Nippon India Low Duration Fund

| Details as on November 30, 2021 |

|

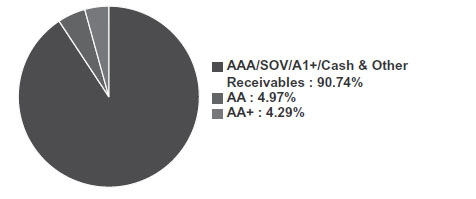

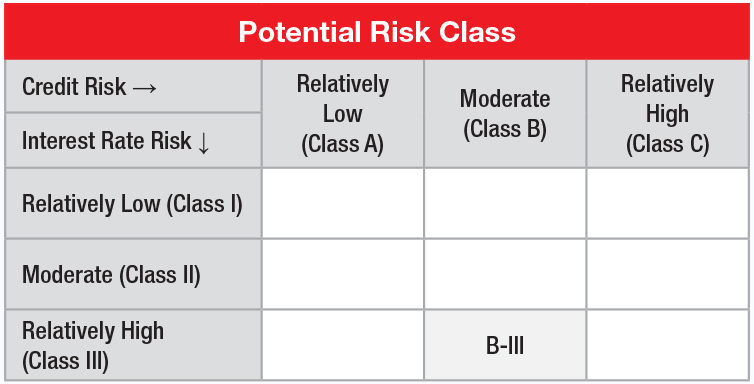

An open ended low duration debt scheme investing in debt and money market instruments such that the Macaulay duration of the portfolio is between 6 - 12 months. Relatively High interest rate risk and moderate Credit Risk.

The fund endeavors to invest more than 80% in higher rated (AAA/A1+/equivalent) assets. A major part of the portfolio gets allocated in 0 - 9 months and 15 – 30% allocation is made in assets of 9 - 18 months maturity bucket, which aims to give the portfolio carry advantage and roll down benefit. The portfolio duration would be maintained between 180 - 365 days.

March 20, 2007

Anju Chhajer

Vivek Sharma

NIFTY Low Duration Debt Index

| Monthly Average : | ₹ 9,403.43 Cr |

| Month End : | ₹ 9,433.49 Cr |

| Growth Plan | ₹3,007.7392 |

| IDCW Plan | ₹1,649.7847 |

| Daily IDCW Plan | ₹1,008.9709 |

| Weekly IDCW Plan | ₹1,008.8390 |

| Monthly IDCW Plan | ₹1,020.9179 |

| Quarterly IDCW Plan | ₹1,017.4115 |

| Bonus Option | ₹1,746.3138 |

| Direct - Growth Plan | ₹3,121.3912 |

| Direct - IDCW Plan | ₹1,701.4307 |

| Direct - Daily IDCW Plan | ₹1,009.0611 |

| Direct - Weekly IDCW Plan | ₹1,008.9644 |

| Direct - Monthly IDCW Plan | ₹1,027.6976 |

| Direct - Quarterly IDCW Plan | ₹1,018.9836 |

| Direct - Bonus Option | ₹1,813.2050 |

| Retail - Growth Plan | ₹2,869.7293 |

| Retail - Daily IDCW Plan | ₹1,008.9716 |

| Retail - Weekly IDCW Plan | ₹1,009.0176 |

| Retail - Monthly IDCW Plan | ₹1,022.9709 |

| Retail - Quarterly IDCW Plan | ₹1,017.3471 |

| Retail - Bonus Option | ₹2,138.4905 |

| Entry Load: | Nil |

| Exit Load: | Nil

|

|

| |

| Average Maturity | 295 Days |

| Modified Duration | 262 Days |

| Yield to Maturity | 4.63% |

| Macaulay Duration | 273 Days |

| Regular/Other than Direct | 1.02% |

| Direct | 0.33% |

| Company/Issuer | Rating | % of Assets |

| Certificate of Deposit | 10.21 | |

| Axis Bank Limited | ICRA A1+ /CRISIL A1+ | 7.21 |

| HDFC Bank Limited | CARE A1+ | 2.49 |

| ICICI Bank Limited | ICRA A1+ | 0.51 |

| Commercial Paper | 7.37 | |

| ICICI Securities Limited | CRISIL A1+ | 2.40 |

| Sikka Ports and Terminals Limited (Mukesh Ambani Group) | CRISIL A1+ | 1.55 |

| Export Import Bank of India | CRISIL A1+ | 1.06 |

| Kotak Securities Limited | ICRA A1+ | 1.05 |

| Reliance Industries Limited | CARE A1+ | 0.53 |

| Jamnagar Utilities & Power Private Limited (Mukesh Ambani Group) | CRISIL A1+ | 0.52 |

| Axis Finance Limited | CRISIL A1+ | 0.26 |

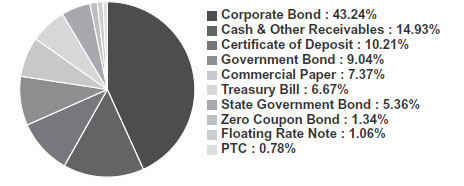

| Corporate Bond | 43.24 | |

| National Bank For Agriculture and Rural Development | CRISIL AAA/ICRA AAA | 6.86 |

| IndInfravit Trust | CRISIL AAA | 5.24 |

| Bajaj Housing Finance Limited | CRISIL AAA | 3.77 |

| Housing Development Finance Corporation Limited | CRISIL AAA | 2.45 |

| Kotak Mahindra Prime Limited | CRISIL AAA | 2.12 |

| Muthoot Finance Limited | CRISIL AA+ | 2.11 |

| Piramal Capital & Housing Finance Limited | ICRA AA/CARE AA | 1.91 |

| L&T Finance Limited | CRISIL AAA/ICRA AAA | 1.72 |

| REC Limited | CRISIL AAA | 1.62 |

| Power Finance Corporation Limited | CRISIL AAA | 1.55 |

| U.P. Power Corporation Limited | FITCH AA(CE) | 1.54 |

| Embassy Office Parks REIT (Blackstone group(Exposure to the NCDs issued by REIT)) | CRISIL AAA | 1.50 |

| State Bank of India Basel III | CRISIL AAA | 1.40 |

| India Grid Trust InvIT Fund | CRISIL AAA | 1.36 |

| Nabha Power Limited (Guaranttee by L&T) | ICRA AAA(CE) | 1.33 |

| Shriram Transport Finance Company Limited | CRISIL AA+ | 1.12 |

| NIIF Infrastructure Finance Limited | ICRA AAA | 1.06 |

| ONGC Petro Additions Limited | ICRA AA/ICRA AAA(CE) | 0.99 |

| Manappuram Finance Limited | CRISIL AA/CARE AA | 0.97 |

| Bajaj Finance Limited | CRISIL AAA | 0.54 |

| Tata Capital Limited | CRISIL AAA | 0.54 |

| Sundaram Finance Limited | CRISIL AAA | 0.53 |

| India Infradebt Limited | CRISIL AAA | 0.48 |

| HDB Financial Services Limited | CRISIL AAA | 0.27 |

| LIC Housing Finance Limited | CARE AAA | 0.27 |

| Floating Rate Note | 1.06 | |

| Shriram Transport Finance Company Limited | FITCH AA+ | 1.06 |

| Government Bond | 9.04 | |

| Government of India | SOV | 9.04 |

| State Government Bond | 5.36 | |

| State Government Securities | SOV | 5.36 |

| Treasury Bill | 6.67 | |

| Government of India | SOV | 6.67 |

| Zero Coupon Bond | 1.34 | |

| Tata Capital Financial Services Limited | ICRA AAA | 1.34 |

| PTC | 0.78 | |

| Mobil Trust Series- 19 | CRISIL AAA(SO) | 0.55 |

| Mobil Trust Series- 14 | FITCH AAA(SO) | 0.22 |

| Cash & Other Receivables | 14.93 | |

| Grand Total | 100.00 |

| Record Date | Rate (₹/ Unit) | Cum IDCW NAV | Ex-IDCW NAV |

| IDCW Plan | |||

| 19-Sep-14 | 57.8673 | 1078.3435 | 1004.0853 |

| Direct - IDCW Plan | |||

| 19-Sep-14 | 61.1289 | 1082.6239 | 1004.1802 |

| Monthly IDCW Plan | |||

| 22-Nov-21 | 2.7950 | 1023.1682 | 1020.3732 |

| 20-Oct-21 | 2.4684 | 1022.7265 | 1020.2581 |

| 20-Sep-21 | 2.6901 | 1022.8558 | 1020.1657 |

| Retail - Monthly IDCW Plan | |||

| 22-Nov-21 | 2.7259 | 1025.1701 | 1022.4442 |

| 20-Oct-21 | 2.4049 | 1024.7360 | 1022.3311 |

| 20-Sep-21 | 2.6274 | 1024.8682 | 1022.2408 |

| Direct - Monthly IDCW Plan | |||

| 22-Nov-21 | 3.4364 | 1030.4494 | 1027.0130 |

| 20-Oct-21 | 3.0485 | 1029.9261 | 1026.8776 |

| 20-Sep-21 | 3.2521 | 1030.0172 | 1026.7651 |

| Quarterly IDCW Plan | |||

| 20-Sep-21 | 12.0983 | 1023.5331 | 1011.4348 |

| 21-Jun-21 | 16.3413 | 1028.6329 | 1012.2916 |

| 19-Mar-21 | 6.8237 | 1020.7219 | 1013.8982 |

| Retail - Quarterly IDCW Plan | |||

| 20-Sep-21 | 11.8956 | 1023.4250 | 1011.5294 |

| 21-Jun-21 | 16.1354 | 1028.5219 | 1012.3865 |

| 19-Mar-21 | 6.6225 | 1020.6159 | 1013.9934 |

| Direct - Quarterly IDCW Plan | |||

| 20-Sep-21 | 13.8619 | 1025.5240 | 1011.6621 |

| 21-Jun-21 | 18.1344 | 1030.6515 | 1012.5171 |

| 19-Mar-21 | 8.5970 | 1022.7198 | 1014.1228 |

| Bonus Option | |||

| 26-02-2014 | 17:2 | ||

| 29-10-2012 | 3:1 | ||

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-

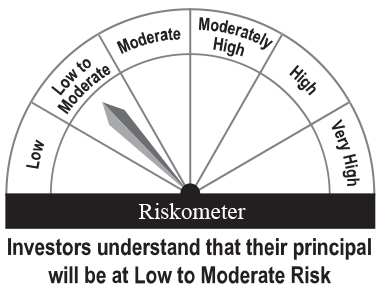

This product is suitable for investors who are seeking*:

• Income over short term

• Investment in debt and money market instruments such that the Macaulay

duration of the portfolio is between 6 - 12 months

Fund Riskometer

Nippon India Low Duration Fund

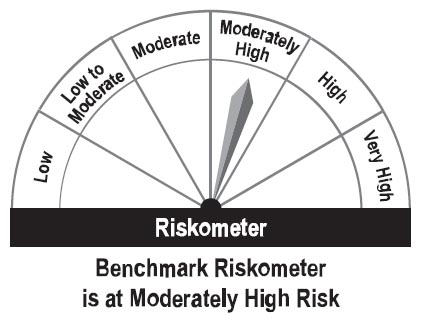

Benchmark Riskometer

Nifty Low Duration Debt Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Special Feature: Nippon India Any Time Money Card

Please click here for explanation on symbol: ^ and @ wherever available

For scheme performance please click here. For Fund manager wise scheme performance click here.