Nippon India Multi Asset Fund

| Details as on January 31, 2023 |

|

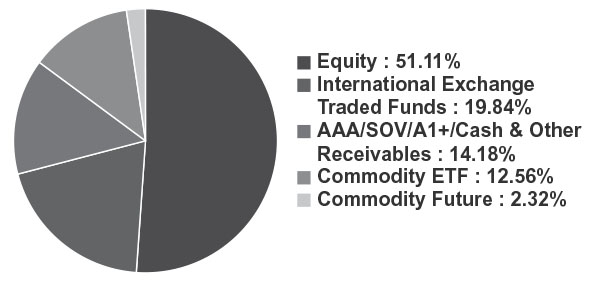

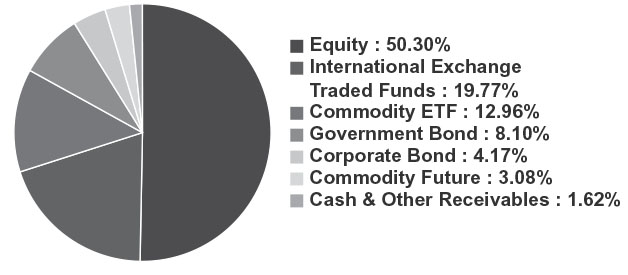

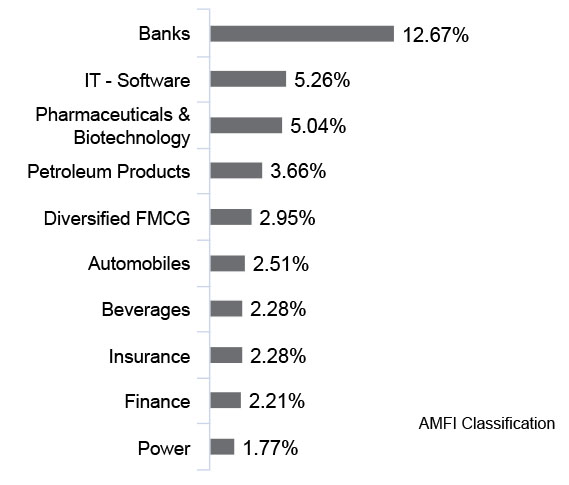

An open ended scheme investing in Equity, Debt and Exchange Traded Commodity Derivatives and Gold ETF

Nippon India Multi Asset Fund invests in a combination of Equity, Debt, International Equity and Gold ETF/ Exchange Traded Commodity Derivatives (ETCD) and other ETCDs as permitted by SEBI from time to time. Since these asset classes are weakly/ negatively co-related and tend to perform at different periods of time, the Fund seeks to benefit from portfolio diversification. Given that asset allocation is the key to wealth creation, this fund would be an ideal offering for investors seeking a one stop solution to reap benefit of Growth of Equity, Stability of Debt & Diversification from Commodities.

August 28, 2020

Ashutosh Bhargava

Vikram Dhawan

Sushil Budhia

Tejas Sheth (Co-Fund Manager)

Kinjal Desai (Fund Manager - Overseas Investment)

Akshay Sharma (Fund Manager - Overseas Investment)

50% of S&P BSE 500 TRI, 20% of MSCI World Index TRI, 15% of Crisil Short Term Bond Fund Index & 15% of Domestic prices of Gold

| Monthly Average : | ₹ 1,152.36 Cr |

| Month End : | ₹ 1.152.92 Cr |

| Growth Plan | ₹ 13.6568 |

| IDCW Plan | ₹ 13.6568 |

| Direct - Growth Plan | ₹ 14.1593 |

| Direct - IDCW Plan | ₹ 14.1593 |

| Entry Load: | Nil |

| Exit Load: | 1% if redeemed or switched out on or before completion of 1 year

from the date of allotment of units. Nil, thereafter. |

| Portfolio Turnover(Times) | 0.59 |

| Average Maturity | 2.01 Years |

| Modified Duration | 1.75 Years |

| Annualized portfolio YTM* | 0.00% |

| Macaulay Duration | 1.84 Years |

| Regular/Other than Direct | 1.84 |

| Direct | 0.31 |

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

For scheme performance please click here. For Fund manager wise scheme performance click here.

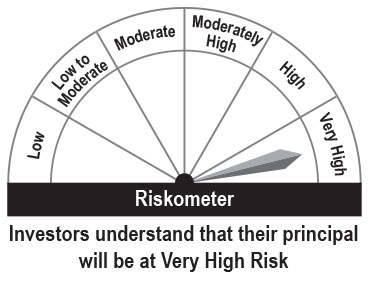

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities, debt & money market

instruments and Exchange Traded Commodity Derivatives and Gold ETF

Fund Riskometer

Nippon India Multi Asset Fund

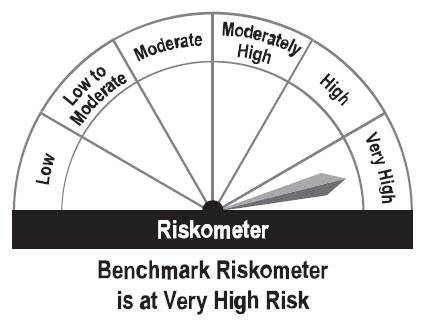

Benchmark Riskometer

50% of S&P BSE 500 TRI, 20% of MSCI World Index TRI, 15% of Crisil Short Term Bond Fund Index & 15% of Domestic prices of Gold

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available