Nippon India Gold Savings Fund

| Details as on January 31, 2023 |

|

Gold - FOF

Type of Scheme

An open ended Fund of Fund Scheme

Current Investment Philosophy

The Scheme employs an investment approach designed to track the performance of Nippon India ETF Gold BeES. The Scheme seeks to achieve this goal by investing in Nippon India ETF Gold BeES.

Date of Allotment

March 07, 2011

Fund Manager

Mehul Dama

Benchmark

Domestic Price of Gold

Fund Size

| Monthly Average : | ₹ 1,484.16 Cr |

| Month End : | ₹ 1,493.11 Cr |

NAV as on January 31, 2023

| Growth Plan | ₹ 22.6647 |

| IDCW Plan | ₹ 22.6647 |

| Direct - Growth Plan | ₹ 23.5728 |

| Direct - IDCW Plan | ₹ 23.5728 |

Load structure

| Entry Load: | Nil |

| Exit Load: | 1% If redeemed or switched out on or before

completion of 15 days from the date of allotment of

units. Nil, thereafter; |

| Regular/Other than Direct | 0.37 |

| Direct | 0.19 |

| (In addition to the above, the scheme will also incur expenses of the underlying scheme, i.e. 0.70%.) | |

| Company/Issuer | % of Assets |

| Others | 99.91 |

| Nippon India ETF Gold Bees | 99.91 |

| Cash and Other Receivables | 0.09 |

| Grand Total | 100.00 |

| Standard Deviation | 4.10 |

| Beta | 1.00 |

| Sharpe Ratio | 0.09 |

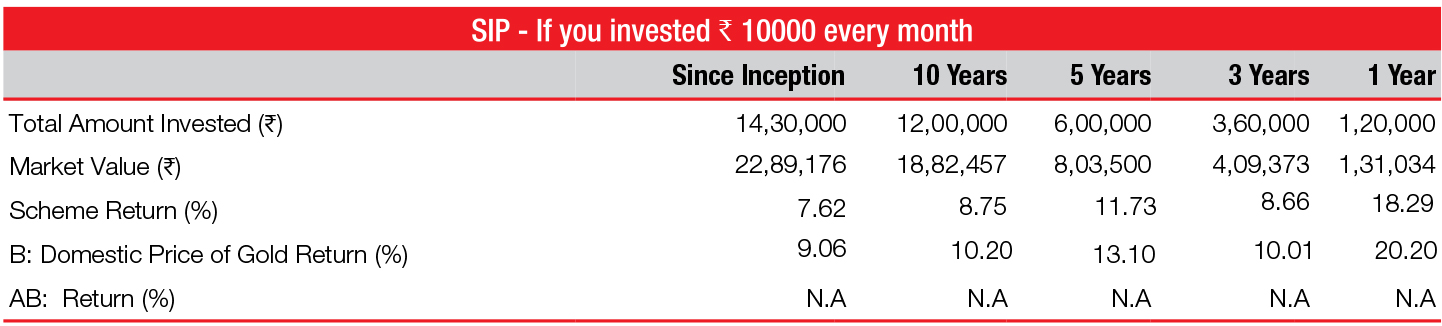

Past performance may or may not be sustained in future. It is assumed that a SIP of ₹10,000 each executed on 10th of every month including the first installment in the Growth option of the Fund. Returns on SIP and Benchmark are annualized and cumulative investment return for cash flows resulting out of uniform and regular monthly subscriptions have been worked out on excel spreadsheet function known as XIRR. Load has not been taken into consideration.

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

This product is suitable for investors who are seeking*:

• Long term capital growth

• Returns that are commensurate with the performance of Nippon India ETF

Gold BeES through investment in securities of Nippon India ETF Gold BeES

Fund Riskometer

Nippon India Gold Savings Fund

Benchmark Riskometer

Domestic Price of Gold

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For SIP performance please click here. For scheme performance please click here. For Fund manager wise scheme performance click here.