com |

|||

|

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |