Page

/ 13

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset Management Limited)

FIRST STEP TOWARDS EQUITY INVESTING

Raj is new to investing.

He wants to invest for his future goals.

HOW DOES HE REBALANCE?

Markets are ever changing and the portfolio needs

to align to the changes in the markets.

Raj needs to rebalance the allocation to equity and debt

instruments on a regular basis.

Rebalancing involves actually selling and buying of

equity or debt instruments.

AGGRESSIVE HYBRID FUND

Raj can invest in an aggressive hybrid fund.

An aggressive hybrid fund invests in a

combination of equity and debt securities.

Aggressive Hybrid Fund have an allocation of

65 - 80% to equity and the rest to debt instruments.

The equity allocation can be increased depending

upon market conditions.

IN A FALLING MARKET

The fund manager increases the exposure to debt

instruments when the market sentiment is not positive.

During a bear phase of stock markets, aggressive hybrid

funds have a cushion of debt.

IN A RISING MARKET

When the market is positive and ready to go on an upswing,

the fund manager gradually shifts from debt to equity.

Once the bearish phase is out of the way, the aggressive

hybrid fund can have a greater allocation

to equity.

Raj is thus relieved of the tedious process of rebalancing that

automatically is taken care of by his investment.

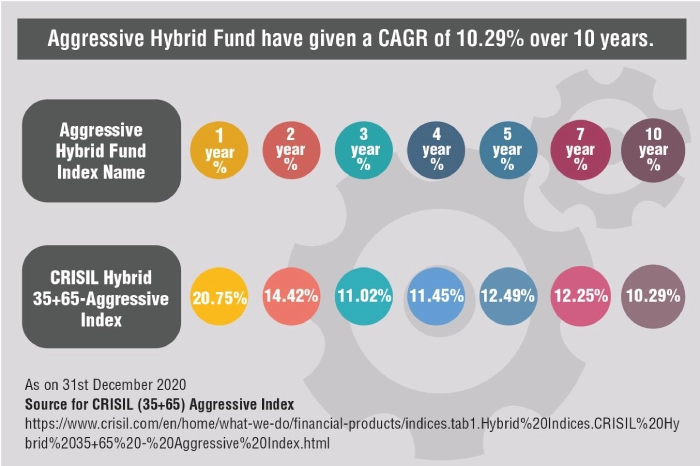

HOW HAVE AGGRESSIVE HYBRID FUND PERFORMED?

*If Raj would have invested Rs. 5000 in an Aggressive Hybrid Fund 7

years ago, it would have fetched him Rs. 11,227 as on 31st December

2020 if it had performed in line with the Index.

The data is related to past performance and is for illustration purposes only"

WHY AGGRESSIVE HYBRID FUNDS?

Expertise of Professional Fund Manager

The Fund Manager has the expertise to make investments across equity and debt instruments.

Eliminates Emotional Bias

Investing through a mutual fund removes emotional bias while rebalancing asset classes.

Diversification

An aggressive hybrid fund allows

diversification through a mix of asset classes

(equity and debt).

Taxation of an Equity Oriented Fund (AY2021-22)

- Long Term Capital gains taxed at 10% over an amount of Rs. 1 lakh during the Financial Year. Dividends are taxed at the slab rates applicable to the investor.

MEDIUM TO LONG TERM HORIZON

Since aggressive hybrid funds have a higher allocation

to equities, Raj should invest in aggressive hybrid

funds for his medium to long term goals.

AIM TO ACHIEVE YOUR FINANCIAL

GOAL THROUGH AGGRESSIVE

HYBRID FUNDS

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm