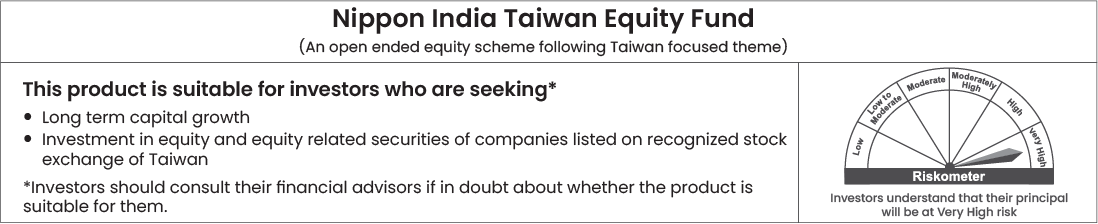

Nippon India Taiwan Equity Fund

(An open ended equity scheme following Taiwan focused theme)

Thanks to its logistical and systemic advantages, Taiwan is among world leaders in science and technology. No wonder then that it has second-highest weight in the MSCI Emerging Markets Index and ranked 8th in IMD World Digital Competitiveness Ranking, 2021

Nippon India Taiwan Equity Fund is one of its kind diversification opportunity into this exciting market.

Leadership position in world Semiconductor industry

Strong science & technology infrastructure

Strong diversification opportunity

NFO Open Date:22nd November, 2021

NFO Close Date:6th December, 2021

Investment Opportunities

- Strong Economy: Surging economic growth boosted by strong global demand.

- Technology Strength: Advanced technology raises the competitiveness in the semiconductor.

- Investment Advantage: Sound economic fundamentals with an attractive dividend yield.

Investment Philosophy

- Long Term: Identify industry leaders from a long term horizon.

- Conviction: Tend to hold less than 40 holdings with a high conviction.

- Downside Control: Bottom up approach layered with flexible cash position to minimize draw down.

- Stewardship: ESG integration procedures for responsible investment.

Note: Investment Philosophy is based on the prevailing market conditions and is subject to changes depending on the fund manager’s view of the equity markets

Investment Strategy

- Investments will be based on 3 Ms: 1) Dominant Market Share from successful business model, 2) Sizable Market from Mass Demand, 3) Sustainable High Margin from superior technology or high entry barrier.

- The fund will follow a Multi Cap investment strategy.

- Portfolio will be a mix of growth and value stocks.

- Focus will be on new technology trends.

- Less than 10% investment in a single stock.

Note: Investment Strategy is based on the prevailing market conditions and is subject to changes depending on the fund manager’s view of the equity markets

Investment Process

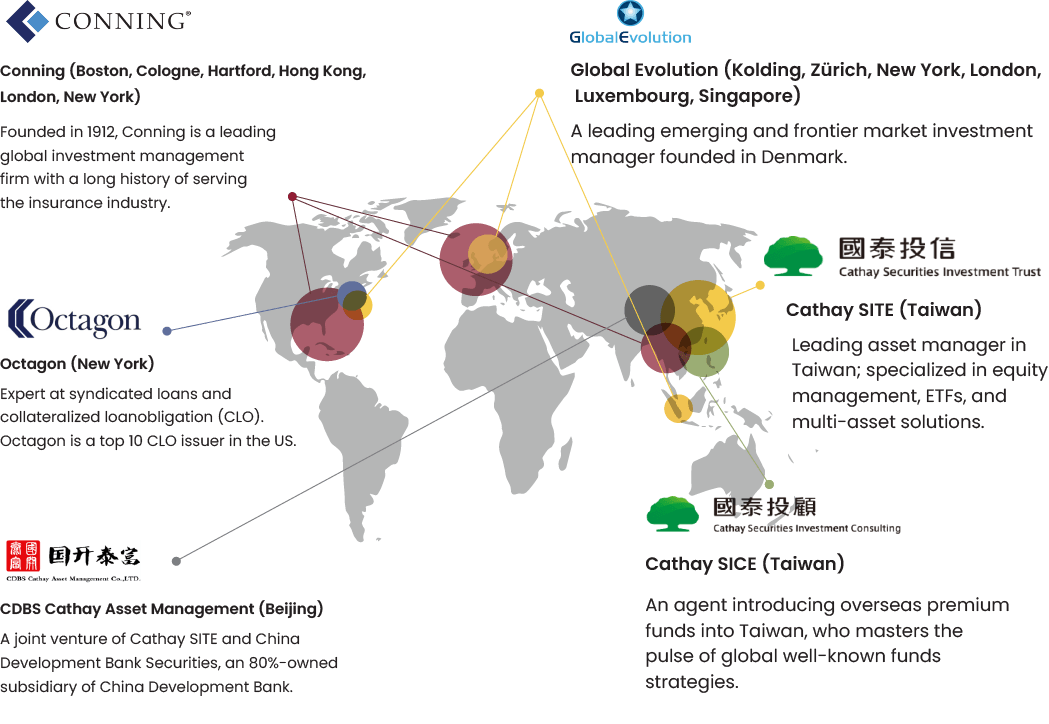

Cathay Asset Management Platform Across the World

- Cathay SITE will be the investment consultant for the fund.

- Total assets under management of Cathay Asset Management Platform: US$209.4 Billion

Source: Conning, Cathay SITE. As of Sept 30, 2021, represents the combined global assets under management for the affiliated firms under Conning Holdings Limited, Cathay Securities Investment Trust Co., Ltd. (“SITE”) and Global Evolution Fondsmæglerselskab A/S and its group of companies (the “Global Evolution Companies”). The Global Evolution Companies are affiliates of Conning. SITE reports internally into Conning Asia Pacific Limited, but is a separate legal entity under Cathay Financial Holding Co., Ltd. which is the ultimate controlling parent of all Conning controlled entities.

Note: The advisory services provided by Cathay shall be non-binding and recommendatory in nature. All final investment decisions in respect of the allocation shall be at the sole and exclusive discretion of Nippon Life India Asset Management Limited.

Other Scheme Details

- Fund Manager : Kinjal Desai (Dedicated Fund Manager for Overseas Investments)

- Benchmark : Taiwan Capitalization Weighted Stock Index (TAIEX)

- Exit Load :

- 1% if redeemed or switched out on or before completion of 3 months from the date of allotment of units.

- Nil, thereafter

- Minimum application amount : Rs. 500 & in multiples of Re. 1 thereafter

- Plans and Options :

Growth Plan (Growth Option), Income Distribution cum capital withdrawal

Plan (Payout Option and Reinvestment Option)

Note: For further details about the scheme, kindly refer to Scheme Information Document

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.