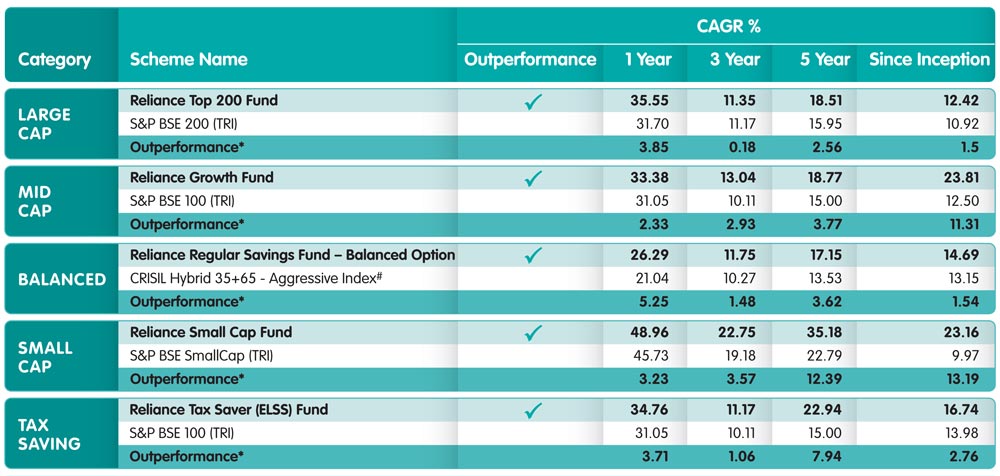

Past performance may or may not be sustained in future.

The performance details provided herein are of Growth Plan (Regular Plan) and is as on 31st January 2018.TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

*As communicated by CRISL, the existing nomenclature of Benchmark for Reliance Regular Saving fund - Balanced Option i.e Crisil Balanced Fund - Aggressive Index has been changed to Crisil Hybrid 35+65 - Aggressive Index w.e.f. Jan 31,2018.Hence, the Benchmark for Reliance Monthly Income Plan

& Reliance Retirement Fund - Income Generation Scheme is now Crisil Hybrid 85+15 - Conservative Index . Benchmark for Reliance Regular Savings Fund - Balanced Option is

now CRISIL Hybrid 35+65 - Aggressive Index

*Scheme’s outperformance over respective Benchmark Inception Dates: Reliance Top 200 Fund – 08/08/2007, Reliance Growth Fund – 08/10/1995, Reliance Small Cap Fund – 16/09/2010, Reliance Tax Saver (ELSS) Fund – 21/09/2005, Reliance Regular Savings Fund – Balanced Option – 08/06/2005

| SCHEME PERFORMANCE SUMMARY | |||||||

|---|---|---|---|---|---|---|---|

| NAV as on Jan 31, 2018: Rs 34.1484 | |||||||

| Performance of Reliance Top 200 Fund as on 31/01/2018 | |||||||

| CAGR % | |||||||

| Particulars | 1 Year | 3 Year | 5 Year | Since Inception | |||

| Reliance Top 200 Fund | 35.55 | 11.35 | 18.51 | 12.42 | |||

| B: S&P BSE 200 (TRI) | 31.70 | 11.17 | 15.95 | 10.92 | |||

| AB: S&P BSE Sensex (TRI) | 31.74 | 8.70 | 14.21 | 10.01 | |||

| Value of Rs 10000 Invested | |||||||

| Reliance Top 200 Fund | 13,555 | 13,816 | 23,391 | 34,148 | |||

| B: S&P BSE 200 (TRI) | 13,170 | 13,746 | 20,966 | 29,649 | |||

| AB: S&P BSE Sensex (TRI) | 13,174 | 12,849 | 19,438 | 27,212 | |||

| Inception Date: Aug 8, 2007 | |||||||

| Fund Manager:Sailesh Raj Bhan (Since Aug 2007) & Ashwani Kumar (Since Aug 2007) | |||||||

| B - Benchmark | AB - Additional Benchmark | TRI - Total Return Index | |||||||

Note: Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

| PERFORMANCE OF OTHER OPEN ENDED SCHEMES MANAGED BY FUND MANAGER: Sailesh Raj Bhan | ||||||

|---|---|---|---|---|---|---|

| Scheme Name/s | CAGR % | |||||

| 1 Year Return | 3 Years Return | 5 Years Return | ||||

| Scheme | Benchmark | Scheme | Benchmark | Scheme | Benchmark | |

| Reliance Pharma Fund | 9.29 | -1.00 | 3.27 | -1.88 | 16.52 | 13.33 |

| Reliance Media & Entertainment Fund | 20.08 | 30.55 | 7.88 | 15.96 | 12.27 | 16.79 |

| Reliance Equity Opportunities Fund | 37.31 | 31.05 | 8.94 | 10.11 | 17.66 | 15.00 |

Mr. Sailesh Raj Bhan has been managing Reliance Pharma Fund since Jun 2004, Reliance Media & Entertainment Fund since Sep 2004, Reliance Equity Opportunities Fund since Mar 2005. Mr. Sailesh Raj Bhan has been managing Reliance Top 200 Fund since Aug 2007 jointly with Mr. Ashwani Kumar.

a.Mr. Shailesh Raj Bhan manages 4 open-ended schemes of Reliance Mutual Fund.

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

| PERFORMANCE OF OTHER OPEN ENDED SCHEMES MANAGED BY FUND MANAGER: Ashwani Kumar | ||||||

|---|---|---|---|---|---|---|

| Scheme Name/s | CAGR % | |||||

| 1 Year Return | 3 Years Return | 5 Years Return | ||||

| Scheme | Benchmark | Scheme | Benchmark | Scheme | Benchmark | |

| Reliance Vision Fund | 34.92 | 31.05 | 10.44 | 10.11 | 17.97 | 15.00 |

| Reliance Tax Saver (ELSS) Fund | 34.76 | 31.05 | 11.17 | 10.11 | 22.94 | 15.00 |

Mr. Ashwani Kumar has been managing Reliance Vision Fund since Jun 2003.

Mr. Ashwani Kumar has been managing Reliance Top 200 Fund since Aug 2007 jointly with Mr. Sailesh Raj Bhan.

a.Mr. Ashwani Kumar manages 3 open-ended schemes of Reliance Mutual Fund .

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Note: Performance as on 31st January 2018

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment. Performance of the schemes (wherever provided) are calculated basis CAGR for the past 1 year, 3 years, 5 years and since inception. Dividends (if any) are assumed to be reinvested at the prevailing NAV. Bonus (if any) declared has been adjusted. In case, the start/end date of the concerned period is non-business day (NBD), the NAV of the previous date is considered for computation of returns.

| OTHER SCHEME PRODUCT LABEL | ||||||

|---|---|---|---|---|---|---|

| Name of Scheme | This product is suitable for investors who are seeking*: | |||||

| Reliance Tax Saver (ELSS) Fund (An open ended Equity Linked Savings Scheme) |

• Long term capital growth •Investment in equity and equity related securities |

|

||||

| Reliance Vision Fund(An open ended Equity Growth Scheme) |

• long term capital growth • investment in equity and equity related instruments through a research based approach |

|||||

| Reliance Equity Opportunities Fund (An open ended Diversified Equity Scheme) | • Long term capital growth. • Investment in equity and equity related securities | |||||

| Reliance Pharma Fund (An open ended Pharma Sector Scheme) |

• long term capital growth • Investment in equity and equity related Securities of pharma & other associated companies |

|

||||

| Reliance Media & Entertainment Fund (An open ended Media & Entertainment sector |

• long term capital growth • investment in equity and equity related securities of media and entertainment and other associated companies |

|||||

| SCHEME PERFORMANCE SUMMARY | |||||||

|---|---|---|---|---|---|---|---|

| NAV as on Jan 31, 2018: Rs 1177.8459 | |||||||

| Performance of Reliance Growth Fund as on 31/01/2018 | |||||||

| CAGR % | |||||||

| Particulars | 1 Year | 3 Year | 5 Year | Since Inception | |||

| Reliance Growth Fund | 33.38 | 13.04 | 18.77 | 23.81 | |||

| B: S&P BSE 100 (TRI) | 31.05 | 10.11 | 15.00 | 12.50 | |||

| AB: S&P BSE Sensex (TRI) | 31.74 | 8.70 | 14.21 | 11.62 | |||

| Value of Rs 10000 Invested | |||||||

| Reliance Growth Fund | 13,338 | 14,455 | 23,648 | 11,77,837 | |||

| B: S&P BSE 100 (TRI) | 13,105 | 13,358 | 20,122 | 1,38,776 | |||

| AB: S&P BSE Sensex (TRI) | 13,174 | 12,849 | 19,438 | 1,16,422 | |||

| Inception Date: Oct 8, 1995 | |||||||

| Fund Manager:Manish Gunwani (Since Sep 2017) | |||||||

| B - Benchmark | AB - Additional Benchmark | TRI - Total Return Index | |||||||

| As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR of S&P BSE 100 PRI values from 06/10/1995 to 29/06/2007 and TRI values since 29/06/2007. |

|||||||

| As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR of S&P BSE Sensex PRI values from 06/10/1995 to 31/05/2007 and TRI values since 31/05/2007. |

|||||||

Note: Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

Mr. Manish Gunwani has been managing Reliance Growth Fund since Sep 2017.

a. Mr.Manish Gunwani manages 1 open-ended schemes of Reliance Mutual Fund.

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Note: Performance as on 31st January 2018

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment. Performance of the schemes (wherever provided) are calculated basis CAGR for the past 1 year, 3 years, 5 years and since inception. Dividends (if any) are assumed to be reinvested at the prevailing NAV. Bonus (if any) declared has been adjusted. In case, the start/end date of the concerned period is non-business day (NBD), the NAV of the previous date is considered for computation of returns.

| SCHEME PERFORMANCE SUMMARY | |||||||

|---|---|---|---|---|---|---|---|

| NAV as on jan 31, 2018: Rs 56.7096 | |||||||

| Performance of Reliance Regular Savings Fund - Balanced Option as on 31/01/2018 | |||||||

| CAGR % | |||||||

| Particulars | 1 Year | 3 Year | 5 Year | Since Inception | |||

| Reliance Regular Savings Fund - Balanced Option | 26.29 | 11.75 | 17.15 | 14.69 | |||

| B:CRISIL Hybrid 35+65 - Aggressive Index | 21.04 | 10.27 | 13.53 | 13.15 | |||

| AB: S&P BSE Sensex (TRI) | 31.74 | 8.70 | 14.21 | 15.37 | |||

| Value of Rs 10000 Invested | |||||||

| Reliance Regular Savings Fund - Balanced Option | 12,629 | 13,965 | 22,073 | 56,710 | |||

| B:CRISIL Hybrid 35+65 - Aggressive Index | 12,104 | 13,415 | 18,871 | 47,747 | |||

| AB: S&P BSE Sensex (TRI) | 13,174 | 12,849 | 19,438 | 61,084 | |||

| Inception Date: Jun 8, 2005 | |||||||

| Fund Manager:Sanjay Parekh (Since Apr 2012) & Amit Tripathi (Since Aug 2010) | |||||||

| B - Benchmark | AB - Additional Benchmark | TRI - Total Return Index | |||||||

| As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR of S&P BSE Sensex PRI values from 08/06/2005 to 31/05/2007 and TRI values since 31/05/2007. |

|||||||

Note: Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

| PERFORMANCE OF OTHER OPEN ENDED SCHEMES MANAGED BY FUND MANAGER: Sanjay Parekh | ||||||

|---|---|---|---|---|---|---|

| Scheme Name/s | CAGR % | |||||

| 1 Year Return | 3 Years Return | 5 Years Return | ||||

| Scheme | Benchmark | Scheme | Benchmark | Scheme | Benchmark | |

| Reliance Monthly Income Plan | 8.00 | 7.08 | 7.19 | 8.57 | 10.11 | 9.72 |

| Reliance Retirement Fund - Wealth Creation Scheme | 32.47 | 31.05 | N.A. | N.A. | N.A. | N.A. |

| Reliance Retirement Fund - Income Generation Scheme | 4.86 | 7.08 | N.A. | N.A. | N.A. | N.A. |

| Reliance Equity Savings Fund | 15.79 | 13.43 | N.A. | N.A. | N.A. | N.A. |

| Reliance Banking Fund | 38.24 | 39.48 | 12.94 | 11.34 | 17.76 | 16.38 |

Mr. Sanjay Parekh has been managing Reliance Monthly Income Plan since April 2012 jointly with Mr. Amit Tripathi who has been managing the fund since Oct 2008. Mr. Sanjay Parekh has been managing Reliance Regular Savings Fund – Balanced Option since April 2012 jointly with Mr. Amit Tripathi who has been managing the fund since Aug 2010. Mr. Sanjay Parekh has been managing Reliance Retirement Fund - Wealth Creation Scheme jointly with Ms. Anju Chhajer since Feb 2015. Mr. Sanjay Parekh has been managing Reliance Retirement Fund - Income Generation Scheme jointly with Ms. Anju Chhajer since Feb 2015. Mr. Sanjay Parekh has been managing Reliance Equity Savings Fund jointly with Ms. Anju Chhajer since May 2015. Mr. Sanjay Parekh has been managing Reliance Banking Fund since Sep 16, 2017.

a.Mr. Sanjay Parekh manages 6 open-ended schemes of Reliance Mutual Fund.

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

| PERFORMANCE OF OTHER OPEN ENDED SCHEMES MANAGED BY FUND MANAGER: Amit Tripathi | ||||||

|---|---|---|---|---|---|---|

| Scheme Name/s | CAGR % | |||||

| 1 Year Return | 3 Years Return | 5 Years Return | ||||

| Scheme | Benchmark | Scheme | Benchmark | Scheme | Benchmark | |

| Reliance Liquidity Fund | 6.58 | 6.68 | 7.44 | 7.39 | 8.12 | 8.10 |

| Reliance Money Manager Fund | 6.38 | 6.68 | 7.78 | 7.39 | 8.35 | 8.10 |

| Reliance Floating Rate Fund - Short Term Plan | 5.43 | 6.68 | 7.55 | 7.39 | 8.16 | 8.10 |

| Reliance Monthly Income Plan | 8.00 | 7.08 | 7.19 | 8.57 | 10.11 | 9.72 |

| Reliance Medium Term Fund | 6.21 | 5.38 | 8.02 | 7.88 | 8.38 | 8.53 |

Mr. Amit Tripathi has been managing Reliance Liquidity Fund since Jun 2005 and jointly with Mr. Vivek Sharma who has been managing the fund since Oct 2013. Mr. Amit Tripathi has been managing Reliance Money Manager Fund since Mar 2007 jointly with Ms. Anju Chhajer who has been managing the fund since Oct 2009. Mr. Amit Tripathi has been managing Reliance Floating Rate Fund - Short Term Plan since Oct 2007 jointly with Mr. Vivek Sharma who has been managing the fund since Oct 2013. Mr. Amit Tripathi has been managing Reliance Monthly Income Plan since Oct 2008 jointly with Mr. Sanjay Parekh who has been managing the fund since April 2012. Mr. Amit Tripathi has been managing Reliance Medium Term Fund since Oct 2008 jointly with Ms. Anju Chhajer who has been managing the fund since Oct 2009. Mr. Amit Tripathi has been managing Reliance Regular Savings Fund – Balanced Option since Aug 2010 jointly with Mr. Sanjay Parekh who has been managing the fund since Apr 2012

a.Mr. Amit Tripathi manages 6 open-ended schemes of Reliance Mutual Fund.

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Note: Performance as on 31st January 2018

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment. Performance of the schemes (wherever provided) are calculated basis CAGR for the past 1 year, 3 years, 5 years and since inception. Dividends (if any) are assumed to be reinvested at the prevailing NAV. Bonus (if any) declared has been adjusted. In case, the start/end date of the concerned period is non-business day (NBD), the NAV of the previous date is considered for computation of returns.

| OTHER SCHEME PRODUCT LABEL | ||||||

|---|---|---|---|---|---|---|

| Name of Scheme | This product is suitable for investors who are seeking*: | |||||

| Reliance Retirement Fund – Wealth Creation Scheme (An open end notifi ed tax savingscum pension scheme with no assured returns) |

• long term growth and capital appreciation •Investment primarily in equity and equity related instruments and balance in fi xed income securities so as to help the investor in achieving the retirement goals |

|

||||

| Reliance Retirement Fund – Income Generation Scheme (An open end notifi ed tax savings cum pension scheme with no assured returns) |

• Income over long term along with capital growth • Investment primarily in fi xed income securities and balance in equity and equity related instruments so as to help the investor in achieving the retirement goals |

|||||

| Reliance Equity Savings Fund(An open ended Equity Scheme) |

• Income and capital appreciation over long term • Investment predominantly in arbitrage opportunities between cash & derivative market and in unhedged equity |

|||||

| Reliance Banking Fund (An Openended Banking Sector Scheme) |

• Long term capital growth. • Investment in equity and equity related securities of companies in banking sector and companies engaged in allied activities related to banking sector |

|

||||

| Reliance Money Manager Fund (An Open-Ended Income Scheme) |

• Income over short term • Investment in debt and money market instruments |

|

||||

| Reliance Medium Term Fund (An Open-Ended Income Scheme with no assured returns) |

• Income over short term • Investment in debt and money market instruments with tenure not exceeding 3 years |

|||||

| Reliance Floating Rate Fund - Short Term Plan (An Open-Ended Income Scheme) |

• Income over short term • Investment predominantly in fl oating rate and money market instruments with tenure exceeding 3 months but upto a maturity of 3 years and fi xed rate debt securities |

|||||

| Reliance Liquidity Fund (An Open-Ended Liquid Scheme) |

• Income over short term • Investment in debt and money market instruments |

|

||||

| Reliance Monthly Income Plan (An Open-Ended Fund. Monthly income is not assured & is subject to the availability of distributable surplus) |

• Regular income and capital growth over long term • Investment in debt & money market instruments and equities & equity related securities |

|

||||

| SCHEME PERFORMANCE SUMMARY | |||||||

|---|---|---|---|---|---|---|---|

| NAV as on Jan 31, 2018: Rs 46.5399 | |||||||

| Performance of Reliance Small Cap Fund as on 31/01/2018 | |||||||

| CAGR % | |||||||

| Particulars | 1 Year | 3 Year | 5 Year | Since Inception | |||

| Reliance Small Cap Fund | 48.96 | 22.75 | 35.18 | 23.16 | |||

| B: S&P BSE SmallCap (TRI) | 45.73 | 19.18 | 22.79 | 9.97 | |||

| AB: S&P BSE Sensex (TRI) | 31.74 | 8.70 | 14.21 | 10.29 | |||

| Value of Rs 10000 Invested | |||||||

| Reliance Small Cap Fund | 14,896 | 18,516 | 45,172 | 46,540 | |||

| B: S&P BSE SmallCap (TRI) | 14,573 | 16,945 | 27,924 | 20,164 | |||

| AB: S&P BSE Sensex (TRI) | 13,174 | 12,849 | 19,438 | 20,603 | |||

| Inception Date: Sep 16, 2010 | |||||||

| Fund Manager:Samir Rachh (Since Jan 2017) | |||||||

| B - Benchmark | AB - Additional Benchmark | TRI - Total Return Index | |||||||

Note: Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

| PERFORMANCE OF OTHER OPEN ENDED SCHEMES MANAGED BY FUND MANAGER: Samir Rachh | ||||||

|---|---|---|---|---|---|---|

| Scheme Name/s | CAGR % | |||||

| 1 Year Return | 3 Years Return | 5 Years Return | ||||

| Scheme | Benchmark | Scheme | Benchmark | Scheme | Benchmark | |

| Reliance Mid & Small Cap Fund | 33.28 | 41.79 | 14.22 | 19.07 | 24.82 | 22.10 |

| Reliance Regular Savings Fund - Equity Option | 37.51 | 31.05 | 13.11 | 10.11 | 18.11 | 15.00 |

Mr. Samir Rachh has been managing Reliance Mid & Small Cap Fund since Sep 2010, Reliance Small Cap Fund since Jan 2017, Reliance Regular Savings Fund - Equity Option since April 2017.

a. Mr. Samir Rachh manages 3 open-ended schemes of Reliance Mutual Fund.

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Note: Performance as on 31st January 2018

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment. Performance of the schemes (wherever provided) are calculated basis CAGR for the past 1 year, 3 years, 5 years and since inception. Dividends (if any) are assumed to be reinvested at the prevailing NAV. Bonus (if any) declared has been adjusted. In case, the start/end date of the concerned period is non-business day (NBD), the NAV of the previous date is considered for computation of returns.

| OTHER SCHEME PRODUCT LABEL | ||||||

|---|---|---|---|---|---|---|

| Name of Scheme | This product is suitable for investors who are seeking*: | |||||

| Reliance Mid & Small Cap Fund (An Open Ended Diversifi ed Equity Scheme) |

• Long term capital growth •investment in equity and equity related instruments through a research based approach |

|

||||

| Reliance Regular Savings Fund - Equity Option (An Open Ended Scheme) |

• long term capital growth • investment in equity and equity related securities |

|||||

| SCHEME PERFORMANCE SUMMARY | |||||||

|---|---|---|---|---|---|---|---|

| NAV as on Jan 31, 2018: Rs 67.8291 | |||||||

| Performance of Reliance Tax Saver (ELSS) Fund as on 31/01/2018 | |||||||

| CAGR % | |||||||

| Particulars | 1 Year | 3 Year | 5 Year | Since Inception | |||

| Reliance Tax Saver (ELSS) Fund | 34.76 | 11.17 | 22.94 | 16.74 | |||

| B: S&P BSE 100 (TRI) | 31.05 | 10.11 | 15.00 | 13.98 | |||

| AB: S&P BSE Sensex (TRI) | 31.74 | 8.70 | 14.21 | 13.78 | |||

| Value of Rs 10000 Invested | |||||||

| Reliance Tax Saver (ELSS) Fund | 13,476 | 13,747 | 28,098 | 67,829 | |||

| B: S&P BSE 100 (TRI) | 13,105 | 13,358 | 20,122 | 50,438 | |||

| AB: S&P BSE Sensex (TRI) | 13,174 | 12,849 | 19,438 | 49,361 | |||

| Inception Date: Sep 21, 2005 | |||||||

| Fund Manager: Ashwani Kumar (Since Sep 2005) | |||||||

| B - Benchmark | AB - Additional Benchmark | TRI - Total Return Index | |||||||

| As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR of S&P BSE 100 PRI values from 21/09/2005 to 29/06/2007 and TRI values since 29/06/2007. |

|||||||

| As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR of S&P BSE Sensex PRI values from 21/09/2005 to 31/05/2007 and TRI values since 31/05/2007. |

|||||||

Note: Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

| PERFORMANCE OF OTHER OPEN ENDED SCHEMES MANAGED BY FUND MANAGER: Ashwani Kumar | ||||||

|---|---|---|---|---|---|---|

| Scheme Name/s | CAGR % | |||||

| 1 Year Return | 3 Years Return | 5 Years Return | ||||

| Scheme | Benchmark | Scheme | Benchmark | Scheme | Benchmark | |

| Reliance Vision Fund | 34.92 | 31.05 | 10.44 | 10.11 | 17.97 | 15.00 |

| Reliance Top 200 Fund | 35.55 | 31.70 | 11.35 | 11.17 | 18.51 | 15.95 |

Mr. Ashwani Kumar has been managing Reliance Vision Fund since Jun 2003.

Mr. Ashwani Kumar has been managing Reliance Top 200 Fund since Aug 2007 jointly with Mr. Sailesh Raj Bhan.

a.Mr. Ashwani Kumar manages 3 open-ended schemes of Reliance Mutual Fund .

b. In case the number of schemes managed by a fund manager is more than six, in the performance data of other schemes, the top 3 and bottom 3 schemes managed by fund manager has been provided herein.

c. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement.

d. Different plans shall have a different expense structure. The performance details provided herein are of Growth Plan (Regular Plan).

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

The performance of the equity scheme is benchmarked to the Total Return variant of the Index.

Note: Performance as on 31st January 2018

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment. Performance of the schemes (wherever provided) are calculated basis CAGR for the past 1 year, 3 years, 5 years and since inception. Dividends (if any) are assumed to be reinvested at the prevailing NAV. Bonus (if any) declared has been adjusted. In case, the start/end date of the concerned period is non-business day (NBD), the NAV of the previous date is considered for computation of returns.

| OTHER SCHEME PRODUCT LABEL | ||||||

|---|---|---|---|---|---|---|

| Name of Scheme | This product is suitable for investors who are seeking*: | |||||

| Reliance Top 200 Fund(An open ended Diversified Equity Scheme) |

• Long term capital growth • Investment in equity and equity related securities of companies whose market capitalization is within the range of highest & lowest market capitalization of S&P BSE 200 Index |

|

||||

| Reliance Vision Fund(An open ended Equity Growth Scheme) |

• long term capital growth • investment in equity and equity related instruments through a research based approach |

|||||

Contact your Financial Advisor | www.reliancemutual.com