Nippon India US Equity Opportunities Fund

| Details as on November 30, 2021 |

|

An open ended equity scheme following US focused theme.

The fund endeavours to invest in a portfolio of high quality stocks

listed on recognized stock exchanges of US. The investment strategy

of the fund would be powered by the research support of Morningstar

Investment Adviser India Private Limited (MIA), a group company of

Morningstar, Inc. Morningstar employs their proprietary research

methodology, focused on Economic Moats, to identify investment

opportunity. The fund proposes to follow the Hare Strategy for its

investments. The Hare portfolio invests in stocks of firms that are

experiencing rapid growth, emphasizing those that possess

sustainable competitive advantages.

Companies in this strategy tend to faster-growing with both higher

risk and higher return potential. The investment philosophy would be

a blend of top down and bottom up approach without any sector or

market capitalization bias.

July 23, 2015

Kinjal Desai,

Anju Chhajer

S&P 500 TRI

| Monthly Average : | ₹ 566.61 Cr |

| Month End : | ₹561.71 Cr |

| Growth Plan | ₹ 25.3286 |

| IDCW Plan | ₹ 25.3286 |

| Direct - Growth Plan | ₹ 27.1168 |

| Direct - IDCW Plan | ₹ 27.1168 |

| Entry Load: | Nil |

| Exit Load: | 1% if redeemed or switched out on or before completion of

1 month from the date of allotment of units. Nil, thereafter w.e.f Sep 20, 2021 |

| Standard Deviation | 5.22 |

| Beta | 0.96 |

| Sharpe Ratio | 0.28 |

| Note:The above measures have been calculated using monthly rolling returns for 36 months period with 3.41% risk free return (FBIL Overnight MIBOR as on 30/11/2021). | |

| Portfolio Turnover | 0.15 |

| Regular/Other than Direct | 2.16 |

| Direct | 1.42 |

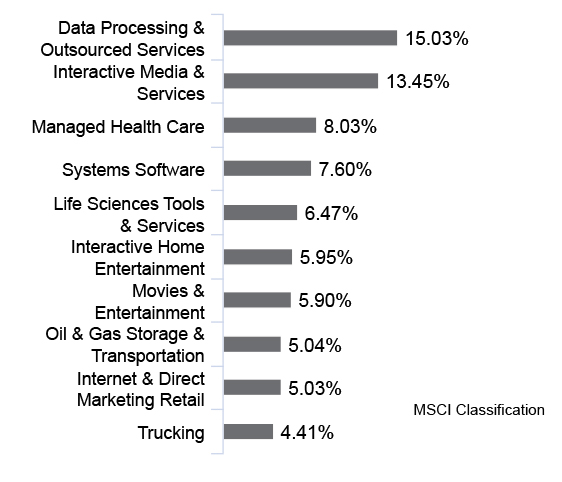

| Company/Issuer | % of Assets |

| Automotive Retail | |

| Carmax Inc* | 4.22 |

| Biotechnology | |

| Alnylam Pharmaceuticals Inc | 2.41 |

| Ionis Pharmaceuticals Inc | 1.27 |

| Data Processing & Outsourced Services | |

| Mastercard Incorporated* | 5.38 |

| Fidelity National Information Services I | 3.55 |

| Visa Inc | 3.50 |

| FISERV INC COM | 2.60 |

| Health Care Distributors | |

| Amerisource Bergen Corp | 3.83 |

| Health Care Services | |

| CVS Health Corp | 2.77 |

| Home Improvement Retail | |

| Lowes Cos Inc | 1.42 |

| Hotels, Resorts & Cruise Lines | |

| Booking Holdings Inc* | 4.06 |

| Interactive Home Entertainment | |

| Roblox Corporation* | 5.95 |

| Interactive Media & Services | |

| Alphabet Inc A* | 8.13 |

| Facebook Inc* | 5.28 |

| Baidu Inc Spon ADR | 0.04 |

| Internet & Direct Marketing Retail | |

| Amazon Com Inc* | 5.03 |

| Life Sciences Tools & Services | |

| Iqvia Holdings* | 6.47 |

| Managed Health Care | |

| Unitedhealth Group Inc | 4.03 |

| Anthem Inc | 4.00 |

| Movies & Entertainment | |

| Netflix Inc | 4.01 |

| The Walt Disney Company | 1.89 |

| Oil & Gas Storage & Transportation | |

| Enbridge Inc* | 5.04 |

| Systems Software | |

| Microsoft Corp* | 7.60 |

| Trucking | |

| Uber Technologies Inc | 2.32 |

| Lyft Inc | 2.09 |

| Cash and Other Receivables | 3.10 |

| Grand Total | 100.00 |

*Top 10 Holdings

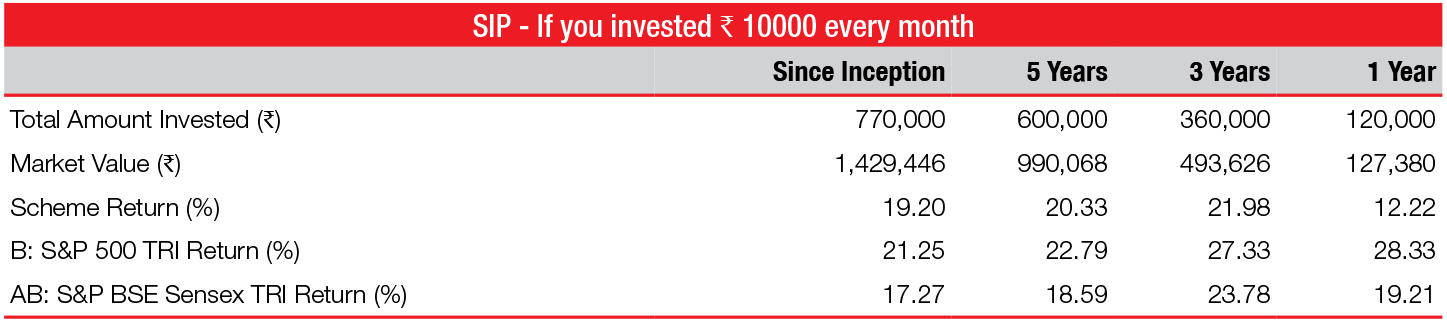

Past performance may or may not be sustained in future. It is assumed that a SIP of ₹10,000 each executed on 10th of every month including the first installment in the Growth option of the Fund. Returns on SIP and Benchmark are annualized and cumulative investment return for cash flows resulting out of uniform and regular monthly subscriptions have been worked out on excel spreadsheet function known as XIRR. Load has not been taken into consideration.

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns

For scheme performance please click here. For Fund manager wise scheme performance click here.

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities of companies listed on recognized

stock exchanges in the US.

Fund Riskometer

Nippon India US Equity Opportunities Fund

Benchmark Riskometer

S&P 500 TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Special Feature: Nippon India Any Time Money Card

Please click here for explanation on symbol: ^ and @ wherever available