Nippon India Floating Rate Fund

| Details as on January 31, 2023 |

|

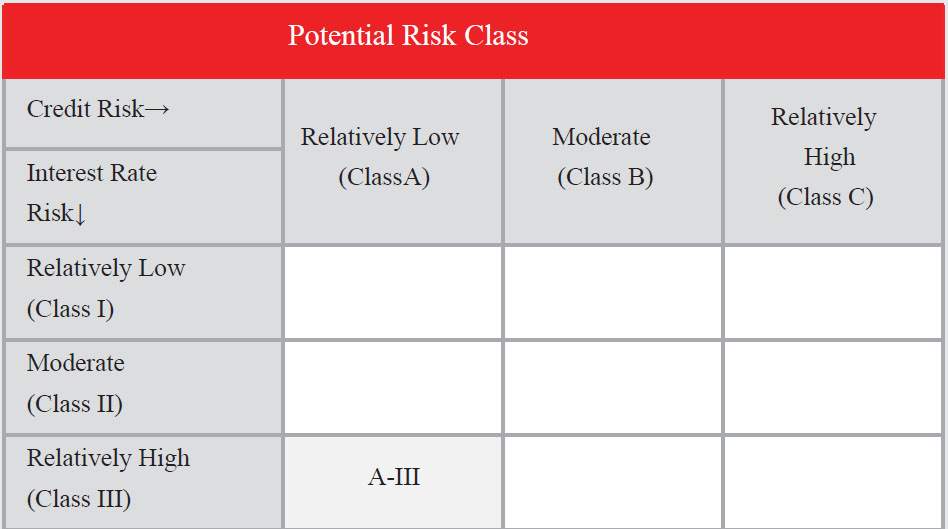

An open ended debt scheme predominantly investing in floating rate instruments (including fixed rate instruments converted to floating rate exposures using swaps/ derivatives). Relatively High interest rate risk and moderate Credit Risk.

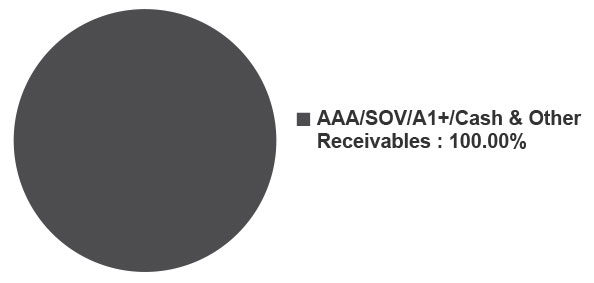

The fund will endeavour to invest in high quality AAA/A1+ rated papers. SEBI restriction of up to 65% investments in floating rate instruments will be taken care through a mix of OIS trades & floating rate instruments.

August 27, 2004

Anju Chhajer

CRISIL Short Term Bond Fund Index

| Monthly Average : | ₹ 7,381.04 Cr |

| Month End : | ₹ 7,393.61 Cr |

| Growth Plan | ₹ 37.4121 |

| IDCW Plan | ₹ 16.8926 |

| Daily IDCW Plan | ₹ 10.2323 |

| Weekly IDCW Plan | ₹ 10.2352 |

| Monthly IDCW Plan | ₹ 11.0096 |

| Quarterly IDCW Plan | ₹ 10.7837 |

| Direct - Growth Plan | ₹ 39.0842 |

| Direct - IDCW Plan | ₹ 17.4450 |

| Direct - Daily IDCW Plan | ₹ 10.2539 |

| Direct - Weekly IDCW Plan | ₹ 10.2385 |

| Direct - Monthly IDCW Plan | ₹ 11.2036 |

| Direct - Quarterly IDCW Plan | ₹ 10.6735 |

| Entry Load: | Nil |

| Exit Load: | Nil |

| Average Maturity | 3.02 Years |

| Modified Duration | 2.17 Years |

| Annualized portfolio YTM* | 7.58% |

*In case of semi annual YTM, it has been annualised

| Macaulay Duration | 2.32 Years |

| Regular/Other than Direct | 0.60% |

| Direct | 0.27% |

| Company/Issuer | Rating | % of Assets |

| Certificate of Deposit | 3.53 | |

| Axis Bank Limited | CRISIL A1+ | 1.90 |

| Canara Bank | CRISIL A1+ | 1.30 |

| HDFC Bank Limited | CARE A1+ | 0.34 |

| Commercial Paper | 1.25 | |

| Panatone Finvest Limited | CRISIL A1+ | 1.25 |

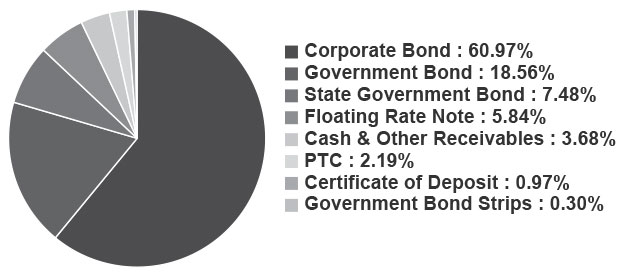

| Corporate Bond | 54.79 | |

| National Bank For Agriculture and Rural Development | CRISIL AAA/ICRA AAA | 7.14 |

| Small Industries Dev Bank of India | ICRA AAA | 7.02 |

| Power Finance Corporation Limited | CRISIL AAA | 5.47 |

| HDB Financial Services Limited | CRISIL AAA | 4.74 |

| State Bank of India Basel III | CRISIL AAA | 4.61 |

| Tata Capital Housing Finance Limited | CRISIL AAA | 4.05 |

| Bajaj Finance Limited | CRISIL AAA | 3.93 |

| Bajaj Housing Finance Limited | CRISIL AAA | 3.37 |

| Housing Development Finance Corporation Limited | CRISIL AAA | 3.36 |

| ICICI Home Finance Company Limited | CRISIL AAA | 3.24 |

| LIC Housing Finance Limited | CRISIL AAA | 2.69 |

| L&T Metro Rail (Hyderabad) Limited (Guarantee by L&T Ltd.) | CRISIL AAA(CE)/ICRA AAA(CE) | 1.87 |

| Nabha Power Limited (L & T Group (Guaranteed by L&T)) | ICRA AAA(CE) | 1.01 |

| Jamnagar Utilities & Power Private Limited (Mukesh Ambani Group) | CRISIL AAA | 1.01 |

| Tata Capital Limited | CRISIL AAA | 0.94 |

| REC Limited | CRISIL AAA | 0.34 |

| Sundaram Finance Limited | CRISIL AAA | 0.00 |

| Floating Rate Note | 5.79 | |

| Reliance Industries Limited | CRISIL AAA | 5.79 |

| Government Bond | 24.76 | |

| Government of India | SOV | 24.76 |

| PTC | 2.18 | |

| First Business Receivables Trust (Mukesh Ambani Group (PTC backed by receivables from Reliance group entities)) | CRISIL AAA(SO) | 2.18 |

| State Government Bond | 2.98 | |

| State Government Securities | SOV | 2.98 |

| Government Bond Strips | 0.30 | |

| Government of India | SOV | 0.30 |

| Cash & Other Receivables | 4.41 | |

| Grand Total | 100.00 |

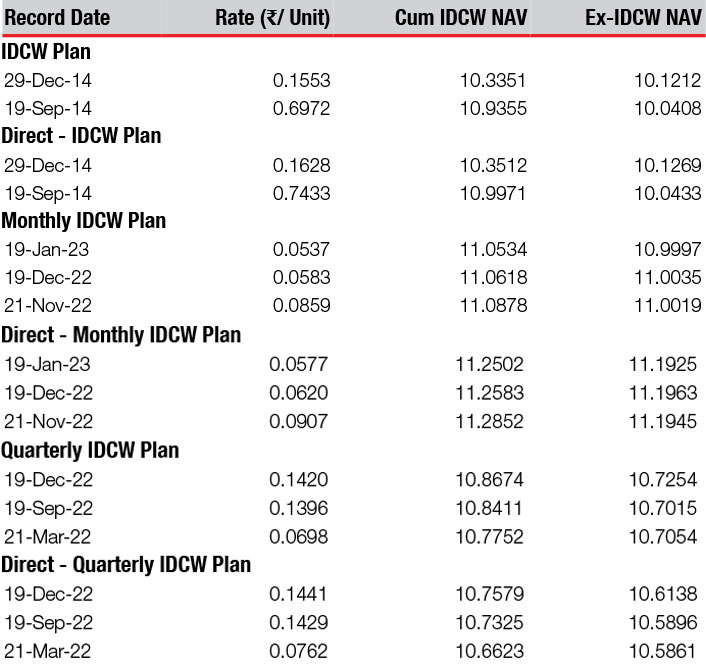

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

This product is suitable for investors who are seeking*:

• Income over short term

• Investment predominantly in floating rate instruments (Including fixed rate

instruments converted to floating rate exposures using swaps/ derivatives)

Fund Riskometer

Nippon India Floating Rate Fund

Benchmark Riskometer

Crisil Short Term Bond Fund

Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For scheme performance please click here. For Fund manager wise scheme performance click here.