Page

/ 16

(c) 2022, EDGE Learning Academy

Helpful information for investors

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to beverified on SEBI website under'lntermediaries/

Market Infrastructure Institutions'. For redressal of your com plaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit https://mf.nipponindiaim.com/lnvestorEducation/what-to-know-when-investing.htm. This is an investor education and awareness initiative by Nippon India Mutual Fund.

Disclaimer

The information provided in this booklet is solely for creating awareness about SIPs and for general understanding. The views expressed herein constitute only the opinions and do not constitute any guidelines or

recommendations on any course of action to befollowed by the reader. Many of the statements and assertions contained inthis booklet reflects the belief of Nippon Life India Asset Management Limited, which may be based inwhole or

in part on data and other information. Nippon Life India Asset Management Limited (formerly known as Reliance Nippon Life Asset Management Limited) does not guarantee the completeness, efficacy, accuracy ortimelines of such information.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Readers of this booklet are advised to seek independent professional advice, verify the contents and

arrive at an informed investment decision.Neither the Sponsor, the Investment Manager, Mutual Fund, the Trustee, their respective Directors, nor any person connected with it accepts any liability arising from the use of this information.

PREFACE

The Mutual Fund industry has grown fast to become an important component of the Indian economy, helping channelise household savings into the capital market. Moreover, Mutual Funds investment has become an important way for citizens' private investment and wealth management. In light of this, investor education is an important aspect to keep the investor well informed, as well as protect their legitimate rights and interests, particularly for small and medium investors.

This booklet is a specific exhibition of Nippon India Mutual Fund's efforts to spread awareness and continue building the investors' knowledge. It explains investment related information in simple language and in a lively and vivid manner. I am sure, investors of all kinds will find value in this booklet and be encouraged to use this as a stepping stone towards practicing financial prudence.

All the very best and happy reading.

Sundeep Sikka

Executive Director & CEO

Nippon Life India Asset Management Limited

(Formerly known as Reliance Nippon Life Asset Management Limited)

SHOULD YOU WORRY ABOUT THE WINTER?

In a field, one summer’s day, a grasshopper was hopping and chirping about merrily, while the ant was toiling away trying to accumulate a stock of food for the harsh winter.

The grasshopper wasn’t worried as he wasn’t thinking about the winter. There was plenty during the summer! He mocked the ant for working so hard to safeguard the future.

FROM PLENTY TO SCARCE

Why bother about the winter now, if there’s plenty during the summer? Winters are harsh when food becomes scarce.

In winter, the grasshopper had to beg for food as it found itself dying of hunger. The ant, on the other hand, had stored enough and could consume it gradually without any difficulty whatsoever.

ACCUMULATE WHEN THINGS ARE APLENTY

The ant took advantage of the season of plenty and stocked up food. She was not lazy when the going was good. She took that opportunity to collect as much as she could. She knew it was a good idea to accumulate when food is available in plenty.

MAKE INVESTING A HABIT

Ant was disciplined and believed in working hard, unperturbed. She knew her goal was to get to a huge stock that would last her the winter.

If the grasshopper also would have been able to inculcate such discipline and planning, he would have not starved later.

BENEFITS OF LONG TERM INVESTING

The small amounts I invest regularly using SIP can grow into substantial wealth over the long term. Ant’s huge stock of food was not built in a day! It was a gradual process. She toiled and toiled endlessly over the whole of summer. The longer the horizon, the higher the benefit.

Grasshopper, on the other hand, ran up and down towards the end of summer trying to gather some grain, but he ran out of time and could only accumulate little. By the time he realised that he should have started early, it was too late!

TIMING THE INVESTMENTIS USELESS

The grasshopper thought that he would work smart (and not hard!) by collecting on days when there was a lot of grain easily available. But he was never able to accurately predict such timings of easy pickings!

The ant, however, picked whatever was available. She picked higher quantities on days when they were available and lower on some others.

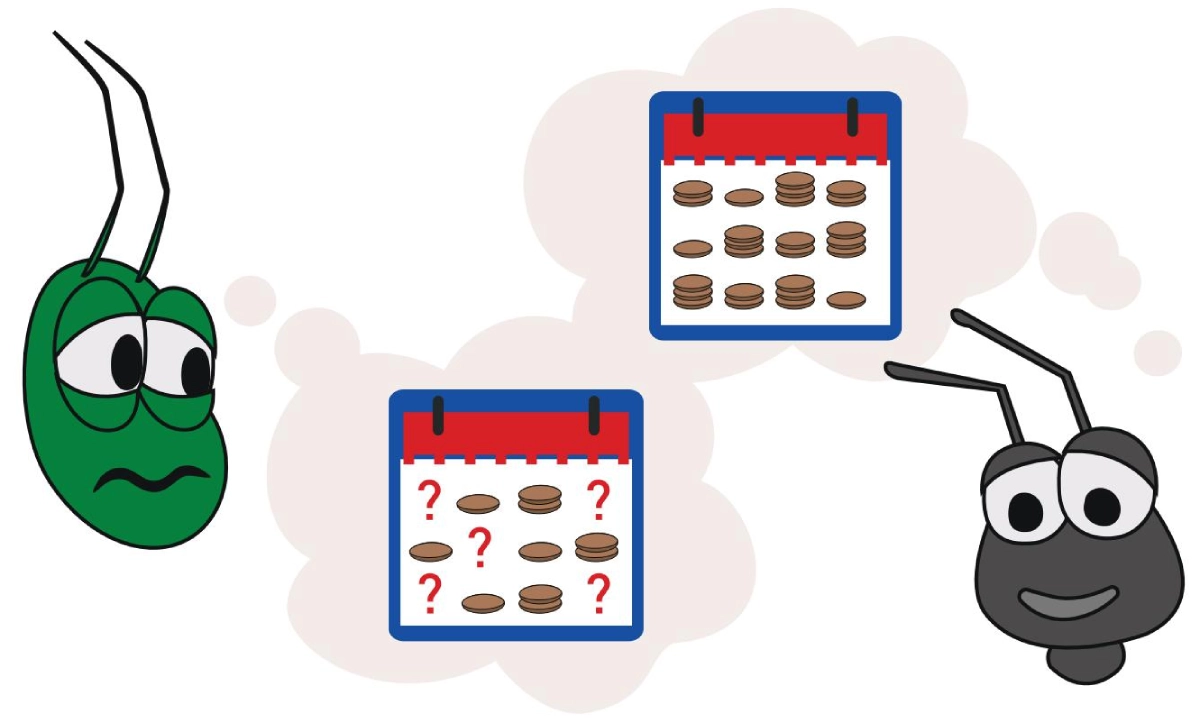

BENEFITS OF RUPEE COST AVERAGING

There were times when the ant was able to accumulate loads, and only smaller portions on the others. But in the end, it all stocked up well for her. The smaller portions on certain days were averaged out by the huge portions she managed on the other days. It didn’t matter how much she was able to collect on individual days. What counts is that she was able to accumulate a sizeable quantity over the long term.

Grasshopper, on the other hand, ran up and down towards the end of summer trying to gather some grain, but he ran out of time and could only accumulate little. By the time he realised that he should have started early, it was too late!

HOW DOES THE MAGIC WORK?

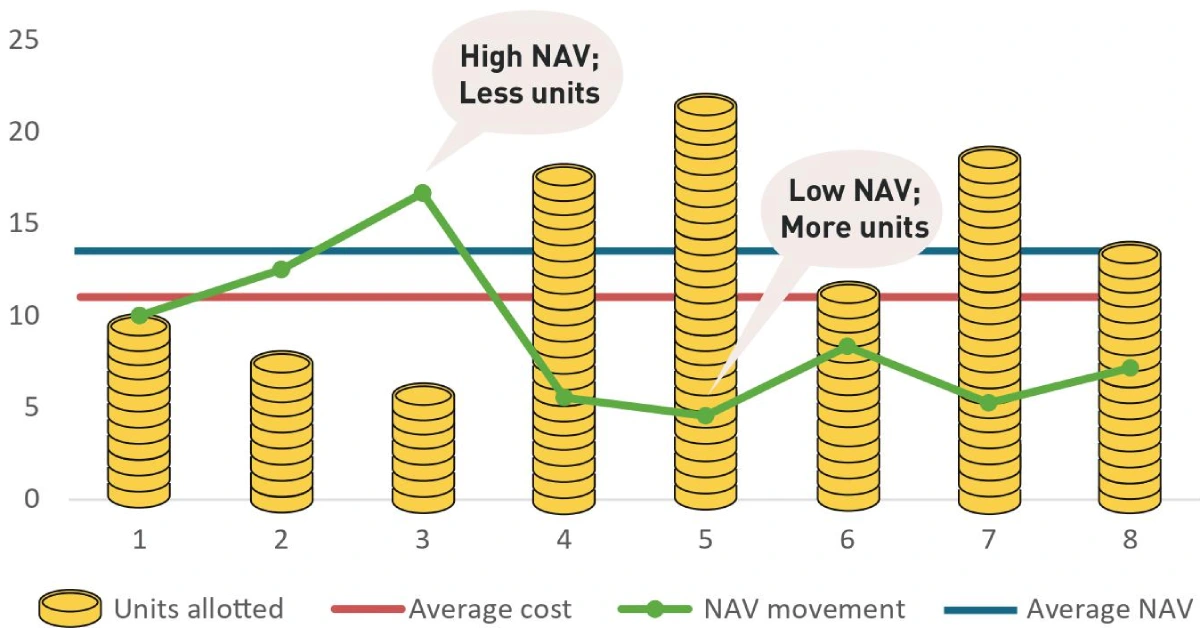

Let us equate the hard-working ant to a disciplined mutual fund SIP investor. He invests Rs.100 every month over a 8-month volatile period. As he invests at various NAVs, he is able to ‘buy more when the markets fall’ and vice versa. As a result, his average cost is much lower than the average NAV This is ideal - takes the guesswork out of investing!

IT IS IMPORTANT TO KEEP AT IT!

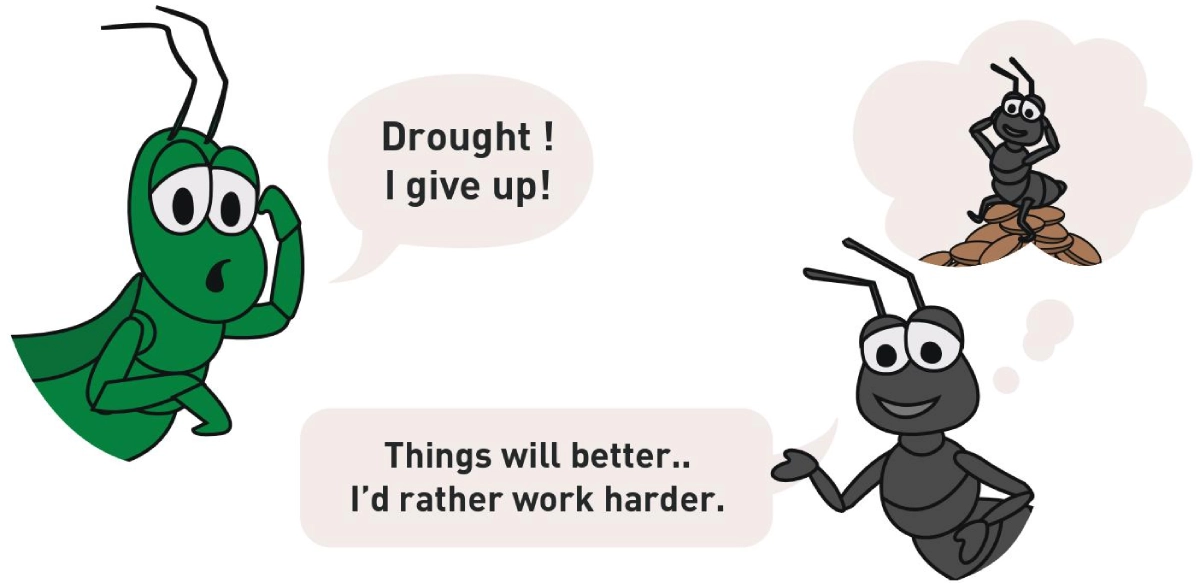

The grasshopper finally saw merit in what the ant preached and started to accumulate regularly. But suddenly there was dearth of grain all around. Everyone panicked and gave up! He too saw no merit in continuing and stopped.

But the ant knew that the scenario would look down sometimes and up other times. So she doubled the effort and kept collecting whatever she could manage. So when the drought was over, to the grasshopper’s amazement, she had accumulated a fairly large quantity.

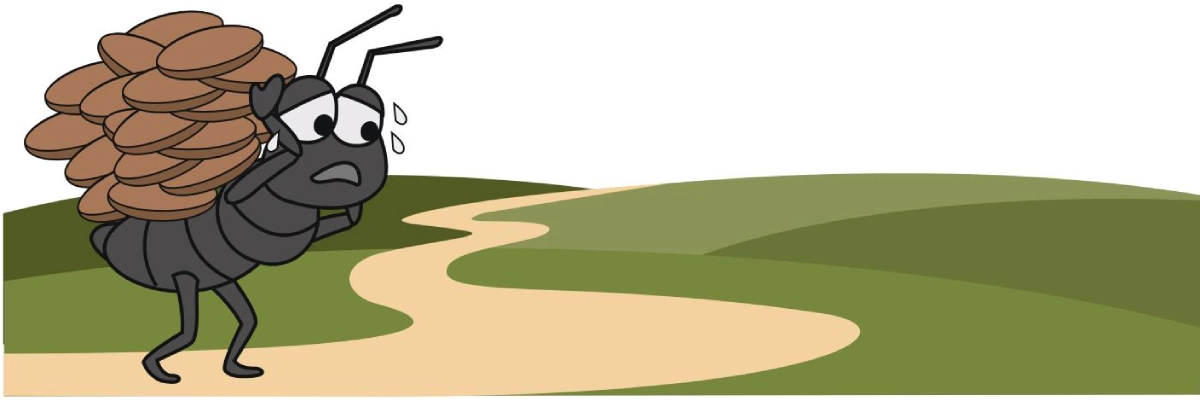

HOW MUCH SHOULD YOU SAVE?

The ant was a tiny creature but carried grain measuring a multiple of its weight. She had set for herself a goal in terms of the quantity that she wanted to accumulate and she worked towards that.

Unlike the grasshopper, she stepped out of her comfort zone and kept at it even when the going was tough. In the end, she alone was sitting on a huge stock of grain, while the grasshopper ran helter skelter looking for food.

START AN SIP NOW

SIP is a powerful tool of wealth creation over the long term. Even a small creature like an ant was able to put together its stock of food by collecting and working bit by bit. This was of course possible owing to its discipline and hard work.

Push yourself now, or else you’ll run short later. So plan for the future. Start an SIP now and dance your way into your winter!

SMS ‘EDU’ to ‘561617’

Visit https://mfnipponindiaim.com/InvestorEducation/home.htm