Constitution of Investing

- Preface

Constitution of Investing

A big thank you for joining Nippon India Mutual Fund in its mission to boost India's financial literacy rate of 27% as on January '22. It is India's 23 rank in the global ranking of financially literate countries that motivated us to create the 'Constitution of Investing'.

Simply put, Constitution of Investing is a journey to make you financially literate that empowers your with the Right to Wealth. And that's our end goal!

Now, take your first step into the world of investing where opportunities to grow your wealth await you.

Constitution of Investing

Constitution of Investing

In your first step, let's understand the basics of why one should learn to invest in the 21 century.

It's no secret that for decades, we have stuck to the traditional ways of saving to accomplish our financial goals such as buying homes, financing a child's education, early retirement planning, etc. However, times are changing and so should our investing ways. The age of idle money in gullak aka piggy bank or traditional investments has gone. Let's make the shift from traditional investing methods to smart alternatives.

Let’s take a look at how the traditional savings method works

Traditional Savings method

Savings in traditional investments ₹1,00,000

+ Interest earned in 1 year @ 3% p.a. ₹3,000

- Tax on interest @ 31.20% ₹936

- Impact of inflation @ 6% p.a. ₹6,000

= ₹96,064

Notes & Assumption:

Constitution of Investing

As a result, traditional investments fail to beat the impact of taxes and ever-increasing inflation. Being a disciplined investor in this era is not enough to grow your wealth.

Constitution of Investing

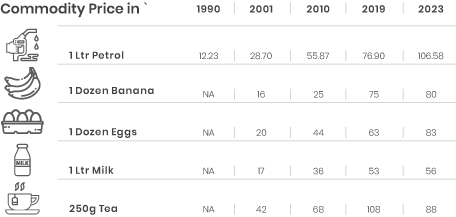

As we can see, inflation has hiked petrol prices by almost 8 times in 33 years. Also, a dozen bananas that cost 16 in 2001 had a price of 80 in 2023.

From the above table, it is evident that inflation ends up almost doubling your monthly expenses every decade. As a result, you need to invest wisely to ensure your investment corpus beats inflation successfully

Source: CIEL Research, www.numbeo.com, www.goodsreturns.in, www.amazon.in

Constitution of Investing

This is where Chapter 1 ends. Now that we understand the need for investing, Chapter 2 is an introduction to the many investment options.

A smart investment is one with an return on investment that beats the impact of ever-increasing ________ .

Answer: Inflation

Constitution of Investing

Constitution of Investing

This chapter introduces you to the world of investments. When you know your investment options well enough, you become well-equipped to invest your hard-earned money the smart way that beats inflation and boosts tax-saving. It all depends on 2 major factors namely your risk-taking capability and how conservative or aggressive is your approach.

Many of these above-mentioned investments have longer lock-in periods and taxable returns. As a result, their return on investment may fail to beat inflation.

Constitution of Investing

When stocks markets go through many ups and downs, it is called a volatile market which often demotivates investors like you. This is why, Mutual Funds were born to help you potentially counter volatile stock market if you stay invested for a long term. In short, the key to creating wealth through mutual funds is long term commitment.

Constitution of Investing

This is why stock markets and mutual funds, though taxable, have an edge over other investment options as they have potential to beat inflation and provide good returns over a period of time.

Now you have a better idea of the stock market's growth trajectory. Basically, you have a better chance of overcoming volatile conditions and earning good returns with long term investments.

On that note, let's take a deep dive into the concept of Mutual Fund in the next and final chapter of module 1.

Mutual Funds were born to help you potentially counter volatile stock market if you stay invested for a _____ term

Answer: Long

Constitution of Investing

Constitution of Investing

Is it risky? How much will I get in return? Is my money safe?

This chapter is not just a formal introduction but also an attempt to address your concerns, doubts or misinformation about Mutual Fund.

Mutual Fund: It is a pool of money accumulated by several investors who aim at saving and making money through their investments. The corpus of money created is invested in various asset classes like Equity, Debt, Gold, etc.

Constitution of Investing

Mutual Fund professionals have a qualified research team that analyses performance and potential of various companies before investing your hard-earned money. They are trained to manage your funds professionally.

Mutual Funds are required to disclose their portfolio, performance, expense ratio, etc., that allows investors to make an informed decision while investing.

If you seek to encash your investments sooner, there are open-ended funds which facilitates redeeming partial or total investment (subject to exit load and lock in). It gives you the present value of your investments.

Mutual Funds are governed by Securities and Exchange Board of India (SEBI) guidelines and they are obliged to adhere to the strict regulations formulated to safeguard investors.

In case you wish to make small investments, Systematic Investment Plan allows you to invest with as less as INR 100 rupees through systematic investment.

Due to huge economies of scale, mutual funds schemes have a low expense ratio. Expense ratio is the annual fund operating expenses of a scheme comprising of administration, management, advertising-related expenses, etc.

*Subject to terms prescribed in scheme information document of particular scheme.

Constitution of Investing

https://www.youtube.com/watch?v=6tHoCYu4aOE&list=PLKBTcRgCqnRYAal-8w8-p0fIMg1kQT6z1

Constitution of Investing

Constitution of Investing

Fun fact: In 1774, a Dutch merchant created the first Mutual Fund which was a diversified pooled security designed for citizens of modest means. The negotiatie was called Eendragt Maakt Magt, which translates to 'Unity creates strength', and owned bonds issued by foreign governments and plantation loans in the West Indies.

Now you know Mutual Funds, the risks and its many advantages. Congratulation! You have successfully completed module 1 of the Consitution of Investing. Module 2 is all about learning how you can grow your wealth through the various types of Mutual Funds.

Quiz: Inflation Risk is also referred to as ‘loss of _______ power'.

Answer: Purchasing

Constitution of Investing

Constitution of Investing

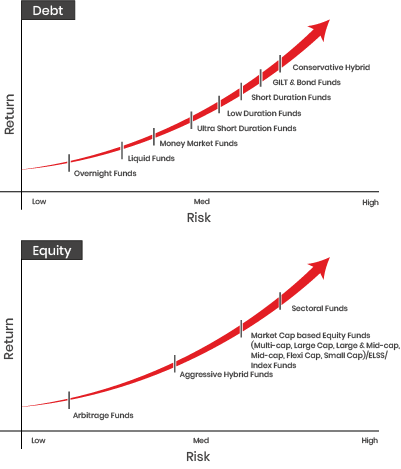

Welcome to Module 2. It is the foundation you need to build your mutual fund knowledge on. Broadly, mutual funds are classified into Equity, Debt, Hybrid, Solution-oriented schemes etc., followed by categorical classification within debt and equity as per your risk-taking ability. Look below to find out the difference in every fund's risk-return ratio.

Constitution of Investing

Invests in: Fixed income instruments including government bonds, corporate bonds, company debentures and other fixed income assets. Nature: Relatively safe investment option

If you are seeking a safe investment option, this could be the one. Liquid funds invest in securities with very low residual maturity which make it ideal for short term goals such as parking idle money, contingency planning, etc. With investments in low maturity instruments, it carries a very low duration risk.

With investments in fixed income instruments, these funds are ultra-short in duration and have short-term maturities which are higher in comparison with liquid funds. It carries offers low interest rate risks and aim to give better returns than liquid funds.

Known for investing in short duration, fixed income instruments such that macaulay duration of the portfolio is between 1 to 3 years. These funds are a good choice for those planning a foreign vacation, park pre-retirement corpus or purchase consumer durables.

Constitution of Investing

These are mutual fund schemes that primarily invest in Government Securities. Government Securities includes securities issued by Central and State Government. While the Gilt funds invest in government securities (G-Sec) which have no credit risk, just be cautious of its interest rate risk.

This type of mutual funds invests majority of the corpus in debt instruments while a smaller proportion is invested in equities to earn capital gains. In general, these funds allocate 75-90% of the corpus in fixed income securities and the rest in equities. With the debt allocation so high, the risk is lower in such schemes than equity funds. Perfect for conservative investors who seek stability of debt and also desire the benefit from upside potential of equities.

An open-ended debt mutual fund schemes focused on overnight securities that mature in a day. Basically, securities are bought on a daily basis in these schemes. With securities maturing every day and the entire cash used to buy new securities, this type of funds is regarded as the safest among the debt mutual fund categories. This is due to their very short maturity which rules out interest rate changes and defaults in securities. If you wish to park a huge sum for a short time, go for overnight funds.

MMF invests in short-term debt and money market instruments that deal only in cash and cash equivalents with with an average maturity of up to 12 months. It may not be as safe as cash but are considered extremely low-risk on the investment spectrum. That's why, a money market fund generates income but little capital appreciation.

Constitution of Investing

This type of funds are ideal if you are not quite ready to make an investment or anticipating a near-term cash outlay for a non-investment purpose. It offers relative safety and liquidity which means you have cash in hand at the very moment of need.

Constitution of Investing

Invests in: Equity stocks or shares of a company.

Nature: Capable of higher returns and are a high-risk option

In mutual funds, aggressive hybrid funds invest 65% to 80% of their total assets in equity while the remaining 20% to 35% in debt securities. This approach may suit you if you are seeking to create wealth with potential equity returns and stability of debt.

Constitution of Investing

(MULTI CAP, LARGE CAP, LARGE & MID CAP, MID CAP, FLEXI CAP, SMALL CAP)

Large Cap Funds invest a minimum of 80% of their total assets in equity andequity-related instruments of large cap companies (the top 100 cos. in terms of market capitalization). You can be rest assured, they are more stable than the mid cap or small cap funds.

Constitution of Investing

Why ELSS (Equity Linked Savings Scheme) is better than the traditional tax saving products which are fixed income products offering regular income for a large lock-in period? Being a tax saving mutual fund scheme, it offers capital appreciation by predominantly investing in equity. There's more! It has tax benefits under Section 80C of Income Tax Act 1961, for investments up to Rs. 1.5 lakh every financial year. Individuals/HUF get an aggregate deduction of Rs 1.5 lakh from the gross total income for investments in an ELSS scheme during the relevant financial year.

Constitution of Investing

Now these are funds with investments primarily in businesses of a particular industry or sector of the economy. But these funds carry risks that affect the entire portfolio due to their targeted sector exposure. Only highly informed investors, who have a long term view of the particular sector, are recommended sectoral funds.

Buying mutual funds from one market only to simultaneously sell in the other, to take advantage of a temporary price differential, is called arbitrage. Simply put, Arbitrage funds exploit the price differences between current cash and future securities forward market price to generate returns. So, every time a fund manager buys shares in the cash market, he simultaneously sells it in futures or derivatives market. The return is the difference in the cost and selling price.

For instance: Mr. X buys ABC share from cash market at `1220 and shorts a futures contract to sell the shares at `1235. As the prices coincide towards the end of month, Mr. X will sell the shares in the futures market and generate a risk-free profit of `15 per share less the transaction costs. If you prefer the conservative approach, Arbitrage funds is an ideal and safe option for you to park your surplus money when there is a persistent fluctuation in the market.

Constitution of Investing

An index is a group of securities defining a market segment like Sensex or Nifty 50. An index fund endeavours to imitate the portfolio of an index at all times.

For instance: If an index fund tracks a benchmark like the Nifty 50, its portfolio will have the 50 stocks that comprise Nifty 50 in the exact same proportions. What you get is the NAV of your index fund moving virtually in line with the index its tracking. In short, with every rise and fall in Nifty, the NAV of your Nifty-linked index fund may also roughly appreciate or drop by a similar % margins. You can expect minor deviation in returns, aka tracking error, from the benchmark. Since index funds are passively managed unlike the 'active funds', where the fund managers constantly fine-tune portfolios basis the market changes, the fees are less in comparison with active funds. This is exactly why Index funds are perfect for risk-averse investors who are cost conscious and content with returns at par with index.

Constitution of Investing

Debt and Debt-oriented hybrid funds are relatively a ________ option.

Answer: safe

Constitution of Investing

Constitution of Investing

Now that you are aware of the savings-investments difference and understand the Mutual Funds landscape, let's learn to align your investments with life goals. Let's start with the basics by classifying goals as short, medium and long term goals.

The above table is a simple yet effective way to invest for the common life goals most of us have in a lifetime.

Constitution of Investing

Note: This above visual is for illustration purpose only. It does not guarantee any returns.

Constitution of Investing

Discipline is the key to success and investing in Mutual funds instils a sense of discipline in you. How? Mutual Funds has an amazing feature that allows investment in small amounts through a Systematic Investment Plan (SIP). SIP is a fixed amount invested at periodical intervals of time in a Mutual fund scheme. Whether you invest monthly, quarterly or daily through a SIP, you gain multiple benefits.

Benefits of starting early

The above table explains the reason behind 'The sooner you start investing in mutual funds the better'. For instance, investing `1,000 at the age of 25, assuming a return of 8% p.a., can give you an ROI (Returns over investment) of almost 5 times as compared to the same amount invested at 40 years old.

Constitution of Investing

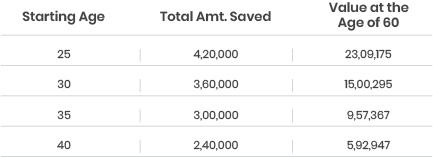

Rupee Cost Averaging

Did you know that you don't need to time the market to invest in Mutual Funds? It is noticeable from the bar graph above that units are accumulated every month in spite of the fall or rise in NAV. Just accumulate more units when the NAV is low and accumulate fewer units when the NAV is high. This is to average out your cost for long term benefits.

Constitution of Investing

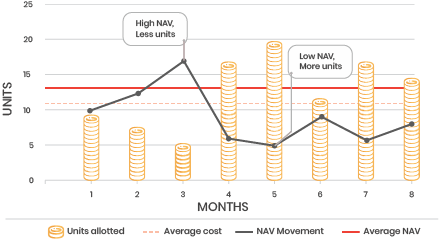

The best way to learn about it is a story.

Story: The king of an empire was very impressed by a poetry of a poor farmer who was barely making ends meet. The king was so happy that he asked the farmer to choose his own reward. The farmer humbly asked for a grain of rice to be placed on the block of the chess board and the same to be doubled in every subsequent block. The king found the farmer's ask very funny, yet ordered his people to start the process. When they reached the 16th block, there were 32,788 grains of rice on the chess board and by the 24th block, there were 8 million grains of rice. It is said that the king had to surrender his entire kingdom to the farmer to pay his reward. So, that's the benefit and Power of Compounding.

Constitution of Investing

Diversified equity mutual funds are ideal for ________ term goals.

Answer: long

And with this, we are halfway through the journey towards financial literacy.

Constitution of Investing

Constitution of Investing

In an era where talks of gender equality and women empowerment are commonly discussed, it is noteworthy that not many women take interest in managing their finances, especially investments.

You will be surprised to learn that financial advisors believe women to be better investors because they are:

So, dear women, here are some pointers to invest well.

It is noticed that people invest randomly when they have a corpus at hand or they simply invest to beat market returns and make more money than traditional instruments. Instead, invest with a goal in mind. Start with locking a time horizon. Every set goal should have a time horizon and the value attached so that investments can be planned accordingly.

For instance, if you are closer to your goal (like retirement), the money can be moved to little safer investments (Debt funds) to keep your investments safe from market volatility at the time of realising your goals. Also, know that regular inflation is around 5 % while the education inflation is growing at a much higher rate. So, investments for children's education has to be planned as comprehensively and early as possible.

Constitution of Investing

With every investment aligned to your goals, you ideally should not redeem any till goals are achieved. But what about unexpected emergencies? Have a contingency fund just for that reason.

Do not let your money sit idle in one of those traditional investments. Instead, park it in liquid funds to aim for better returns which has potential to beat inflation.

Women must take tax saving seriously. Tax planning can be done intelligently and systematically through Systematic Investment Plans (SIP) of small amounts in Equity-linked saving funds throughout the year; starting at the beginning of the financial year. This helps women avoid the pressure of arranging lumpsum amount for tax saving in March, ensure tax saving and even build a retirement corpus with SIP in the long run.

We urge women to kindly get involved in every financial discussion that happens in the family as it gets very difficult to understand investments done by husband or elders in case of an untoward incident.

Constitution of Investing

Constitution of Investing

Guess what! Retirement has as many non-working years in our life as compared to working years. So, better start planning for retirement by building a corpus through Systematic Investment Plan in various equity schemes as she has a long way to go. Make sure you divide the investments basis your goals and timeframe required to achieve them.

This is the golden rule of investments. Insurance and investments are equally necessary in life. Insurance helps the family in case of any eventualities or death of the policy holder and investments focus on growing your wealth while you are alive to meet your long term goals.

In conclusion, remember to start early, get a grip on your goals, plan for retirement, stay invested and don't break your investments before achieving your goals, top-up your SIPs, have separate money assigned to your short-term goals and enjoyment as well.

Make sure you divide the investments basis your ____ and ________ required to achieve them.

Answer: Goals, Timeframe

Constitution of Investing

Constitution of Investing

Time to learn from the common mistakes many mutual fund investors have made.

Long term investments are often done keeping a big goal in mind, right? However, investors often surrender their investments way before the goals and dreams turn into reality. Say no to impulse purchases and other such untimely expenses that unsettle your investments partially or fully. And if you are investing without a goal, it is almost like travelling without a destination.

You are not alone if you do not like to see your principal amount drop. Do not panic and exit the minute markets turn volatile causing loss of capital. If you have the capacity to withstand capital erosion, it could eventually help investors make money in the long term.

Constitution of Investing

Parking your money in traditional investments is not an investment, investing in mutual funds aimed for wealth creation is. Remember to beat inflation and get some tax saving with mutual fund investments.

If you think having sufficient amount of insurance policies help meet all of your investment goals, you are making a big mistake. Insurance is meant for health protection and not for wealth creation.

Do you time your investments to maximise returns? Do you choose to sell your investments when the markets appear overpriced? Unfortunately, this does not work for all investors. Some wait for the markets to correct while others repent their decision to sell at a previous high. Instead, keep investing at regular intervals and let your money grow over a long period of time.

This is not diversification of portfolio. Since each Mutual Fund scheme has a diversified portfolio of securities, the more you buy, more difficult it becomes to track them all. Rather, simply build a portfolio of 5 to 7 wellmanaged schemes and keep adding to your investments.

Constitution of Investing

Don't ever get carried away by the fear of missing out. For instance, ignoring risk profile and asset allocation to invest in risky instruments (equity funds) when the market is at its peak. In case of a conservative or a moderate risktaker, he could consider debt funds which invests in fixed income instruments that offer stable returns.

Almost every other investor makes this mistake of not tracking performances at regular intervals. It is advisable to conduct a periodical review of all your mutual fund schemes.

Answer: Capital

Constitution of Investing

Constitution of Investing

Do you have a bank account?

Do you have PAN?

If you answered with 2 yeses, just follow the steps below to start your mutual funds journey.

Constitution of Investing

All you need is a ______ account and ____ to invest in mutual funds.

Answer: Bank, PAN

And just like that, we have accomplished Module 3. This means you are 1 module away from being financially literate.

Constitution of Investing

Constitution of Investing

Here's your quick guide to learning commonly used terms in the Mutual Fund world.

All Mutual fund schemes (actively managed) offer a Direct Plan and Regular plan. The difference is that Direct Plan does not route the investment through distributors like the Regular Plan. As a result, Regular Plans expense ratio is higher in comparison since more people are involved. Also, Direct Plans have a separate NAV which is often marginally higher than the normal Regular Plans NAV.

Constitution of Investing

Systematic Transfer Plan is a useful feature for investors that allows transfer of a fixed amount from one scheme to the other at regular intervals. For instance, if you invest 'systematically' in equities, you aim to earn better returns even during volatile market scenarios. Now, imagine investing a lumpsum amount in one scheme (e.g. Liquid scheme) and transferring a fixed amount to another scheme regularly (e.g. Equity scheme). STP is a great choice for investors who seek to invest lumpsum but don't want to invest it together in equity.

SWP feature allows you to withdraw a fixed or variable amount from your mutual fund scheme periodically, every month on a fixed date. If you need a fixzed income every month, just go for SWP. The major SWP benefit is that the withdrawals are tax efficient as only the capital gains are taxed, and subject to withholding tax, (applicable for non-resident investor) and not the entire amount withdrawn.

Constitution of Investing

Mutual Funds are required to label their schemes as follows:

Constitution of Investing

A fund fact sheet helps you to assess the scheme and keep a track of its performance. The fund fact sheet is easy to understand and provides a snapshot of various schemes.

The fund fact sheet showcases the NAV, returns, fund manager managing the portfolio, Riskometer that gives an indication whether the scheme carries a low, low to moderate, moderate, moderately high, high or very high risk and other statistics that help you compare mutual funds and decide which ones to invest in.

You will often come across the term 'NAV (Net Asset Value)' which is the market value of all the scheme investments, less the liabilities and expenses divided by the outstanding number of units. NAV of a mutual fund scheme is like a share price of a particular stock.

Constitution of Investing

Mutual Funds are tax-efficient as compared to other forms of investments. Amount invested in Equity Linked Savings Schemes (ELSS) schemes is eligible for tax deduction u/s 80C of Income Tax Act 1861, up to `1.5 lakh Individuals/HUF get an aggregate deduction of `1.5 lakh from the gross total income for investments in an ELSS scheme during the relevant financial year.

However, w.e.f 1 April 2023, The Finance Bill 2023 has removed indexation benefit on long term capital gain for the investment made in specified mutual fund schemes. In such case, any capital gains would be considered as short term in nature and taxed as per applicable tax rate slab of the investor irrespective of the holding period. This provision is applicable only for any fresh investments made on or after 1 April 2023. “Specified Mutual Fund” means a Mutual Fund scheme which does not invest more than 35% in equity shares of domestic companies.

Constitution of Investing

Disclaimers

The information being provided in this material is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore, cannot be considered as guidelines, recommendations or a professional guide for the readers. Many of the statements and assertions contained in this booklet merely reflect the views, opinions and beliefs of Nippon Life India Asset Management Limited (NAM India) and therefore, Nippon Life India Asset Management Limited (NAM India) does not in any manner guarantee the completeness, efficacy, accuracy or authenticity of such information. This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision. Neither, the sponsors, investment manager, Mutual Fund, Trustee, their respective directors, nor any person connected with them, accepts any liability arising from the use of this information.

All Mutual Fund investors have to go through a one-time KYC (know your Customer) process. Investors should deal only with registered mutual funds, to be verified on SEBI website under 'Intermediaries/ Market Infrastructure Institutions'. For redressal of your complaints, you may please visit www.scores.gov.in. For more info on KYC, change in various details & redressal of complaints, visit mf.nipponindiaim.com/investoreducation/what-to-know-when-investing