Nippon India Nifty AAA CPSE Bond Plus SDL

- Apr 2027 Maturity 60:40 Index Fund

Scheme would invest into AAA CPSE bonds & State Development Loans (SDLs) issued by States/UTs representing Nifty AAA CPSE Bond Plus SDL Apr 2027 Maturity 60:40 Index Fund

NFO Open Date: March 22nd, 2022

NFO Close Date: March 23rd, 2022

A Fund that ticks all boxes for a Target Maturity Product

High Quality

High quality AAA CPSE & SDL bonds

No Lock-in

Subscribing and redeeming units with Mutual Fund anytime during the life of the fund

Low Cost*

Low Cost in terms of Expense Ratio

Buy and Hold

Investment Strategy^

The scheme investments are proposed to be held till maturity

Tax Efficient#

Enjoy indexation benefit by holding for more than 36 months

Offer of Units Rs. 10/- each during the New Fund Offer and Continuous offer for Units at NAV based prices

About Index

- Type of Securities :

- Index seeks to measure the performance of portfolio of AAA CPSE bonds & SDLs

- Maturing during the twelve month period ending April 30, 2027

- Security Category :

Weightage Proportion of investment into AAA CPSE bonds and SDLs will be 60% & 40% respectively at the time of index launch and subsequent quarterly index rebalancing to maintain the ratio - Defined Maturity : Index shall mature on April 30, 2027 and hence has defined maturity date

- Index Strategy : Index would use buy and hold strategy wherein the portfolio selected at the time of launch would be held till maturity date, subject to quarterly index rebalancing

- Index Computation : Index is computed using the total return methodology including price return and coupon return

- Source: NSE

Why Invest in Nippon India Nifty AAA CPSE Bond Plus SDL – Apr 2027 Maturity 60:40 Index Fund

- Relatively Safe : The Fund would predominantly invest into AAA CPSE Bonds and State Development Loans (SDLs) which are government securities. Hence, it is relatively safe as compared to Equity and Debt funds.

- Opportunity : Will allow non demat account holders to seek exposure in passive debt fund via investing in Nippon India Nifty AAA CPSE Bond Plus SDL – Apr 2027 60:40 Index Fund

- Relatively lower tax : Tax efficient due to mutual fund indexation benefit

- No lock-in : Subscribing and redeeming units with mutual fund anytime during the life of the fund

- Reduce Risk : Reduction in non-systematic risk like security selection and portfolio manager selection, as the fund will apply buy & hold strategy and follow the index

- Low Cost : Fund will be managed at relatively low cost

Investment Philosophy

- Scheme would predominantly invest into AAA CPSE Bonds and State Development Loans (SDLs) representing Nifty AAA CPSE Bond Plus SDL Apr 2027 60:40 Index

- Securities which will form part of the scheme portfolio are expected to have in the aggregate, similar key characteristics of the underlying index in terms of maturity profile and type of securities

- Scheme will follow Buy and Hold investment strategy in which existing AAA CPSE Bonds and SDLs will be held till maturity, subject to quarterly index rebalancing

- Portfolio will be rolled down in line with the index, hence incremental investment will be in AAA CPSE Bonds and SDLs representing the index

- In case of maturity of any or all AAA CPSE Bonds and SDLs which are part of the Scheme portfolio, the maturity proceeds will be deployed in the outstanding security of the same issuer having longest maturity or Treasury bills or Tri-Party Repos on Government securities or Treasury bills, till the scheme “Maturity Date”

- Scheme will mature in line with the maturity of the index

Scheme Details

-

Investment Objective :

The investment objective of the scheme is to provide investment returns closely

corresponding to the total returns of the securities as represented by the Nifty AAA CPSE

Bond Plus SDL Apr 2027 60:40 Index before expenses, subject to tracking errors. However,

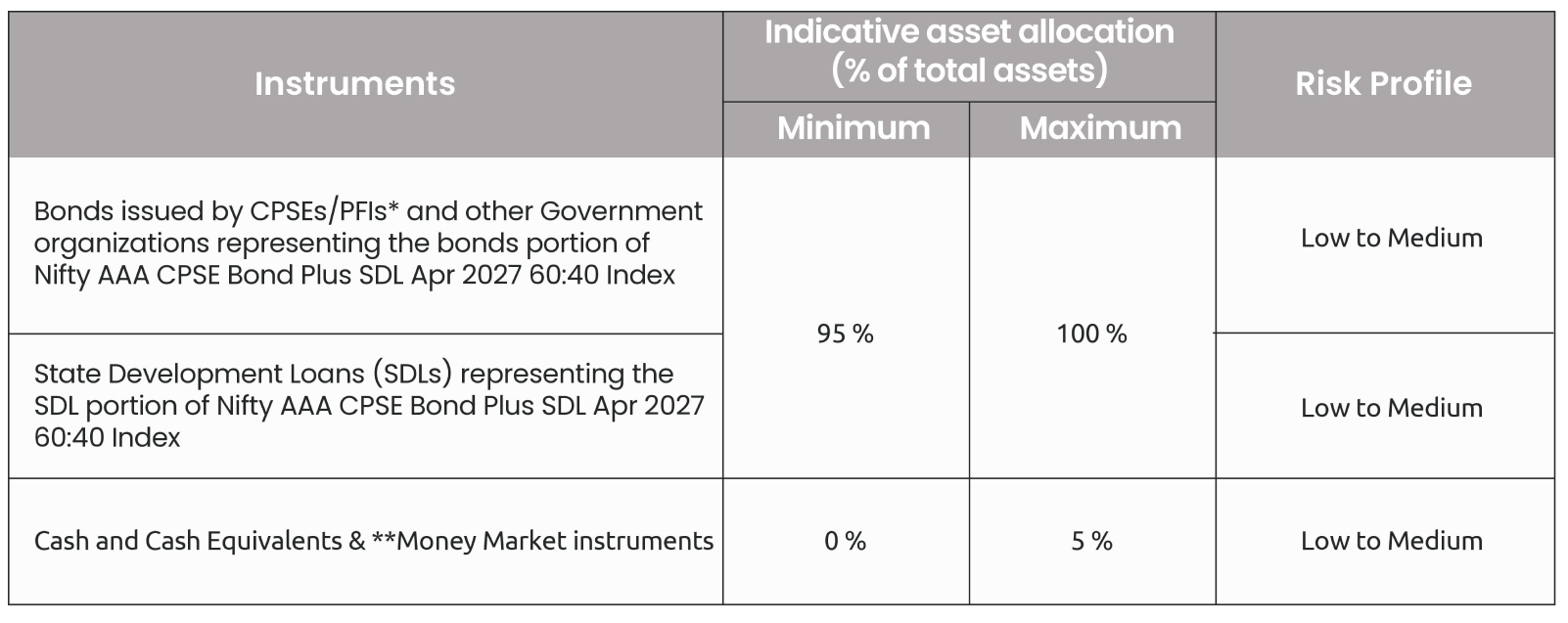

there can be no assurance or guarantee that the investment objective of the Scheme will be achieved. - Asset Allocation :

*CPSE – Central Public Sector Enterprise | Public Financial Institution (PFI)

**Money Market Instruments will include treasury bills and government securities having a residual maturity upto one year, Tri-Party Repos on Government securities or Treasury bills, Commercial Deposits (CDs) & Commercial Papers (CPs) on CPSEs/PFIs and other Government organizations as specified by the Reserve Bank of India/SEBI from time to time after seeking necessary approval, wherever required. -

Note : For more details, refer Scheme Information Document (SID).

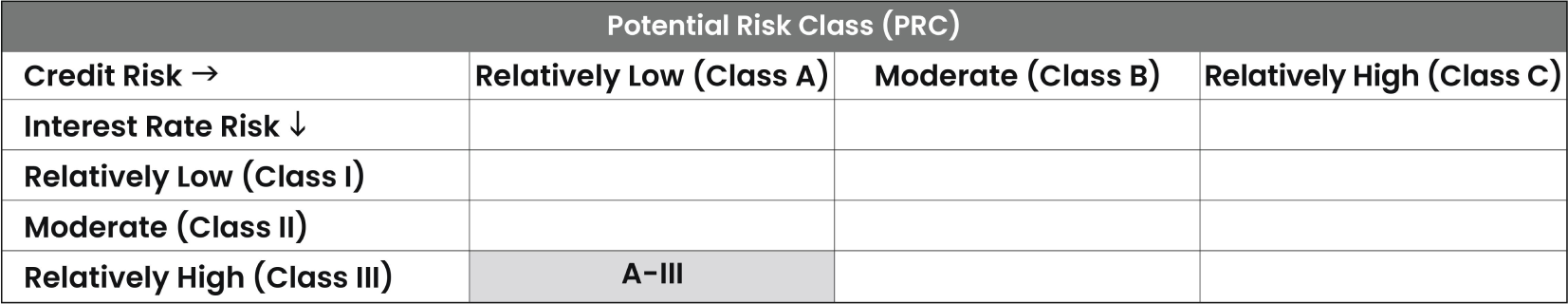

- Type of Scheme : An open-ended Target Maturity Index Fund investing in constituents of Nifty AAA CPSE Bond

Plus SDL Apr 2027 60:40 Index. A Relatively High interest rate risk and Relatively Low Credit Risk.

Fund Details

- Benchmark Index : Nifty AAA CPSE Bond Plus SDL Apr 2027 60:40 Index

- Fund Manager : Vivek Sharma & Siddharth Deb

- Load Structure : Entry Load & Exit Load : NIL

- Minimum application amount : During NFO

(during NFO & ongoing basis )

Minimum amount of Rs.1,000 and in multiples of Re.1 thereafter

During Ongoing Basis

Minimum amount of Rs.1,000 and in multiples of Re.1 thereafter

Additional amount of Rs.1,000 and in multiples of Re.1 thereafter - Plans :

The Scheme offers following Plans under Direct Plan and Regular Plan:

a) Growth Plan

- (1) Growth Option

b) Income Distribution cum Capital Withdrawal Plan

- (1) Payout Option

- (2) Reinvestment Option

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.