Nippon India Focused Equity Fund

| Details as on December 31, 2021 |

|

An open ended Multi Cap Equity Scheme investing in maximum 30 stocks

Nippon India Focused Equity Fund is a multi cap fund which

enedeavours to invest in an active and concentrated portfolio of upto

30 stocks across market capitalisation.

The fund adopts a combination of top-down and bottom-up investment approach to

identify sector and stock weightage in the portfolio. The portfolio is

well diversified across stocks & themes.

The fund strategy revolves around – niche ideas, focus on good

quality companies and an optimal mix of Growth & Value plays

April 28, 2018

Vinay Sharma

Prateek Poddar (Co-Fund Manager)

S&P BSE 500 TRI

| Monthly Average : | ₹ 5,690.70 Cr |

| Month End : | ₹ 5,698.95 Cr |

| Growth Plan | ₹ 75.5390 |

| IDCW Plan | ₹ 29.4531 |

| Direct - Growth Plan | ₹ 81.0869 |

| Direct - IDCW Plan | ₹ 37.4185 |

| Entry Load: | Nil |

| Exit Load: |

10% of the units allotted shall be redeemed without any

exit load, on or before completion of 12 months from the date of

allotment of units. Any redemption in excess of such limit in the first 12 months from the date of allotment shall be subject to the following exit load, Redemption of units would be done on First in First out Basis (FIFO): • 1% if redeemed or switched out on or before completion of 12 months from the date of allotment of units. • Nil, thereafter. |

| Standard Deviation | 7.77 |

| Beta | 1.16 |

| Sharpe Ratio | 0.19 |

| Note: The above measures have been calculated using monthly rolling returns for 36 months period with 3.6% risk free return (FBIL Overnight MIBOR as on 31/12/2021). | |

| Portfolio Turnover | 0.77 |

| Regular/Other than Direct | 2.00 |

| Direct | 1.31 |

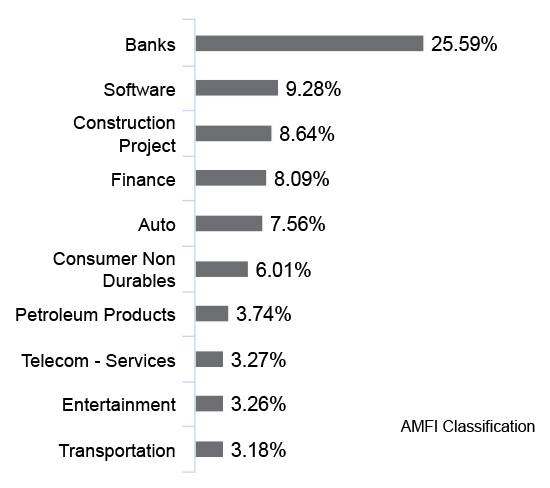

| Company/Issuer | % of Assets |

| Auto | |

| Tata Motors Limited | 2.98 |

| TVS Motor Company Limited | 2.44 |

| Ashok Leyland Limited | 2.14 |

| Auto Ancillaries | |

| Varroc Engineering Limited | 2.60 |

| Banks | |

| ICICI Bank Limited* | 9.35 |

| Axis Bank Limited* | 7.68 |

| State Bank of India* | 6.71 |

| HDFC Bank Limited | 1.85 |

| Construction Project | |

| Larsen & Toubro Limited* | 4.73 |

| Sterling And Wilson Renewable Energy Limited | 2.25 |

| NCC Limited | 1.67 |

| Consumer Non Durables | |

| Varun Beverages Limited* | 3.58 |

| ITC Limited | 2.43 |

| Entertainment | |

| PVR Limited* | 3.26 |

| Finance | |

| SBI Cards and Payment Services Limited* | 4.07 |

| Cholamandalam Financial Holdings Limited | 2.66 |

| Housing Development Finance Corporation Limited | 1.36 |

| Industrial Capital Goods | |

| Honeywell Automation India Limited | 2.95 |

| Leisure Services | |

| Chalet Hotels Limited | 1.33 |

| Thomas Cook (India) Limited | 1.15 |

| Petroleum Products | |

| Reliance Industries Limited* | 3.74 |

| Pharmaceuticals | |

| Sun Pharmaceutical Industries Limited | 2.75 |

| Retailing | |

| Zomato Limited | 1.03 |

| Software | |

| Infosys Limited* | 7.66 |

| Route Mobile Limited | 1.62 |

| Telecom - Services | |

| Bharti Airtel Limited* | 3.27 |

| Transportation | |

| Container Corporation of India Limited | 3.18 |

| Equity Less Than 1% of Corpus | 1.84 |

| Cash and Other Receivables | 7.73 |

| Grand Total | 100.00 |

*Top 10 Holdings

*Reliance Focused Large Cap Fund was merged into Reliance Mid & Small Cap Fund and the merged scheme was renamed as Nippon India Focused Equity Fund (formerly Reliance Focused Equity Fund) (‘Scheme’) with effect from April 28, 2018. In line with SEBI circular SEBI/HO/IMD/DF3/CIR/P/2018/69 dated April 12, 2018, since the Scheme did not retain the features of either the transferor or transferee scheme, the performance has been provided herein since the effective date i.e. April 28, 2018

Past performance may or may not be sustained in future. It is assumed that a SIP of ₹10,000 each executed on 10th of every month including the first installment in the Growth option of the Fund. Returns on SIP and Benchmark are annualized and cumulative investment return for cash flows resulting out of uniform and regular monthly subscriptions have been worked out on excel spreadsheet function known as XIRR. Load has not been taken into consideration.

B: Benchmark, AB: Additional Benchmark, TRI: Total Return Index

TRI - Total Returns Index reflects the returns on the index arising from (a) constituent stock price movements and (b) dividend receipts from constituent index stocks, thereby showing a true picture of returns

For scheme performance please click here. For Fund manager wise scheme performance click here.

| Record Date | Rate (₹/ Unit) | Cum IDCW NAV | Ex-IDCW NAV |

| IDCW Plan | |||

| 06-Mar-20 | 1.33 | 17.6468 | 16.1468 |

| 08-Mar-19 | 1.55 | 21.3154 | 19.5654 |

| Direct - IDCW Plan | |||

| 06-Mar-20 | 1.33 | 21.7651 | 20.2651 |

| 08-Mar-19 | 1.55 | 25.7195 | 23.9695 |

Past performance may or may not be sustained in future. Pursuant to IDCW payment, NAV falls to the extent of payout & statutory levy (if applicable). Face Value-₹ 10.

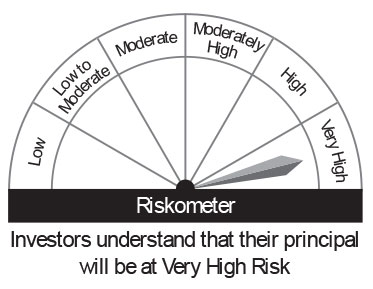

This product is suitable for investors who are seeking*:

• Long term capital growth

• Investment in equity and equity related securities including derivatives

Fund Riskometer

Nippon India Focused Equity Fund

Benchmark Riskometer

S&P BSE 500 TRI

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Special Feature: Nippon India Any Time Money Card

Please click here for explanation on symbol: ^ and @ wherever available