Nippon India Value Fund

| Details as on January 31, 2023 |

|

An open ended equity scheme following a value investment strategy

Value investment strategy with an aim to participate in investment opportunities across all sectors and market capitalization. Fund endeavors to invest in undervalued stocks having the potential to deliver long term relatively better risk-adjusted returns. Undervalued stocks will be identified based on the evaluation of various factors including but not limited to stock valuation, financial strength, cash flows, company’s competitive advantage, business prospects and earnings potential.

June 8, 2005

Dhrumil Shah w.e.f Jan 01 2023

Meenakshi Dawar

Nifty 500 TRI

| Monthly Average : | ₹ 4,824.34 Cr |

| Month End : | ₹ 4,748.97 Cr |

| Growth Plan | ₹124.7061 |

| IDCW Plan | ₹31.5105 |

| Direct - Growth Plan | ₹134.1525 |

| Direct - IDCW Plan | ₹45.5594 |

| Entry Load: | Nil |

| Exit Load: |

10% of the units allotted shall be redeemed without any

exit load, on or before completion of 12 months from the date of

allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load, Redemption of units would be done on First in First out Basis (FIFO): • 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units. • Nil, thereafter. |

| Standard Deviation | 6.87 |

| Beta | 0.99 |

| Sharpe Ratio | 0.16 |

| Note: The above measures have been calculated using monthly rolling returns for 36 months period with 6.5% risk free return (FBIL Overnight MIBOR as on 31/01/2023). | |

| Portfolio Turnover | 0.31 |

| Regular/Other than Direct | 1.94 |

| Direct | 1.21 |

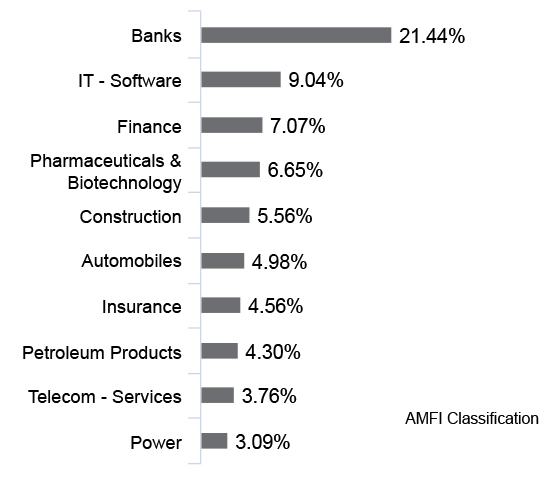

| Company/Issuer | % of Assets |

| Aerospace & Defense | |

| Bharat Electronics Limited | 1.06 |

| Automobiles | |

| Mahindra & Mahindra Limited | 1.89 |

| Tata Motors Limited | 1.47 |

| Banks | |

| ICICI Bank Limited* | 6.26 |

| HDFC Bank Limited* | 5.17 |

| Axis Bank Limited* | 3.97 |

| State Bank of India* | 2.65 |

| Bank of Baroda | 1.37 |

| Capital Markets | |

| Angel One Limited | 1.86 |

| Construction | |

| Larsen & Toubro Limited* | 4.72 |

| Consumer Durables | |

| Dixon Technologies (India) Limited | 1.20 |

| Diversified FMCG | |

| ITC Limited* | 2.03 |

| Ferrous Metals | |

| Jindal Steel & Power Limited | 1.09 |

| Tata Steel Limited | 1.01 |

| Finance | |

| Housing Development Finance Corporation Limited* | 3.15 |

| Healthcare Services | |

| Fortis Healthcare Limited | 1.47 |

| IT - Software | |

| Infosys Limited* | 5.72 |

| Insurance | |

| SBI Life Insurance Company Limited | 1.62 |

| HDFC Life Insurance Company Limited | 1.53 |

| Max Financial Services Limited | 1.41 |

| Oil | |

| Oil & Natural Gas Corporation Limited | 1.01 |

| Others | 0.28 |

| Nippon India ETF Nifty 50 Value 20 | 0.28 |

| Petroleum Products | |

| Reliance Industries Limited* | 3.27 |

| Hindustan Petroleum Corporation Limited | 1.03 |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Limited | 1.97 |

| Divi's Laboratories Limited | 1.19 |

| Torrent Pharmaceuticals Limited | 1.13 |

| Power | |

| NTPC Limited | 1.51 |

| Telecom - Services | |

| Bharti Airtel Limited* | 3.76 |

| Transport Services | |

| InterGlobe Aviation Limited | 1.15 |

| Equity Less Than 1% of Corpus | 31.63 |

| Cash and Other Receivables | 1.43 |

| Grand Total | 100.00 |

*Top 10 Holdings

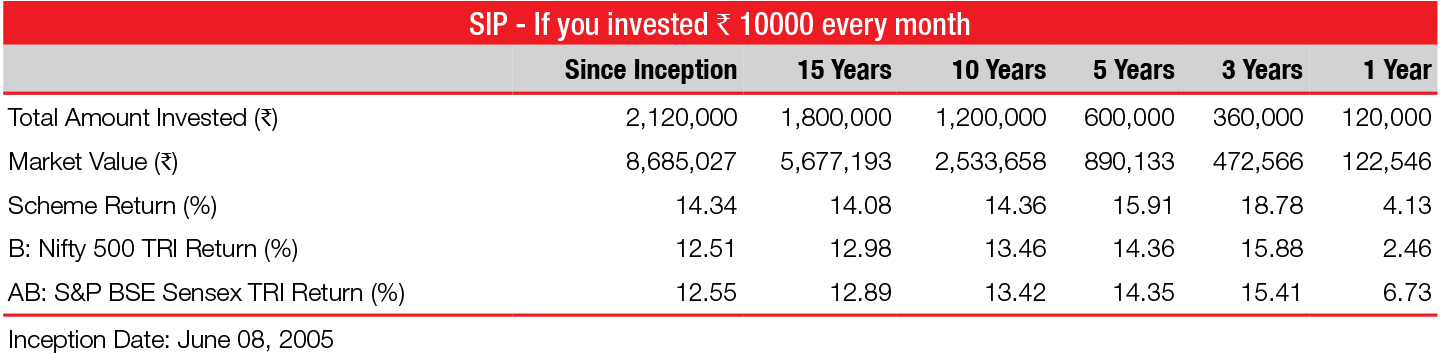

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns.

For scheme performance please click here. For Fund manager wise scheme performance click here.

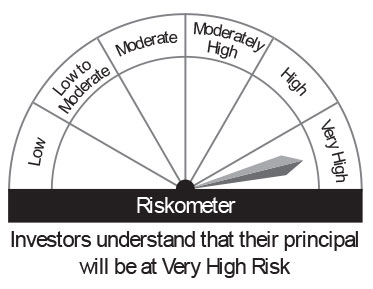

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities

Fund Riskometer

Nippon India Value Fund

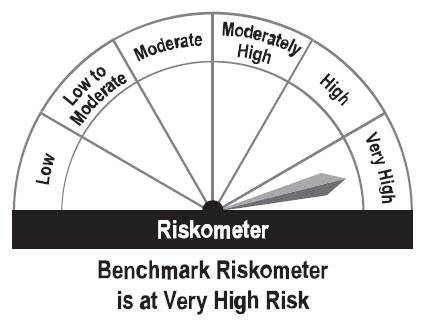

Benchmark Riskometer

Nifty 500 TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Please click here for explanation on symbol: ^ and @ wherever available