Page

/ 16

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset

Management Limited)

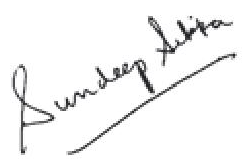

PLANNING FOR LONG-TERM GOALS

Ashok, 35, works in a private sector bank and is starting to get worried about life after retirement. Education is becoming an expensive affair and all parents want the best for their children. He also wants to save enough to be able to fund his daughter’s higher education. He and his wife dream about a lavish wedding for their daughter, who is currently 8-years old. He has made some broad estimates as regards what amounts he might need for the three goals, 15-20 years down the line.

SAVINGS AND GOALS

Ashok thinks he’s done well to save in all the various instruments.

Has he? Let’s find out.

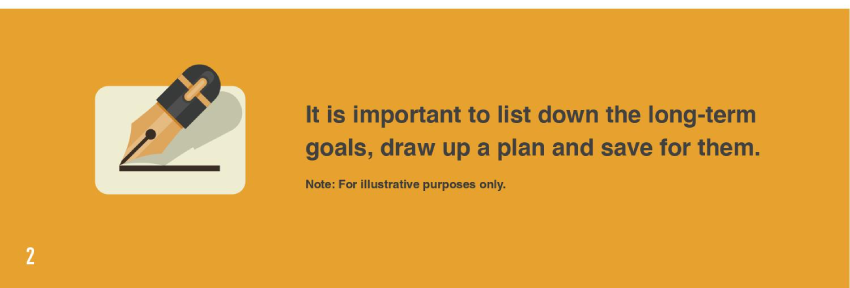

AFTER A TIME LEAP?

Ashok is curious to know whether the investments that he has planned will be good enough in time? Will they allow him to accumulate enough to meet his goals over his investment horizon?

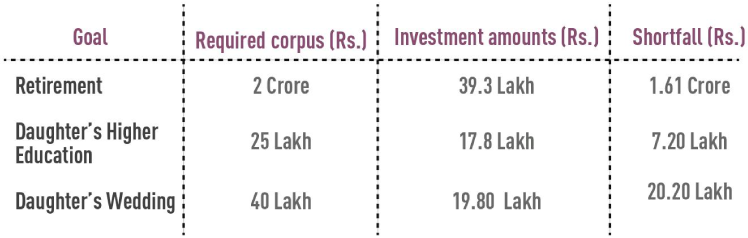

THE SHORTFALL!

Ashok is shocked to realise that going by historical returns, he may or may not be able to meet his goals at the end of stated investment horizons.

Estimates vs. Growth in Assets

INFLATION IS A THREAT

Ashok wonders what is inflation and how is it a threat. The goods he could have bought for Rs.100 last year can be bought for Rs.107 this year. This implies an inflation rate of 7%. If his investment fetches him 10%, his ‘real’ return is only 3%. Instead if it fetches 5%, his ‘real’ return will be negative! He must realise that the value of long term goals keep moving higher and higher due to the effect of inflation.

BRIDGING THE GAP

How can he protect himself against inflation? Ashok realises he needs to invest in a higher return-yielding investment, high enough to be able to cover for inflation. Therefore, he needs to get his savings to work harder for him. What could have Ashok done differently? Ashok could use equity to meet his long term goals. But why equity?

POWER OF COMPOUNDING

Ashok will realise that even the small amounts that he saves could grow into bigger amounts. The gains made each year will get added and contribute more to the gains for the subsequent year. Therefore, the returns on money invested are in turn reinvested again and again. This means the invested amount keeps getting bigger and bigger. This is called the power of compounding.

At 7% p.a. your retirement assets will grow into Rs. 61 Lakhs

At 15% p.a. your assets would have grown to Rs.3.46 Crores

Calculation Methodology: The above calculation is based on monthly compounding of the assumed rate of

return. For example, if you have assumed 9% rate of return, 0.75% (9% divided by 12) monthly compounded rate is used for various time periods.

The above graph is for illustration purpose only and Nippon India Asset Management

does not recommend any action based on this illustration.

BUT ISN’T EQUITY RISKY?

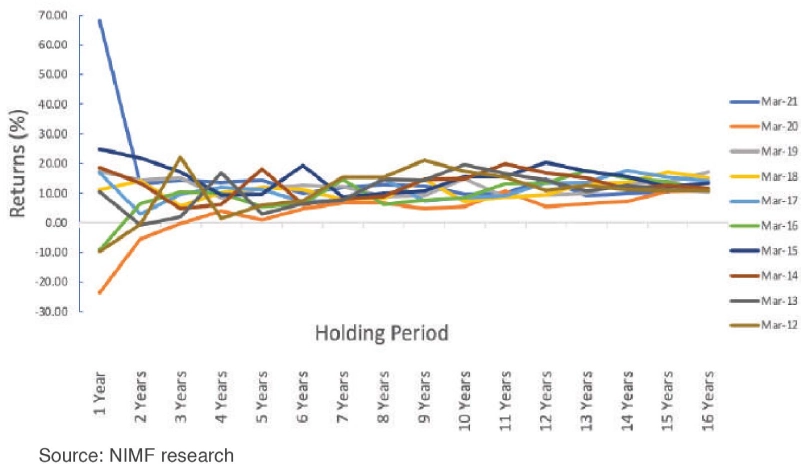

Over the short term, yes! Long term, may be not!

Research has shown that Ashok will be able to considerably reduce the risk of volatility if he continues to stay invested through the market ups and downs.

Volatility in returns reduces as holding period increases (Sensex)

WHY EQUITY MF?

Ashok cannot figure out which stock will be a good buy! He doubts his abilities to research, pick and track performance of stocks. Direct equity investing may not be the most sensible way to achieve long term goals. Is there an alternative? Ashok could buy an equity fund which invests in various stocks, where each stock is researched and selected by a professional fund manager.

Which one to pick?

Which one is likely to give good returns?

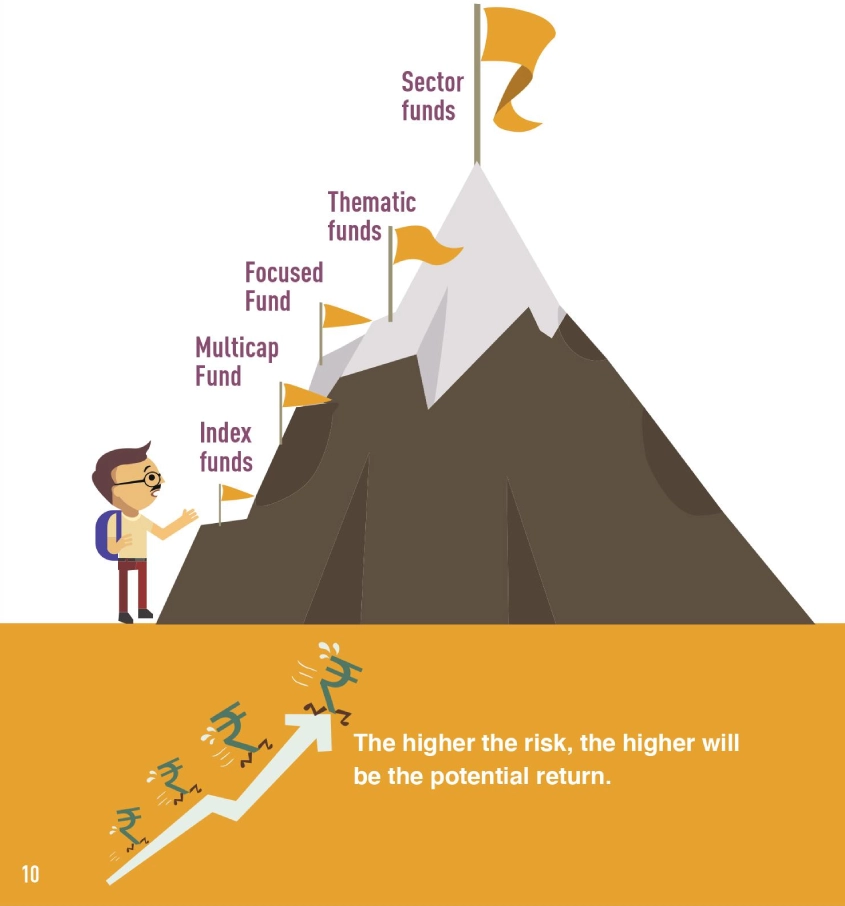

EQUITY PRODUCT MATRIX

Various types of equity funds are available for investment.

The risk and return varies depending upon the stocks and

sectors that the fund invests in.

MAKE EQUITY WORK FOR YOU

Have a big goal in life? Is the goal long term? Don’t worry about how you will save for it. You will get there. Equity works well for long-term wealth creation, as it has the potential for delivering inflation-beating returns over the long term. You may use equity mutual funds to do this job for you.

Please consult your financial/investment advisor before investing.

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm