Page

/ 13

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset

Management Limited)

What is an ETF?

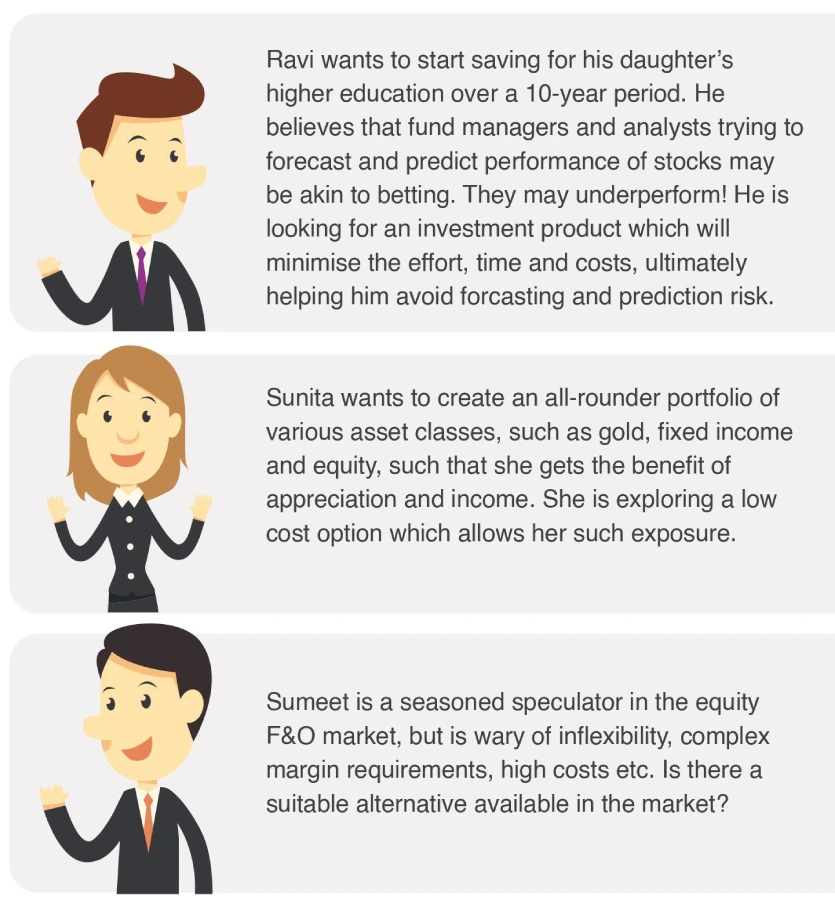

Ravi, Sunita and Sumeet can use an Exchange Traded Fund (ETF). ETF is a Mutual Fund scheme which is listed and traded through the stock market platform. But let us begin with understanding what an ETF is.

An Index Fund is an open-ended mutual fund that endeavours to replicate the performance of it’s underlying index (subject to expense ratio and tracking error). In other words, it’s portfolio tends to mirror it’s underlying index constituents by holding the securities in the similar propotion as their weightage in that index.

ETFs are also open-ended funds and can also be traded like stocks on the exchange(s).

For example, there may be an ETF on Nifty or S&P BSE Sensex, whose portfolio will be exactly the same as the index. It will hold all the securities in the same weightage as in the index.

Active Investing Vs

Passive Investing

Even the experts have come to believe that over the long term, trying to ‘beat’ the market by picking ‘multi-baggers’ and ‘out-performers’ is like gazing into a crystal ball. In essence, it is similar to gambling – taking a call on what the company’s sales, expenses and profits are likely to be!

| Percentage of Funds | ||||

|---|---|---|---|---|

| Fund Category | 1-Year (%) | 3-Year (%) | 5-Year (%) | 10-Year (10%) |

| Indian Equity Large-Cap S&P BSE 100 | 80.65 | 88.14 | 87.95 | 67.57 |

Source: SPIVA India Scorecard as on December 31, 2020

Past performance may or may not be sustained in future.

The legendary Fund Manager

Nobel Laureate in Economics

ETF Scheme Return = Market Return*

(*subject to ETF expense ratio and tracking error)

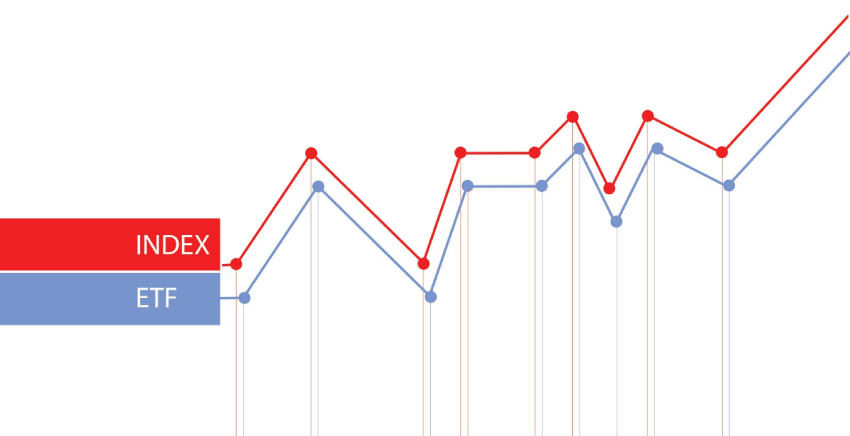

Since the ETF mirrors the performance of the index, it makes no attempt at forecasting and analysis of companies and stocks. This is called passive investing. Thus, the performance of ETF would rise or fall in accordance with the rise or fall in the benchmark index. No more and no less.

An Equity ETF, therefore, serves Ravi’s purpose of consciously avoiding the risks of active investing, where the returns will depend on the fund manager’s ability and timing to pick stocks/sectors. While it will provide equity-oriented returns using the index, the risk of underperformance is minimised vis-a-vis the broad market index.

Trades Like a Stock

As opposed to a conventional mutual fund, ETF is listed and traded like shares on a stock exchange through a trading account. Just like a stock, an ETF has a ticker symbol and follows the same settlement cycle.

It has an indicative real-time NAV (market price) as compared to only a single end-of-day NAV for traditional mutual fund schemes. The indicative NAV of an ETF changes in tandem with the change in its benchmark index value.

Diversify Across Asset Classes

Sunita can easily create a diversified portfolio using ETFs across asset classes and the best part is that she need not be an expert to be able to achieve that. All she needs is to buy the different ETFs and let each one replicate its respective market index or asset classes.

Equities

Replicating the composition and performance of an equity index.

(e.g. Nifty 50, Dow Jones, Nifty Bank)

Commodities

Tracking the domestic price of commodity. (e.g. gold)

Fixed income

Earning regular income by investing in a basket of bonds (e.g. long-term government bonds or money market instruments and CBLO)

With ETFs, Sunita will find it is easy to move money between specific asset classes such as equity, commodities and fixed income.

Don’t Overlook Costs

The cost of running an ETF is usually lower than a conventional mutual fund. This is mainly because unlike the other mutual funds, the fund manager doesn't actively manage the ETF, and thus takes a smaller fee. This helps to keep the costs down for Ravi, Sunita as well as Sumeet. Operational and client servicing costs are lower as they are handled by the demat service provider or the broking house. Further, there is no exit load levied by an ETF.

Having said that, they must realise that brokerage will be payable for buying/selling through their Demat accont (brokerage charges similar to any other stocks) and STT @0.001% will be payable on delivery based trades and @0.025% wil be payable on intra-day based trades. STT is applicable only at the time of ETF redemptions of equity oriented schemes.

Alternative to Futures

Speculative investors, who want to bet on the performance of the index, love ETFs for their flexibility and convenience. ETFs can be purchased in smaller sizes. They also don't require special documentation, special accounts, rollover costs or margin. Furthermore, some ETFs cover benchmarks where there are no futures contracts.

ETFs can be short-sold intra day and squared off like a stock. Additionally, ETFs can be short-sold for a longer duration by borrowing ETF units in Securities Lending and Borrowing (SLB) scheme.

Therefore, because of ETFs ability to be traded on real-time basis, Sumeet may want to prefer them over futures as his objective of investing in futures can be achieved with ETFs, albeit with greater flexibility and convenience.

Different Kinds of ETFs

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm