Nippon India Nifty AAA CPSE Bond Plus SDL - Apr 2027 Maturity 60:40 Index Fund

| Details as on January 31, 2023 |

|

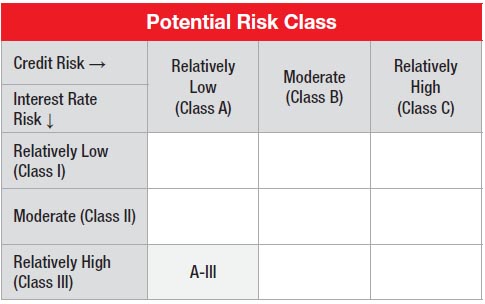

An open-ended Target Maturity Index Fund investing in constituents of Nifty AAA CPSE Bond Plus SDL Apr 2027 60:40 Index. A Relatively High interest rate risk and Relatively Low Credit Risk

• The Scheme employs a passive investment approach designed to track the

performance of Nifty AAA CPSE Bond Plus SDL Apr 2027 60:40 Index.

• The Scheme seeks to achieve this goal by investing in AAA CPSE bonds &

State Development Loans (SDLs) representing Nifty AAA CPSE Bond Plus SDL

Apr 2027 60:40 Index.

March 29, 2022

Vivek Sharma

Siddharth Deb

Nifty AAA CPSE Bond Plus SDL Apr 2027 60:40 Index

| Monthly Average : | ₹ 1,629.14 Cr |

| Month End : | ₹ 1,695.37 Cr |

| Growth Plan | ₹ 10.1672 |

| IDCW Plan | ₹ 10.1672 |

| Direct - Growth Plan | ₹ 10.1841 |

| Direct - IDCW Plan | ₹ 10.1841 |

| Entry Load: | Nil |

| Exit Load: | Nil

|

| Tracking Error@ | Regular Plan 1.11% | Direct Plan 1.11% |

| Average Maturity | 3.77 Years |

| Modified Duration | 3.11 Years |

| Annualized portfolio YTM* | 7.51% |

| Standard portfolio YTM | 7.46% |

| Macaulay Duration | 3.29 Years |

| Regular/Other than Direct | 0.37% |

| Direct | 0.15% |

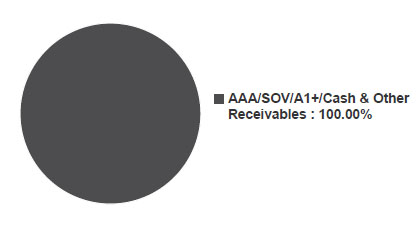

| Company/Issuer | Rating | % of Assets |

| Corporate Bond | 58.48 | |

| Power Finance Corporation Limited | CRISIL AAA | 12.30 |

| Indian Railway Finance Corporation Limited | CRISIL AAA | 11.31 |

| REC Limited | CRISIL AAA | 8.50 |

| Power Grid Corporation of India Limited | ICRA AAA/CRISIL AAA | 7.36 |

| Export Import Bank of India | CRISIL AAA | 5.32 |

| NHPC Limited | CARE AAA/ICRA AAA | 4.89 |

| Nuclear Power Corporation Of India Limited | CRISIL AAA | 3.66 |

| NTPC Limited | CRISIL AAA | 3.45 |

| Indian Oil Corporation Limited | CRISIL AAA | 1.69 |

| State Government Bond | 38.13 | |

| State Government Securities | SOV | 38.13 |

| Treasury Bill | 0.22 | |

| Government of India | SOV | 0.22 |

| Cash & Other Receivables | 3.17 | |

| Grand Total | 100.00 |

*Top 10 Holdings

This product is suitable for investors who are seeking*:

• Income over long term

• Investments in CPSE Bonds & State Development Loans

(SDLs) similar to the composition of Nifty AAA CPSE

Bond Plus SDL Apr 2027 60:40 Index, subject to

tracking errors

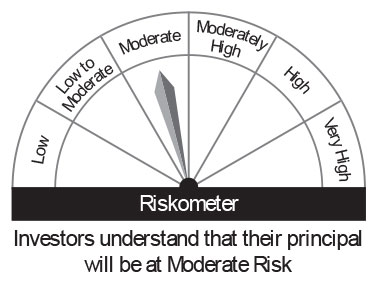

Fund Riskometer

Nippon India Nifty AAA CPSE Bond Plus SDL - Apr 2027 Maturity 60:40 Index Fund

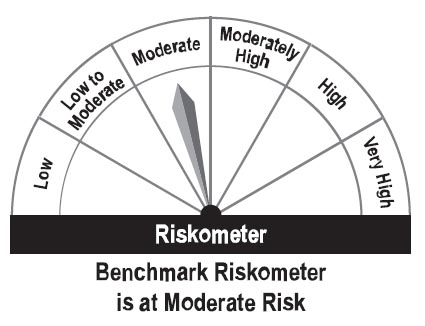

Benchmark Riskometer

Nifty AAA CPSE Bond Plus SDL Apr 2027 60:40 Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available