Nippon India ETF Nifty CPSE Bond Plus SDL Sep 2024 50:50

| Details as on January 31, 2023 |

|

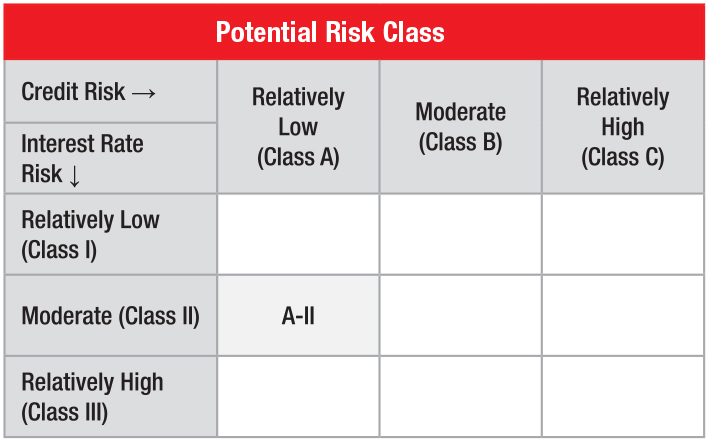

An open-ended Target Maturity Exchange Traded CPSE Bond Plus SDL Fund predominately investing in constituents of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index. Moderate interest rate risk and Relatively Low Credit Risk.

The scheme employs a passive approach designed to track the performance of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index.The Scheme seeks to achieve this goal by investing in securities representing the Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index.The Scheme will invest 95% to 100% in Bonds issued by CPSEs/CPSUs/CPFIs and other Government organizations representing the bonds portion of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index and in State Development Loans (SDLs) representing the SDL portion of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index.The Scheme may also invest in money market instruments.

November 13, 2020

Vivek Sharma

Siddharth Deb

Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index

| Monthly Average : | ₹ 1,849.84 Cr |

| Month End : | ₹ 1,858.72 Cr |

| NAV as on January 31, 2023 | ₹ 110.7713 |

| Tracking Error@ | 0.63% |

| Creation Unit Size | 230,000 Units |

| Pricing (per unit)(approximately) | 1/10th of Index |

| Average Maturity | 1.46 Years |

| Modified Duration | 1.31 Years |

| Annualized Portfolio YTM* | 7.52% |

| *In case of semi annual YTM, it has been annualised | |

| Macaulay Duration | 1.38 Years |

| Entry Load: | Nil |

| Exit Load: | Nil |

| Exchange Listed | NSE |

| Exchange Symbol | SDL24BEES |

| ISIN | INF204KB18W4 |

| Bloomberg Code | NNIFCP24 IN Equity |

| Reuters Code | NA |

| Total Expense Ratio^ | 0.20 |

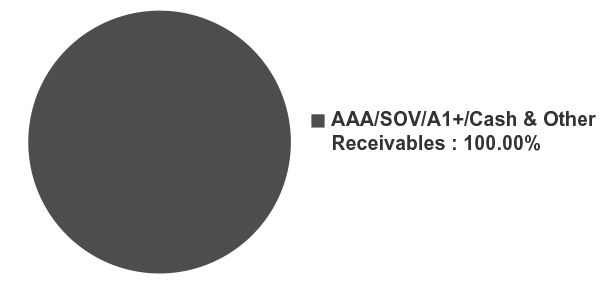

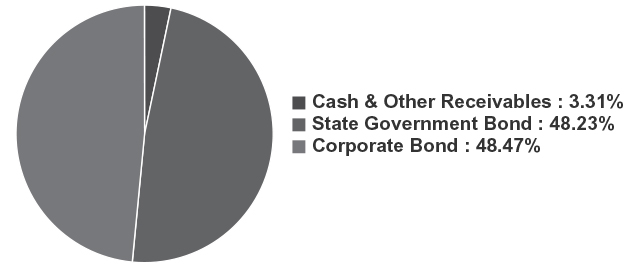

| Holding | Rating | % of Assets |

| Corporate Bond | 48.47 | |

| National Bank For Agriculture and Rural Development | CRISIL AAA/ICRA AAA | 9.64 |

| REC Limited | CRISIL AAA | 9.28 |

| Power Finance Corporation Limited | CRISIL AAA | 7.59 |

| Hindustan Petroleum Corporation Limited | CRISIL AAA | 6.40 |

| NTPC Limited | CRISIL AAA | 6.32 |

| Power Grid Corporation of India Limited | CRISIL AAA | 5.56 |

| Indian Railway Finance Corporation Limited | CRISIL AAA | 2.05 |

| Export Import Bank of India | CRISIL AAA | 0.82 |

| NHPC Limited | CARE AAA | 0.81 |

| State Government Bond | 48.23 | |

| State Government Securities | SOV | 48.23 |

| Cash and Other Receivables | 3.31 | |

| Grand Total | 100.00 |

This product is suitable for investors who are seeking*:

• Income over long term

• Investments in CPSE Bonds & State Development Loans (SDL) similar to the

composition of Nifty CPSE Bond Plus SDL Sep 2024 50:50 Index, subject to

tracking errors

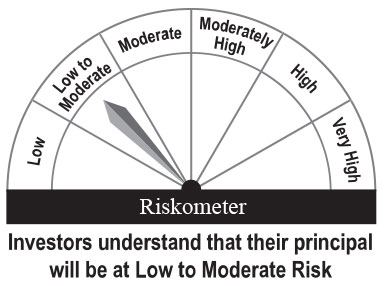

Fund Riskometer

Nippon India ETF Nifty CPSE

Bond Plus SDL Sep 2024 50:50

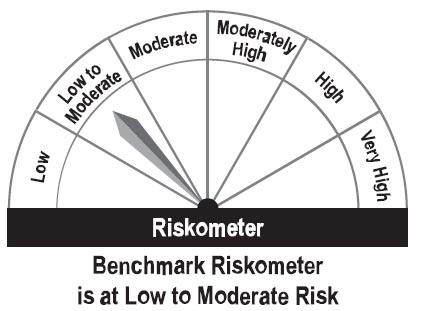

Benchmark Riskometer

Nifty CPSE Bond Plus SDL Sep

2024 50:50 Index

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

Since the fund has not completed one year, the scheme performance has not been provided.