Nippon India ETF Nifty 5 yr Benchmark G-Sec

| Details as on January 31, 2023 |

|

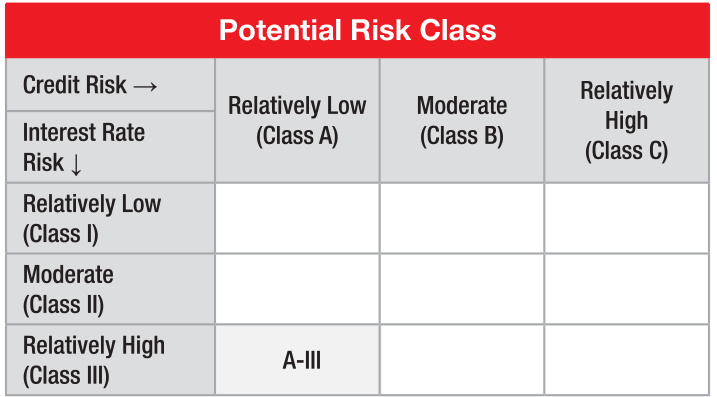

An open ended scheme replicating/tracking Nifty 5 yr Benchmark GSec Index. Relatively High interest rate risk and Relatively Low Credit Risk.

The scheme employs a passive approach designed to track the

performance of Nifty 5 Yr Benchmark G-sec Index.It will invest mainly

in securities constituting Nifty 5 Yr Benchmark G-Sec Index which has

the portfolio of Government Securities.

April 05, 2021

Pranay Sinha

Siddharth Deb

Nifty 5 Yr Benchmark G-Sec Index

| Monthly Average : | ₹ 37.39 Cr |

| Month End : | ₹ 35.75 Cr |

| NAV as on January 31, 2023 | ₹ 50.6707 |

| Tracking Error@ | 0.33% |

| Creation Unit Size | 200,000 Units |

| Pricing (per unit)(approximately) | 1/100th of Index |

| Average Maturity | 4.32 Years |

| Modified Duration | 3.61 Years |

| Annualized Portfolio YTM* | 7.34% |

| *In case of semi annual YTM, it has been annualised | |

| Macaulay Duration | 3.74 Years |

| Entry Load: | Nil |

| Exit Load: | Nil |

| Exchange Listed | NSE |

| Exchange Symbol | GILT5YBEES |

| ISIN | INF204KC1030 |

| Bloomberg Code | NETF5YGL IN Equity |

| Reuters Code | NA |

| Total Expense Ratio^ | 0.08 |

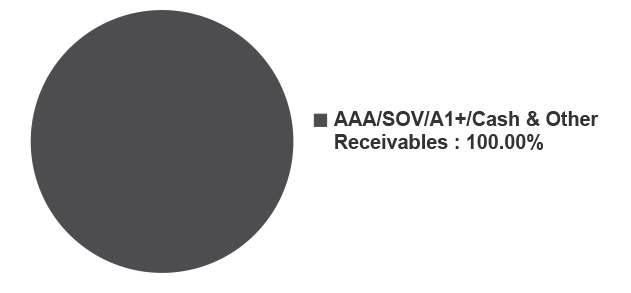

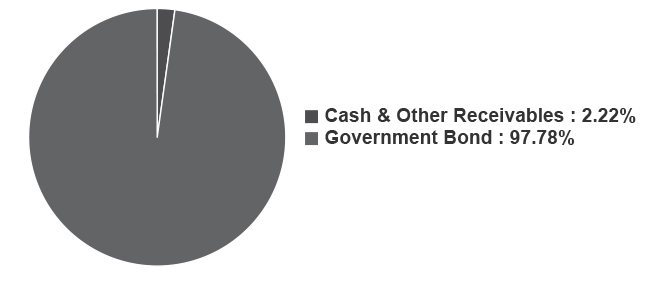

| Holding | Rating | % of Assets |

| Government Bond | 97.78 | |

| 7.38% GOI (MD 20/06/2027) | SOV | 97.78 |

| Cash and Other Receivables | 2.22 | |

| Grand Total | 100.00 |

This product is suitable for investors who are seeking*:

• Income over long term

• Investments in Gilt Securities replicating the composition of Nifty 5 Yr

Benchmark G-Sec Index, subject to tracking errors

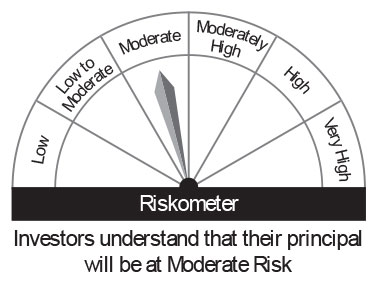

Fund Riskometer

Nippon India ETF Nifty 5 yr Benchmark G-Sec

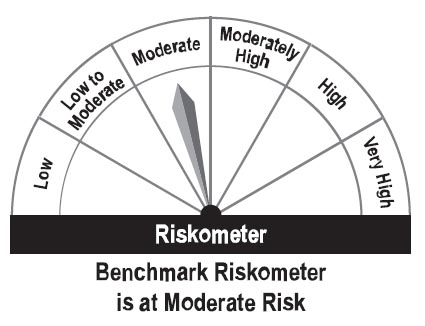

Benchmark Riskometer

Nifty 5 Yr Benchmark G-Sec

Index

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

Since the fund has not completed six months, the scheme performance has not been provided.