Nippon India Small Cap Fund

| Details as on January 31, 2023 |

|

An open-ended equity scheme predominantly investing in small cap stocks

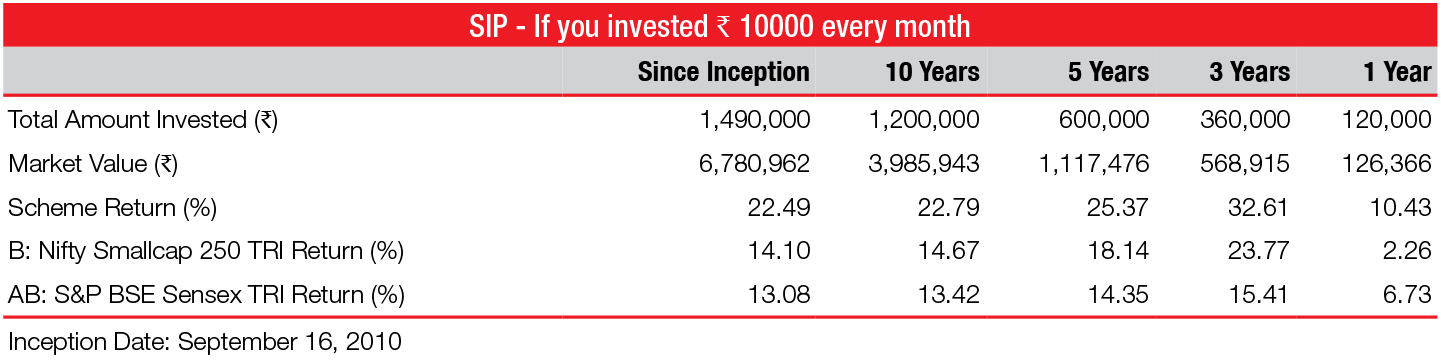

The fund attempts to generate relatively better risk adjusted returns by focusing on the smaller capitalization companies. Small cap stocks, for the purpose of the fund are defined as stocks whose market capitalization is below top 250 companies in terms of full market capitalization. Small cap companies are potential mid caps of tomorrow and offer twin advantage of high growth prospects & relatively lower valuation. The fund focuses on identifying good growth businesses with reasonable size, quality management and rational valuation. The investment approach adopts prudent risk management measures like margin of safety and diversification across sectors & stocks with a view to generate relatively better risk adjusted performance over a period of time.

September 16, 2010

Samir Rachh

Tejas Sheth (Assistant Fund Manager) w.e.f Feb 01 2023

Nifty Smallcap 250 TRI

| Monthly Average : | ₹ 23,749.66 Cr |

| Month End : | ₹ 23,756.50 Cr |

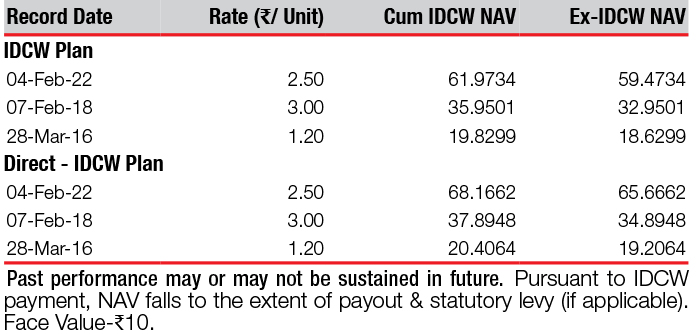

| Growth Plan | ₹91.5802 |

| IDCW Plan | ₹62.7115 |

| Bonus Option | ₹91.5802 |

| Direct - Growth Plan | ₹100.6416 |

| Direct - IDCW Plan | ₹69.8828 |

| Direct - Bonus Option | ₹100.6416 |

| Entry Load: | Nil |

| Exit Load: |

1% if redeemed or switched out on or before completion of

1 month from the date of allotment of units. Nil, thereafter. |

| Standard Deviation | 7.99 |

| Beta | 0.88 |

| Sharpe Ratio | 0.26 |

| Note: The above measures have been calculated using monthly rolling returns for 36 months period with 6.5% risk free return (FBIL Overnight MIBOR as on 31/01/2023). | |

| Portfolio Turnover | 0.24 |

| Regular/Other than Direct | 1.76 |

| Direct | 0.86 |

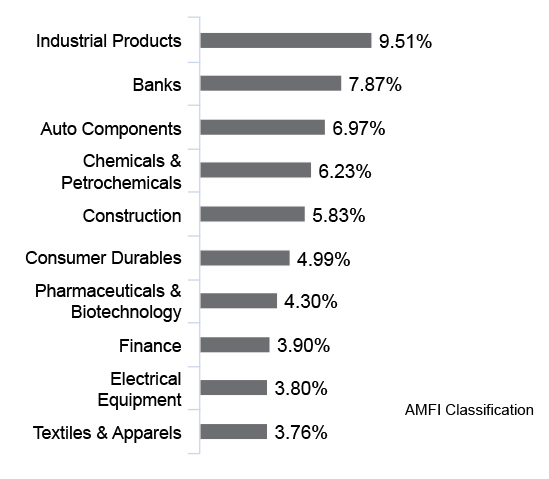

| Company/Issuer | % of Assets |

| Aerospace & Defense | |

| Hindustan Aeronautics Limited | 1.14 |

| Agricultural Food & other Products | |

| Balrampur Chini Mills Limited* | 1.48 |

| Auto Components | |

| Tube Investments of India Limited* | 3.59 |

| Banks | |

| HDFC Bank Limited* | 1.82 |

| Bank of Baroda* | 1.77 |

| Axis Bank Limited | 1.28 |

| State Bank of India | 1.27 |

| Karur Vysya Bank Limited | 1.12 |

| Beverages | |

| Radico Khaitan Limited | 1.06 |

| Capital Markets | |

| Multi Commodity Exchange of India Limited | 1.18 |

| Cement & Cement Products | |

| Birla Corporation Limited | 1.10 |

| Chemicals & Petrochemicals | |

| Navin Fluorine International Limited | 1.31 |

| Fine Organic Industries Limited | 1.27 |

| Commercial Services & Supplies | |

| eClerx Services Limited | 1.06 |

| Construction | |

| Larsen & Toubro Limited* | 1.42 |

| Consumer Durables | |

| Bajaj Electricals Limited* | 1.39 |

| Orient Electric Limited | 1.14 |

| Finance | |

| Poonawalla Fincorp Limited | 1.29 |

| CreditAccess Grameen Limited | 1.22 |

| Food Products | |

| Zydus Wellness Limited | 1.31 |

| IT - Services | |

| Affle (India) Limited | 1.02 |

| IT - Software | |

| KPIT Technologies Limited* | 1.53 |

| Industrial Products | |

| Timken India Limited* | 1.40 |

| Carborundum Universal Limited | 1.34 |

| Elantas Beck India Limited | 1.18 |

| Other Consumer Services | |

| NIIT Limited* | 1.46 |

| Telecom - Equipment & Accessories | |

| Tejas Networks Limited* | 1.37 |

| Textiles & Apparels | |

| Raymond Limited | 1.03 |

| Equity Less Than 1% of Corpus | 58.16 |

| Cash and Other Receivables | 3.30 |

| Grand Total | 100.00 |

*Top 10 Holdings

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

For scheme performance please click here. For Fund manager wise scheme performance click here.

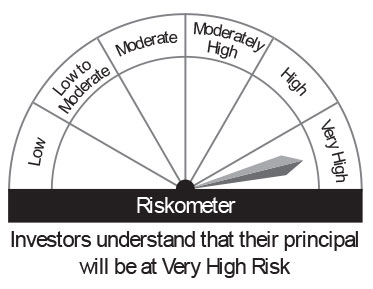

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities of small cap companies

Fund Riskometer

Nippon India Small Cap Fund

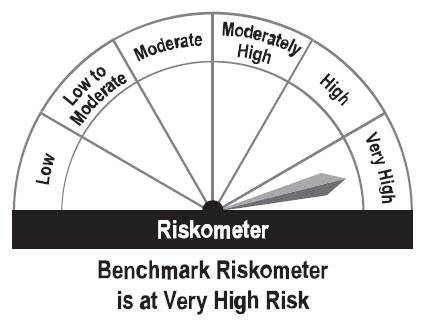

Benchmark Riskometer

Nifty Smallcap 250 TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available