Nippon India Tax Saver (ELSS) Fund

| Details as on July 31, 2021 |

|

An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit.

Seeks to maintain balance between large cap companies and mid

cap companies. Endeavors to invest in potential leaders. Invest in

companies with potential of high growth prospects over medium term

(2-3 years). Generally, the fund has two or three sector calls at a time.

They are mostly in-line of emerging market trends. Small percentage

of portfolio is invested in contrarian calls.

Significant percent of outstanding equity of the scheme is invested in

high conviction mid-cap companies. Significant allocation/exposure is

taken in Multinational Companies (MNC’s). Attempt to have a

balanced portfolio on a macro basis, allocating to themes like

Domestic, Consumption & Defensive.

September 21, 2005

Sanjay Parekh till June 30, 2021

Rupesh Patel w.e.f Jul 01, 2021

Ashutosh Bhargava (Co-fund manager)

S&P BSE 100 TRI till Jul 08, 2021

S&P BSE 200 TRI w.e.f. Jul 09, 2021

| Monthly Average : | ₹ 11,727.05 Cr |

| Month End : | ₹ 11,822.53 Cr |

| Growth Plan | ₹70.1434 |

| IDCW Plan | ₹23.2731 |

| Annual IDCW Plan | ₹13.7062 |

| Direct - Growth Plan | ₹74.8943 |

| Direct - IDCW Plan | ₹29.3409 |

| Direct - Annual IDCW Plan | ₹14.3369 |

| Entry Load: | Nil |

| Exit Load: | Nil

|

| Standard Deviation | 7.51 |

| Beta | 1.09 |

| Sharpe Ratio | 0.08 |

| Note: The above measures have been calculated using monthly rolling returns for 36 months period with 3.40% risk free return (FBIL Overnight MIBOR as on 30/07/2021). | |

| Portfolio Turnover | 0.53 |

| Regular/Other than Direct | 1.82 |

| Direct | 1.19 |

| Company/Issuer | % of Assets |

| Auto | |

| Maruti Suzuki India Limited | 1.18 |

| Ashok Leyland Limited | 1.12 |

| Auto Ancillaries | |

| Wheels India Limited | 1.30 |

| Banks | |

| HDFC Bank Limited* | 8.52 |

| ICICI Bank Limited* | 6.81 |

| Axis Bank Limited* | 3.78 |

| State Bank of India* | 3.65 |

| Kotak Mahindra Bank Limited | 1.05 |

| Cement & Cement Products | |

| Dalmia Bharat Limited | 1.70 |

| Grasim Industries Limited | 1.31 |

| UltraTech Cement Limited | 1.03 |

| Chemicals | |

| Linde India Limited | 2.96 |

| Construction Project | |

| Larsen & Toubro Limited* | 4.12 |

| Consumer Non Durables | |

| Hindustan Unilever Limited | 2.43 |

| ITC Limited | 1.91 |

| Ferrous Metals | |

| Tata Steel Limited | 2.79 |

| Jindal Steel & Power Limited | 1.83 |

| Finance | |

| Housing Development Finance Corporation Limited* | 3.35 |

| Cholamandalam Financial Holdings Limited | 1.08 |

| Industrial Products | |

| KSB Limited | 1.20 |

| Insurance | |

| SBI Life Insurance Company Limited | 1.39 |

| Bajaj Finserv Limited | 1.08 |

| Petroleum Products | |

| Reliance Industries Limited* | 5.51 |

| Pharmaceuticals | |

| Sun Pharmaceutical Industries Limited* | 3.51 |

| Power | |

| NTPC Limited | 1.80 |

| Software | |

| Infosys Limited* | 8.72 |

| HCL Technologies Limited | 2.43 |

| Telecom - Services | |

| Bharti Airtel Limited* | 3.42 |

| Transportation | |

| Adani Ports and Special Economic Zone Limited | 1.31 |

| Equity Less Than 1% of Corpus | 16.06 |

| Cash and Other Receivables | 1.65 |

| Grand Total | 100.00 |

*Top 10 Holdings

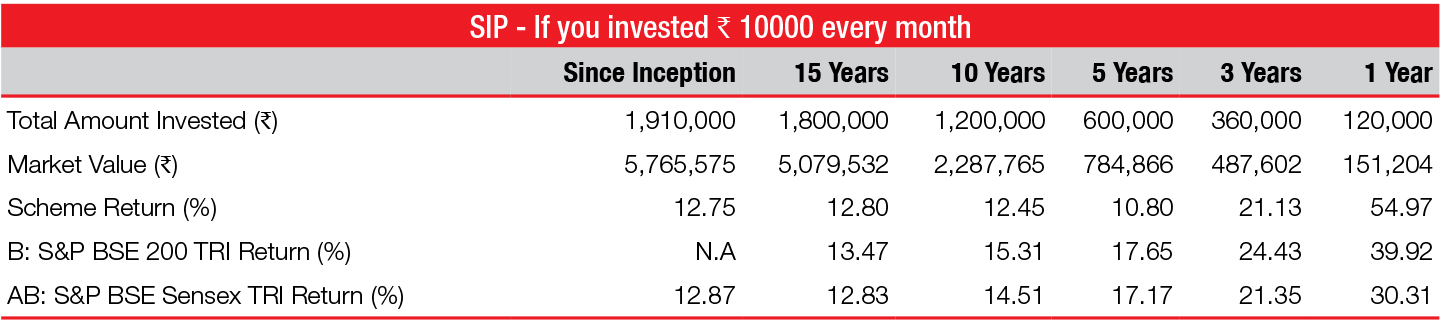

N.A: Since TRI data is not available prior to 01-08-2006 for S&P BSE 100 , performance for such period is not provided

Past performance may or may not be sustained in future. It is assumed that a SIP of ₹10,000 each executed on 10th of every month including the first installment in the Growth option of the Fund. Returns on SIP and Benchmark are annualized and cumulative investment return for cash flows resulting out of uniform and regular monthly subscriptions have been worked out on excel spreadsheet function known as XIRR. Load has not been taken into consideration.

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

For scheme performance please click here. For Fund manager wise scheme performance click here.

| Record Date | Rate (₹/ Unit) | Cum Dividend NAV | Ex-Dividend NAV |

| IDCW Plan | |||

| 10-Jan-20 | 0.18 | 19.0858 | 18.8858 |

| 13-Nov-19 | 0.18 | 18.1582 | 17.9582 |

| 26-Sep-18 | 0.35 | 18.9787 | 18.5786 |

| Direct - IDCW Plan | |||

| 10-Jan-20 | 0.18 | 23.7499 | 23.5499 |

| 13-Nov-19 | 0.18 | 22.5239 | 22.3239 |

| 26-Sep-18 | 0.35 | 23.2553 | 22.8553 |

| Annual IDCW Plan | |||

| 29-Mar-19 | 0.80 | 11.9184 | 11.0184 |

| Direct - Annual IDCW Plan | |||

| 29-Mar-19 | 0.80 | 12.2430 | 11.3430 |

Past performance may or may not be sustained in future. Pursuant to dividend payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Special Features: Nippon India Any Time Money Card & SIP Insure

Please click here for explanation on symbol: ^ and @ wherever available