Page

/ 11

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset Management Limited)

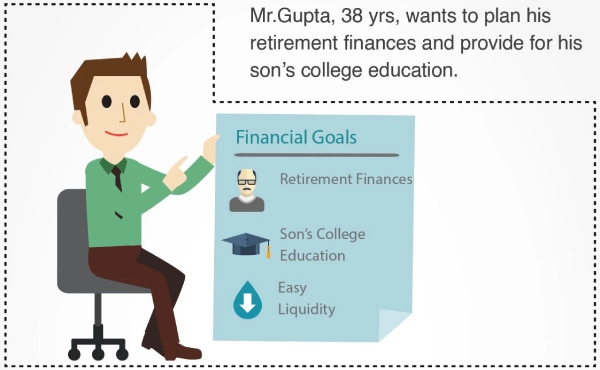

He has received an unexpected bonus that he does not mind

putting at risk, but he prefers easy liquidity. He is looking for an

investment product which will help him meet all these goals.

Is there a one-size-fit-all product?

RESEARCH BEFORE INVESTING

Deepak is impressed by a scheme that claims to give

25% returns in 2 years.

His market savvy colleague has recommended it. A good friend is planning to invest. Some media reports have praised it. But the scheme has a poor past track record and Deepak does not know where it is going to invest and how it is going to generate the returns.

Should Deepak invest?

DIVERSIFY ACROSS INVESTMENTS

Vijay was investing for funding his daughter’s higher education. He decides to invest his entire savings into an equity fund that earned a massive 50% return last year.

This year the stock market falls, and his savings are wiped out! Was he right in investing all his savings in one product? What should he have done instead?

If Vijay had invested in different types of assets, losses in one would have been made up by gains in another.

FOCUS ON GOAL, NOT PRODUCT

Sheela’s grandfather had gifted her a monthly

savings product 15 years ago, so she could use it

for building her retirement corpus.

The product has been underperforming last 3-4 years, making it

harder to achieve her desired corpus value.

She should have rebalanced her portfolio in favour of a

high-yielding investment instead of staying put.

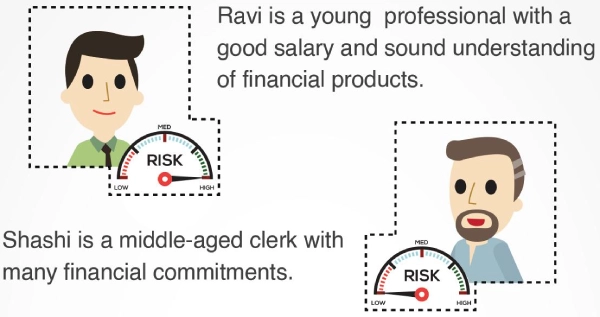

CALCULATE YOUR RISK APPETITE

They do not have the same capacity for risk and therefore,

must consider different asset classes and instruments for their

investment needs.

Ravi can afford to take on risk to earn a higher return

and he has time on his side. Shashi is better off with

low-risk, steady return assets.

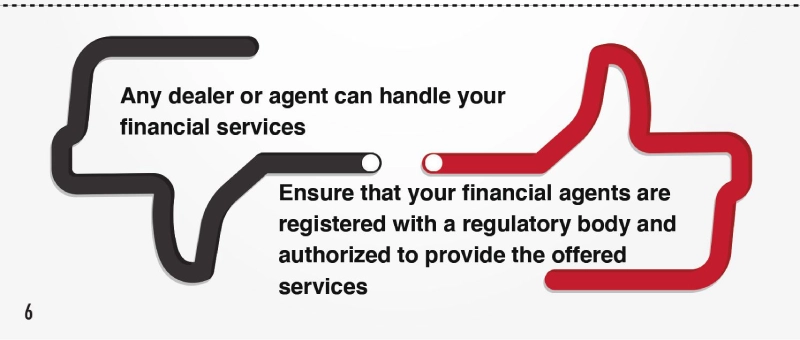

DEAL WITH AUTHORIZED AGENTS

Sujit was investing through an acquaintance, who claimed to be a broker.

However, in case of a dispute, he realised that he had no recourse to the regulator as the broker was neither registered nor qualified for investment advice.

He must:

- Be careful of dealing with unregistered dealers or brokers

- Beware of unscrupulous financial advisers who may swindle your hard-earned money

- Not hesitate to ask for and check all related documents

- Remember: A fool and his money are soon parted!

INVEST THROUGH MUTUAL FUNDS

Mutual funds are professionally managed and suitably diversify portfolios across securities, sectors and asset classes. These

are low cost, convenient and liquid investment options,

available in various risk-return combinations.

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm