Nippon India Ultra Short Duration Fund (Number of Segregated Portfolio -1)

| Details as on January 31, 2023 |

|

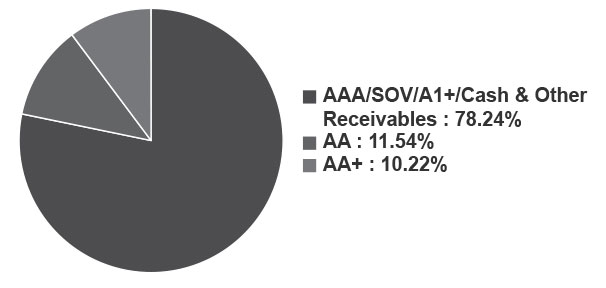

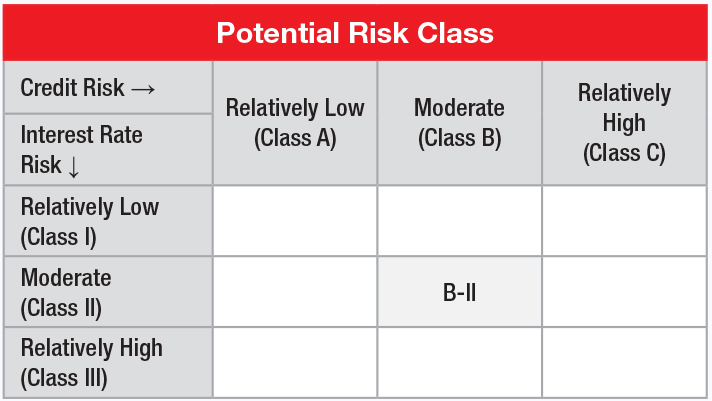

An open ended ultra-short term debt scheme investing in debt and money market instruments such that the Macaulay duration of the portfolio is between 3 - 6 months. Moderate interest rate risk and moderate Credit Risk.

The fund invests in debt and money market instruments with an endeavor to maintain portfolio duration between 120 - 180 days. The aim is to generate higher gross yield through a portfolio investing across credit categories. Carry endeavors to protect against volatility.

December 07, 2001

Vivek Sharma

NIFTY Ultra Short Duration Debt Index B-I

| Fund Size | |

| Monthly Average : | ₹ 5,060.26 Cr |

| Month End : | ₹ 4,974.27 Cr |

| Growth Plan | ₹ 3,412.5019 |

| Daily IDCW Plan | ₹ 1,114.1500 |

| Weekly IDCW Plan | ₹ 1,092.2692 |

| Monthly IDCW Plan | ₹ 1,012.2015 |

| Quarterly IDCW Plan | ₹ 1,017.2322 |

| Direct - Growth Plan | ₹ 3,695.3785 |

| Direct - Daily IDCW Plan | ₹ 1,114.1500 |

| Direct - Weekly IDCW Plan | ₹ 1,092.3655 |

| Direct - Monthly IDCW Plan | ₹ 1,021.1744 |

| Direct - Quarterly IDCW Plan | ₹ 1,024.5462 |

| Entry Load: | Nil |

| Exit Load: | Nil

|

|

Not applicable for Segregated Portfolio | |

Segregated Portfolio 1

Due to credit event (Default of debt servicing by Altico capital India

Limited (ACIL) on Sep 13, 2019), securities of ACIL have been

segregated from the scheme's portfolio w.e.f. Sep 25, 2019. Part

payments received on Dec 30,2019 (6.06% of total exposure), on Oct

8, 2020 (3.64% of total exposure), on Mar 12, 2021 (55.87% of total

exposure) and on Jun 8, 2021 (1 .02% of total exposure).

Final

settlement payment from Altico capital India Limited (ACIL)

amounting INR 9.50 Cr (which is 6.04% of the total exposure in ACIL)

received on March 10, 2022. Considering this, the total recovery from

ACIL is 72.63% of the total exposure. The segregated portfolio of

Nippon India Ultra Short Duration Fund will now cease to exist.

| Average Maturity | 169 Days |

| Modified Duration | 146 Days |

| Annualized portfolio YTM* | 7.72% |

*In case of semi annual YTM, it has been annualised

| Macaulay Duration | 157 Days |

| Regular/Other than Direct | 1.18% |

| Direct | 0.38% |

| Company/Issuer | Rating | % of Assets |

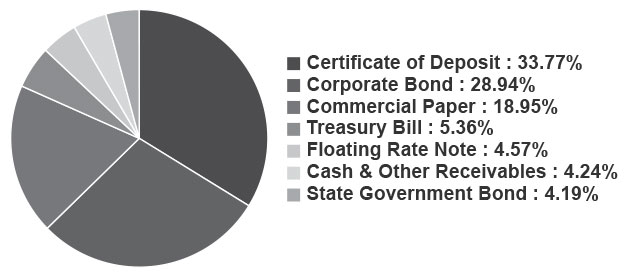

| Certificate of Deposit | 33.77 | |

| Canara Bank | CRISIL A1+ | 6.85 |

| Axis Bank Limited | CRISIL A1+ | 6.18 |

| Small Industries Dev Bank of India | CARE A1+ | 4.78 |

| HDFC Bank Limited | CARE A1+ | 4.37 |

| State Bank of India | CARE A1+ | 2.88 |

| Bank of Baroda | FITCH A1+ | 2.88 |

| Union Bank of India | FITCH A1+ | 1.87 |

| ICICI Bank Limited | ICRA A1+ | 1.44 |

| The Federal Bank Limited | CRISIL A1+ | 1.05 |

| IndusInd Bank Limited | CRISIL A1+ | 0.98 |

| Kotak Mahindra Bank Limited | CRISIL A1+ | 0.48 |

| Commercial Paper | 18.95 | |

| Vedanta Limited | CRISIL A1+ | 4.28 |

| Piramal Capital & Housing Finance Limited | CRISIL A1+ | 2.45 |

| Panatone Finvest Limited | CRISIL A1+ | 2.33 |

| Motilal Oswal Financial Services Limited | FITCH A1+ | 2.00 |

| Mindspace Business Parks REIT (K RAHEJA CORP GROUP) | CRISIL A1+ | 1.99 |

| Tata Value Homes Limited | CARE A1+ | 1.99 |

| Bahadur Chand Investments Pvt Limited (Hero Group) | ICRA A1+ | 1.95 |

| Export Import Bank of India | CRISIL A1+ | 1.00 |

| Small Industries Dev Bank of India | CARE A1+ | 0.50 |

| Housing Development Finance Corporation Limited | CRISIL A1+ | 0.47 |

| Corporate Bond | 28.94 | |

| Tata Power Company Limited | FITCH AA | 3.32 |

| TATA Realty & Infrastructure Limited | ICRA AA+ | 3.00 |

| Jamnagar Utilities & Power Private Limited (Mukesh Ambani Group) | CRISIL AAA | 2.92 |

| Shriram Finance Limited | CRISIL AA+ | 2.82 |

| Manappuram Finance Limited | CRISIL AA | 2.58 |

| National Housing Bank | CRISIL AAA | 2.50 |

| Andhra Pradesh State Beverages Corporation Limited (A.P.State PSU (Structured escrow mechanism for payments & Guarantee by government of Andhra Pradesh)) | FITCH AA(CE) | 1.96 |

| Motilal Oswal Finvest Limited | ICRA AA | 1.80 |

| Piramal Capital & Housing Finance Limited | ICRA AA | 1.51 |

| Nabha Power Limited (L & T Group (Guaranteed by L&T)) | ICRA AAA(CE) | 1.51 |

| Samvardhana Motherson International Limited | FITCH AAA | 1.49 |

| Muthoot Finance Limited | CRISIL AA+ | 1.00 |

| Bharti Telecom Limited | CRISIL AA+ | 0.50 |

| Reliance Industries Limited | CRISIL AAA | 0.50 |

| Embassy Office Parks REIT (Blackstone group(Exposure to the NCDs issued by REIT)) | CRISIL AAA | 0.49 |

| North Eastern Electric Power Corporation Limited (Central Public sector Undertaking Group) | ICRA AA+ | 0.36 |

| Nirma Limited | CRISIL AA | 0.30 |

| Bharat Petroleum Corporation Limited | CRISIL AAA | 0.30 |

| U.P. Power Corporation Limited (U.P. State PSU (Structured escrow mechanism for payments & Guarantee by government of Uttar Pradesh)) | FITCH AA(CE) | 0.07 |

| Floating Rate Note | 4.57 | |

| Reliance Industries Limited | CRISIL AAA | 2.03 |

| Shriram Housing Finance Limited | FITCH AA+ | 2.02 |

| Shriram Finance Limited | CRISIL AA+ | 0.51 |

| State Government Bond | 4.19 | |

| State Government Securities | SOV | 4.19 |

| Treasury Bill | 5.36 | |

| Government of India | SOV | 5.36 |

| Cash & Other Receivables | 4.24 | |

| Grand Total | 100.00 |

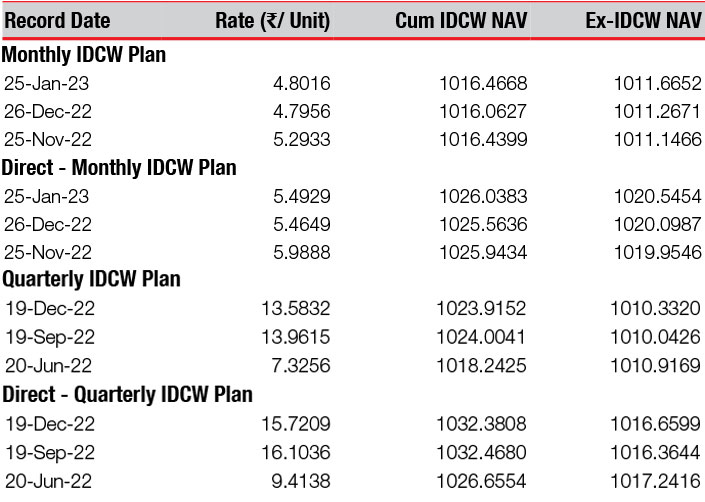

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 1000.

This product is suitable for investors who are seeking*:

• Income over short term

• Investment in debt and money market instruments such that the Macaulay duration of the portfolio is between 3 - 6 months

Fund Riskometer

Nippon India Ultra Short Duration Fund

(Number of Segregated Portfolio -1)

Benchmark Riskometer

NIFTY Ultra Short Duration Debt

Index B-I

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available

For scheme performance please click here. For Fund manager wise scheme performance click here.