Nippon India Nifty Alpha Low Volatility 30 Index Fund

| Details as on January 31, 2023 |

|

An open-ended scheme replicating/tracking Nifty Alpha Low Volatility 30 Index

• The Scheme employs a passive investment approach designed to

track the performance of Nifty Alpha Low Volatility 30 TRI.

• The Scheme seeks to achieve this goal by investing in securities

constituting the Nifty Alpha Low Volatility 30 Index in same proportion

as in the Index.

August 19, 2022

Mehul Dama

Nifty Alpha Low Volatility 30 TRI

| Monthly Average : | ₹ 41.14 Cr |

| Month End : | ₹ 41.09 Cr |

| Growth Plan | ₹ 9.9453 |

| IDCW Plan | ₹ 9.9453 |

| Direct - Growth Plan | ₹ 9.9775 |

| Direct - IDCW Plan | ₹ 9.9775 |

| Entry Load: | Nil |

| Exit Load: | Nil

|

| Tracking Error@ | Regular Plan 0.17% | Direct Plan 0.16% |

| Regular/Other than Direct | 1.01 |

| Direct | 0.30 |

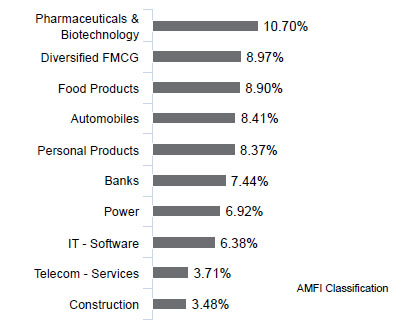

| Company/Issuer | % of Assets |

| Agricultural Food & other Products | |

| Tata Consumer Products Limited | 2.37 |

| Automobiles | |

| Mahindra & Mahindra Limited* | 4.33 |

| Bajaj Auto Limited* | 4.08 |

| Banks | |

| ICICI Bank Limited* | 4.14 |

| State Bank of India | 3.30 |

| Cement & Cement Products | |

| Ambuja Cements Limited | 2.38 |

| Chemicals & Petrochemicals | |

| Pidilite Industries Limited | 3.37 |

| Construction | |

| Larsen & Toubro Limited | 3.48 |

| Consumer Durables | |

| Titan Company Limited | 2.40 |

| Diversified FMCG | |

| ITC Limited* | 5.37 |

| Hindustan Unilever Limited | 3.60 |

| Electrical Equipment | |

| Siemens Limited | 3.13 |

| Finance | |

| Power Finance Corporation Limited | 1.97 |

| Food Products | |

| Nestle India Limited* | 4.75 |

| Britannia Industries Limited* | 4.14 |

| IT - Software | |

| Tata Consultancy Services Limited | 3.45 |

| HCL Technologies Limited | 2.92 |

| Industrial Products | |

| Cummins India Limited | 2.34 |

| Insurance | |

| SBI Life Insurance Company Limited | 3.20 |

| Personal Products | |

| Dabur India Limited | 3.28 |

| Marico Limited | 2.77 |

| Colgate Palmolive (India) Limited | 2.32 |

| Petroleum Products | |

| Reliance Industries Limited | 2.68 |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Limited* | 4.98 |

| Cipla Limited* | 3.95 |

| Alkem Laboratories Limited | 1.77 |

| Power | |

| NTPC Limited* | 3.98 |

| Power Grid Corporation of India Limited | 2.94 |

| Telecom - Services | |

| Bharti Airtel Limited* | 3.71 |

| Textiles & Apparels | |

| Page Industries Limited | 2.68 |

| Cash and Other Receivables | 0.19 |

| Grand Total | 100.00 |

*Top 10 Holdings

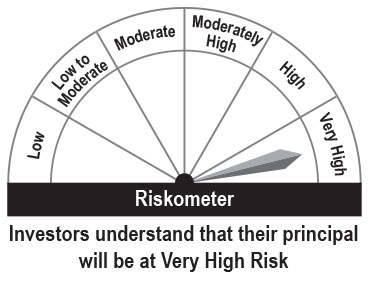

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities and portfolio

replicating the composition of the Nifty Alpha Low Volatility 30 Index,

subject to tracking errors

Fund Riskometer

Nippon India Nifty Alpha Low Volatility 30 Index Fund

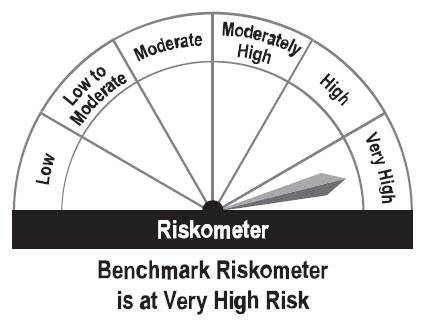

Benchmark Riskometer

Nifty Alpha Low Volatility 30 TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Since the fund has not completed six months, the scheme performance has not been provided.

Please click here for explanation on symbol: ^ and @ wherever available