Page

/ 16

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset

Management Limited)

MATCHING SAVINGS WITH FINANCIAL GOALS

Deepak earns a stable salary income. At the end of the month,

he has some money lying idle.

He likes the comfort of knowing that he has put aside some amount for emergencies such as loss of job, accident, illness. His father is retired and wants to invest his retirement proceeds. He and his wife are saving for an overseas vacation in 2 years time. They also want to get some home repairs done over the next one year.

TRADITIONAL CHOICES

Investors often keep their savings in bank deposits.

They choose Public Provident Funds and small savings schemes

for tax advantages. Some invest in

bonds for the regular interest

income. These are traditional fixed income choices.

Are there other alternatives?

EMERGENCY FUNDING

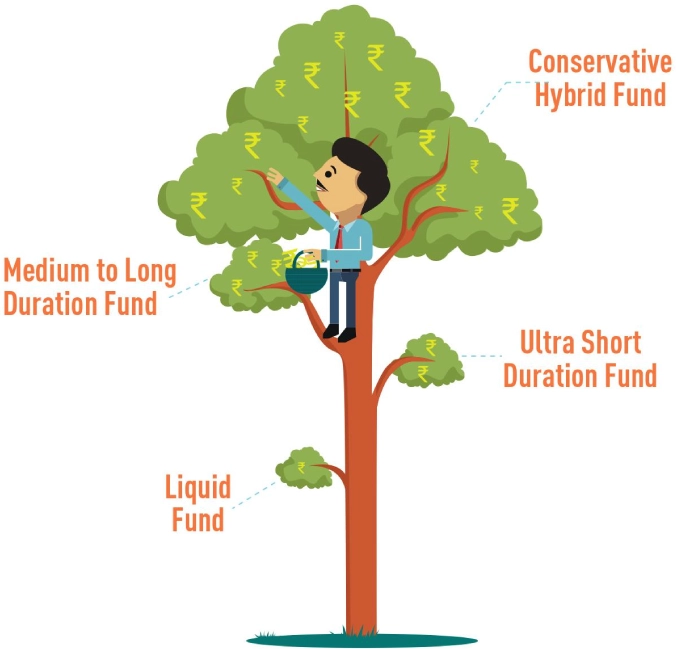

Deepak believes that ready cash is best for emergencies. But Cash does not earn any returns! He could invest in liquid funds.

Liquid funds invests in money market instruments.

Liquid funds may give a low but less volatile interest income.

Deepak may earn market returns for every single day that he stays

invested (depending on market conditions). He will be able to

withdraw the funds at very

short notice.

Mutual Fund may charge upto 0.0070% if Deepak exits before 7 days.

MAKING IDLE CASH WORK

Deepak uses the traditional fixed income instruments to invest his idle cash. Instead he can invest in an ultra short duration fund, which in turn invests in the money market and debt instruments. A small allocation to longer-term bonds gives it the potential to earn a better return.

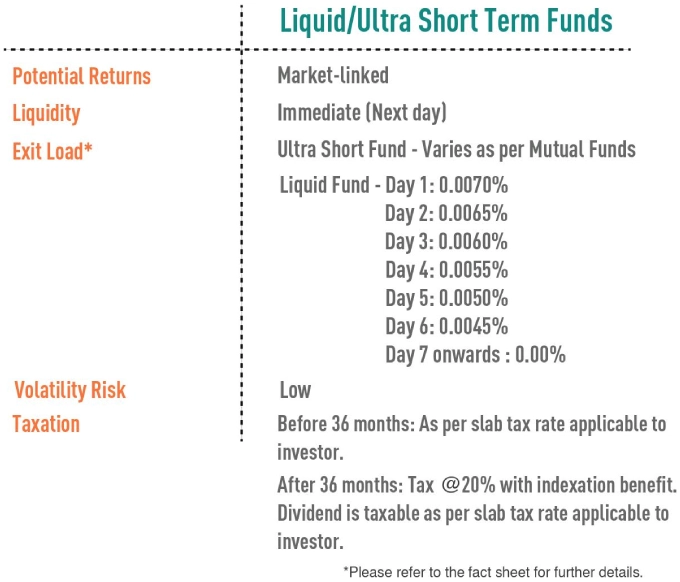

LIQUID/ ULTRA SHORT TERM FUNDS

Ultra short duration and liquid funds invest is high quality securities as stipulated by the regulators (RBI & SEBI) like Treasury Bills, Bank CD, CP, Inter-bank Call/notice money etc.

POST-RETIREMENT INVESTING

Deepak’s father would like to earn a regular income from his

retirement corpus without taking undue risk. He is considering the

traditional saving instruments.

However, he is also worried about impact of inflation on his

returns/income. He can look at investing in Conservative Hybrid

Funds (CHF) as it also aims to give regular income.

He may opt for a dividend payout or

Systematic Withdrawal Plan (SWP).

Due to a small allocation to equity (10-25%), Conservative

Hybrid Funds are moderately high risk open ended

schemes, with an objective to generate inflation + returns

without increasing overall risk.

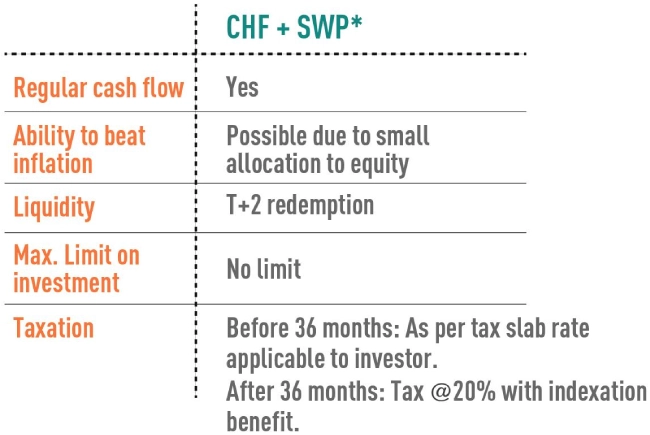

CASH FLOW FROM CONSERVATIVE HYBRID FUND

He wonders - How can an Conservative Hybrid Fund

generate regular and steady cash flows for him?

*Subject to balance in the folio and taxes and exit loads, as applicable.

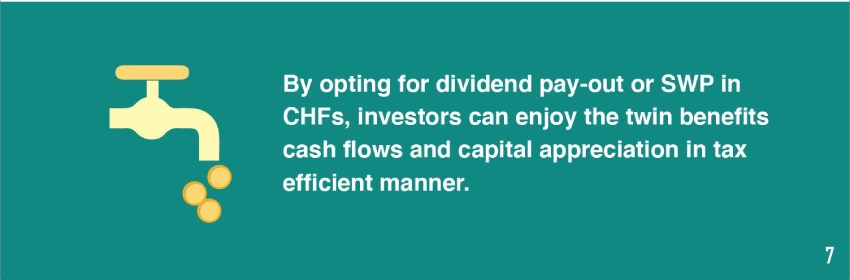

By opting for Systematic Withdrawal Plan (SWP) with CHF, a certain percentage of the accumulated amount will be withdrawn and paid

out to him at a pre-determined frequency.

MEDIUM-TERM GOALS

In order to meet their medium-term goals such as vacation and home repairs, Deepak and his wife can consider Medium to Long Duration Funds.

This is a debt mutual fund that invests in Debt & Money Market instruments such that the duration of the portfolio is between 4-7 years.

FIXED INCOME INVESTING FOR NRIs

Please check your eligibility to invest as an NRI.

Deepak’s NRI brother wants to invest in an Indian fixed-income instrument. He could invest in traditional fixed income instruments except certain small saving schemes wherein the NRIs are not allowed to invest. However, Deepak informs him that he could also consider debt mutual funds for investments.

DEBT PRODUCT MATRIX

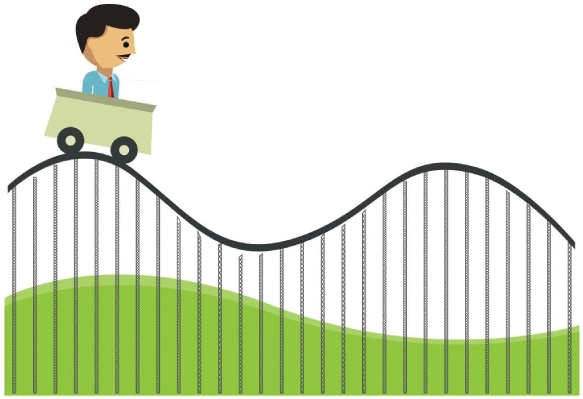

Debt mutual funds that have the potential to

yield higher returns are also more risky.

THINGS TO LOOK OUT FOR..

Mutual funds that invest in very short term securities, such as liquid funds, carry low risk of volatility in returns. Deepak’s return might vary depending upon the interest rates prevailing in the debt market.

The bonds issued by corporates are rated by credit rating agencies as “good” and “bad” quality, depending upon their ability to repay. Mutual funds typically invest in good quality bonds, in an endeavour to safeguard the investors' interest.

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm