Page

/ 14

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset

Management Limited)

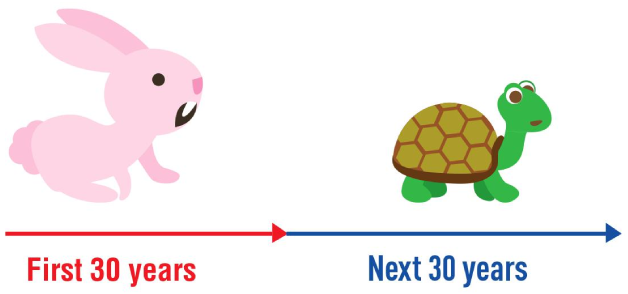

An average person works for about 30 years and retires at around 60 years of age. Given the advancement in medicine and healthcare, we should plan for another 30 years post-retirement. In the modern nuclear family system, the elderly mostly live alone, paying their bills and managing their households by themselves.

If you retired with

Rs.1 crore today...

30 years later it would be as

if you had approx Rs.13 lakhs

*Assuming inflation at 7% p.a. Rs. 1 crore discounted at

7% for 30 years, would amount to Rs.13,13,671.

Retirement planning involves

two distinct phases.

ACCUMULATION PHASE

The accumulation phase is the building of assets, by saving and investing in the earning years.

DISTRIBUTION PHASE

The distribution phase is the use of assets, by ensuring that retirement is comfortably funded as long as one lives.

INFLATION : THE SILENT KILLER

Monthly expense of say, Rs.1 lakh at retirement will

balloon year after year.

For eg: Let’s asume that the age of Retirement is 60 years

This is only for illustration purposes to purely explain the concept of impact of inflation.

The distribution phase begins when we retire. We now depend on the retirement assets to generate adequate income. The focus now shifts from growing the value of the corpus, to the regular income it should generate.

Shift in preference..

In the distribution phase, you are drawing down some of

your assets, to fund your expenses. You may need

income assets to generate this regular income. You

should allow the rest of the assets to grow in value, even

if modestly, by holding a small portion in growth assets.

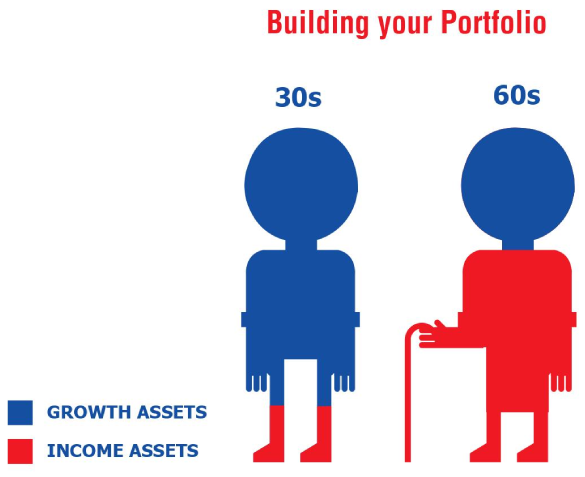

During accumulation you primarily need growth, but you also want some downside risk protection. A predominantly growth oriented portfolio shall endeavour to serve this need.

During distribution, you primarily require sufficient income to meet your expenses. A predominantly debt oriented portfolio shall endeavour to serve this need.

Use the Peak Income

to Save More

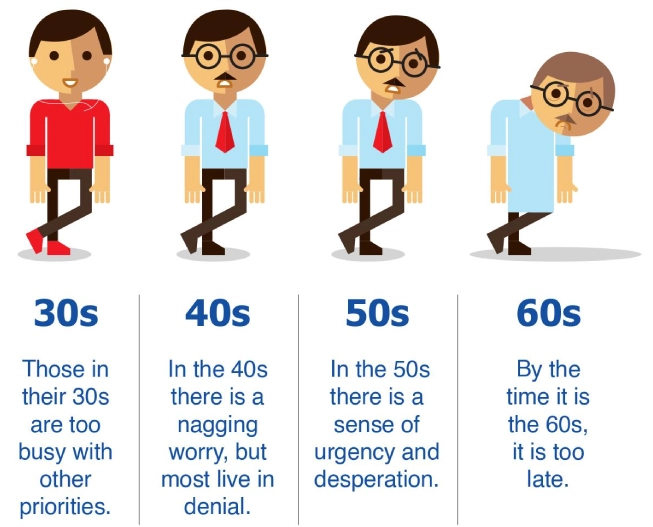

It is ideal if we began early... But in reality, we will find ourselves being able to save more, as we age. In our peak earning phase, many of us may be able to even save 50% of the income. Small amounts saved in early years, topped up by large amounts saved in later years, will help accumulating a large corpus.

BUILD BIG, BUILD AGGRESSIVELY

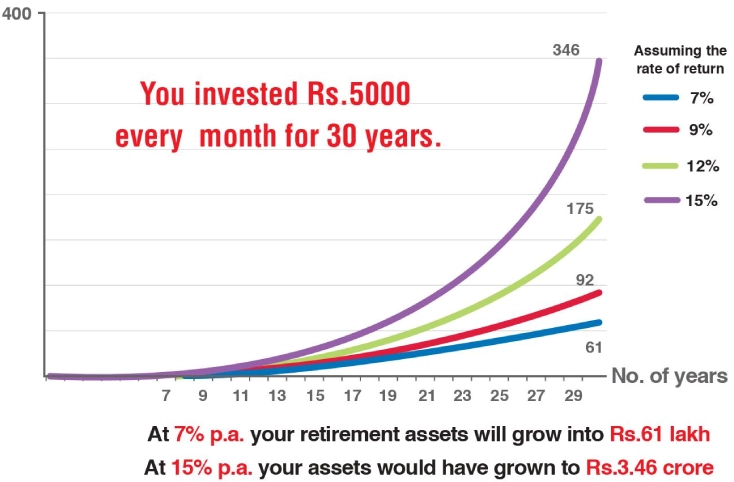

Accumulating adequate retirement assets is a challenge. We can only save a portion of our income, even with the best effort. But to retire comfortably, we need those assets to generate an income that completely funds all expenses, after inflation.

BEGIN EARLY OR BUILD BIG

SECOND INNINGS

Thinking about retirement as the time to live frugally is so

old-fashioned. The new-age retirees look forward to a

second inning. An inning filled with travel and discovery;

pursuit of new interests; and a life of joy

and dignity.

RETIREMENT CALCULATOR

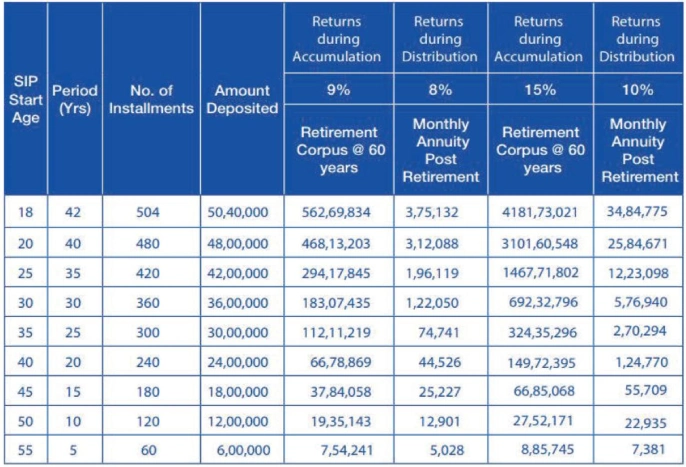

| Assumptions | ||

|---|---|---|

| Monthly Instalment Rs. | 10,000 | The returns earned on the retirement corpus is assumed to be systematically withdrawn as annuity. Hence the principal of the retirement corpus will remain intact and the annuity will be perpetual in nature. |

| Retirement Age | 60 Years | |

*The illustration above is based on assumptions and is solely for the purpose of understanding how the age of retirement planning affects the retirement corpus.Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s)

A person who starts a monthly SIP of Rs. 10,000 at age of 20 has 40 years of accumulation till retirement at 60. This gives him 40*12 =480 installments. Each installment is compounded at a monthly rate of (9/12) = 0.75% for the months till retirement. The total investmentamount is Rs. 48,00,000 and corpus accumulated will be Rs, 4,68,13,203. This amount when invested at 8% gives Rs. 3,12,088 permonth during retirement.

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm