Nippon India Power & Infra Fund

| Details as on January 31, 2023 |

|

An Open Ended Equity Scheme investing in power & infrastructure sectors

It is an investment opportunity to participate in India’s capex growth by investing in securities of companies in power and infra sectors. The portfolio has an adequate diversification within the power and infra sectors by spreading investment over a large range of companies. The fund provides opportunity within these sectors, with focused approach and flexibility to invest in Transportation, Energy, Resources, Communication and other power and infrastructure allied companies. The portfolio is focused on creating long term risk adjusted return.

May 8, 2004

Sanjay Doshi

Nifty Infrastructure TRI

| Monthly Average : | ₹ 1,909.80 Cr |

| Month End : | ₹ 1,896.16 Cr |

| Growth Plan | ₹172.2373 |

| IDCW Plan | ₹41.857 |

| Bonus Option | ₹172.2373 |

| Direct - Growth Plan | ₹182.9641 |

| Direct - IDCW Plan | ₹45.8622 |

| Direct - Bonus Option | ₹182.9641 |

| Entry Load: | Nil |

| Exit Load: | 1% if redeemed or switched out on or before completion of

1 month from the date of allotment of units. Nil, thereafter |

| Standard Deviation | 7.62 |

| Beta | 1.09 |

| Sharpe Ratio | 0.18 |

| Note: TheThe above measures have been calculated using monthly rolling returns for 36 months period with 6.5% risk free return (FBIL Overnight MIBOR as on 31/01/2023). | |

| Portfolio Turnover | 0.55 |

| Regular/Other than Direct | 2.20 |

| Direct | 1.58 |

| Company/Issuer | % of Assets |

| Aerospace & Defense | |

| MTAR Technologies Limited | 2.98 |

| Hindustan Aeronautics Limited | 2.83 |

| Mishra Dhatu Nigam Limited | 1.51 |

| Auto Components | |

| Bosch Limited* | 3.37 |

| Sona BLW Precision Forgings Limited | 1.19 |

| Cement & Cement Products | |

| UltraTech Cement Limited* | 5.42 |

| ACC Limited | 2.08 |

| JK Lakshmi Cement Limited | 1.94 |

| Construction | |

| Larsen & Toubro Limited* | 9.94 |

| RITES Limited* | 7.54 |

| Sterling And Wilson Renewable Energy Limited* | 3.17 |

| NCC Limited | 3.09 |

| PNC Infratech Limited | 2.34 |

| Electrical Equipment | |

| Siemens Limited* | 3.47 |

| Gas | |

| Indraprastha Gas Limited | 2.69 |

| Healthcare Services | |

| Apollo Hospitals Enterprise Limited | 1.91 |

| Industrial Manufacturing | |

| Kaynes Technology India Limited | 2.33 |

| Praj Industries Limited | 1.09 |

| Industrial Products | |

| Cummins India Limited | 2.27 |

| Astral Limited | 1.24 |

| Petroleum Products | |

| Reliance Industries Limited* | 6.21 |

| Power | |

| NTPC Limited* | 4.96 |

| Power Grid Corporation of India Limited* | 3.88 |

| NHPC Limited | 2.32 |

| Realty | |

| Oberoi Realty Limited | 2.76 |

| The Phoenix Mills Limited | 2.21 |

| Telecom - Services | |

| Bharti Airtel Limited* | 5.48 |

| Transport Infrastructure | |

| Adani Ports and Special Economic Zone Limited | 2.10 |

| Equity Less Than 1% of Corpus | 5.04 |

| Cash and Other Receivables | 2.64 |

| Grand Total | 100.00 |

*Top 10 Holdings

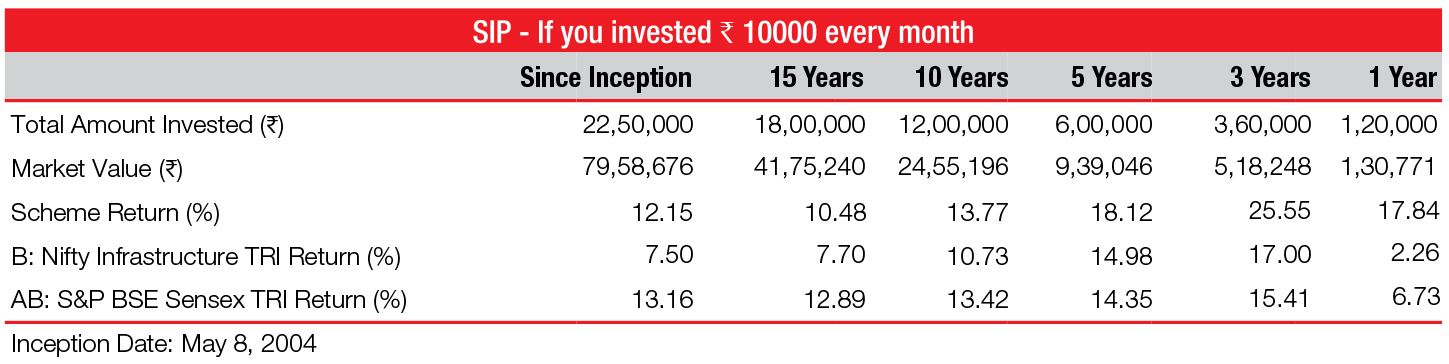

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

For scheme performance please click here. For Fund manager wise scheme performance click here.

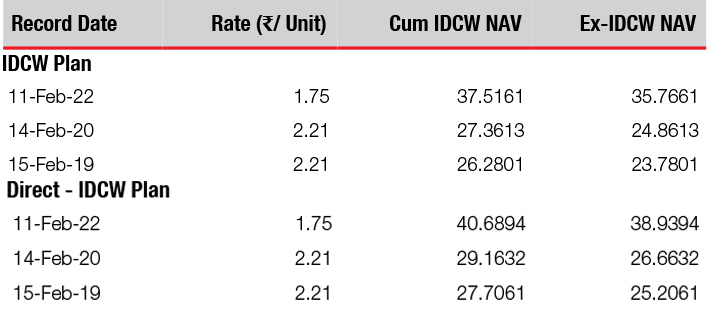

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment predominantly in equity and equity related securities of

companies engaged in power and infrastructure space.

Fund Riskometer

Nippon India Power & Infra Fund

Benchmark Riskometer

Nifty Infrastructure TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available