Nippon India Pharma Fund

| Details as on July 31, 2022 |

|

An open ended equity scheme investing in pharma sector

The Fund seeks to invest in pharma sector with focus on important segments of the sector viz Domestic Business, International & CRAMS and include deep value as well as high growth pharma businesses. The fund invests across market capitalization within the sector. It may suit investment horizon of around 2-3 years.

June 5, 2004

Sailesh Raj Bhan

S&P BSE Healthcare TRI

| Monthly Average : | ₹ 4,538.40 Cr |

| Month End : | ₹ 4,619.53 Cr |

| Growth Plan | ₹274.8469 |

| IDCW Plan | ₹76.3199 |

| Bonus Option | ₹274.8469 |

| Direct - Growth Plan | ₹298.1012 |

| Direct - IDCW Plan | ₹101.7979 |

| Direct - Bonus Option | ₹298.1012 |

| Entry Load: | Nil |

| Exit Load: | 1% if redeemed or switched out on or before

completion of 1 month from the date of allotment of units. Nil,thereafter. |

| Standard Deviation | 6.06 |

| Beta | 0.89 |

| Sharpe Ratio | 0.27 |

| Note: The above measures have been calculated using monthly rolling returns for 36 months period with 5.25% risk free return (FBIL Overnight MIBOR as on 29/07/2022). | |

| Portfolio Turnover | 0.28 |

| Regular/Other than Direct | 1.98 |

| Direct | 1.06 |

| Company/Issuer | % of Assets |

| Healthcare Services | |

| Narayana Hrudayalaya Limited* | 5.75 |

| Fortis Healthcare Limited* | 3.92 |

| Apollo Hospitals Enterprise Limited | 2.74 |

| Thyrocare Technologies Limited | 2.44 |

| Vijaya Diagnostic Centre Limited | 1.42 |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Limited* | 14.91 |

| Cipla Limited* | 8.46 |

| Dr. Reddy's Laboratories Limited* | 7.53 |

| Divi's Laboratories Limited* | 7.47 |

| Torrent Pharmaceuticals Limited* | 6.48 |

| Lupin Limited* | 6.00 |

| Abbott India Limited* | 5.60 |

| Aurobindo Pharma Limited* | 4.14 |

| JB Chemicals & Pharmaceuticals Limited | 3.24 |

| Sanofi India Limited | 3.05 |

| Gland Pharma Limited | 2.94 |

| Pfizer Limited | 2.43 |

| Alkem Laboratories Limited | 1.97 |

| Zydus Lifesciences Limited | 1.85 |

| Ajanta Pharma Limited | 1.63 |

| Indoco Remedies Limited | 1.53 |

| IPCA Laboratories Limited | 1.08 |

| Equity Less Than 1% of Corpus | 2.76 |

| Cash and Other Receivables | 0.65 |

| Grand Total | 100.00 |

*Top 10 Holdings

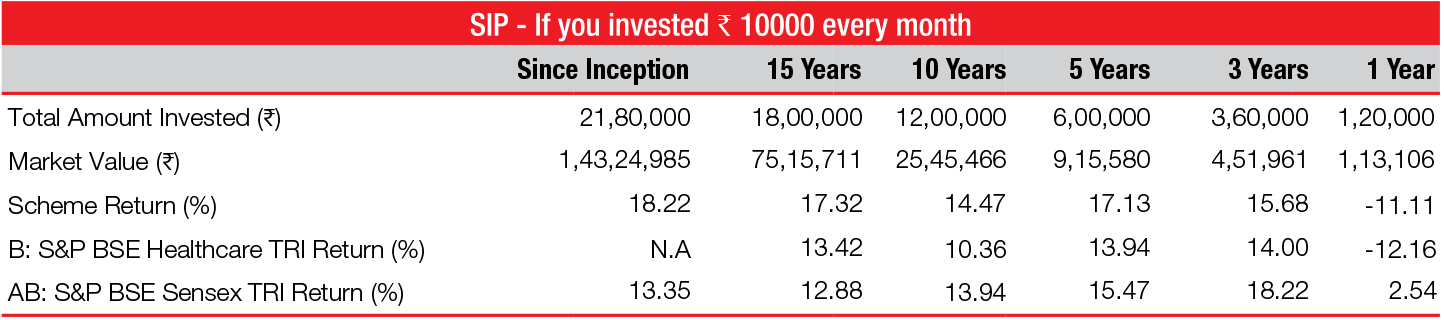

N.A :Since TRI data is not available prior to 23/08/2004 for S&P BSE Healthcare , performance for such period is not provided

Past performance may or may not be sustained in future. It is assumed that a SIP of ₹ 10,000 each executed on 10th of every month including the first installment in the Growth option of the Fund. Returns on SIP and Benchmark are annualized and cumulative investment return for cash flows resulting out of uniform and regular monthly subscriptions have been worked out on excel spreadsheet function known as XIRR. Load has not been taken into consideration.

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

For scheme performance please click here. For Fund manager wise scheme performance click here.

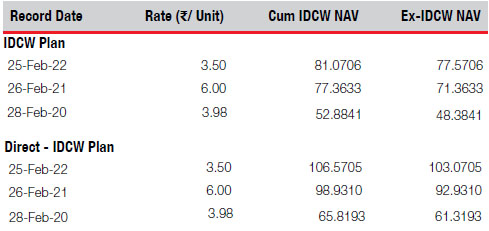

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment predominantly in equity and equity related Securities of pharma &

other associated companies.

Fund Riskometer

Nippon India Pharma Fund

Benchmark Riskometer

S&P BSE Healthcare TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available