Nippon India Credit Risk Fund (Number of Segregated Portfolios- 2)

| Details as on January 31, 2023 |

|

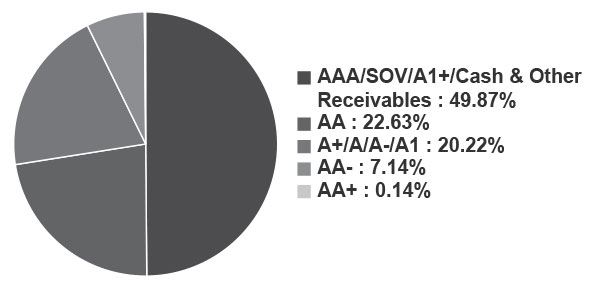

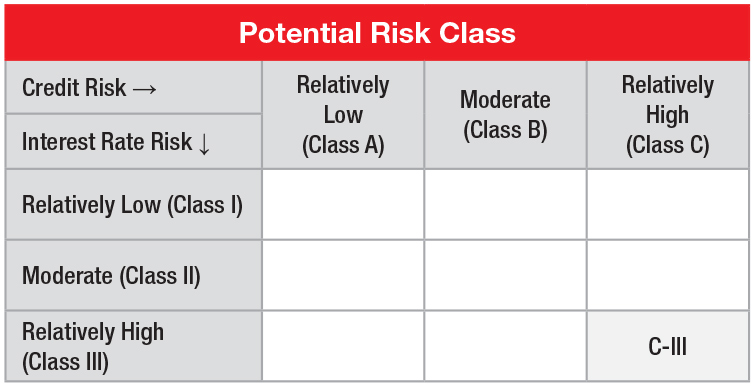

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (excluding AA+ rated corporate bonds). Relatively High interest rate risk and Relatively High Credit Risk.

The Fund focuses on maximizing accrual with increased allocation to AA- and below segment, while maintaining duration of 1.5 - 2.5 years. Core mandate is to generate returns through accrual, hence low duration profile. Emphasis is on credit risk diversification.

June 08, 2005

Sushil Budhia

NIFTY Credit Risk Bond Index C-III

| Fund Size | Main Portfolio | Segregated Portfolio 2 |

| Monthly Average : | ₹ 1,013.63 Cr | 0.00 Cr. |

| Month End : | ₹ 996.38 Cr | 0.00 Cr. |

| Main Portfolio | Segregated Portfolio 2 | |

| Growth Plan | ₹ 28.6787 | ₹ 0.0000 |

| IDCW Plan | ₹ 15.7324 | ₹ 0.0000 |

| Quarterly IDCW Plan | ₹ 12.7277 | ₹ 0.0000 |

| Direct - Growth Plan | ₹ 30.9897 | ₹ 0.0000 |

| Direct - IDCW Plan | ₹ 16.7786 | ₹ 0.0000 |

| Direct - Quarterly IDCW Plan | ₹ 13.2800 | ₹ 0.0000 |

| Institutional - Growth Plan | ₹ 29.8958 | ₹ 0.0000 |

| Entry Load: | Nil |

| Exit Load: | 10% of the units allotted shall be redeemed without any

exit load, on or before completion of 12 months from the date of

allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load. Redemption of units would be done on First in First out Basis (FIFO): • 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units. • Nil, if redeemed or switched out after completion of 12 months from the date of allotment of units. Not applicable for Segregated Portfolio |

|

Segregated Portfolio 1 Vodafone Idea Limited was segregated from the scheme"s portfolio due to some adverse developments and rating downgrade by CARE to BB- on Feb 17, 2020. An amount of 4.30% of total exposure realized on Sep 16, 2020. The annual coupon amounting Rs 6.98 cr received on Jan 27, 2021. Further entire due amount of Rs 93.78 Cr (Face Value + Accrued Interest) was received on January 27, 2022, subsequently all the units in this segregated portfolio were redeemed and the portfolio was closed, and the investors were duly paid in proportion to their holding. Segregated Portfolio 2 Yes Bank Limited has been segregated from the scheme’s portfolio due to rating downgrade by ICRA to “D” on March 6, 2020. | |

| Average Maturity | 2.14 years |

| Modified Duration | 1.81 years |

| Annualized portfolio YTM* | 8.51% |

*In case of semi annual YTM, it has been annualised

| Macaulay Duration | 1.89 Years |

| Main | Segregated Portfolio 2 | |

| Regular/Other than Direct | 1.61% | - |

| Direct | 1.00% | - |

| Company/Issuer | Rating | % of Assets |

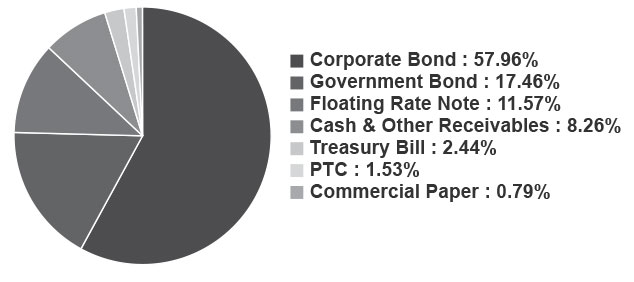

| Commercial Paper | 0.79 | |

| Trust Investment Advisors Private Limited (TRUST GROUP) | CARE A1+ | 0.79 |

| Corporate Bond | 57.96 | |

| JSW Steel Limited | CARE AA | 5.53 |

| Andhra Pradesh State Beverages Corporation Limited (A.P.State PSU (Structured escrow mechanism for payments & Guarantee by government of Andhra Pradesh)) | FITCH AA(CE) | 4.87 |

| Piramal Capital & Housing Finance Limited | ICRA AA | 4.81 |

| Greenlam Industries Limited (GREENLAM GROUP) | ICRA AA- | 4.39 |

| L&T Metro Rail (Hyderabad) Limited (Guarantee by L&T Ltd.) | ICRA AAA(CE) | 4.17 |

| Spandana Sphoorty Financial Limited | FITCH A | 3.97 |

| U.P. Power Corporation Limited (U.P. State PSU (Structured escrow mechanism for payments & Guarantee by government of Uttar Pradesh)) | CRISIL A+ (CE)/FITCH AA(CE) | 3.74 |

| Grasim Industries Limited | CRISIL AAA | 3.51 |

| Summit Digitel Infrastructure Limited (BROOKFIELD GROUP) | CRISIL AAA | 3.40 |

| Embassy Office Parks REIT (Blackstone group(Exposure to the NCDs issued by REIT)) | CRISIL AAA | 2.92 |

| National Bank For Agriculture and Rural Development | ICRA AAA/CRISIL AAA | 2.92 |

| Ashoka Concessions Limited (Ashoka Buildcon Group (Guaranteed by the parent i.e Ashoka Buildcon Ltd)) | CRISIL AA-(CE) | 2.45 |

| Godrej Industries Limited | CRISIL AA | 2.45 |

| India Shelter Finance Corporation Limited (INDIA SHELTER FINANCE GROUP) | ICRA A+ | 2.41 |

| Avanse Financial Services Limited (Avanse Financial Services Group) | CARE A+ | 1.99 |

| Nirma Limited | CRISIL AA | 1.50 |

| REC Limited | CRISIL AAA | 1.47 |

| Fullerton India Home Finance Company Limited | CARE AAA | 1.00 |

| TMF Holdings Limited | CRISIL AA- | 0.47 |

| Floating Rate Note | 11.57 | |

| Shriram Housing Finance Limited | FITCH AA+ | 4.00 |

| Macrotech Developers Limited | ICRA A+ | 3.99 |

| Vivriti Capital Private Limited (VIVRITI) | ICRA A | 2.37 |

| Profectus Capital Private Limited (Profectus Capital Group) | CRISIL A- | 1.21 |

| Government Bond | 17.46 | |

| Government of India | SOV | 17.46 |

| Treasury Bill | 2.44 | |

| Government of India | SOV | 2.44 |

| PTC | 1.53 | |

| First Business Receivables Trust (Mukesh Ambani Group (PTC backed by receivables from Reliance group entities)) | CRISIL AAA(SO) | 1.53 |

| Cash & Other Receivables | 8.26 | |

| Grand Total | 100.00 | |

| #Security defaulted beyond its maturity date as on 31st January 2023 (forming part of net current assets) are as follows : 8.9% Reliance Home Finance Ltd Ser I Matured on 03/01/2020 - 5.23% | ||

| Segregated Portfolio 2 as on January 31, 2023 | ||

| Company/Issuer | Rating | % of Assets |

| Corporate Bond | 0.00 | |

| Yes Bank Limited BASEL III | ICRA D | 0.00 |

| Cash & Other Receivables | 100.00 | |

| Grand Total | 100.00 |

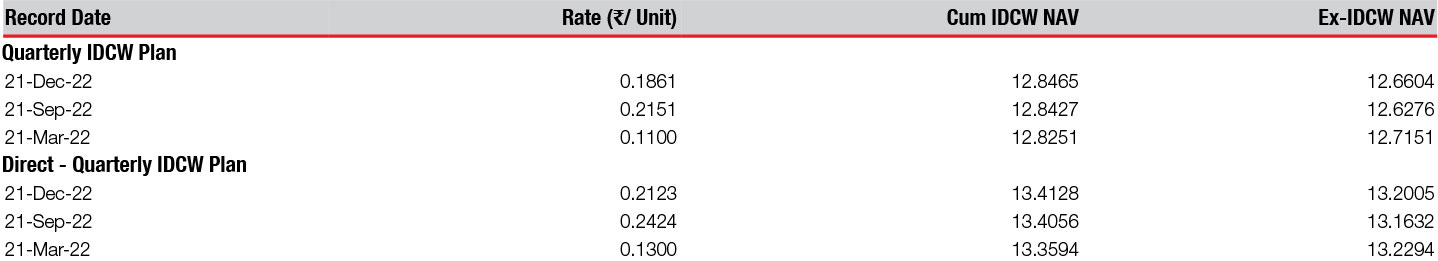

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

This product is suitable for investors who are seeking*:

• Income over medium term.

• Investment predominantly in AA and below rated corporate bonds.

Fund Riskometer

Nippon India Credit Risk Fund

(Number of

Segregated Portfolios- 2)

Benchmark Riskometer

NIFTY Credit Risk Bond Index

C-III

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

Kindly refer to SID/KIM for complete details on segregation of portfolio.

For SIP performance click here. For scheme performance please click here. For Fund manager wise scheme performance click here.