Page

/ 13

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset Management Limited)

MATCHING SAVINGS WITH FINANCIAL GOALS

Pallavi works for a Bank and is a single mother. She wants to plan ahead and start building a corpus over a period of time for her 6-year old son. Her dream is to be able to send her son abroad for higher studies.

This also happens to be the time she does her tax planning. She wonders what product she should choose, such that both her objectives are met.

TRADITIONAL TAX SAVING PRODUCTS

Pallavi realizes that traditional tax saving products are fixed

income products. They offer regular income and typically have

a large lock in period.

She needs her capital to grow

over a period of time. Can she

do better?

BEAT INFLATION

Pallavi understands that the value of goals tends to move higher due to inflation. Inflation eats into the return on investments. Pallavi wants her investment to earn a rate of return higher than the inflaton rate.

Equity investments typically have the potential to deliver

better returns adjusted for inflation.

Is there a way in which she marry the two -

Tax Saving and Growth in Investments?

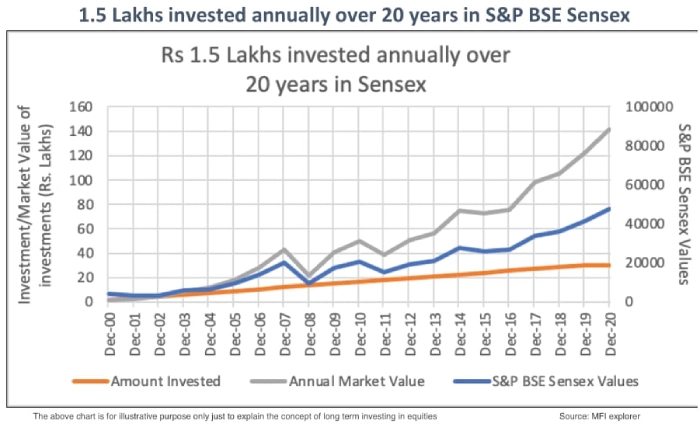

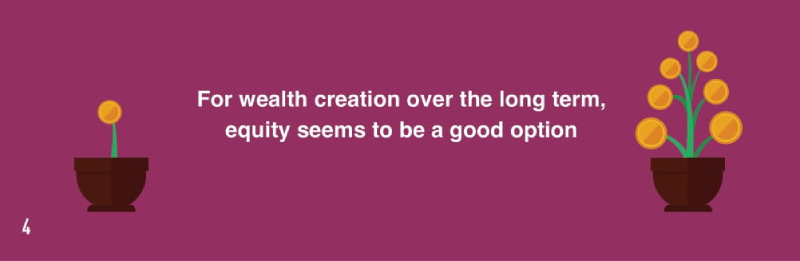

WHY EQUITY FOR LONG TERM GOALS

Yes, she may consider an equity-based alternative. Equity helps

generate growth in the investments. Equity has generated good

returns historically as depicted in the graph below:

Pallavi could invest in equity which has potential to achieve her

long term goals and beat inflation. If she had made staggered

investments of 1.5 lakh from Dec 2000 till 2020, an investment of

30 Lakhs would have

grown to 1.4 Crore as on 31st Dec 2020

Past performance may or may not be sustained in future. Investors are requested to consult their financial advisor before making any investment decisions

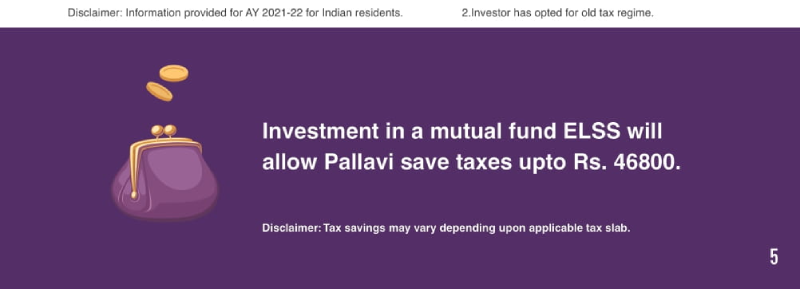

EQUITY LINKED SAVINGS SCHEME (ELSS)

Pallavi may consider ELSS!

It is a tax saving mutual fund scheme that predominantly invests

in equity, hence, providing scope for capital appreciation.

ELSS provides tax benefits under Section 80C of Income Tax

Act, 1961 for investments upto Rs. 1.5 lakh in each financial

year. Individuals/HUF are entitled to an aggregate deduction

of Rs. 1.5 lakh from the gross

total income for investments in

an ELSS scheme during the relevant financial year.

AIM FOR WEALTH CREATION THROUGH ELSS

3 YEAR LOCK-IN PERIOD

Investment in ELSS schemes has the lowest lock-in period

of 3 years amongst the complete list of tax-saving options

available to Pallavi.

Moreover, a three year lock-in works to her advantage as it makes

the fund less likely to face extreme events during the period.

TAX SAVING AND MUCH MORE…

Investment in an ELSS offers dual advantage of potential capital appreciation and tax rebate. Pallavi can achieve her goal by creating an ELSS portfolio for her son and availing tax rebates each year for fresh investments. Investment in an ELSS can be made as a lump sum or by SIP installments as low as Rs. 500. Investment can be made online through net banking channels too.

ALLOW YOUR FUNDS TO GROW

WITH AN ELSS AND GET A TAX

BENEFIT FOR INVESTMENT UPTO

RS. 1.5 LAKH IN EACH FINANCIAL

YEAR

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm