|

|

|

Dear Investor,

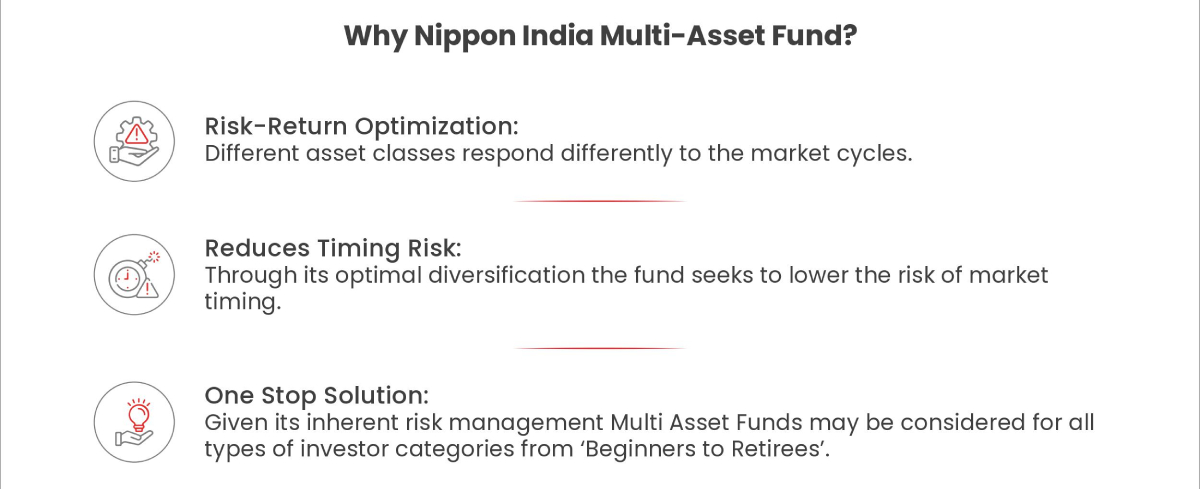

Asset asslocation works potentially best when one stays true to the

strategy irrespective of market conditions. Besides, in a volatile market, it might not be a great decision to risk investing in only a single asset class.

|

|

|

|

|

Data for last 10 Calendar Years; Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment.

Note: 1) Gold Futures prices from MCX 2) For Domestic Equity, S&P BSE 100 TRI returns are considered; 3) For Debt, CRISIL Short Term Bond Fund Index returns are considered; 4) For Overseas Equity, returns of MSCI World Net Return Index (in INR terms) are considered; Source: Bloomberg, MFI Explorer The scheme will invest in Gold ETF/ETCD/Sovereign Gold Bonds. Investors are requested to note that investment into physical Gold is neither envisaged nor is part of the core investment strategy in the scheme.

|

|

|

With Nippon India Multi-Asset Fund, funds are allocated across asset

classes, to optimse the risk adjusted returns at all times.

|

|

|

|

|

|

|

|

Regards,

Nippon India Mutual Fund

|

|

|

Now, you can Opt in & start investing on  by just saying ‘Hi’ to us on

843 3938 264 from your registered mobile number. Say Hi Now! by just saying ‘Hi’ to us on

843 3938 264 from your registered mobile number. Say Hi Now!

|

|

|

|

|

|

#Note: Probable allocation – the anticipated asset allocation would be as follows: Equity & Equity related securities (including overseas securities/ETFs) – 50% to 80%,

Debt & Money Market Instruments – 10% to 20% , Commodities Including Gold ETF and Exchange Traded Commodity Derivatives (ETCDs) – 10% to 30%. The above exposure/

strategy is subject to change within the limits of SID depending on the market conditions. Inception date: 28 August 2020.

|

|

|

|

|

|

Mutual Fund investments are subject to market risks,

read all scheme related documents carefully.

|