Nippon India Balanced Advantage Fund

| Details as on January 31, 2023 |

|

An Open Ended Dynamic Asset Allocation Fund

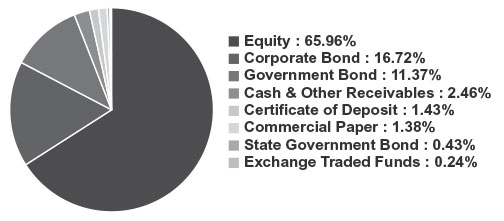

Nippon India Balanced Advantage Fund attempts to capitalize on the

potential upside in equity markets while attempting to limit the

downside by dynamically managing the portfolio through investment

in equity and active use of debt, money market instruments and

derivatives. A model based Dynamic Asset Allocation Fund that aims

to offer Triple Benefits of 1. Emotion Free Asset Allocation through

Model Based Asset Allocation, 2. Lowers downside risk through

hedging and 3. Long Term Alpha – through Active Stock selection and

Sector. The fund follows an in-house proprietary Model (which follows

Valuations & Trend Following) to determine unhedged equity

allocation.

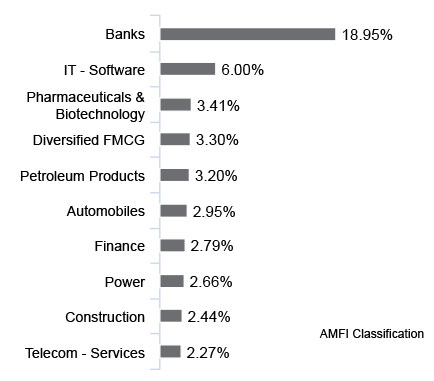

The fund maintains a large cap oriented portfolio diversified across

sectors. Debt portfolio is managed conservatively, focused at the

shorter end through investment in a combination of liquid and short

term fixed income securities.

November 15, 2004

Amar Kalkundrikar

Ashutosh Bhargava

Sushil Budhia

CRISIL Hybrid 50+50 - Moderate Index

| Monthly Average : | ₹ 6766.14 Cr |

| Month End : | ₹ 6709.53 Cr |

| Growth Plan | ₹ 125.9439 |

| IDCW Plan | ₹ 28.2411 |

| Bonus Option | ₹ 125.9439 |

| Direct - Growth Plan | ₹ 138.5121 |

| Direct - IDCW Plan | ₹ 36.6733 |

| Entry Load: | Nil |

| Exit Load: |

10% of the units allotted shall be redeemed without any exit load,

on or before completion of 12 months from the date of allotment of units. Any

redemption in excess of such limit in the first 12 months from the date of

allotment shall be subject to the following exit load. Redemption of units would be done on First in First out Basis (FIFO): • 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units. • Nil, thereafter. |

| Standard Deviation | 3.75 |

| Beta | 1.04 |

| Sharpe Ratio | 0.08 |

| Note:The above measures have been calculated using monthly rolling returns for 36 months period with 6.5% risk free return (FBIL Overnight MIBOR as on 31/01/2023). | |

| Portfolio Turnover | 3.36 |

| Average Maturity | 4.44 Years |

| Modified Duration | 3.01 Years |

| Annualized portfolio YTM* | 7.85% |

| Macaulay Duration | 3.16 Years |

*In case of semi annual YTM, it has been annualised

| Regular/Other than Direct | 1.83 |

| Direct | 0.65 |

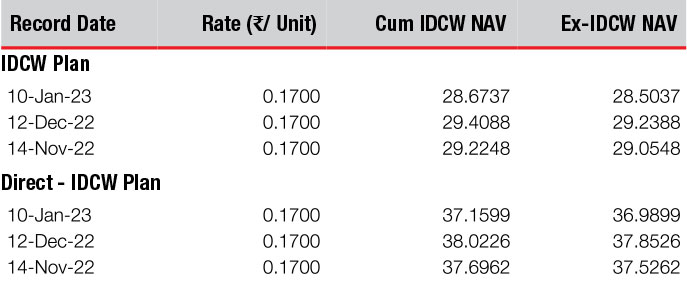

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value- ₹ 10 .

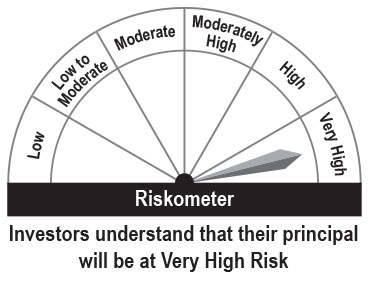

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity & equity related instruments, debt, money market

instruments and derivatives

Fund Riskometer

Nippon India Balanced

Advantage Fund

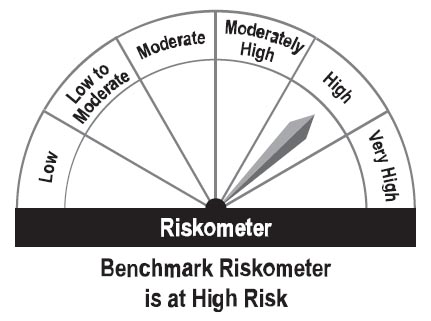

Benchmark Riskometer

CRISIL Hybrid 50+50 - Moderate

Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For SIP performance please click here. For scheme performance please click here. For Fund manager wise scheme performance click here.