Page

/ 13

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset

Management Limited)

For any dream to come true, it is very important to set certain goals for oneself. The same holds true even in the case of financial investments. One can spend an entire life earning and saving money, but if one has not planned and invested smartly, it will all be in vain.

You may be saving, but not necessarily investing. Did you know there is a difference between savings and investments? Let’s understand what savings and investments mean.

Savings

When income from various resources like salary, interest income or rent from a house property, exceeds a person's expenses, the balance money is the saving. In simple terms, your income inflow is greater than your outflow. Savings are imperitive as they insure your financial stability in the future. It is also the first step in the overall financial planning process. Savings are imperative as they ensure your financial stability in the future. However, saving smartly is not investing smartly.

Investments

Investments

If your income is Rs. 40,000 per month and your expenses are Rs. 30,000, then the remaining amount of Rs.10,000 becomes your savings, which you can then invest to gain profits. Investments consists of putting the money

into different areas and assets so that it generates a rate of return that is better than what it would earn if it was lying idle. From the example above, the amount of Rs.10,000 could be invested into something as simple as fixed

deposit or it could be invested in equities, mutual funds, gold or any other Investment avenues with proper financial planning.

Conclusion: Savings only help initiate investments, however investments give an opportunity to grow your money/ savings.

Now that you have learnt the difference between savings and investments, it is important that you device a smart financial plan. Whatever you want in the future - a secured retirement, holiday, car, home or business - only good financial planning will get you there.

What is Financial Planning?

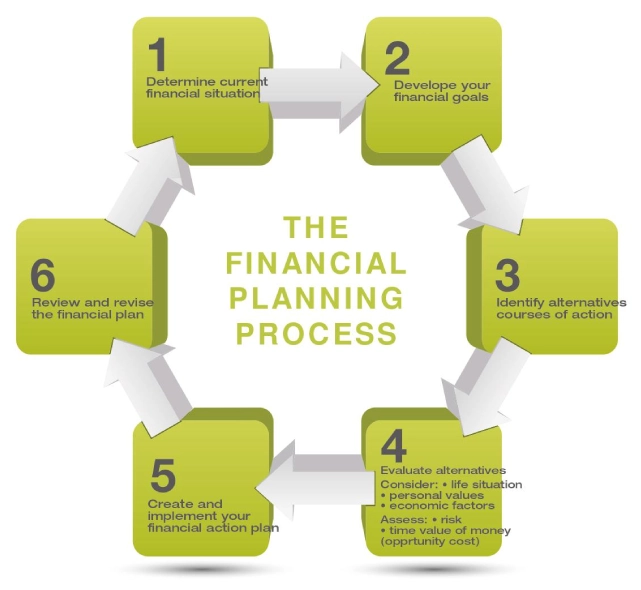

A financial plan is a comprehensive strategy tailor-made in accordance with your financial goals taking into account your current financial position and designing a plan that helps you achieve your future financial destination in the most effective manner.

Step 1: Determine current financial situation

First, you need to determine your existing financial situation. Understand how much you have saved and invested.

Step 2: Develop your financial goals

Your next step, would be to define your financial goals. Your financial goals could entail going for a vacation, buying a holiday home, buying a second house, a new car, kid’s education & such other goals.

Step 3: Identify alternative courses of action

After defining your goals, you need to identify resources that will help you achieve them. You will identify various alternative ways like Fixed Deposit, PPF, Postal savings, Mutual Fund, or other Investment avenues that will help you achieve them.

Step 4: Evaluate alternatives

Next step would be to identify these alternative ways of savings or investments that will help achieve your financial goals. Each goal can be achieved using different methods of saving or investments. Depending upon the time horizon, risk factors, liquidity needs, potential for growth, return/risk profile, etc., you can choose the alternative to fulfill the goal.

Step 5: Create and implement your financial action plan

Post evaluating the alternatives, and basis the shortlisted alternatives, you can create and implement a financial plan that can help you achieve your goals.

Step 6: Review and revise the financial plan

Post developing your financial plan, it is important to review the same step by step to ensure that there is no scope of error.

Let’s understand the importance of Financial Planning and how it can be rewarding.

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals. Its helps to:-

1. Manage Income:

To manage income more efficiently. The cash and need analysis and income expenditure budgeting will show the best way possible in managing income. Regardless of the amount of income earned, part of the earning will go for tax payment, expenditure and what's left would be the saving. Thus, proper management of income is necessary in increasing cash flow.

2. Manage Cash flow:

Money, if not available when required is said to be of no use. Many of us will have one cash inflow (eg; salary for a salaried person) and multiple cash out flows (eg; expenses like grocery, bills, fees etc). One needs to manage their cash flow well so as to lead a happy today and also maintain a happy tomorrow for themselves and their loved ones. Appropriate Financial Planning would help one to manage cash-flows in accordance to their today’s needs and tomorrow’s responsibilities/ financial dreams.

3. Build Wealth:

To secure one’s financial future, one needs to build wealth and also protect the same. However, one needs to understand that earning/making money is not not equivalent to building capital. Everybody wants to build wealth, however very few understand and follow the discipline required to build the same. Building wealth requires a systematic approach which is key part of financial planning.

4. Identify Investment opportunities:

To identify investment opportunities relevant to your financial situation. Financial planning can help in evaluating the best investment opportunities. A good investment planning has the potential of turning goals from dreams into realities. Apart from picking the ‘right’ investment, it shows how to allocate money among different type of investment. This can have a greater effect on investment success.

5. Gives Financial understanding:

To get a whole new approach to budgeting and gain control over your financial lifestyle, one can evaluate the level of risk in an investment portfolio or adjust a retirement plan due to changing family circumstances for example. It becomes obvious that financial understanding has been attained when measurable financial goals are set, the effect of each financial decision is understood, the financial situation is periodically evaluated, financial planning is done as soon as possible with realistic expectations and ultimately when one realizes that only he or she is fully in charge of it.

6. Maintains Standard of living

One can maintain your family's present standard of living by maximizing the household insurance portfolio. One can create a personal and family financial plan so that there are clearly defined goals or targets and there is enough savings to get there. For example, one can make sure that there is enough disability coverage to replace any lost income. This can ensure that the family remains financially secure if the head of the family or the bread winner dies. Thus, the family's standard of living doesn't suffer and is maintained.

7. Protect the future of your loved ones:

Proper planning and disciplined investments help us build the financial future. However, one needs to also take care of those financial responsibilities of our loved ones even in case of an eventuality. This can be done by insuring one self and also the assets one has built. Thus, Insurance is of utmost importance in an individual’s personal finance.

Financial Planning provides direction and meaning to your financial decisions. It allows you to understand how each financial decision you make affects other areas of your finances. By viewing each financial decision as part of the whole, you can consider its short and long-term effects on your life goals. You can also adapt more easily to life changes and feel more secure that your goals are on track.

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm