Hybrid Mutual Funds – Types, Advantages and Investment

Consider how your local multi-purpose shop keeps everything from grocery to vegetables to even stationery at times. What the shopkeeper is trying to do here is to avoid concentration on any one product, so that the risks are distributed, and his

earnings are safe. Following a somewhat similar logic are hybrid mutual funds schemes. These are funds that invest in different asset classes like equity, debt, etc. Because, why not? You, as an investor, may want the wealth creation opportunity

that an asset class like equity can offer and at the same time, you may want the lower-risk that the debt asset class offers. Hybrid mutual funds schemes distribute the corpus across asset classes to avoid concentration risk.

Hybrid mutual funds schemes are based on the concepts of diversification and asset allocation. Asset allocation is the process of allocating your

money to different asset classes according to your financial goals, risk appetite and investment horizons. Diversification is about creating diversity within the asset classes. While the former may help you with a risk-return balance for the

overall portfolio, the latter helps you balance the risks within an asset class. Hybrid mutual fund schemes aim at combining these concepts and giving an investor the goodness of both equity and debt worlds.

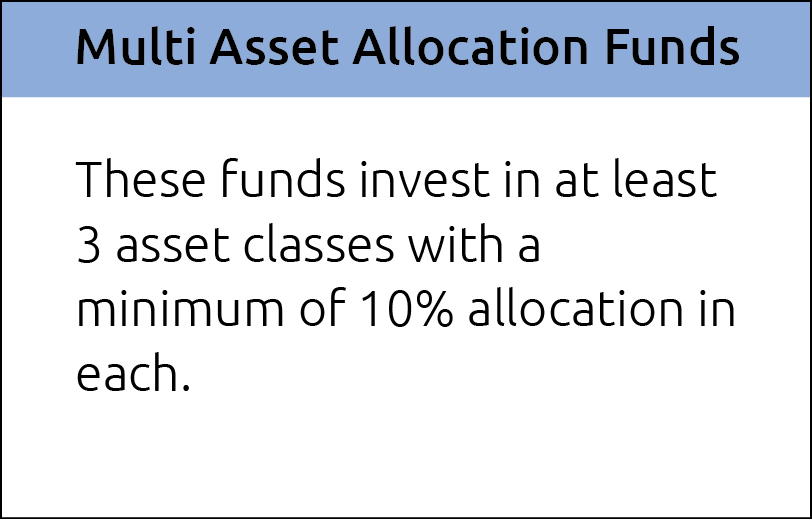

Predominantly, hybrid mutual fund schemes have a mix of equity and debt securities. But some of the hybrid mutual funds may invest in other asset classes like gold, etc. as well.

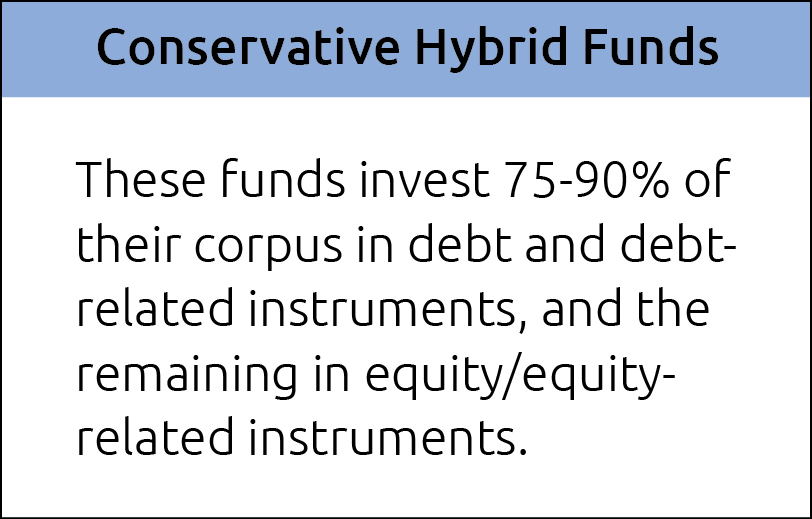

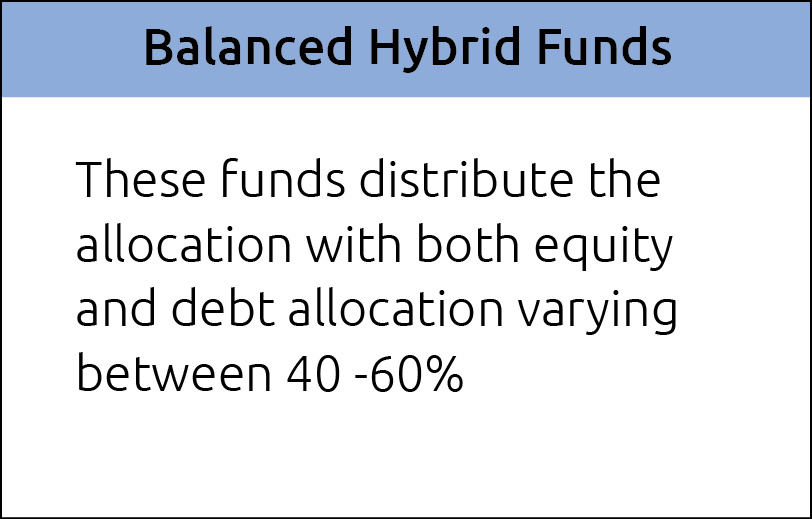

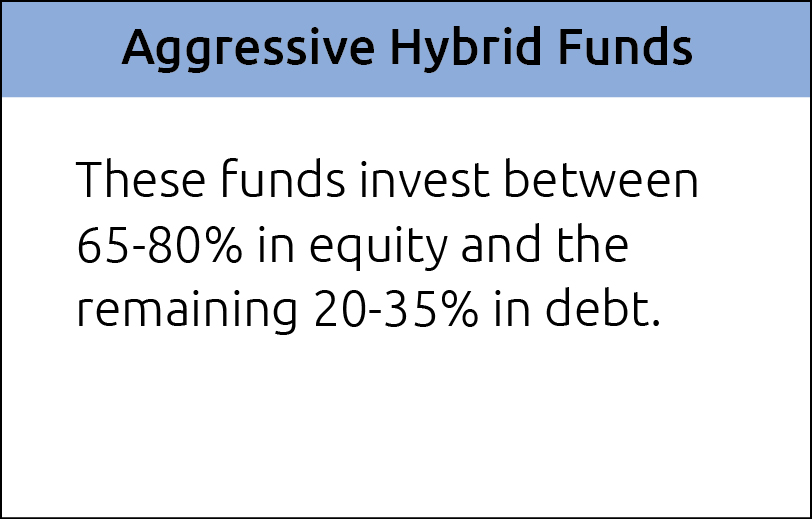

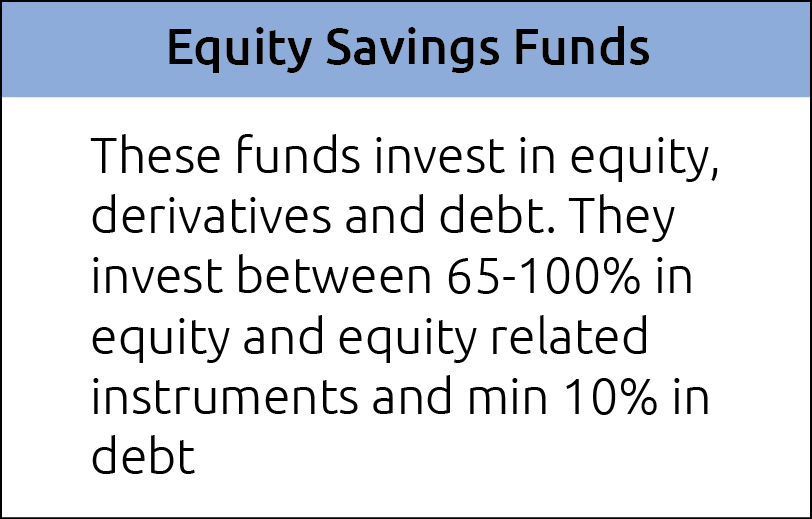

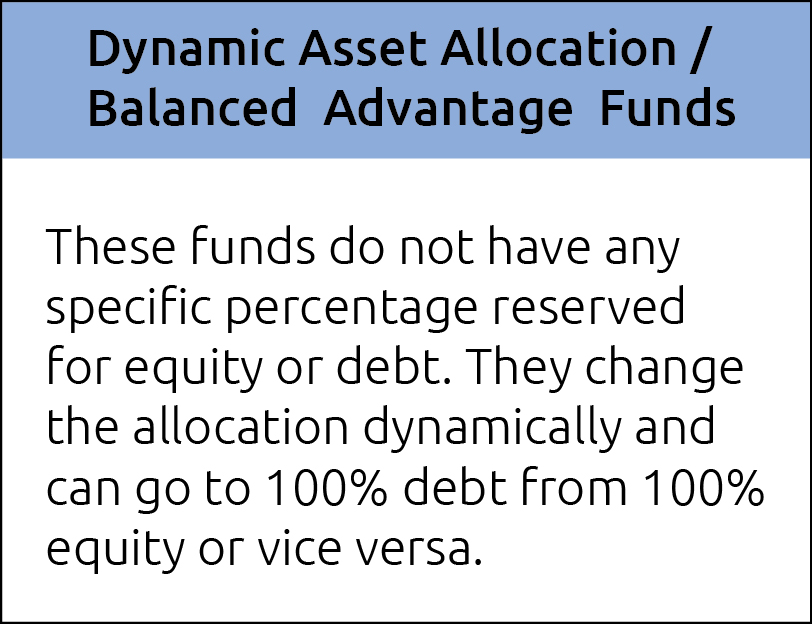

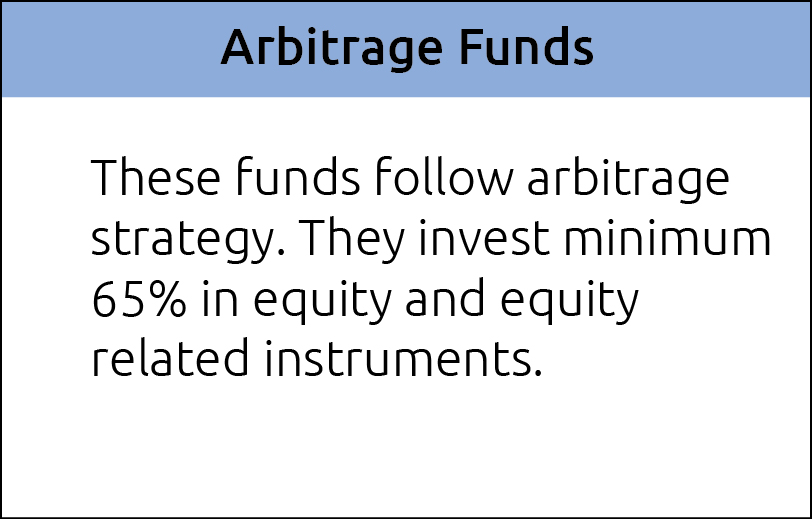

Types of Hybrid Mutual Fund schemes

Note: The above mentioned Hybrid Schemes have been considered according to SEBI Circular on ‘Categorization and Rationalization of Mutual Fund Schemes’ dated 6 Oct 2017

Advantages of Hybrid mutual funds

- You get access to multiple asset classes in a single mutual fund scheme

- Depending on your risk appetite and preference for the asset classes, you can choose the kind of hybrid mutual fund scheme that fits your requirements

- They give you an opportunity to diversify your risks between equity and debt asset classes

- They provide you with not just asset allocation, but diversification also

Who should invest in Hybrid mutual fund schemes?

Hybrid mutual fund schemes may be a good entry point in the mutual fund world for first-time investors. The debt component may provide relative stability and at the same time equity exposure

may give you wealth creation opportunity. Investors looking for diversification in their portfolio or retired individuals looking for exposure in various asset classes can also consider investing in hybrid mutual fund schemes.

Taxation for hybrid mutual funds

A hybrid fund with 65% or more allocation to domestic equity share is considered as an equity mutual fund for taxation purposes (other than fund

of fund), and all the rest are considered as other than equity funds.

For equity oriented mutual fund scheme, taxation is as below-

Short-term capital gains (STCG) tax- If units held by an investor for a period less than 12 months from the date of acquisition then such gain is taxable at the rate of 15%.

Long-term capital gains (LTCG) tax- If units held by an investor for a period more than 12 months from the date of acquisition then such gain is taxable @ 10%. There is an additional benefit of grandfathering of cost and a threshold limit of Rs.

1 Lac is available.

Further, Equity oriented mutual funds are subject to STT (securities transaction tax).

For other than equity mutual funds scheme taxation is as below-

Short-term capital gains (STCG) tax- If units held by an investor for a period less than 36 months from the date of acquisition then such gain is taxable as per the tax slab rates applicable to the investor.

Long-term capital gains (LTCG) tax- If units held by an investor for a period more than 36 months from the date of acquisition then such gain is taxable @ 20% (with indexation) for resident investors. The indexation benefit helps you to account for the inflation of the purchase price, thereby calculating the gains with the indexed investment value rather than the original investment value. The cost of inflation index (CII)

is the factor used to determine this value which is declared every year.